The US claims it wants crypto dominance. But Ray Youssef says that’s a cover story for something far darker.

According to the NoOnes CEO, Binance transformed from Chinese upstart to American weapon. Now it sits at the center of what he calls a “controlled demolition” of the entire crypto industry. This isn’t conspiracy theory speculation. It’s a pattern he’s watched unfold across regulatory moves, executive pardons, and structural changes at the world’s largest exchange.

The question isn’t whether Washington wants control. It’s whether crypto will recognize the threat before it’s too late.

From Rogue Exchange to State Asset

Binance launched in 2017 and dominated global crypto trading within six months. The exchange now processes more volume than its next three competitors combined.

But that success came with consequences. US prosecutors charged founder Changpeng Zhao with violating anti-money laundering laws and breaking economic sanctions. In 2023, CZ pleaded guilty. He paid $50 million personally. Binance paid $4.3 billion, one of the largest corporate penalties in history.

Then came the real transfer of power. As part of the settlement, the US installed a compliance monitor inside Binance. That person doesn’t just advise. According to Youssef, they run the company now.

“People that know compliance know what that means. That means this guy actually runs Binance. That’s why you’re having the KYC every two weeks on Binance. They run the company. It’s not the Chinese folks. It’s Uncle Sam that runs Binance,” Youssef told BeInCrypto.

CZ served four months in a US prison. After his release, he stayed outside America and couldn’t hold executive positions at his own company. Then President Trump pardoned him in 2025, erasing his felony record completely.

The White House framed it as ending Biden’s “war on crypto.” But Youssef sees something else. He views the pardon as confirmation that CZ aligned himself with American interests. The message? Play ball with Washington, and your problems disappear.

The FTX Blueprint That Failed

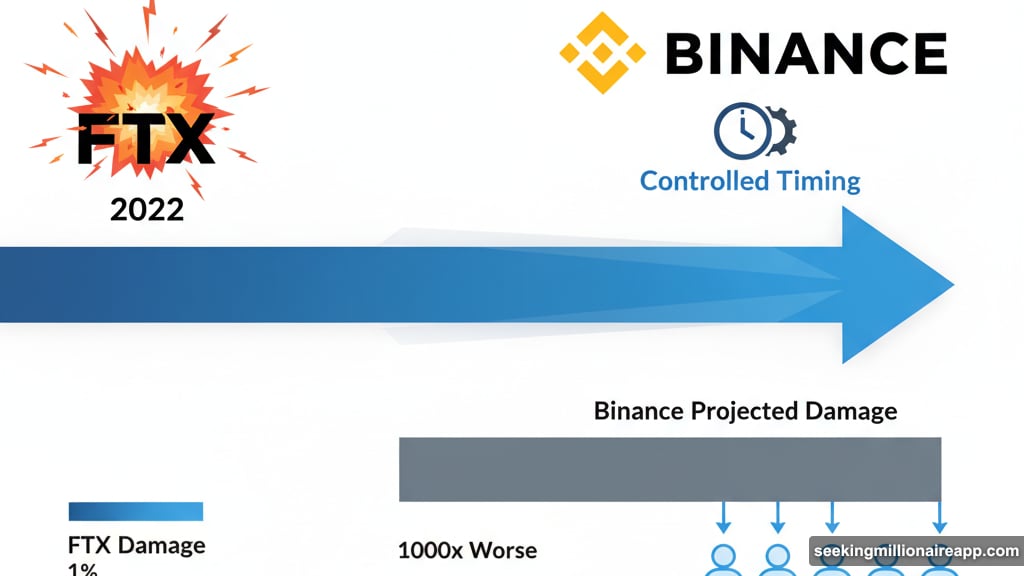

Youssef believes FTX was supposed to trigger the first controlled collapse. The exchange imploded in 2022, wiping out billions in customer funds. But it happened too early and too messily.

“Binance is becoming the next FTX or what FTX should have been,” he stated. The executive emphasized that FTX’s implosion happened ahead of schedule. So Washington needed a backup plan.

That backup is Binance. Except this time, the timing will be deliberate. The scale will be massive. And the fallout will justify whatever regulatory crackdown comes next.

“When CZ burst the bubble on FTX, the damage was really basically 1% of what the state planned it to be. Now they’re going to use Binance. They’re going to make that corpse explode right in our face,” Youssef warned.

He predicts Binance’s collapse will be a thousand times worse than FTX. Not because of incompetence or fraud, but because of strategic planning. A state-controlled demolition designed to break trust across the entire sector.

Why Washington Would Want Crypto to Fail

Here’s the paradox. The US government claims it wants to lead the global crypto revolution. President Trump promised to make America the “crypto capital of the world.” Congress passed the GENIUS Act to create clearer regulations.

So why would the same government want the industry to collapse? Because control matters more than innovation.

Every government’s power depends on its ability to control money. Cryptocurrencies bypass banks, ignore borders, and operate outside traditional financial surveillance. That threatens the dollar’s dominance and Washington’s economic leverage.

“They want to weaken all the state currencies. They want to usher in their own new global currency. For that to happen, there has to be desperation, poverty, and instability and chaos. And what better way to do that than by bringing down the entire crypto market with a controlled demolition of the biggest exchange,” Youssef explained.

Think about it. Before 9/11, you could walk into Charles Schwab with cash and buy stocks without showing ID. After the attacks, that freedom vanished. Governments used the crisis to justify sweeping financial surveillance.

Youssef sees the same pattern emerging in crypto. Each major scandal from Mt. Gox to FTX to whatever comes next leads to new restrictions. The Travel Rule. Operation Chokepoint initiatives. Stricter KYC requirements.

The next big collapse will give regulators the excuse they need to lock down the entire industry. What was designed as a decentralized alternative to state control becomes state-controlled infrastructure.

Binance Sits at the Center of Global Crypto

Why focus on Binance specifically? Because it dominates the market like no other exchange ever has.

Binance offers access to more than 400 cryptocurrencies and 1,600 trading pairs. It processes more trading volume than Coinbase, Kraken, and Gemini combined. Millions of users worldwide trust it with their funds.

That concentration creates enormous systemic risk. If Binance collapses, whether from hacking, regulatory seizure, or deliberate destruction, the shock waves would devastate the entire crypto economy.

Plus, Binance now operates with US oversight baked into its structure. That compliance monitor doesn’t just ensure rule-following. According to Youssef, they steer decisions, monitor flows, and gather intelligence.

Washington doesn’t need to ban crypto if it controls the platforms where most people interact with it. By embedding itself within Binance, the US gains leverage over global crypto markets without passing a single new law.

The Split That’s Coming

Youssef predicts the crypto world will fracture into two camps after Binance falls. Most exchanges will “go with the man,” accepting heavy regulation and state oversight. A small number of truly decentralized platforms will fight to preserve independence.

But even that resistance faces challenges. Many DEXs already follow sanction lists and blacklists. They’re not as free as their users believe.

“It’s going to completely fracture the entire industry, where only a few places like Silk Road will exist, and the vast majority of humanity will be under their control. That’s what they’re planning. They make power moves, and we’re just looking a couple of weeks ahead. They’re looking at least 20 years ahead,” he commented.

The executive warns that most crypto users don’t see the bigger picture. They focus on price charts and token launches while governments plan decades-long strategies to capture the industry.

Washington isn’t playing a short game. The goal isn’t to crush crypto tomorrow. It’s to gradually transform crypto from a tool of financial freedom into another instrument of state power.

What Crypto Users Can Actually Do

So is resistance even possible? Youssef believes it is, but only if users take responsibility now.

First, withdraw funds from centralized exchanges. Self-custody isn’t just safer. It’s a political statement. When users control their own keys, exchanges lose leverage.

Second, adopt truly decentralized platforms. Not DEXs that follow government blacklists, but peer-to-peer networks where no single entity controls access.

Third, abandon leverage trading. These products tie users to centralized platforms and create dependencies that make withdrawal difficult.

Most importantly, stop waiting for regulators or courts to fix the problem. “We are the people. We choose where to put our money, where to use our money, where to spend our money,” Youssef noted.

The power doesn’t rest with Washington or Binance executives. It rests with millions of individual users who decide every day whether to trust centralized platforms or build alternatives.

The Real Question Nobody’s Asking

Whether or not Youssef’s prediction comes true, his warning reveals crypto’s fundamental tension. The technology was designed to escape government control. But most users interact with it through centralized companies that governments can easily capture.

Bitcoin exists on a decentralized network. But most people buy it on Coinbase or Binance. Ethereum enables permissionless finance. But most transactions flow through regulated exchanges.

That centralization creates vulnerability. Not just technical vulnerability to hacks or failures, but political vulnerability to state pressure.

Maybe the US government doesn’t need to destroy crypto. Maybe it just needs crypto users to keep choosing convenience over independence. That choice, repeated by millions of people, achieves the same result as any deliberate attack.

The industry can’t survive if it keeps depending on the very institutions it was built to replace. So the real question isn’t why the US wants to destroy crypto. It’s whether crypto will destroy itself through centralization and complacency.

Your choice of where to trade might matter more than you think.