Long traders just loaded up on leverage across multiple altcoins. Now those positions sit dangerously exposed as January approaches.

The problem? These traders bet big on continued rallies without planning exits. Meanwhile, exchange data and market indicators flash warning signs that could trigger cascading liquidations worth hundreds of millions.

Three altcoins face particularly severe risks. Let’s examine why their overleveraged longs could get crushed in early January.

Solana’s ETF Demand Just Collapsed

SOL traders piled into long positions throughout late December. The reasoning seemed solid at first. January historically delivers strong performance for Solana. Plus, bullish technical signals suggested a recovery was brewing.

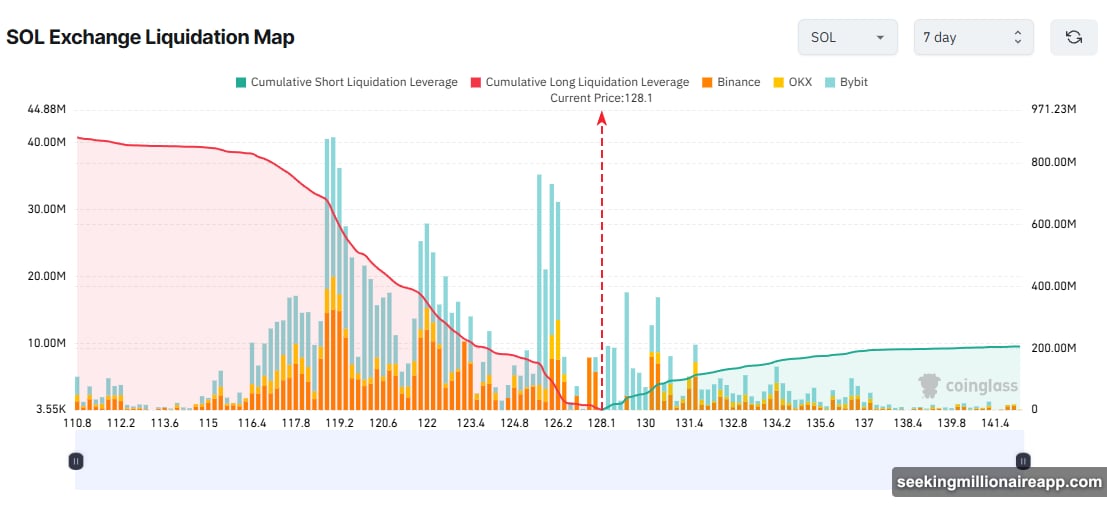

But the liquidation map tells a different story now. Cumulative long positions massively outweigh shorts. That imbalance creates dangerous vulnerability.

Here’s what changed. SOL spot ETF inflows crashed by over 93% in just one week. Last week brought only $13.14 million in net inflows. Compare that to nearly $200 million during the launch week.

No week has recorded negative flows yet. However, this sharp decline signals weakening institutional demand. Without fresh capital flowing in, SOL’s price support could crumble fast.

The math gets brutal if SOL drops to $110. Long liquidations could exceed $880 million at that level. Many traders would get wiped out before they could react.

Zcash Whales Are Already Backing Away

ZEC’s December rally looked spectacular on the surface. The token surged over 70%, climbing from around $300 to above $500. Traders naturally wanted to ride that momentum with leveraged longs.

Meanwhile, ZEC locked in Shielded Pools increased again. That metric typically indicates holder confidence. So the long positions seemed justified.

But the party might end soon. Technical analysis suggests ZEC needs to correct after such a strong run. A pullback to retest former resistance as new support would be normal price behavior.

More concerning, whale activity shows growing caution. ZEC whales started reducing their exposure after the sharp recovery. These large holders rarely exit without reason.

Early December buyers could start taking profits any day. That selling pressure would hit overleveraged longs hard. If ZEC retraces to $466, liquidations could surpass $78 million.

The consolidation range from earlier price action creates a natural target for this pullback. Traders who bought the breakout now face the classic trap of holding too long.

Chainlink’s Binance Reserves Tell an Ugly Story

LINK holders seem confident about a recovery from current $12 levels. They committed substantial capital to long positions. The plan looks straightforward: hold support at $11.50 and push toward $13.50, then $14, then $15.

But exchange reserve data contradicts that optimistic outlook. LINK reserves on Binance climbed steadily throughout December. The 7-day average just reversed a two-month downtrend and started moving higher.

That shift matters. Rising exchange reserves typically signal preparation for selling. LINK holders appear to be moving tokens to Binance, waiting for any price recovery to dump their positions.

The demand zone around $12 might hold temporarily. Yet if LINK breaks below $11.50, the setup invalidates completely. Downside risk becomes the dominant factor.

Liquidation data shows the potential damage. A drop to $11 would trigger approximately $40 million in cumulative long liquidations. Not as massive as SOL or ZEC, but still enough to hurt plenty of traders.

The Pattern Every Trader Should Recognize

All three altcoins share the same dangerous setup. Strong December performance attracted overleveraged long positions. Now those positions face deteriorating fundamentals and technical setups.

SOL lost its ETF demand catalyst. ZEC whales are taking profits. LINK holders are loading exchanges with supply. Each scenario points toward the same outcome: liquidation cascades that punish traders who held too long.

January historically brings volatility to crypto markets. This year, that volatility could arrive through liquidation events rather than sustained rallies. Long traders who ignore stop-losses or fail to take profits risk getting crushed.

Smart traders recognize when market conditions shift. The data clearly shows weakness building across these three altcoins. Whether you’re currently long or considering new positions, these warning signs deserve serious attention.