Changpeng Zhao walked out of prison four months ago. Now he’s walking back into American crypto with a presidential pardon.

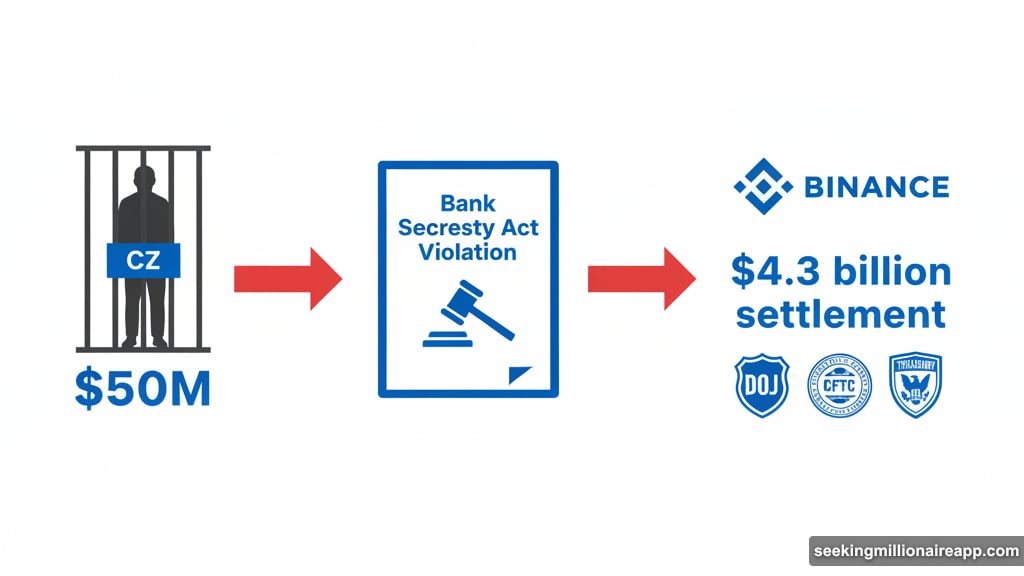

Thursday brought one of the biggest crypto stories of 2025. President Donald Trump pardoned Binance founder “CZ” Zhao, wiping clean a federal conviction that cost him his company, four months in prison, and $50 million. The move shocked even those who expected it.

But here’s what most people are missing. This isn’t just about one person getting a second chance.

The Money Laundering Conviction That Almost Stuck

CZ pleaded guilty in November 2023 to violating the Bank Secrecy Act. That’s the federal law requiring financial companies to report suspicious transactions and block money laundering.

Federal prosecutors had receipts. Internal chat logs showed Binance employees knew they were breaking rules. The exchange served users in sanctioned countries like Iran. Plus, it helped move money between Americans and people in those banned nations.

Attorney General Merrick Garland announced the charges personally. That tells you how big this case was. The Justice Department doesn’t roll out the top boss for minor violations.

CZ agreed to step down as CEO of Binance, the exchange he’d built since 2017. He paid $50 million personally. Binance itself coughed up a record-breaking $4.3 billion to settle with the DOJ, CFTC, and Treasury Department.

Four months in federal prison followed. Not exactly a slap on the wrist.

Trump Delivers What CZ Asked For

CZ admitted in May 2025 that he’d requested a pardon. Bloomberg and the Wall Street Journal had already reported his team was lobbying for one.

So this wasn’t a surprise. But the timing matters.

Trump’s pardon changes CZ’s legal status immediately. Before Thursday, his federal conviction limited where he could do business in America. Banking relationships? Nearly impossible. Regulatory approvals? Forget it.

Now those doors swing open. CZ can conduct business operations in the U.S. without that conviction hanging over him. That’s huge for someone who built the world’s largest crypto exchange.

Moreover, this sets a precedent. If Binance itself receives a pardon like BitMEX did earlier this year, the exchange could expand American operations aggressively. That would reshape competitive dynamics across the entire crypto industry.

The Money Connection Nobody’s Talking About

Let’s follow the money here. Because it gets interesting fast.

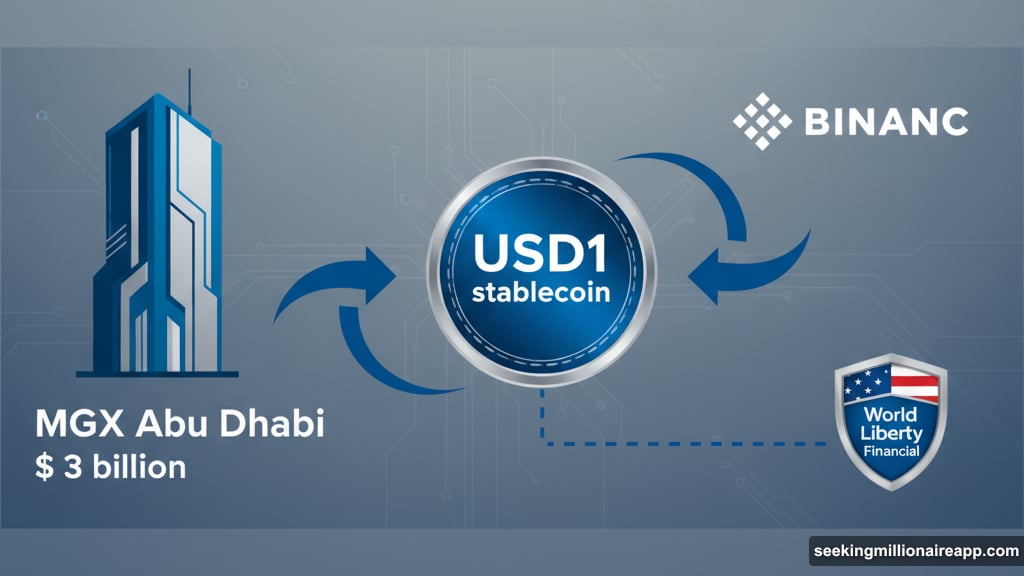

Binance recently received a $2 billion investment from MGX, an Abu Dhabi firm. But here’s the kicker. MGX used USD1 stablecoin to make that investment. And USD1? It’s issued by World Liberty Financial, a Trump-linked crypto venture.

So Trump pardons the founder of a company that just invested in a Trump-linked product. That’s either remarkable timing or calculated strategy. I’ll let you decide.

BNB, the token originally created as Binance’s native currency, jumped 3% in minutes after the pardon news broke. Markets clearly see this as bullish for Binance’s future.

Warren Calls It Corruption

Senator Elizabeth Warren didn’t mince words. As the leading Democrat on the Senate Banking Committee, she released a blistering statement Thursday.

“First, Changpeng Zhao pleaded guilty to a criminal money laundering charge. Then he boosted one of Donald Trump’s crypto ventures and lobbied for a pardon. Today, Donald Trump did his part and pardoned him.”

Warren sees quid pro quo corruption. Crypto supporters see overreach getting corrected. The truth probably lives somewhere between those extremes.

But Warren’s warning carries weight. “If Congress does not stop this kind of corruption in pending market structure legislation, it owns this lawlessness.”

Translation: This pardon will become ammunition in upcoming crypto regulation battles. Democrats will paint the industry as corrupt and needing strict oversight. Republicans will frame it as innovation-friendly policy correction.

What This Means for American Crypto

CZ’s pardon shifts power dynamics across the industry. Binance was already the world’s largest exchange by volume. Now its founder can operate freely in America again.

Other exchanges facing regulatory scrutiny are watching closely. If Binance gets a corporate pardon next, competitors might push for similar treatment. That could trigger a wave of settled cases getting revisited.

Plus, this signals Trump’s willingness to use pardons for crypto industry figures. That encourages aggressive business practices. Why worry about compliance when presidential pardons might erase consequences?

Some view this as pro-innovation policy. Others see it as greenlight for cutting corners. Both perspectives hold merit.

The Four-Month Prison Stay Nobody Mentions

Let’s talk about what actually happened to CZ. Because four months in federal prison isn’t nothing.

He served his time at a minimum-security facility. But prison is prison. You lose freedom. You’re separated from family. You eat prison food and follow prison schedules.

CZ completed his sentence. Then he got released and started rebuilding. The pardon came months after he’d already paid his debt to society through incarceration.

That timing matters. This wasn’t Trump letting CZ skip prison entirely. It’s erasing the conviction after he’d already served time. Reasonable people can disagree on whether that distinction matters legally or ethically.

Binance’s Path Forward in America

With CZ pardoned, Binance’s American strategy likely shifts dramatically. The exchange has operated at a distance from U.S. customers since the 2023 settlement.

But now? Doors open that were previously locked. Banking relationships become possible. Partnerships with American firms look less risky. Regulatory conversations start from a different baseline.

Remember, Binance already has deep pockets. That $2 billion MGX investment gives them massive resources. Plus, they’re still the dominant global exchange by trading volume.

Adding American market access to that mix creates a formidable competitor. Coinbase, Kraken, and others should be watching nervously.

The Precedent That Keeps Giving

BitMEX received a pardon earlier in 2025. Now CZ gets one. This pattern suggests Trump views crypto prosecutions from the previous administration as overreach worth correcting.

That philosophy extends beyond individual cases. It shapes how aggressively the crypto industry will operate going forward. If consequences can be pardoned away, risk calculations change fundamentally.

Federal prosecutors build cases over years. They gather evidence, flip witnesses, and construct narratives designed to secure convictions. Pardons bypass all that work instantly.

Career prosecutors watching this must feel frustrated. Their work gets erased with a signature. That affects morale and strategy for future crypto investigations.

Trump’s Crypto Strategy Comes Into Focus

This pardon reveals Trump’s broader crypto approach. He’s not just neutral on the industry. He’s actively removing barriers and supporting major players.

World Liberty Financial’s involvement with Binance. CZ’s pardon. Trump’s general pro-crypto rhetoric. These pieces fit together into a clear pattern.

America is competing globally for crypto industry dominance. Other countries like Singapore and the UAE offer friendly regulatory environments. Trump appears to be fighting for American leadership by removing obstacles.

Whether that strategy succeeds depends on execution. Pardons grab headlines. But sustainable crypto growth requires clear regulations, robust infrastructure, and consumer protection. Headlines alone won’t build that.

What CZ Said

CZ’s response on X was brief but telling. “Deeply grateful for today’s pardon and to President Trump for upholding America’s commitment to fairness, innovation, and justice.”

He continued: “Will do everything we can to help make America the Capital of Crypto and advance web3 worldwide.”

That’s not subtle. CZ explicitly commits to helping Trump achieve crypto dominance for America. The quid pro quo Warren alleged looks more explicit with each statement.

But from CZ’s perspective, this makes perfect sense. He spent months in prison. He paid millions in fines. He lost his company. Now he’s got a second chance. Of course he’s grateful and willing to align with Trump’s goals.

The Market Reaction Tells the Story

BNB’s 3% immediate jump says markets view this pardon positively for Binance. That’s not surprising. The world’s largest exchange just got its founder back with a clean record.

But broader market reactions matter too. Bitcoin and other major cryptocurrencies didn’t move dramatically on the news. That suggests markets already expected this outcome. CZ had publicly lobbied for a pardon. Trump has been vocally pro-crypto. The pieces were visible for months.

Still, confirmation matters. Markets now price in a world where Binance operates more freely in America. That changes competitive dynamics and potentially shifts trading volumes between exchanges.

Where This Goes Next

CZ’s pardon opens doors. But Binance itself still operates under its 2023 settlement terms. The exchange agreed to a court-appointed monitor and extensive compliance measures.

If Trump pardons Binance corporately like he did with BitMEX, those restrictions might ease. That would represent a massive shift in how major crypto exchanges operate in America.

Congress will respond. Warren already signaled Democrats plan to fight this in upcoming legislation. Expect crypto regulation to become even more partisan and contentious.

Meanwhile, CZ can get back to building. Whether that’s at Binance or new ventures remains to be seen. But don’t expect someone this ambitious to sit still for long.

The crypto industry just got a boost. The precedent just got stronger. And the debate about crypto’s role in America just got louder.

This story isn’t over. It’s just getting started.