The crypto market just shed $7 billion overnight. Not a crash. But enough to make traders nervous.

Bitcoin hovers just under $115,000, unable to punch through resistance. Meanwhile, altcoins like MYX Finance dropped 12% in 24 hours. So what’s driving this cooldown after days of steady gains?

Let’s break down the three key pressure points shaping prices right now.

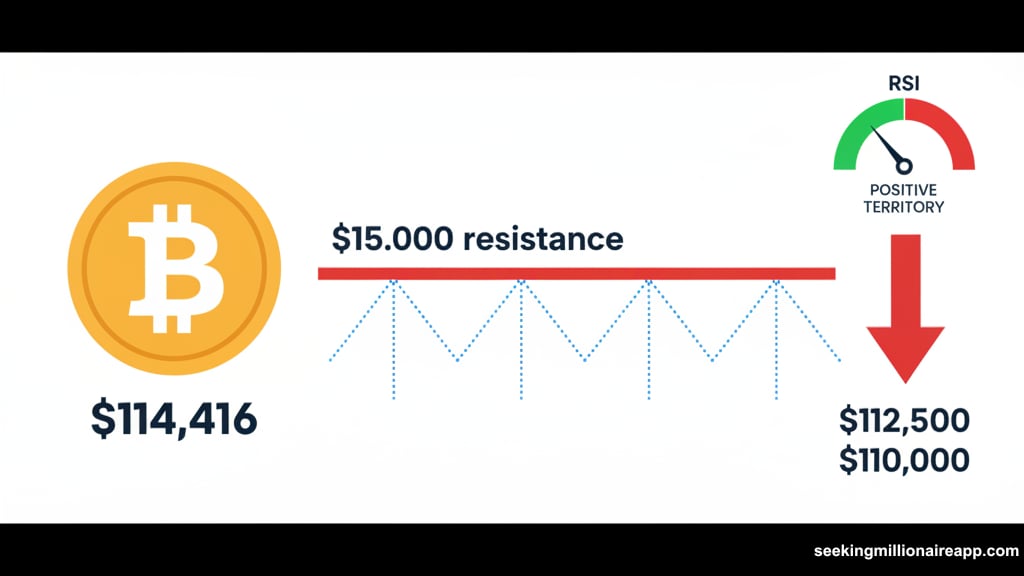

Bitcoin Can’t Break $115,000

Bitcoin trades at $114,416 as of this writing. That’s tantalizingly close to $115,000, but close doesn’t count in crypto.

The price has tested this resistance multiple times over the past 24 hours. Each time, selling pressure pushes it back down. This pattern suggests traders are taking profits at this psychological barrier rather than betting on further upside.

Here’s the risk. If Bitcoin can’t break through soon, momentum could reverse. A failed breakout often triggers profit-taking, which could send BTC sliding toward $112,500. Lose that support, and $110,000 becomes the next target.

However, the Relative Strength Index (RSI) tells a more optimistic story. The indicator sits in positive territory, showing bullish momentum building beneath the surface. So if buying pressure increases, Bitcoin could finally breach $115,000 and aim for $117,261 in the near term.

Total Market Cap Holds Critical Support

The total crypto market cap fell from an intraday high of $3.89 trillion to $3.81 trillion. That’s a $7 billion decline that might seem minor but carries real significance.

Why does this matter? Because $3.81 trillion represents a crucial support level. The market has bounced from this zone multiple times recently. As long as it holds, the broader crypto market maintains its bullish structure.

But break below $3.81 trillion, and things get dicey. Losing this support could trigger cascading liquidations, potentially pushing the total market cap down to $3.73 trillion. That’s where stronger support exists, but reaching it would require enduring another 2% decline.

The positive sign? Despite the pullback, the market stabilized rather than collapsing. This consolidation suggests traders are pausing rather than panicking. A rebound from $3.81 trillion would signal renewed buying interest and could push the total market cap back toward $3.89 trillion.

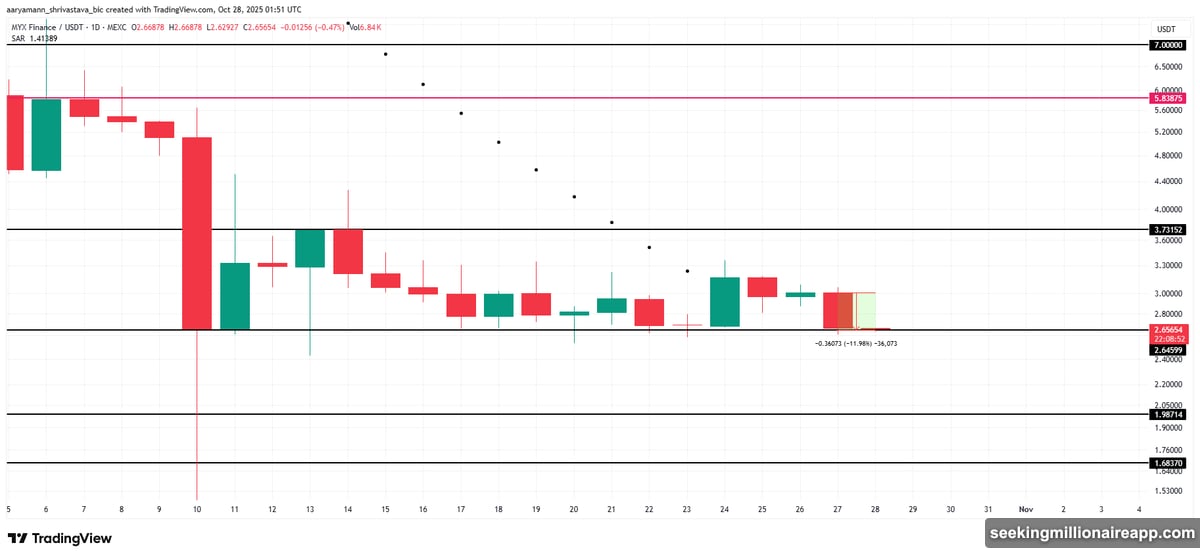

MYX Finance Tests Its Breaking Point

MYX price dropped 12% in the past day, making it one of the session’s worst performers. Currently trading above $2.64, the altcoin sits right on critical support.

This $2.64 level has held firm through multiple tests. Each time selling pressure mounted, buyers stepped in at this price. But patience wears thin. Another strong wave of selling could finally break support and send MYX tumbling toward $1.98.

Yet the Parabolic SAR indicator still points to an active uptrend. This technical signal suggests underlying bullish momentum hasn’t completely died. So if MYX can hold $2.64 and bounce, a rally toward $3.73 becomes possible in the coming days.

The next 24-48 hours will determine which direction MYX breaks. Hold support, and bulls stay in control. Break below, and a deeper correction follows.

New ETF Launches Fail to Spark Rally

Bitwise and Canary Capital just confirmed their Solana and HBAR ETFs start trading tomorrow. This should be big news. Institutional products typically signal growing acceptance and bring new capital into crypto markets.

But prices haven’t responded. Both Solana and Hedera remain flat despite the announcement. This muted reaction reveals broader market uncertainty and regulatory caution among traditional investors.

In fact, the disconnect between positive news and price action suggests traders are waiting for clearer signals before committing capital. ETF launches don’t guarantee immediate rallies anymore. The market has matured beyond simply pumping on institutional products.

Regulatory Pressure Mounts in Asia

The US sanctioned Cambodia-based Huione Group as a transnational crime organization. The group allegedly laundered money through South Korean crypto exchanges, moving roughly $12 million in Tether transactions over three years.

South Korea’s Financial Supervisory Service (FSS) revealed the details, adding regulatory pressure to an already cautious market. When money laundering headlines hit, they tend to spook institutional investors and delay capital inflows.

This type of news creates friction. Exchanges tighten compliance. Banks hesitate to work with crypto firms. Capital flows slow down. None of this directly crashes prices, but it certainly doesn’t help during consolidation periods.

What Traders Should Watch Next

Three scenarios could play out over the next few days.

Scenario one: Bitcoin breaks $115,000 with conviction. This would likely trigger a relief rally across the market, pushing the total market cap back above $3.89 trillion. Altcoins like MYX would probably follow, potentially reclaiming higher levels.

Scenario two: Bitcoin fails at $115,000 and drops to $112,500 or lower. In this case, the total market cap could slip below $3.81 trillion toward $3.73 trillion. Altcoins would likely suffer deeper corrections, with MYX potentially falling to $1.98.

Scenario three: The market continues consolidating in a tight range. Bitcoin stays between $112,500 and $115,000. The total market cap oscillates between $3.81 trillion and $3.89 trillion. This sideways action could last days or weeks before a decisive move.

Right now, technical indicators lean slightly bullish. But price action shows hesitation. The conflict between positive signals and stalled momentum suggests the market needs a catalyst. Either a macro event or a technical breakout must arrive to resolve this standoff.

The key levels are clear. Watch $115,000 for Bitcoin, $3.81 trillion for total market cap, and $2.64 for MYX. These thresholds will determine whether the recent rally continues or takes a breather.