Christmas week could wipe out millions in leveraged crypto positions. Three altcoins show extreme imbalance between long and short traders.

The data paints a brutal picture. Open interest surged while liquidation heatmaps reveal dangerous one-sided bets. Plus, profit-taking pressure builds as holiday volume thins out liquidity.

Let’s examine which tokens face the biggest squeeze and what’s driving the risk.

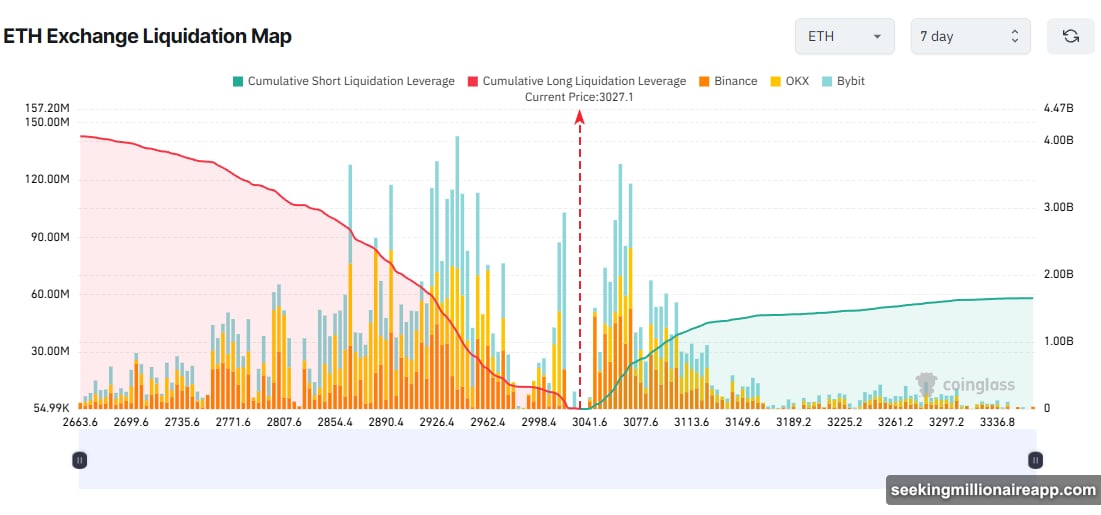

Ethereum Long Positions Look Dangerously Exposed

ETH traders piled into leveraged longs at the worst possible time. The numbers tell a scary story.

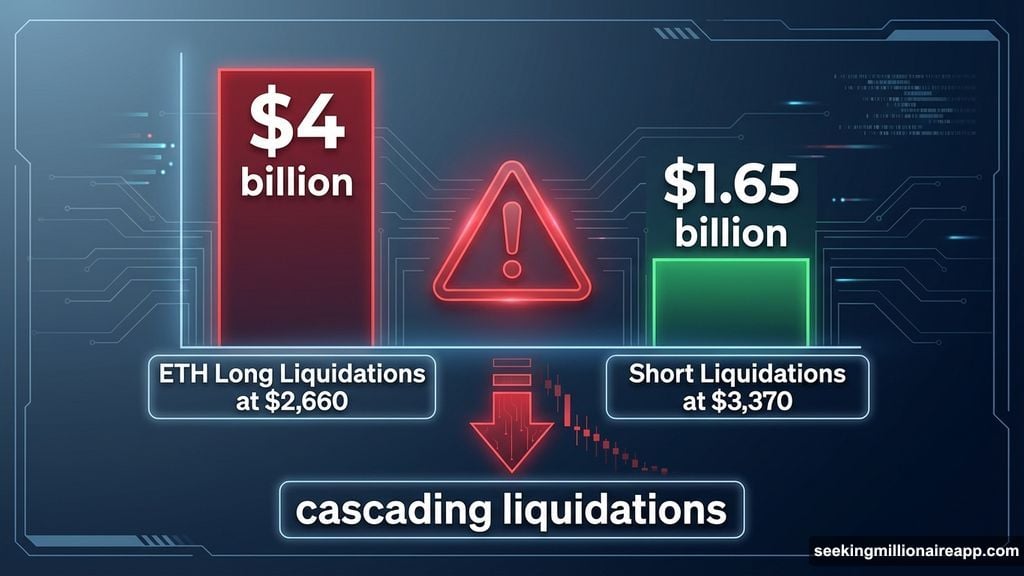

Liquidation data shows potential long wipeouts could hit $4 billion if ETH drops to $2,660. Meanwhile, short liquidations would only reach $1.65 billion if prices climb to $3,370. That’s a massive imbalance.

Three warning signs flash red for long holders. First, Arthur Hayes transferred 508.6 ETH worth $1.5 million to Galaxy Digital recently. Market watchers interpret this as reducing exposure before potential downside.

Second, the Ethereum Coinbase Premium Index turned negative in late December. This metric tracks institutional buying pressure from Coinbase. Negative readings suggest big players are selling, not buying.

Third, ETH ETF outflows reached $643.9 million last week. That’s real money leaving the ecosystem. When institutional investors pull funds this aggressively, retail traders holding leveraged longs face serious danger.

So if these pressures continue, cascading liquidations could hammer ETH prices lower. Each liquidation triggers more selling, creating a downward spiral that feeds on itself.

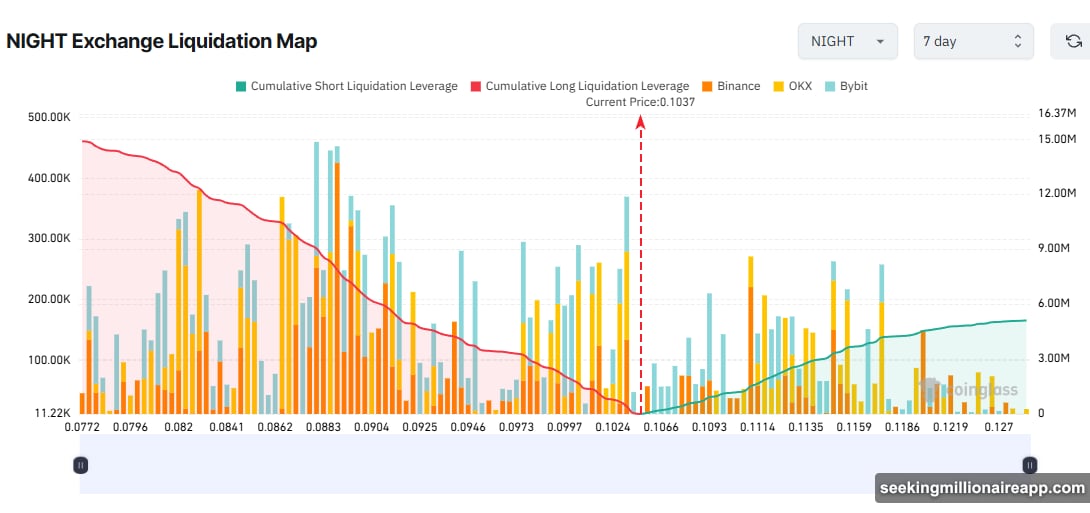

Midnight’s Parabolic Rise Sets Up Brutal Reversal

NIGHT exploded from nowhere into the spotlight. But that attention comes with consequences.

Open interest rocketed from $15 million to over $90 million in just two weeks. That’s not normal growth. Instead, it signals speculative frenzy fueled by extreme leverage.

The token posted seven consecutive green daily candles before finally closing red. Then trading volume hit $6.8 billion daily, surpassing SOL, XRP and BNB combined. Yet this isn’t sustainable momentum—it’s classic late-stage euphoria.

Here’s the problem everyone ignores. Data from DexHunter shows 100% of current NIGHT holders who bought on the market are in profit. Every single one. That creates massive profit-taking pressure.

Moreover, one whale swapped 6.2 million ADA for 28 million NIGHT tokens. When whales this size start taking profits, smaller traders get crushed by the selling pressure.

Liquidation heatmaps reveal the danger clearly. If NIGHT falls to $0.077, cumulative long liquidations could reach $15 million. That might not sound huge compared to ETH, but for a token this small, it represents catastrophic losses for leveraged traders.

The risk grows worse during Christmas week when liquidity dries up. Thin order books mean large sell orders push prices down faster and farther than normal market conditions allow.

Audiera Shows Classic Pump-and-Dump Warning Signs

BEAT surged over 5,000% since launching in November. It peaked at $4.99, yet traders keep expecting more upside. That greed shows in the liquidation data.

But something stinks about this rally. Several red flags suggest manipulation rather than organic growth.

First, BEAT dropped 30% in one hour, then rebounded 50% in just one minute. Natural market moves don’t work like that. Instead, this pattern suggests large wallets manipulating price to trigger liquidations and hunt stop losses.

Second, Audiera’s official website remains inaccessible. The project’s X account only posts about BEAT being a top gainer. No roadmap updates, no team communications, no actual development progress.

Third, market data platform CoinAnk issued explicit warnings about liquidation risk. They noted that extreme volatility in BEAT can easily trigger cascading liquidations affecting both long and short positions.

The negative funding rate environment makes this worse. While holding short positions costs little, the explosive volatility means any position—long or short—faces sudden liquidation risk.

If BEAT falls below $3, total long liquidations could reach $10 million. Given the suspicious price action and lack of project transparency, that scenario looks increasingly likely.

Plus, comparisons to Bitlight’s 75% collapse feel uncomfortably accurate. LIGHT showed similar parabolic gains before crashing violently, wiping out leveraged traders on both sides.

The Christmas Liquidity Trap

Holiday trading creates perfect conditions for liquidation events. Volume drops as traders step away from screens. Order books thin out significantly.

So even moderate selling pressure moves prices further than usual. That triggers stop losses and liquidations that wouldn’t activate during normal trading conditions.

Moreover, institutional traders and market makers reduce activity during Christmas week. Their absence removes the liquidity cushion that typically absorbs volatility spikes.

This setup particularly threatens altcoins with already elevated open interest. When leverage ratios are high and liquidity is low, small price movements create outsized consequences.

Cascading liquidations become self-fulfilling prophecies. One liquidation triggers the next, feeding downward momentum that accelerates as it spreads across positions.

What This Means For Your Portfolio

These aren’t isolated risks affecting random altcoins. They represent systemic fragility built into overleveraged markets.

If you’re holding long positions in ETH, NIGHT or BEAT, the data suggests reducing leverage immediately. Better to miss potential upside than face forced liquidation during thin holiday trading.

For traders considering new positions, this week demands extra caution. The risk-reward ratio tilts heavily toward risk when liquidation imbalances are this extreme.

The safest play? Step back until after Christmas. Let the leverage flush out. Wait for clearer market structure before deploying serious capital.

Because when liquidation cascades start, they don’t discriminate. Both bulls and bears get crushed when volatility explodes and liquidity disappears.