Tether just claimed it’s heading toward $15 billion in profit this year. That’s not a typo.

Paolo Ardoino, CEO of the world’s largest stablecoin issuer, dropped this bombshell during a Bloomberg interview. He pegged Tether’s profit margin at 99%. So basically, for every dollar that flows through their system, 99 cents stays with them. No other company on Earth operates like that, according to Ardoino.

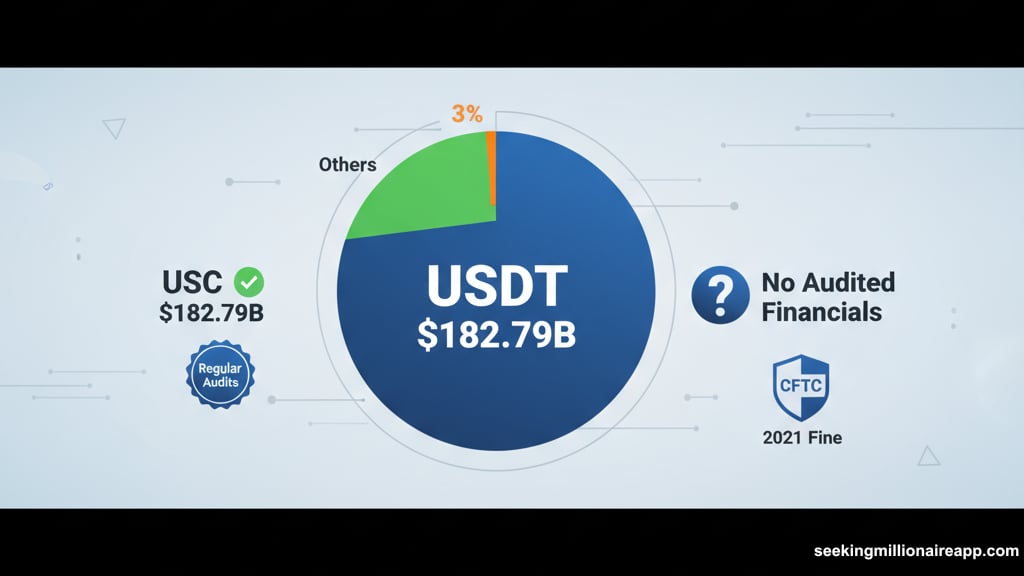

But here’s the catch. Tether doesn’t publish audited financials. We’re taking their word for it.

The Numbers Behind The Claim

Tether’s USDT token dominates the stablecoin market with $182.79 billion in circulation. That represents 59% of the entire stablecoin ecosystem, per DefiLlama data.

The company’s business model is surprisingly straightforward. Users deposit dollars. Tether issues USDT tokens backed by those dollars. Then Tether invests those reserves in government bonds and other assets. The interest generated becomes pure profit since Tether charges no transaction fees.

Plus, with interest rates elevated over the past two years, those returns have been substantial. Bond yields in the 4-5% range mean billions in passive income for Tether.

However, retail sentiment on Stocktwits remained bearish toward USDT despite the profit announcement. Message volume stayed low.

Trust Issues Still Linger

Tether’s credibility took a hit back in 2021. The Commodity Futures Trading Commission fined them for misrepresenting their reserves. The company had claimed USDT was fully backed by cash when it wasn’t.

That history matters. Without audited financials or public reporting standards, investors can’t independently verify Tether’s claims about profitability or reserve backing.

Ardoino hasn’t addressed these transparency concerns in recent interviews. Instead, he’s focused on expansion plans and valuation.

Meanwhile, competitors like Circle issue regular audits for their USDC stablecoin. That transparency gap puts Tether at a disadvantage among institutional investors who demand proof.

Massive Fundraising Plans

Tether is reportedly exploring a $20 billion fundraising round. The company would sell roughly 3% equity at a $500 billion valuation.

That valuation is staggering. It would make Tether more valuable than most Fortune 500 companies. For context, Goldman Sachs has a market cap around $170 billion.

Ardoino told Bloomberg the company has received enormous interest from potential investors. But he acknowledged the valuation is high. “We have to draw a line in the sand on a valuation that we think is very cheap,” he said.

The CEO added that Tether will evaluate investors based on synergy and impact rather than just capital. He didn’t name specific firms in discussions.

That selectivity suggests Tether isn’t desperate for cash. With $15 billion in annual profit, the company doesn’t need outside funding to operate.

The Return To America

Tether announced plans in September to launch a new stablecoin called USAT for the U.S. market. The token will comply with the GENIUS Act, legislation designed to integrate stablecoins into regulated financial systems.

This marks Tether’s attempt to rebuild trust in its home market after years of regulatory scrutiny. The CFTC fine and questions about reserve backing pushed many U.S. institutions toward competitors.

USAT could change that dynamic if Tether commits to full transparency and regular audits. But the company hasn’t confirmed those details yet.

The timing aligns with broader stablecoin adoption. Major banks are now exploring digital dollar tokens for cross-border payments. Zelle just announced plans to integrate stablecoins into its network.

That growing mainstream acceptance creates opportunities for Tether. But it also intensifies competition from better-regulated players.

What This Means For Crypto

Tether’s dominance shapes the entire cryptocurrency ecosystem. USDT serves as the primary trading pair on most exchanges. When traders buy Bitcoin or Ethereum, they typically use USDT.

That central role gives Tether enormous influence. A crisis of confidence in USDT could destabilize crypto markets globally.

The lack of transparency remains the biggest risk. Investors trust that Tether’s reserves actually exist and can handle mass redemptions. But without audits, that trust relies solely on the company’s word.

Competitors are chipping away at Tether’s market share. Circle’s USDC now holds $76 billion in market cap. Ripple plans to launch RLUSD soon. Even traditional payment giants like PayPal entered the stablecoin market.

Plus, regulatory pressure is mounting. The Trump administration’s pro-stablecoin legislation could force Tether to meet stricter standards or lose U.S. market access.

Ardoino’s profit projections sound impressive. But the real question is whether Tether can maintain dominance while improving transparency. The company’s next moves will determine if it becomes a regulated financial giant or remains a controversial crypto outlier.

Choose carefully if you hold USDT. The profit margins look incredible, but the lack of audited financials creates risk. Diversifying across multiple stablecoins might make more sense than betting everything on one player, no matter how dominant they currently are.