CleanSpark just made a big bet. The bitcoin mining company is diving headfirst into AI infrastructure, and investors are already rewarding the move.

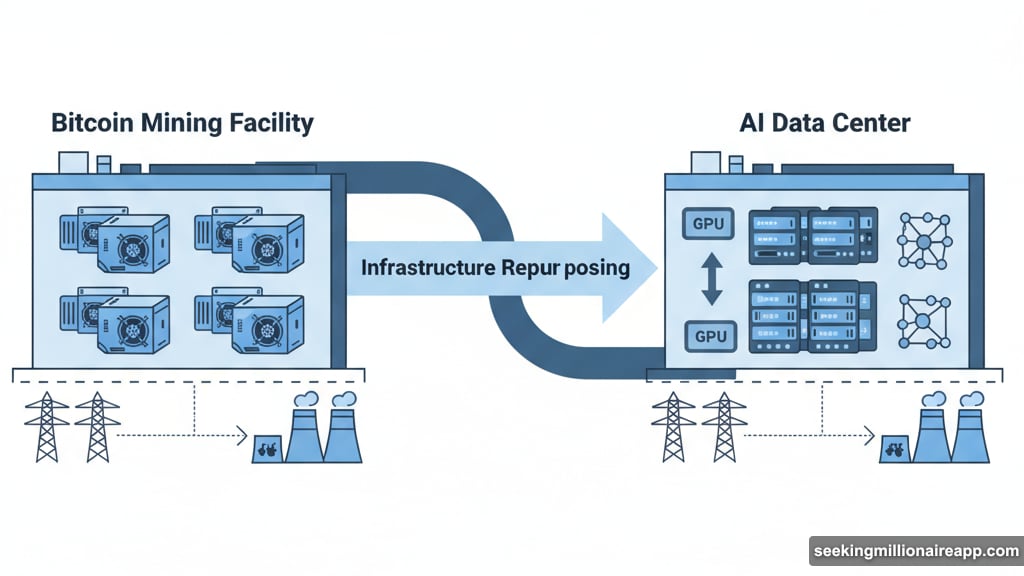

The pivot comes as bitcoin miners across the industry scramble to capture AI’s explosive growth. Mining bitcoin alone isn’t enough anymore. So companies are racing to repurpose their power infrastructure and real estate for AI compute workloads.

CleanSpark hired Jeffrey Thomas to lead the charge. He’s a 40-year industry veteran who helped build over $12 billion in shareholder value across 19 ventures. Most recently, Thomas ran Humain’s multi-billion-dollar AI data center project in Saudi Arabia, working directly with tech giants and hyperscalers.

Why Bitcoin Miners Are Chasing AI Revenue

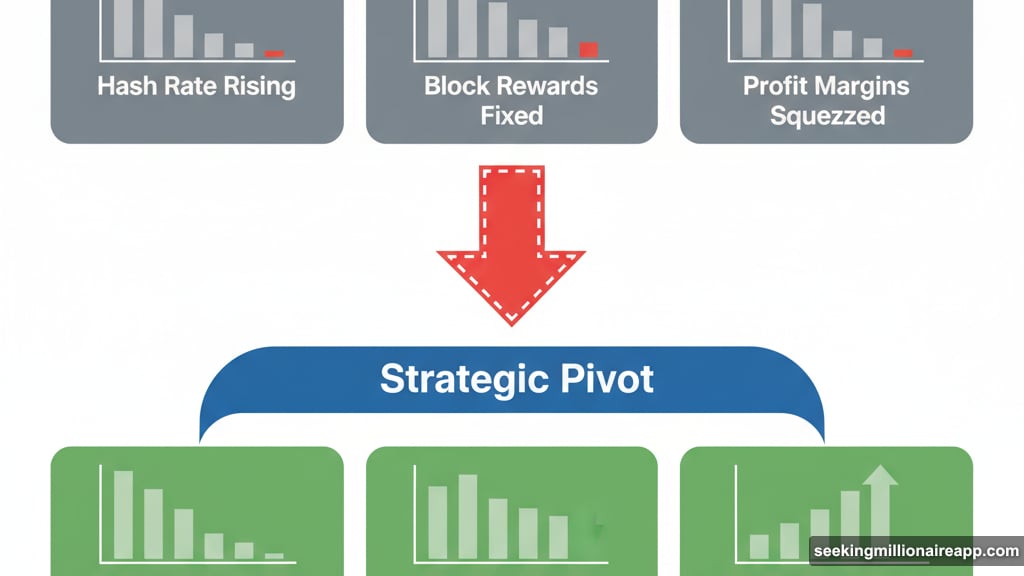

Bitcoin mining faces brutal economics. Hash rate keeps climbing while block rewards stay fixed. That squeezes profit margins relentlessly.

Meanwhile, AI companies desperately need compute power. They’ll pay premium rates for reliable data center capacity. Plus, the infrastructure overlap between bitcoin mining and AI workloads is substantial. Both need massive power, cooling systems, and real estate.

So the math is simple. Miners already own the hard-to-build pieces: power contracts, land, and operational expertise. Converting that infrastructure to serve AI clients unlocks new revenue without abandoning bitcoin operations entirely.

CleanSpark isn’t alone in this strategy. Bitdeer Technologies recently earned a price target hike to $38 from Benchmark after announcing its own AI pivot. The analyst noted Bitdeer trades at just 4.3x forward revenue versus an 8.6x industry average, suggesting the market hasn’t fully priced in the AI opportunity yet.

Georgia Becomes Ground Zero

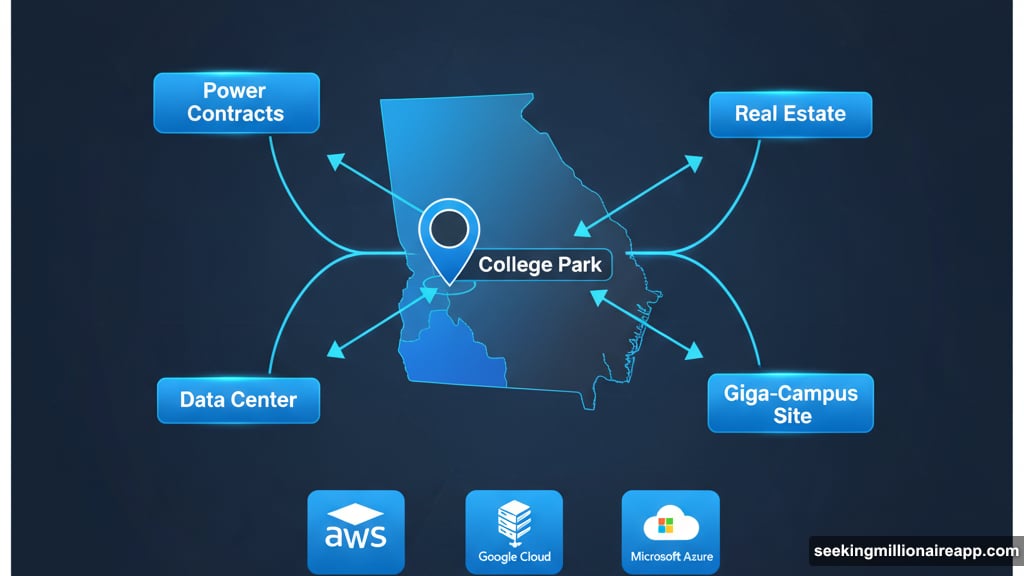

CleanSpark is targeting Georgia for expansion. The company already secured power and real estate contracts in College Park. Now they’re evaluating “giga-campus” opportunities across the region.

Why Georgia? The state offers favorable power rates, business-friendly policies, and proximity to major tech hubs. Several hyperscalers already operate massive data centers there. That creates an ecosystem of suppliers, skilled workers, and established infrastructure.

Thomas will focus on large-scale builds designed specifically for AI and high-performance computing (HPC) workloads. These differ from bitcoin mining setups in key ways. AI requires faster networking, more memory bandwidth, and different cooling approaches. But the core power and real estate assets translate directly.

Markets Reward the Shift Fast

CleanSpark’s stock jumped 5% Monday morning following the announcement. That’s alongside a broader rally in mining stocks, but the company’s gains outpaced many peers.

Investors clearly like diversification stories right now. Pure-play bitcoin miners face valuation compression. But companies positioning for AI growth get premium multiples. The logic is straightforward: AI demand looks more certain and better-funded than bitcoin’s price trajectory.

This repricing is happening across the sector. Companies announcing AI strategies consistently see stock bumps. Those sticking to bitcoin-only models lag behind. The market is sending a clear signal about where it sees opportunity.

The Real Challenge Nobody Mentions

Converting bitcoin mining facilities to AI data centers sounds easy on paper. But the execution is brutally complex.

AI workloads need uptime guarantees that bitcoin mining doesn’t. You can restart a mining rig without major consequences. Interrupting an AI training run costs clients millions. So reliability standards are completely different.

Plus, AI clients demand specific hardware configurations, network topologies, and security certifications. CleanSpark will need to prove it can deliver enterprise-grade service, not just cheap power. That requires new talent, processes, and capital investments.

Thomas’s experience matters here. He’s built AI infrastructure before and knows what hyperscalers expect. But even with strong leadership, the transition will take time and money. Investors betting on this pivot should watch execution closely, not just strategy announcements.

CleanSpark is making a calculated gamble. Bitcoin mining alone looks increasingly commodity-like. AI infrastructure could be their path to premium valuations and sustainable growth. Whether they can actually deliver remains the open question.