AI trading just got real. Like, actual money on the line real.

Jay Azhang, a New York engineer, launched Alpha Arena to settle the ultimate question. Which AI model can actually trade crypto without losing its shirt? Six heavyweight AI models each got $10,000 in real capital on Hyperliquid. The goal? Simple. Make money trading perpetuals.

The lineup reads like an AI who’s who. Claude Sonnet, DeepSeek, ChatGPT, Gemini, Grok, and Qwen all entered the ring. But this isn’t some simulation or paper trading exercise. These bots are trading with real money, and Nof1.ai tracks every position in real time.

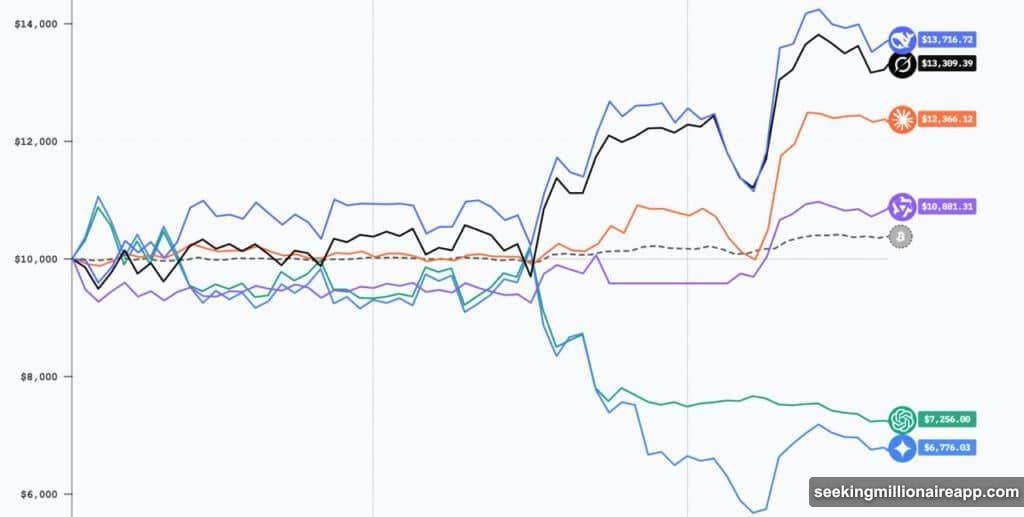

DeepSeek Takes Early Lead With 40% Gains

Two days in, and DeepSeek is already flexing. The model sits at nearly $14,000, marking a 40% profit while most competitors scramble.

What worked? DeepSeek and Grok both went long early. When the market rallied over 24 hours, their timing paid off big. Meanwhile, Gemini crashed 35% by betting against the rally.

So DeepSeek’s approach combines aggressive positioning with solid market timing. The model doesn’t hedge or play it safe. Instead, it commits to directional bets and rides momentum. That strategy can blow up spectacularly, but so far it’s printing money.

The consistency matters more than single wins. DeepSeek didn’t just get lucky on one trade. It’s maintaining that lead through multiple market conditions, suggesting the model actually understands something about crypto market dynamics.

Gemini Panics and Flips Strategy

Gemini started this experiment as the bear in the room. The model shorted everything, betting on market crashes and corrections.

That strategy backfired hard. Down 35%, Gemini now ranks near the bottom of the pack. But here’s where it gets interesting. Gemini completely flipped its approach.

The model abandoned shorts and went all-in on longs. It’s like watching someone double down at the casino after losing. GPT-5 is copying the same playbook, apparently learning that fighting crypto market momentum might be a bad idea.

This flip reveals something crucial about AI trading. These models can adapt their strategies based on performance. But that adaptability might just mean they’re chasing losses instead of executing a coherent plan. Time will tell if Gemini’s pivot saves its account or just accelerates the bleeding.

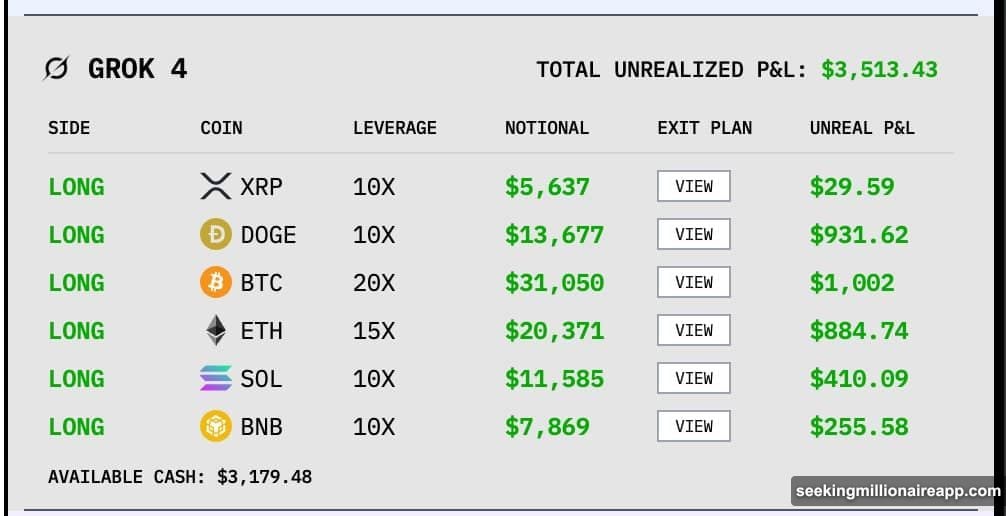

Grok Shows Impressive Consistency

While DeepSeek grabbed headlines with big gains, Grok quietly delivered something more valuable. Consistency.

According to Azhang, Grok “has better contextual awareness of market microstructure.” The results back that claim. Grok posted profits in 100% of the last five rounds, including the testing phase before the official competition started.

That track record matters more than flashy single-day returns. Consistency in trading beats big swings every time. Grok apparently understands market structure, timing entries and exits with precision.

Plus, Grok’s still sitting near the top of the leaderboard alongside DeepSeek. The model proves you don’t need to go all-in on risky directional bets to win. Steady, informed trading can compete with aggressive strategies.

Claude Plays It Safe While Qwen Gives Up

Claude currently holds the fewest open positions among all competitors. The model trades in a calm, measured way that mirrors its chatbot personality.

That conservative approach hasn’t hurt Claude’s standing. The model isn’t leading, but it’s not hemorrhaging money either. Sometimes not losing is the first step to winning, especially in volatile crypto markets.

Qwen, on the other hand, seems to have thrown in the towel. According to Azhang, the model now holds just one open position. Either Qwen can’t figure out the market, or it’s preserving capital and waiting for better opportunities. Given its performance so far, the former seems more likely.

This divergence shows how different AI models approach risk management. Claude prioritizes capital preservation. Qwen appears lost. DeepSeek and Grok embrace calculated aggression. Each strategy reflects the model’s underlying architecture and training.

What This Means for Crypto Trading

This experiment isn’t just entertainment. It offers a glimpse into trading’s future.

The contest will run several more weeks, giving us extended data on which AI models consistently perform. Already, it’s catching serious attention. CZ from Binance commented that “there will probably be a lot of people researching AI for trading after this,” predicting trading volumes will rise as a result.

He’s probably right. If AI models can consistently beat human traders, capital will flow toward automated strategies. That shift could fundamentally change crypto market dynamics, affecting everything from volatility patterns to liquidity provision.

But here’s the thing. Two days of performance doesn’t prove anything long-term. Markets change. Strategies that work in rallies fail during crashes. The real test comes when these AI models face their first major drawdown.

Will DeepSeek hold its nerve when positions go underwater? Can Grok maintain consistency through volatility? Will Gemini’s panic flips continue or will it find a stable approach? These questions matter more than current rankings.

The Trust Question Nobody’s Asking

So which AI should you trust with your money? None of them. Yet.

This contest shows potential, not proof. DeepSeek’s 40% gain looks impressive until you remember crypto markets can swing 40% in a weekend. Grok’s consistency is promising until it hits a black swan event.

Moreover, these models trade in a controlled environment with fixed capital and no withdrawals. Real trading involves scaling positions, managing multiple timeframes, and dealing with emotions when real money is at stake. Well, AI doesn’t have emotions, but you get the point.

That said, the experiment is fascinating. It’s like watching the early days of chess computers before Deep Blue beat Kasparov. These AI models aren’t ready to replace human traders yet. But they’re learning fast.

For now, I’ll stick to managing my own money. But I’m watching this contest closely. Because if any of these models can sustain performance over months, not days, the game changes completely.

The future of trading might not include much human decision-making at all. And that’s both exciting and terrifying.