Mining bitcoin got 7% less profitable last month. That’s not just a dip. It’s a warning sign for the entire industry.

September brought a perfect storm. Bitcoin’s price slipped 2% while the network hashrate jumped 9%. So miners faced more competition for smaller rewards. Plus, publicly traded North American miners are feeling the pressure heading into Q4.

Production Numbers Tell the Story

Public miners in North America produced 3,401 bitcoin in September. That’s down from 3,576 BTC in August. Their share of the global network also shrank from 26% to 25%.

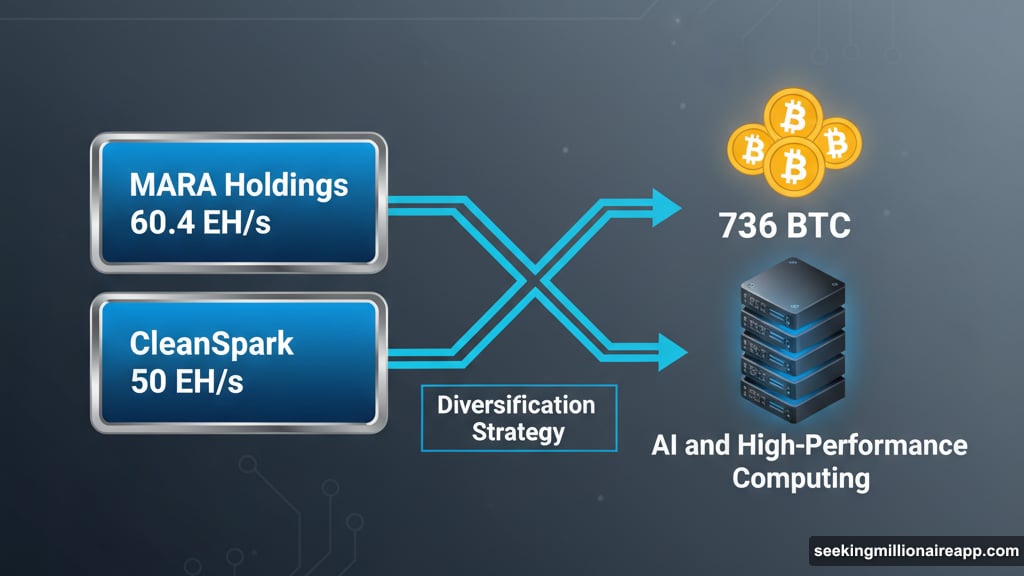

MARA Holdings led the pack with 736 bitcoin mined. That’s actually up from August’s 705 BTC. But CleanSpark slipped from 657 bitcoin to 629, according to Jefferies’ latest report.

Both companies maintain massive operations. MARA runs 60.4 exahashes per second (EH/s) of energized hashrate. CleanSpark follows with 50 EH/s. These aren’t small players struggling at the margins.

Yet even the big guys are feeling the squeeze.

The Hashrate Problem Nobody Wants to Talk About

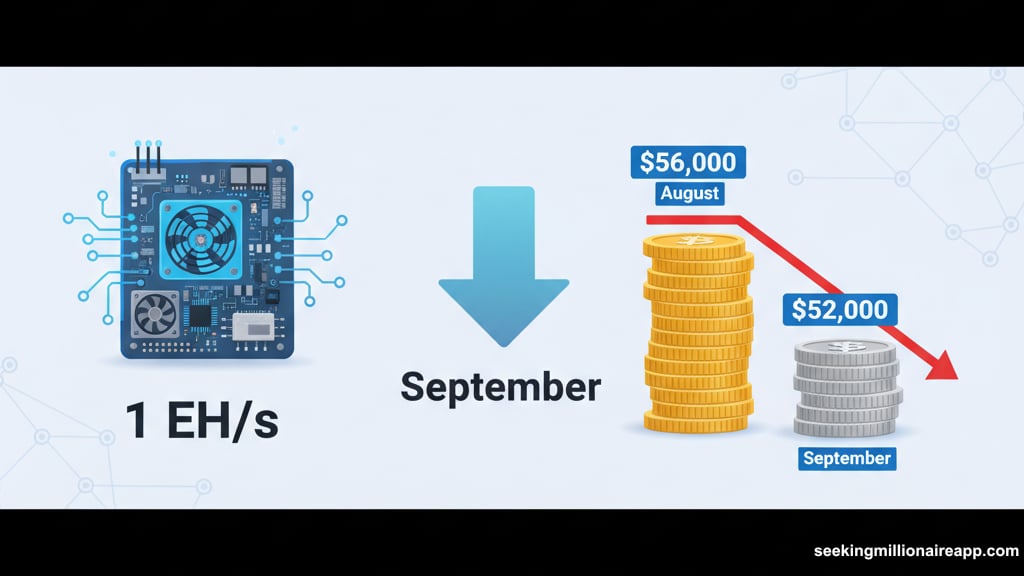

Here’s the brutal math. A theoretical mining fleet with 1 EH/s capacity earned about $52,000 per day in September. That’s down from $56,000 in August.

Sure, it’s still way better than last year’s $43,000. But the trend is wrong. More miners are joining the network, which makes mining harder for everyone. Plus, bitcoin’s price hasn’t kept pace with the rising difficulty.

The hashrate measures total computational power on the Bitcoin network. When it rises, mining becomes more competitive. September’s 9% jump means miners burned more electricity to earn fewer bitcoin.

That’s not sustainable long-term. Eventually, unprofitable miners shut down. Then difficulty adjusts and margins recover. But we’re not there yet.

Why This Month Looks Even Worse

October’s numbers aren’t looking great either. The hashrate eased slightly this month. But bitcoin’s price dropped hard recently. That combination intensifies pressure on profitability.

Jefferies noted that lower bitcoin prices and rising network difficulty continue to tighten margins across the sector. Translation: it’s getting harder to make money mining bitcoin.

Smaller miners without access to cheap power are probably underwater right now. Even efficient operations are seeing compressed margins. The only winners are miners with rock-bottom electricity costs and the latest generation hardware.

Big Money Still Sees Value

Despite the squeeze, investment banks remain bullish on certain mining stocks. Jefferies raised its price target for Galaxy Digital to $45 from $37. The stock jumped 3.5% on the news.

They also boosted MARA’s target to $19 from $18. The stock rose 5% to $20.55. So Wall Street thinks these companies can weather the storm.

Why the optimism? Many public miners are diversifying into AI and high-performance computing. They’re using their infrastructure and cheap power to support data centers. That provides revenue streams beyond just mining bitcoin.

But here’s the catch. Building data centers requires massive capital investment. Returns take years to materialize. Meanwhile, core mining operations are getting squeezed right now.

The AI Data Center Pivot

Speaking of diversification, Benchmark raised its price target on Bitdeer Technologies to $38. They cited the company’s shift to in-house AI data center development.

Bitdeer is accelerating buildouts in Ohio and Norway. They’re expanding into AI and high-performance computing while scaling bitcoin mining. Analyst Mark Palmer thinks the stock is undervalued, trading at 4.3x forward EV/revenue versus an 8.6x peer average.

This represents a broader trend. Miners realize they can’t rely solely on bitcoin production anymore. Their infrastructure—cheap power, cooling systems, physical space—works for AI training too. So they’re hedging their bets.

Smart strategy? Maybe. But it also means these aren’t pure bitcoin mining plays anymore. Investors need to evaluate them as hybrid tech companies, not just crypto miners.

What Happens Next

Miners face a tough choice. They can keep mining at compressed margins, hoping bitcoin’s price recovers. Or they can shut down unprofitable operations and wait for difficulty to adjust.

Most public miners will keep running. They have investor expectations to meet and debt to service. But smaller private miners are probably pulling the plug already. That’s healthy for the network long-term, even if it hurts individual operators.

The real question is whether bitcoin’s price can climb fast enough to offset rising difficulty. If not, we’ll see more consolidation in the mining industry. The big players with cheap power and efficient operations will survive. Everyone else gets squeezed out.

Jefferies thinks the current environment “continues to tighten margins across the mining sector.” That’s polite analyst-speak for “things are getting tough out there.”

September’s 7% profitability drop might just be the beginning. October could be worse if bitcoin’s price doesn’t recover soon. Miners better hope the bulls return before the next difficulty adjustment hits.