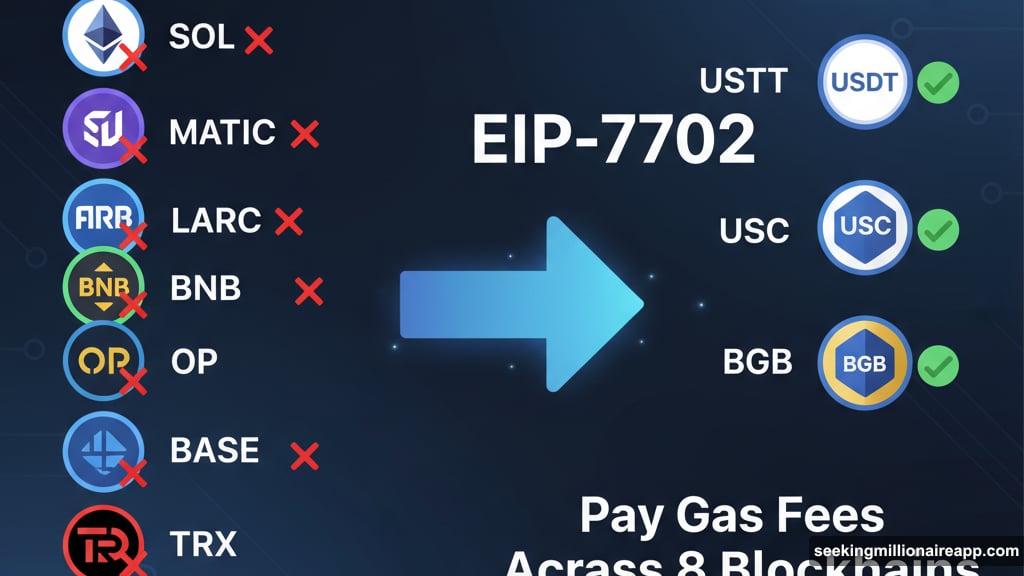

Managing gas fees across different blockchains is annoying. You need ETH for Ethereum, SOL for Solana, MATIC for Polygon. It’s a mess that stops people from using crypto wallets.

Bitget Wallet just fixed that problem. Now you can pay gas fees with stablecoins like USDT and USDC instead of hunting down native tokens. Plus, it works across eight major blockchains without requiring wallet upgrades.

This changes how people interact with decentralized finance. No more keeping small balances of dozens of different tokens just to move money around.

How Stablecoin Gas Payments Actually Work

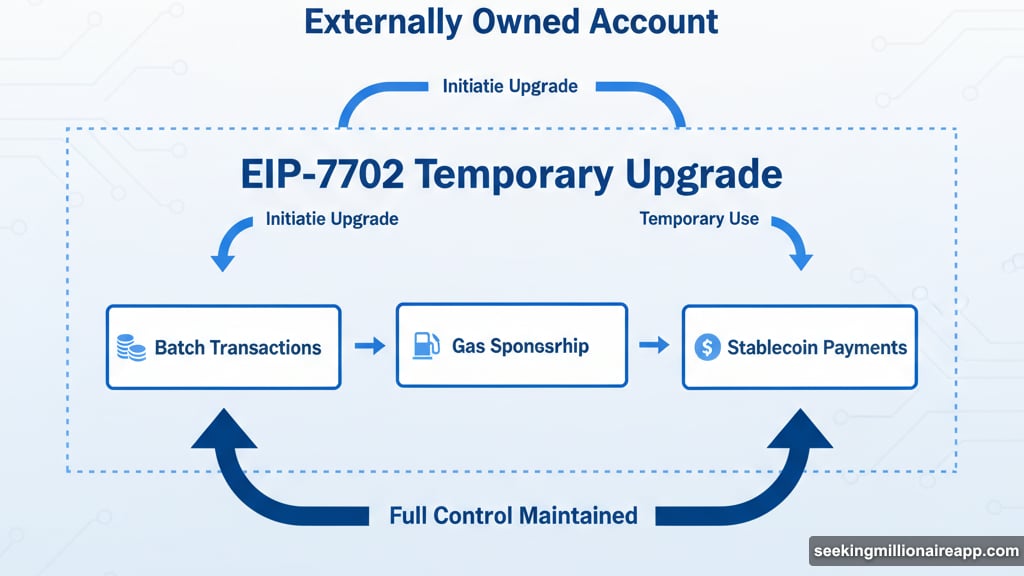

The secret sauce is Ethereum’s EIP-7702 standard. This upgrade lets regular wallets temporarily act like smart contract wallets without changing their structure.

So what does that mean for users? Your wallet can now batch transactions, sponsor gas fees, and accept stablecoins for payments. But you still maintain full control over your keys and assets.

The system works across both EVM chains (Ethereum, Polygon, BNB Chain, Arbitrum, Base, Optimism) and non-EVM networks like Solana and TRON. That’s pretty impressive coverage. Most competing solutions only work on Ethereum-based chains.

Here’s the practical benefit. Say you want to swap tokens on Arbitrum. Normally you’d need to hold ARB tokens for gas. Now you just pay with USDT from your existing balance. The wallet handles the conversion behind the scenes.

Eight Blockchains, One Payment Method

Bitget Wallet supports stablecoin gas payments on these networks:

- Ethereum

- Solana

- Polygon

- Base

- TRON

- BNB Chain

- Arbitrum

- Optimism

Each network has different native tokens and fee structures. Yet users can ignore all that complexity. Just hold USDT, USDC, or BGB and pay fees anywhere.

This matters most for people who use multiple chains regularly. Cross-chain trading, NFT hunting, DeFi farming—all these activities require moving between networks constantly. Before this update, you’d need to maintain gas token balances on every single chain. That’s expensive and inefficient.

Now you can keep one stablecoin balance and operate everywhere. It’s like having a universal gas card for crypto. The friction just disappeared.

Why This Beats Other Wallet Solutions

MetaMask, OKX Wallet, and Base App all experiment with gas abstraction. But Bitget Wallet’s approach has key advantages.

First, broader chain coverage. Most solutions focus exclusively on Ethereum Virtual Machine chains. Bitget includes Solana and TRON too. That expands the addressable market significantly.

Second, no account upgrades required. Some gas abstraction methods force users to migrate to smart contract wallets. That creates security concerns and adds complexity. Bitget’s EIP-7702 integration preserves your existing wallet structure while adding smart features temporarily.

Third, multiple stablecoin options. Users can choose USDT, USDC, or BGB based on availability and preference. Flexibility matters when dealing with different liquidity pools and exchange listings.

Jamie Elkaleh from Bitget highlighted that this bridges the gap between decentralized and centralized platforms. Self-custody wallets traditionally sacrifice convenience for security. This update maintains security while matching centralized exchange ease of use.

What EIP-7702 Actually Enables

EIP-7702 grants externally owned accounts temporary smart contract capabilities. That sounds technical. Let’s break down what it means.

Regular crypto wallets (externally owned accounts) can only send simple transactions. Smart contract wallets can batch multiple actions, sponsor fees for others, and implement advanced security features. But smart contract wallets cost more to create and use.

EIP-7702 lets regular wallets borrow smart contract powers when needed. You get transaction batching, gas sponsorship, and flexible payment options. Then your wallet returns to its normal state after completing the operation.

This temporary transformation happens automatically. Users don’t see the technical details. They just experience smoother transactions and more payment flexibility.

Developers can now build more user-friendly applications. For example, a DeFi protocol could sponsor gas fees for new users trying out their platform. Or a game could let players pay all fees in the game’s native token instead of chain-specific gas tokens.

The possibilities expand significantly once you remove the gas token requirement. It lowers barriers to entry and reduces the learning curve for crypto newcomers.

Real Impact on User Experience

Transaction delays from insufficient gas balances are incredibly frustrating. You queue up a swap or NFT purchase. Then it fails because you forgot to keep 0.01 ETH for gas. By the time you acquire more ETH, the opportunity passed.

Stablecoin gas payments eliminate this problem entirely. Most crypto users already hold stablecoins. USDT and USDC are the most liquid trading pairs across exchanges and DeFi protocols. Using them for gas makes logical sense.

The update also helps with onboarding new users. Explaining different gas tokens for different chains confuses beginners. “You need ETH for Ethereum but SOL for Solana and MATIC for Polygon” sounds complicated. “Pay with USDT everywhere” is simple and clear.

Moreover, this reduces the need for constant swapping. Previously, users would convert small amounts to various gas tokens regularly. Each swap incurs fees and slippage. Those costs add up over time. Now you avoid unnecessary conversions and keep more value in productive assets.

Competition Heats Up in Wallet Space

The wallet market is getting crowded. MetaMask dominates market share but faces challenges from newer players offering better features.

MetaMask recently added Snaps for extensibility and improved transaction batching. But it still lacks comprehensive multi-chain stablecoin gas support. OKX Wallet focuses heavily on their exchange ecosystem but doesn’t match Bitget’s chain coverage.

Base App (built by Coinbase) only works on Base chain. That’s sufficient for users committed to that ecosystem. However, it doesn’t help people operating across multiple networks.

Bitget Wallet’s strategy targets cross-chain users who need maximum flexibility. By supporting both EVM and non-EVM chains with unified gas payments, they position themselves as the go-to choice for multi-chain operations.

This competitive pressure benefits users. As wallets race to offer better experiences, we get more features, lower costs, and simpler interfaces. The crypto wallet space is maturing rapidly.

What This Means for DeFi Adoption

DeFi struggled with user experience issues since its inception. High gas fees, complex interfaces, and technical barriers kept mainstream users away. Bitget Wallet’s update addresses one major friction point.

When gas fees become invisible and manageable, more people will experiment with DeFi protocols. Lower barriers mean higher adoption rates. That brings more liquidity, better pricing, and improved protocol sustainability.

Developers gain flexibility too. They can build applications assuming users won’t struggle with gas tokens. That opens design possibilities previously impractical. Imagine a lending protocol that lets borrowers pay everything (including gas) from their collateral. Or a DEX that absorbs gas costs for trades above certain sizes.

These innovations require gas abstraction as a foundation. Bitget Wallet’s implementation makes them possible today across eight major blockchains. That’s significant infrastructure progress for the entire ecosystem.

The stablecoin payment option also reduces volatility concerns. Native tokens fluctuate in price. USDT and USDC remain stable. Users can predict transaction costs more accurately, which helps with budgeting and planning.

Technical Implementation Challenges

Rolling out EIP-7702 across multiple chains isn’t simple. Each blockchain has unique architecture and consensus mechanisms. Making them all work with the same gas payment system requires serious engineering effort.

Bitget Wallet had to build infrastructure that monitors exchange rates, routes transactions appropriately, and handles failures gracefully. If a stablecoin payment fails, the system needs fallback options. Otherwise users get stuck with failed transactions and lost time.

The team also needed to ensure security. Gas abstraction introduces new attack vectors. What if someone tries to manipulate the stablecoin-to-gas-token conversion rate? Or flood the system with spam transactions?

These concerns require robust solutions. Bitget Wallet must have implemented rate limiting, conversion slippage protections, and monitoring systems. Users won’t see this backend work. But it’s critical for reliable service.

The fact that the system works across such diverse chains (Ethereum, Solana, TRON) suggests solid technical execution. Those platforms have very different transaction models and fee structures. Creating a unified experience across them is legitimately difficult.

Long-Term Industry Implications

If stablecoin gas payments become standard, it reshapes blockchain economics. Gas tokens have been fundamental to network security and tokenomics since Bitcoin launched.

Reducing demand for native gas tokens could affect their market prices. However, it might also increase overall network usage by removing friction. Higher transaction volume could offset reduced per-transaction gas token demand.

We’ll see experimentation with fee models. Networks might offer discounts for stablecoin payments to encourage adoption. Or implement dynamic pricing that adjusts based on payment method. Market forces will determine optimal approaches.

This trend also validates stablecoins as the foundation of crypto commerce. People want price stability for everyday transactions. Paying gas fees with volatile tokens feels like gambling. Stablecoins solve that problem while maintaining blockchain benefits.

Regulation will play a role too. As stablecoins gain more utility (like gas payments), regulators will pay closer attention. Clear legal frameworks could accelerate adoption. Uncertainty could slow progress.

Either way, Bitget Wallet made a bold move that positions them well for the evolving market. Other wallets will likely follow with similar features. The race is on to deliver the best multi-chain experience.

This feature won’t solve every crypto UX problem. But it eliminates one major pain point that’s frustrated users for years. That’s genuine progress worth recognizing.