Over $4 billion in Bitcoin and Ethereum options vanished from the market today. But here’s the twist: traders aren’t panicking. Instead, they’re quietly loading up on mid-2026 contracts.

This Friday’s expiry marks a major shift in positioning. While 247,000 options contracts disappear, institutional money is flowing into longer-dated calls. Plus, the data reveals something surprising about what smart money expects next year.

BTC Shows Caution While ETH Leans Bullish

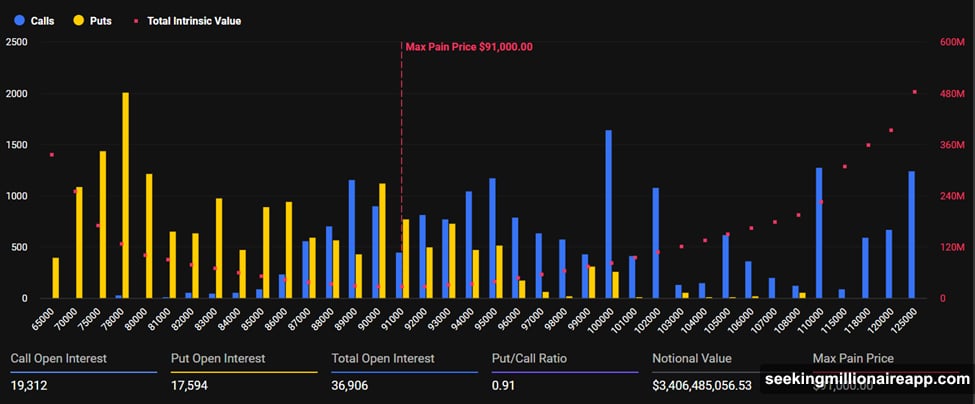

Bitcoin’s expiring options tell a balanced story. The notional value hits $3.4 billion across 36,906 contracts. Meanwhile, the Put-to-Call ratio sits at 0.91, suggesting traders are almost evenly split between bullish calls and bearish puts.

That near-perfect balance signals uncertainty. Traders aren’t convinced Bitcoin will surge higher in the near term. So they’re hedging both directions, protecting portfolios against potential swings.

The maximum pain point landed at $91,000. That’s the price where most contracts expire worthless, inflicting maximum losses on option holders. With BTC currently trading around $92,279, the price sits just above that threshold.

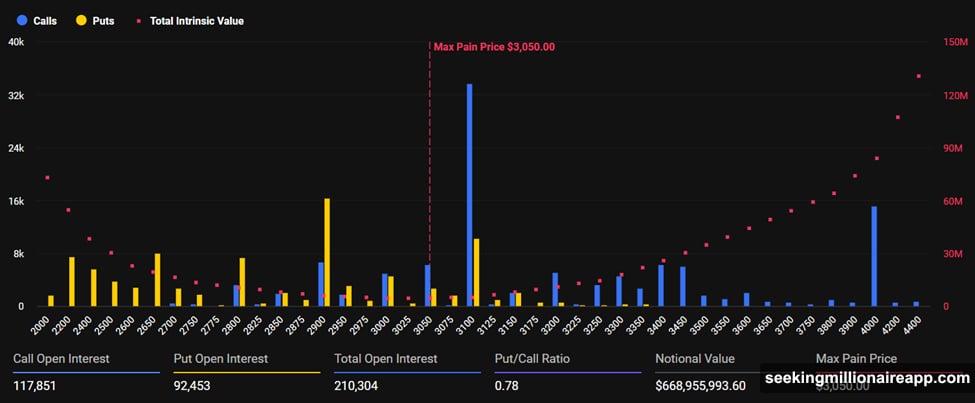

Ethereum paints a different picture. Its expiring options carry a $668.95 million notional value with 210,304 contracts. But the Put-to-Call ratio drops to 0.78, indicating significantly more calls than puts.

More calls means traders expect ETH to climb. That bullish tilt contrasts sharply with Bitcoin’s cautious positioning. Plus, ETH’s maximum pain point sits at $3,050, below the current $3,180 price.

Today’s Expiry Is Smaller But Still Significant

This week’s expiry pales compared to last week’s massive event. On November 28, over $15 billion in options disappeared, including 145,482 BTC and 574,208 ETH contracts.

Today’s tranche represents less than one-third of that volume. However, the positioning shifts matter more than raw numbers. Traders aren’t just closing positions—they’re rotating into new ones.

Options open interest continues climbing on Deribit. October 2025 hit 1.49 million BTC contracts, the highest monthly volume ever recorded. November followed close behind at 1.33 million contracts.

These numbers reflect growing institutional participation. Professional traders dominate the options market now. Their moves signal where big money expects prices to head next.

Smart Money Moves Into Mid-2026 Calls

Despite choppy spot prices, options data reveals a stealth rotation happening. Institutional desks are quietly building mid-2026 call positions, particularly in Bitcoin.

Why 2026? Three factors drive this positioning. First, projected Federal Reserve rate cuts should improve liquidity conditions. Second, Bitcoin ETF demand continues expanding. Third, improved market infrastructure supports larger institutional flows.

Fresh capital flows into derivatives platforms confirm this trend. Traders aren’t betting on immediate price spikes. Instead, they’re positioning for a multi-quarter recovery that plays out through next year.

Laevitas data shows year-to-date BTC options volume remains strong. The sustained activity indicates institutions are building long-term exposure, not making short-term speculative bets.

Volatility Compression Creates ETH Opportunities

Bitcoin’s implied volatility keeps dropping. That compression makes BTC options less attractive for premium sellers. So where’s capital flowing instead?

Ethereum options suddenly look more appealing. ETH volatility remains elevated compared to Bitcoin. That creates better opportunities for traders seeking yield through options strategies.

Greeks.live describes current positioning as “cautiously bullish bias with traders calling bottoms and expecting upside.” However, they note frustration over choppy price action and false breakout attempts.

Put skew stays elevated across the market. Traders still price in near-term downside risk. Risk sellers dominate through short put strategies, avoiding aggressive call buying after February’s violent swings from $100,000 to $78,000 and back.

That caution makes sense. Markets remember getting burned by premature bullish bets. So traders wait for clearer confirmation before committing to large directional positions.

Capital Shifts From Flips to Yield

The broader derivatives market is maturing fast. Traders are abandoning the “5-10x flip” mentality that dominated 2021. Instead, capital flows into strategies focused on preservation and sustainable yield.

Deribit highlighted this evolution in recent commentary. On-chain options products are rising to meet demand for transparent, self-custodied income generation. Institutional investors want predictable returns, not lottery tickets.

This shift reflects crypto’s growing legitimacy. As regulated products expand and traditional finance enters the space, strategies evolve toward professional standards. Reckless speculation gives way to calculated positioning.

The change benefits long-term market health. Sustainable yield generation attracts sticky capital that doesn’t disappear during downturns. That stability helps crypto markets mature beyond pure speculation.

What Happens After Expiry

Expect some volatility around today’s 8:00 UTC expiry time. Large options expirations often trigger short-term price swings as market makers adjust hedges. However, these moves typically fade quickly.

After expiry, markets should settle into new trading ranges. Traders will adjust to changed positioning as expired contracts get replaced with fresh ones. The real story unfolds in coming weeks as 2026 bets accumulate.

Watch for continued rotation into longer-dated calls. If institutional desks keep building mid-2026 exposure, that signals confidence in multi-quarter recovery. Plus, rising open interest confirms conviction behind these positions.

Conversely, if traders start buying more near-term puts, that indicates growing concern about immediate downside. The Put-to-Call ratio shifts provide real-time sentiment readings worth monitoring.

The 2026 Bet Reflects Bigger Trends

This options positioning reflects broader changes in crypto markets. Institutional participation keeps growing. Regulated products expand access. Market infrastructure improves dramatically.

These developments support longer investment horizons. Traders can now confidently build positions months in advance, trusting that liquid markets and reliable infrastructure will exist when they need to exit.

That marks a fundamental shift from crypto’s earlier days. Markets that once moved purely on retail speculation now incorporate sophisticated institutional flows. Options data captures this evolution in real-time.

The quiet accumulation of 2026 calls suggests big money expects crypto to climb over the next 12-18 months. Not through vertical rallies. But through steady appreciation as adoption expands and liquidity improves.

Smart traders are positioning for that scenario now. Today’s $4 billion expiry represents the old guard. The real action happens in fresh contracts being written for next year.