Stripe’s blockchain subsidiary just closed one of crypto’s biggest funding rounds in years. But the real story? A key Ethereum developer thinks this startup could reshape stablecoins without competing against ETH.

Tempo secured $500 million in Series A funding this week. That puts the stablecoin payment processor at a $5 billion valuation. Plus, the backing comes from traditional finance heavyweights like Sequoia and Thrive Capital, not just crypto-native VCs.

Then came the surprise announcement. Dankrad Feist, who’s worked on Ethereum since 2018, revealed he’s joining Tempo. His move sparked immediate questions about whether this signals trouble for existing blockchain infrastructure.

Why This Matters for Stablecoin Payments

Tempo builds blockchain infrastructure specifically for processing stablecoin transactions. Think of it as specialized plumbing for moving USDC, USDT, and similar assets between wallets and platforms.

The company operates as a Stripe subsidiary. So it inherits credibility from one of the world’s most trusted payment processors. In fact, Stripe just expanded native stablecoin support yesterday, allowing subscription payments with these digital dollars.

But Tempo takes a different approach than its parent company. Instead of integrating stablecoins into existing payment rails, it’s building entirely new blockchain infrastructure from scratch.

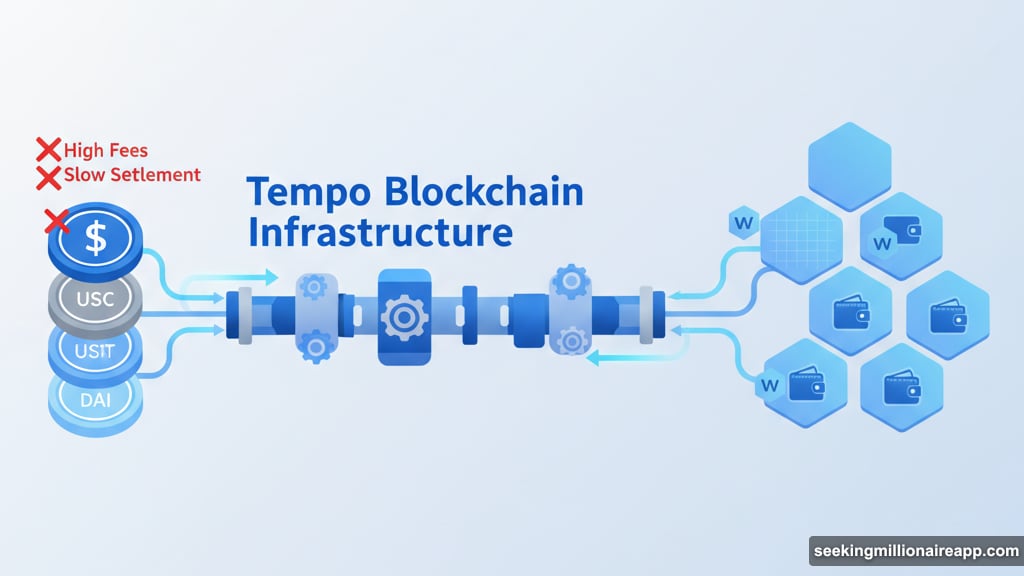

That matters because current stablecoin transfers often face bottlenecks. High fees, slow settlement times, and limited interoperability plague existing solutions. Tempo claims its specialized blockchain solves these problems.

The Traditional Finance Connection

Here’s what makes this funding round unusual. Jared Kushner’s Thrive Capital led the investment. Sequoia and Greenoaks also contributed significant amounts. These are traditional venture capital firms, not crypto specialists.

Traditional finance backing represents a shift in how Wall Street views blockchain technology. Previously, most TradFi firms avoided direct crypto investments. Now they’re writing nine-figure checks for stablecoin infrastructure.

Notably, Stripe and Paradigm didn’t participate in this round. Both companies created Tempo initially but sat out the Series A. That suggests the startup already has significant runway and doesn’t need parent company support.

The $5 billion valuation also signals confidence in stablecoins’ future. That’s higher than many established crypto projects. In fact, it’s one of the largest blockchain venture rounds since 2021’s bull market peak.

Ethereum Developer Says No Competition Here

Dankrad Feist’s announcement caught the crypto community off guard. He’s been an Ethereum Foundation developer since 2018. His work focused on scaling solutions and protocol improvements.

So why leave Ethereum for a startup? According to Feist, Tempo complements Ethereum’s vision rather than competing against it. He wrote that “Tempo’s work will complement Ethereum’s vision in the long run.”

That’s an interesting take. Many analysts assumed Tempo would compete directly with Ethereum for stablecoin transaction volume. After all, most stablecoins currently run on Ethereum or compatible chains.

But Feist sees something different. He believes stablecoin payments represent a specific use case that benefits from specialized infrastructure. Meanwhile, Ethereum continues handling broader smart contract applications and DeFi protocols.

His perspective carries weight. Seven years working on Ethereum’s core protocol gives him deep insight into the blockchain’s strengths and limitations. If he thinks Tempo fills a complementary role, that’s worth considering seriously.

What Tempo Actually Does Differently

Tempo isn’t launching its own stablecoin. Instead, it’s building infrastructure that works with existing tokens like USDC and USDT. Think of it as neutral payment rails rather than a competing currency.

The blockchain focuses specifically on payment processing. That narrow focus allows optimization that general-purpose blockchains can’t match. Faster settlement times, lower fees, and better interoperability between different stablecoins.

Currently, sending stablecoins between wallets requires gas fees, network congestion, and sometimes multiple confirmations. Tempo aims to make these transfers instant and nearly free. Similar to how traditional payment processors handle credit cards.

However, the company hasn’t revealed full technical details yet. We don’t know exactly how it achieves these improvements. Nor do we know which stablecoins will initially support Tempo’s infrastructure.

The Stripe Connection Changes Everything

Stripe’s involvement matters more than you might think. The company processes hundreds of billions in payments annually. It has relationships with millions of businesses worldwide.

If Stripe integrates Tempo into its existing platform, adoption could happen quickly. Businesses already using Stripe wouldn’t need to learn new systems. They’d just gain access to stablecoin payment options alongside credit cards.

Yesterday’s announcement about stablecoin subscription support hints at this direction. Stripe is clearly positioning itself to offer crypto payment options to mainstream businesses. Tempo likely plays a key role in that strategy.

But there’s a risk here too. Centralized infrastructure controlled by a single company contradicts crypto’s decentralization ethos. Some developers worry Tempo could become a bottleneck or single point of failure.

Traditional Finance Sees Stablecoin Opportunity

Sequoia, Thrive Capital, and Greenoaks don’t typically bet on unproven technology. Their participation signals that TradFi views stablecoins as mature enough for serious investment.

Stablecoins already process more transaction volume than many traditional payment networks. Monthly volume regularly exceeds $1 trillion across all chains. That’s real economic activity, not just speculation.

Plus, regulatory clarity improved significantly in recent months. The U.S. and European Union both advanced stablecoin frameworks. That reduces uncertainty for institutional investors.

Jared Kushner’s involvement through Thrive Capital adds political implications. His connections to the previous administration and ongoing influence in certain circles could smooth regulatory paths for Tempo.

However, regulatory approval isn’t guaranteed. Banking regulators remain cautious about crypto infrastructure. Tempo will need to navigate complex compliance requirements as it scales.

What This Means for Existing Stablecoins

USDC and USDT issuers should pay attention. Tempo’s infrastructure could shift power dynamics in the stablecoin ecosystem. Right now, issuers control distribution and earn interest on reserves.

But if Tempo becomes the dominant payment rail, it gains influence over which stablecoins succeed. The company could favor certain tokens or charge different fees based on issuer relationships.

Tempo claims it will remain neutral. The company hasn’t announced plans to launch its own stablecoin. But business incentives could change that strategy later.

For now, major stablecoin issuers are watching closely. Some may view Tempo as a partner that improves their distribution. Others might see a potential competitor that could cut them out of the value chain.

Scaling Challenges Ahead

$500 million buys a lot of development time. But building blockchain infrastructure that scales to millions of daily transactions takes years. Tempo faces significant technical challenges before it can deliver on ambitious promises.

Payment processing requires near-perfect uptime. Traditional payment networks achieve 99.99% availability. Blockchain networks often struggle to match that reliability. One major outage could destroy trust with business customers.

Plus, Tempo needs to convince businesses to integrate its infrastructure. That means competing against established payment processors and existing blockchain solutions. Network effects favor incumbents in the payments industry.

The company also hasn’t clarified its business model yet. Will it charge transaction fees? Take a percentage of payment volume? Earn interest on stablecoin reserves? These details matter for understanding whether the valuation makes sense.

My Take on Where This Goes

Tempo’s funding round proves that serious money is betting on stablecoin payments. The combination of Stripe’s credibility and TradFi backing creates real momentum.

But I’m skeptical about the timeline. Payment infrastructure takes years to build correctly. Security, compliance, and reliability all require extensive testing. Expect slow rollout rather than rapid adoption.

Feist’s involvement suggests Tempo found something technically interesting. He wouldn’t leave Ethereum for a mediocre project. But “complementary” might just mean “focused on a niche Ethereum doesn’t prioritize.”

The real question is whether businesses want specialized stablecoin infrastructure. Many companies already accept crypto payments through existing solutions. Tempo needs to offer compelling improvements to justify switching costs.

Watch how Stripe integrates Tempo into its platform. If mainstream businesses start offering stablecoin payments through familiar Stripe interfaces, adoption could surprise everyone. If not, this $5 billion valuation might look optimistic in hindsight.