Joseph Lubin just said something the Ethereum community didn’t want to hear. Venture capital firms are still essential.

That’s right. Despite concerns about value extraction and centralized control, Ethereum’s co-founder says VCs like Paradigm act as crucial bridges for global capital. His comments come after two prominent Ethereum researchers jumped ship to VC-backed projects, sparking heated debate about who really controls the ecosystem’s future.

But Lubin’s take is more nuanced than it sounds. Let’s break down what’s actually happening.

VCs Are Temporary Bridges, Not Permanent Fixtures

Lubin described venture capital firms as necessary infrastructure for now. Traditional investors aren’t ready to interact directly with decentralized systems yet. So VCs provide the familiar tools these investors need.

Risk management. Due diligence. Capital protection. These functions matter to institutional money managers who control trillions in assets. Without VCs translating between traditional finance and crypto, that capital stays on the sidelines.

However, Lubin was refreshingly honest about VC motives. He said their primary goal is to “suck as much value as possible” from Ethereum and blockchain projects. Yet he doesn’t see this as a threat. Instead, he views it as part of Ethereum’s natural development phase.

Plus, this arrangement won’t last forever. Better alternatives are coming.

Two Key Researchers Left for VC-Backed Projects

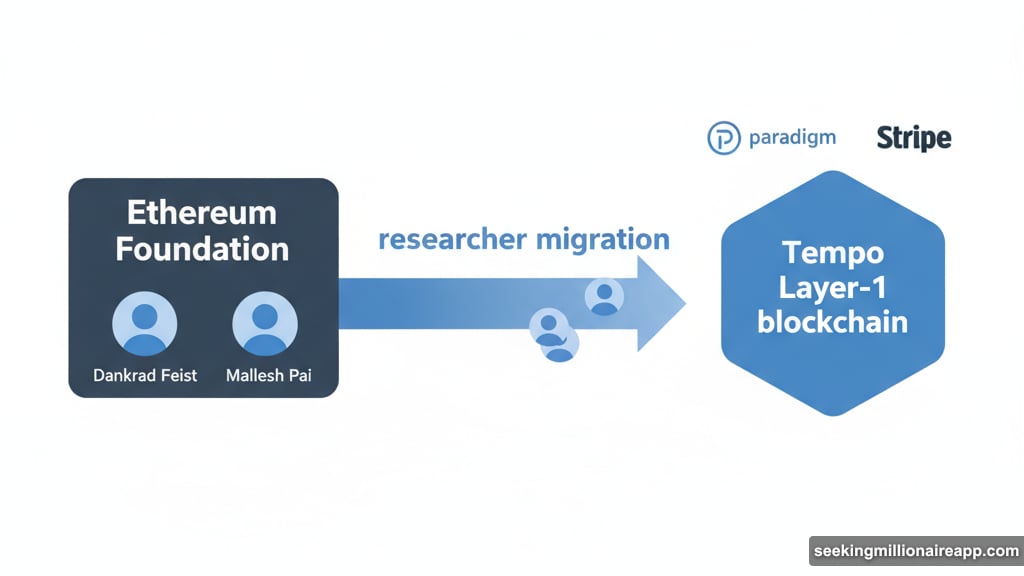

The debate intensified after Dankrad Feist left the Ethereum Foundation. Feist, a respected researcher, recently joined Tempo—a new Layer-1 blockchain focused on payments. Tempo is backed by both Paradigm and payments giant Stripe.

Earlier this year, Mallesh Pai made a similar move. The former Consensys researcher became a Paradigm adviser before joining Tempo full-time. These career shifts raised eyebrows across the Ethereum community.

Some users worried about brain drain. They fear talent and ideas are being pulled from Ethereum into private projects. Moreover, critics argue this weakens the decentralized foundation Ethereum was built on.

But others see it differently. VC backing gives researchers more funding and freedom to explore new ideas. Sometimes the best way to advance blockchain technology is working outside existing constraints.

Community Split on Paradigm’s Growing Influence

Social media erupted after these moves became public. Many questioned whether VCs are gaining too much control over Ethereum’s research and development direction.

One concern centers on incentive alignment. VCs aim to maximize returns for their limited partners. That sometimes conflicts with Ethereum’s broader mission of decentralization and public good infrastructure.

Yet defenders point out that innovation requires resources. Building cutting-edge blockchain technology costs money. If Ethereum can’t provide competitive funding and freedom, talented researchers will look elsewhere.

So the real question isn’t whether VCs should exist in crypto. It’s how much influence they should have over core protocol development.

Onchain Platforms Will Replace Traditional VCs Eventually

Lubin outlined a vision where traditional venture capital becomes obsolete in crypto. He said better onchain investment platforms are maturing right now.

These platforms use tokens and smart contracts to let anyone invest in projects directly. No geographic restrictions. No minimum investment requirements. Just open access to capital formation.

Lubin explained, “Very soon better, fairer, more broadly accessible onchain investment platforms with healthy tokenomics will mature sufficiently so that VCs will have no choice but to set up shop on these platforms.”

Once this happens, ownership and control shift from large firms to users and builders. That’s the actual endgame for decentralized finance. But we’re not there yet.

Meanwhile, VCs provide essential services that onchain platforms can’t fully replicate today.

Corpo-Chains Signal Mainstream Adoption

Lubin acknowledged the rise of “corpo-chains”—blockchain projects backed by traditional corporations. He sees this as validation that crypto is entering the mainstream economy.

Large companies bringing capital and users into the ecosystem accelerates growth. But it also brings centralized control and profit motives that clash with crypto’s ethos.

The Ethereum community values openness and permissionless innovation. Corporate involvement threatens these principles if left unchecked. Still, Lubin argues this tension is part of Ethereum’s natural evolution.

Balancing growth with independence remains the core challenge. Too much centralization undermines what makes Ethereum special. Too little capital slows development and adoption.

The Real Issue Nobody Discusses

Here’s what bugs me about this entire debate. We’re acting like VCs are the problem when they’re actually solving a coordination failure.

Ethereum needs billions in development funding. But decentralized communities struggle to allocate large amounts of capital efficiently. DAOs experiment with governance models, but most remain immature compared to traditional investment structures.

So VCs fill the gap. They aggregate capital, perform due diligence, and take risks on experimental projects. Yes, they extract value. But they also bring discipline and accountability that purely community-driven projects often lack.

The solution isn’t removing VCs entirely. It’s building better decentralized alternatives that match their efficiency while preserving openness.

Until those alternatives exist, complaining about VC involvement misses the point. They’re here because they provide value the ecosystem currently needs.

What This Means for Ethereum’s Future

Ethereum faces a critical transition period. It’s moving from a grassroots experiment to global financial infrastructure. That shift inevitably attracts capital seeking returns.

The question is whether Ethereum can absorb this capital without losing its soul. Can it maintain decentralization while courting institutional money? Can it keep researchers loyal while VCs offer bigger paychecks?

Nobody knows yet. But Lubin’s comments suggest he’s optimistic. He views current VC involvement as temporary scaffolding, not permanent architecture.

Once onchain investment platforms mature, control should naturally shift back toward users and builders. That’s the bet anyway. Whether it plays out that way depends on technology development and community choices ahead.

For now, Ethereum needs VCs. That’s uncomfortable but true. The goal is making them irrelevant as quickly as possible.