Another AWS meltdown just exposed crypto’s dirty little secret. Turns out, the “decentralized” blockchain industry can’t function when Amazon’s servers hiccup.

On October 20, 2025, Amazon Web Services went dark. Within minutes, Coinbase crashed. Base network froze. Robinhood stopped processing trades. So much for cutting out the middleman.

The irony burns. An industry built on eliminating central points of failure relies entirely on one.

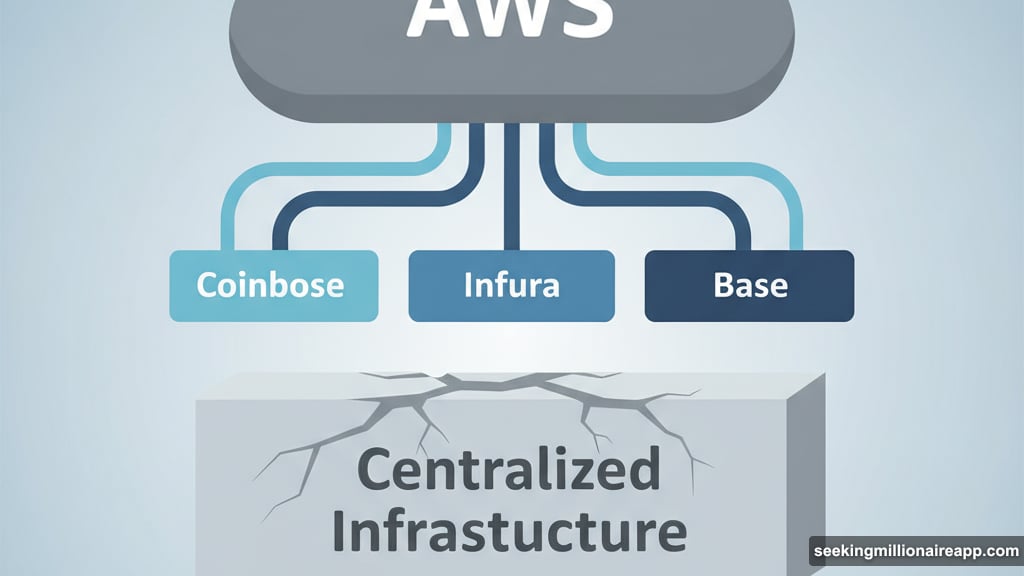

Coinbase, Infura, and the Cloud Dependency Problem

The October outage hit hard and fast. Coinbase’s trading platform went offline completely. Base, their layer-2 network, stopped processing transactions. Meanwhile, ConsenSys’ Infura struggled to stay afloat.

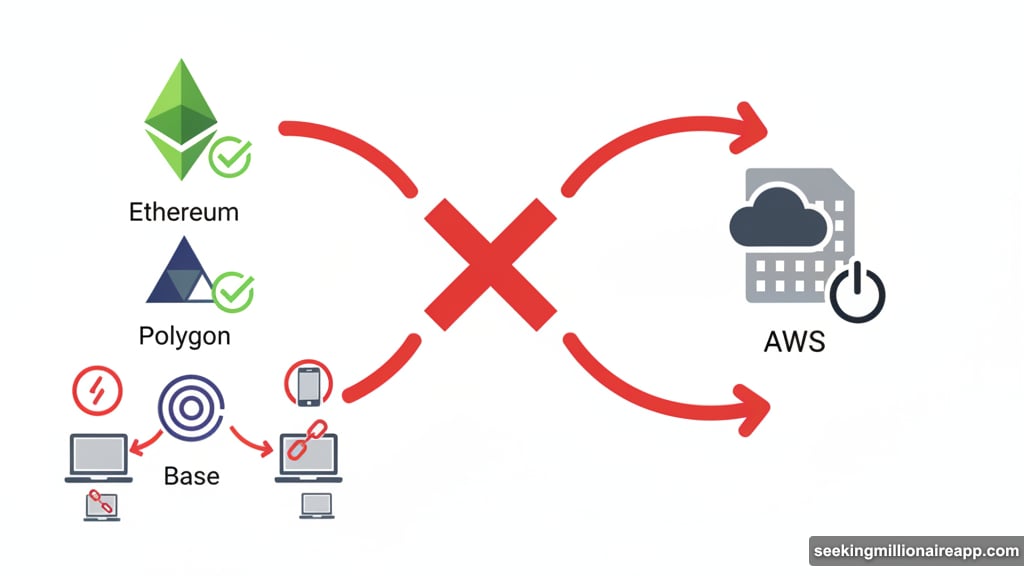

Infura provides critical infrastructure that connects wallets and apps to blockchains. When AWS stumbled, Infura’s endpoints for Ethereum, Polygon, Optimism, Arbitrum, Linea, Base, and Scroll all failed. Users couldn’t access their funds. Developers watched helplessly as their applications became unresponsive.

Here’s what stings most. The blockchains themselves kept running. Consensus layers hummed along fine. But without AWS-powered gateways like Infura, most users had no way to interact with those perfectly functional networks.

It’s like having a working car with no roads to drive it on.

This Wasn’t the First Time

AWS already disrupted crypto once this year. Back in April 2025, another widespread outage knocked exchanges and infrastructure providers offline. The pattern is clear and troubling.

Crypto Twitter erupted immediately after the October incident. Users pointed out what everyone already knew but preferred not to discuss. Most crypto companies depend heavily on centralized cloud infrastructure. Amazon, Google, and Microsoft essentially control the access points to supposedly decentralized networks.

The technical reality conflicts with the marketing message. Yes, blockchain consensus mechanisms are distributed. But the infrastructure that makes them usable? Highly centralized.

Why Crypto Keeps Using AWS Despite the Risk

Cloud services offer undeniable advantages. They scale quickly. They handle traffic spikes during market volatility. They provide reliability most of the time. Building equivalent infrastructure in-house costs millions and requires specialized teams.

So crypto companies make a calculated trade-off. They sacrifice true decentralization for operational convenience. The business logic makes sense until AWS goes down and everything stops working.

Some projects are exploring alternatives. Decentralized RPC providers like Pocket Network or Ankr aim to distribute access across multiple nodes. But adoption remains limited because centralized providers still dominate on speed and reliability during normal operations.

The economics favor centralization. That’s the uncomfortable truth nobody wants to admit.

What Actually Breaks When AWS Fails

Most people don’t realize how much crypto infrastructure runs on traditional cloud servers. Exchanges host their matching engines on AWS. Wallet providers rely on cloud-based key management systems. Analytics platforms pull data from centralized databases. Even “decentralized” apps often use centralized frontends hosted on cloud platforms.

When AWS fails, several critical functions stop:

- API endpoints that broadcast transactions

- WebSocket connections that stream real-time data

- Database queries that show account balances

- Authentication services that verify user access

Meanwhile, the actual blockchains keep producing blocks. Validators continue reaching consensus. But if users can’t submit transactions or check balances, does it matter?

The Decentralization Theater Problem

This reveals crypto’s biggest contradiction. The industry promises to eliminate single points of failure. Then it builds everything on top of Amazon’s infrastructure.

It’s not necessarily hypocrisy. Building genuinely decentralized systems is expensive and slow. Most users prioritize speed and convenience over censorship resistance. So companies optimize for user experience first and decentralization second.

But the October outage shows the real cost of that choice. When centralized infrastructure fails, supposedly unstoppable networks grind to a halt. All the distributed consensus in the world doesn’t help if nobody can access it.

Solutions Exist But They’re Costly

Some projects are working toward better infrastructure resilience. Running redundant systems across multiple cloud providers helps. Investing in decentralized RPC infrastructure reduces single points of failure. Building peer-to-peer networks for data distribution improves censorship resistance.

However, these solutions require significant investment. Small projects can’t afford multi-cloud deployments. Even large exchanges hesitate to build custom infrastructure when AWS works fine 99.9% of the time.

The incentive structure works against decentralization. Until outages become frequent enough to seriously damage business, most companies will stick with the convenient centralized option.

What This Means for Users

If you hold crypto, understand the reality. Your “decentralized” assets depend on centralized infrastructure. When AWS fails, you might not be able to access your funds even though they’re technically safe on the blockchain.

For developers, the lesson is clear. Don’t rely on single infrastructure providers. Build redundancy into your architecture. Test what happens when your primary RPC provider goes down. Have backup plans for accessing blockchain data.

For the industry overall, this outage should spark serious conversations about infrastructure resilience. But it probably won’t. Previous AWS disruptions generated similar discussions that led nowhere. Companies will express concern publicly while continuing to prioritize convenience over decentralization.

Crypto claims to be different from traditional finance. Yet it replicates the same centralization problems it promises to solve. The October AWS outage just made that contradiction impossible to ignore.

Build better infrastructure or accept that “decentralization” is mostly marketing. Those are the only honest options left.