More than 11.6 million crypto tokens collapsed in 2025. That’s not a typo.

CoinGecko’s latest data reveals 86% of all cryptocurrency failures since 2021 happened in a single year. The carnage accelerated in Q4, when 7.7 million tokens vanished in just three months. Now industry insiders warn the worst may not be over.

Token Creation Exploded While Survival Rates Collapsed

The numbers tell a brutal story. Between 2021 and 2025, listed cryptocurrency projects surged from 428,383 to nearly 20.2 million. But growth came at a devastating cost.

More than half of all tracked cryptocurrencies are now inactive. Specifically, 53.2% of tokens on GeckoTerminal have stopped trading entirely.

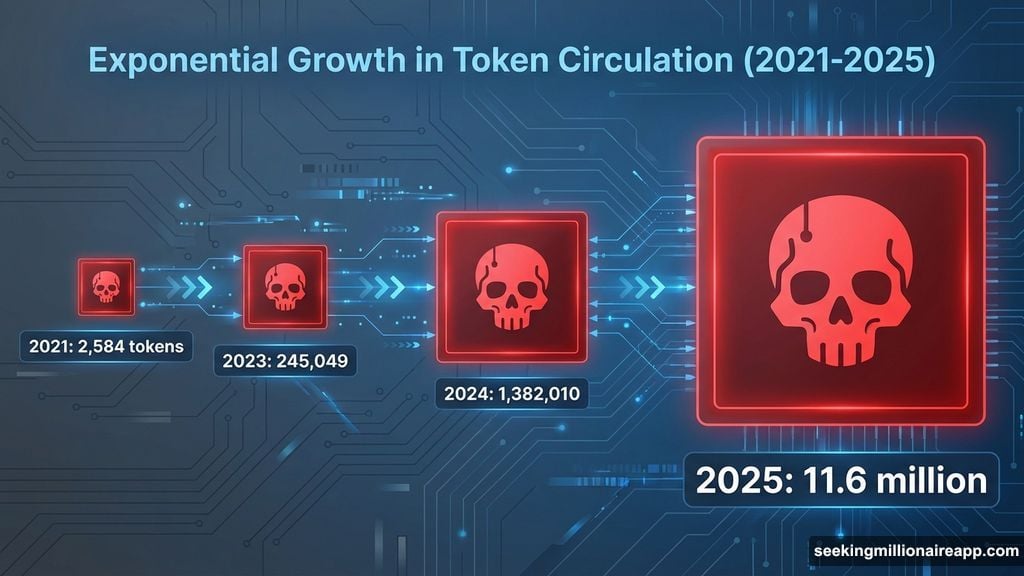

The failure rate didn’t climb gradually. It exploded in two years. In 2021, just 2,584 tokens failed. That number jumped to 213,075 in 2022, then 245,049 in 2023. Things got serious in 2024 when 1,382,010 tokens collapsed.

Then 2025 happened. Nearly 11.6 million tokens died. That’s more than all previous years combined, multiplied several times over.

Plus, 2024 and 2025 together account for 96% of all crypto failures since 2021. The token economy didn’t just shift—it broke.

Easy Launch Tools Flooded Markets With Doomed Projects

Platforms like Pump.fun removed every barrier to token creation. Anyone can now launch a cryptocurrency in minutes without technical knowledge.

This democratization sounds positive. But it created a flood of low-effort projects with zero long-term viability.

CoinGecko’s methodology excluded tokens that never traded. So these 11.6 million failures represent projects that actually launched, found traders, then died anyway. That makes the data even more damning.

Moreover, the meme coin sector drove much of this expansion. Traders chased quick profits through speculative launches. Most projects lacked sustainable business models, committed communities, or real utility.

DWF Labs executive Andrei Grachev described the environment as “crime season.” He pointed to systemic pressures crushing both founders and investors. Projects struggle to attract attention, secure liquidity, or find product-market fit.

The market consolidated around three categories: Bitcoin, established blue-chip assets, and pure gambling. Everything else fights for scraps of remaining retail liquidity.

Q4 2025 Marked the Breaking Point

The collapse accelerated dramatically in the year’s final months. Q4 alone saw 7.7 million token failures—34.9% of all recorded collapses since 2021.

This surge coincided with October 10’s liquidation cascade. That day, $19 billion in leveraged positions evaporated within 24 hours. It marked crypto’s largest single-day deleveraging event in history.

The shock exposed brutal truths about thinly traded tokens. Projects lacking deep liquidity or committed participants couldn’t survive extreme volatility. So they died by the millions.

Capital rotation toward Bitcoin during this period accelerated the carnage. As money flowed out of altcoins and into BTC, thousands of small-cap tokens lost their already-fragile liquidity cushions.

Many projects had relied on speculative trading rather than genuine adoption. When that speculation vanished, so did the tokens.

Why 2026 Could Be Even Worse

The forces that killed millions of tokens in 2025 haven’t changed. Token creation remains frictionless. Retail liquidity stays fragmented. Market attention continues concentrating on Bitcoin and established assets.

Token supply has grown far faster than the market’s capacity to absorb new projects. With nearly 20.2 million tokens listed by year-end, even modest continuation of launchpad issuance risks pushing failure rates higher.

Industry analyst Stacy Muur argued most 2025 launches failed because of structural flaws, not market conditions. Specifically, high fully diluted valuations with low float created “short-vol and short-trust” dynamics that guaranteed collapse.

These design patterns haven’t disappeared. So 2026 launches face the same structural weaknesses that killed their predecessors.

Plus, market stress events remain likely. The October liquidation cascade proved how quickly systemic shocks cascade through thinly traded assets. Similar volatility episodes would trigger additional mass failures.

Andrei Grachev warned current conditions are structurally hostile to new projects. He described ongoing “liquidity wars” across crypto markets. As retail capital thins and competition intensifies, newer tokens face rising barriers to survival.

Without changes to launch incentives, disclosure standards, or investor education, the market risks repeating 2025’s cycle: rapid issuance, brief speculation, eventual collapse.

The Structural Problem Nobody’s Fixing

Here’s what frustrates me most. The industry knows these problems exist but keeps repeating the same mistakes.

Token launches remain optimized for quick exits rather than long-term sustainability. Founders focus on generating initial hype instead of building real products. Investors chase meme coin lottery tickets rather than evaluating fundamentals.

This creates a self-reinforcing failure cycle. New projects launch with inflated expectations, attract speculative capital, then collapse when reality fails to match hype. That destroys investor confidence, reducing available liquidity for future launches.

Some argue this purge strengthens crypto by eliminating weak projects. Maybe. But the data suggests we’re nowhere near the bottom.

Token creation continues outpacing liquidity growth. Until that dynamic reverses, expect more failures. Not fewer.