Trump tweets about tariffs. Markets nosedive. He backtracks. Markets recover. Rinse and repeat.

This isn’t normal policy-making. It’s become a reliable formula for creating wild price swings in crypto and tech stocks. In fact, the pattern now resembles classic pump-and-dump schemes, except nobody’s actually orchestrating it. Market psychology just does the work automatically.

Plus, AI mega-deals are copying the same playbook. Big companies announce flashy partnerships. Stock prices explode. Then reality sets in, and everything crashes back down. The whole system is starting to look less like rational markets and more like a speculative fever dream.

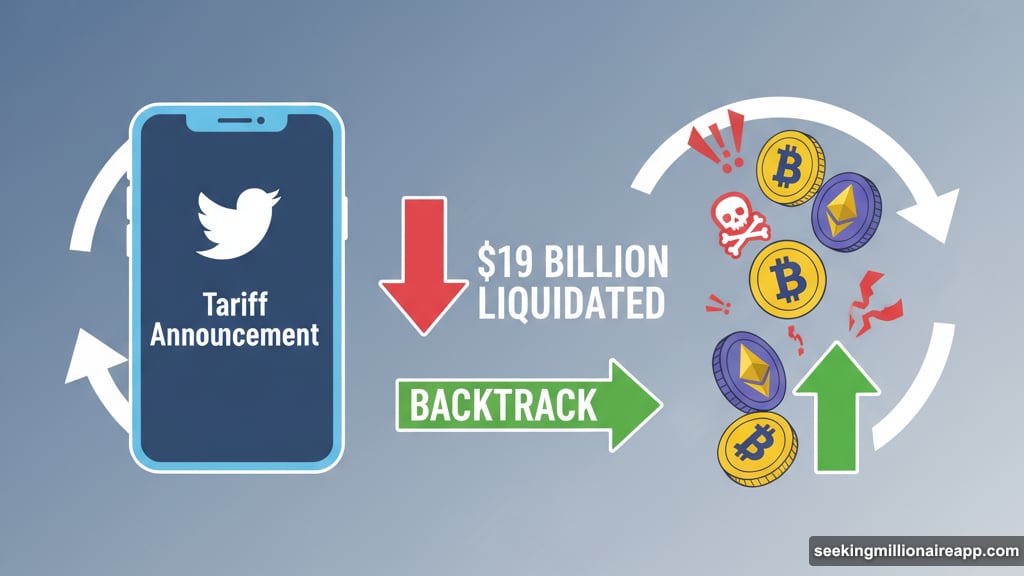

When Tariff Tweets Move Billions

Trump’s trade announcements have trained markets to panic on command. Earlier this month, renewed tariff threats wiped out more than $19 billion in leveraged crypto positions in 24 hours.

The mechanism works like clockwork. Trump announces or escalates tariffs, particularly against China. Investors immediately dump risk assets. Crypto takes the hardest hit since it trades 24/7 with no circuit breakers. Then Trump softens his stance or hints at negotiations. Markets bounce back almost as fast as they fell.

However, nothing fundamental actually changed. Companies didn’t suddenly become more or less profitable. The entire cycle runs on pure sentiment and fear. Traders now position themselves specifically to profit from these predictable swings.

Moreover, this creates perverse incentives. Some investors actually want more tariff chaos because volatility equals opportunity. So the dysfunction itself becomes a feature, not a bug.

AI Deals Follow the Same Script

Tech giants recently discovered they can move markets just by announcing partnerships with each other. But these moves increasingly follow the Trump tariff playbook.

Take AMD and OpenAI. They announced a computing deal where OpenAI could acquire up to 10% of AMD stock. AMD shares jumped 38% that day. Sounds amazing, right? But analysts quickly realized the deal’s structure was complicated. Profits wouldn’t materialize immediately. So the stock cooled off fast.

Then Nvidia and Intel pulled the same trick. Their $5 billion collaboration sent Intel stock up 23% overnight. Yet within days, the same pattern emerged. Analysts questioned whether the hype matched reality. The answer was no. The stock pulled back as enthusiasm faded.

Still, neither company lost anything real. They just created temporary price volatility that mimicked the Trump tariff effect. Announcement generates excitement. Price spikes. Reality disappoints. Price retreats.

The Closed-Loop Casino

Here’s what makes the AI situation different from tariff chaos. These tech deals mostly recirculate money within a tiny ecosystem of the same companies.

OpenAI partners with AMD. Nvidia teams with Intel. Microsoft invests in OpenAI. Google competes with all of them. But they’re all buying from and investing in each other. The money doesn’t leave the system. It just sloshes around in a closed loop.

This creates an illusion of growth without necessarily generating new value. Think about it. When OpenAI gets AMD computing power in exchange for equity, no new money entered the economy. They just swapped assets. But both stock prices moved as if something substantial happened.

Furthermore, this feeds speculative momentum. Investors see big numbers and flashy announcements. They pile in without understanding the actual economics. Prices inflate based on hype rather than fundamentals. And the cycle continues.

Pump Without the Dump?

Traditional pump-and-dump schemes require coordination and fraud. Someone artificially inflates prices, then sells before the crash. But what happens when the same pattern emerges organically?

Trump doesn’t coordinate with crypto traders. He’s just making policy announcements. Yet his timing consistently moves markets in predictable ways. Similarly, tech companies aren’t conspiring to manipulate stocks. They’re announcing real partnerships. But the market reaction vastly exceeds the underlying value created.

So we’ve somehow built a system where pump-and-dump dynamics happen naturally. No fraud required. Just headlines, speculation, and repetition.

That should worry everyone. Markets are supposed to allocate capital efficiently. Instead, they’re becoming reaction machines that respond to noise rather than signal.

When Closed Systems Explode

The biggest danger isn’t individual price swings. It’s that this entire mechanism could be inflating a massive bubble.

A handful of companies now control enough capital to move entire market sectors. Their announcements create waves of buying and selling. Prices disconnect from actual business performance. And investors keep chasing momentum because it’s worked so far.

However, bubbles don’t deflate gently. They pop. When investors finally realize that these mega-deals aren’t generating proportional returns, confidence will evaporate fast. The same closed system that pumped prices up will accelerate the crash down.

Plus, crypto remains the most vulnerable. It lacks traditional market protections and trades continuously. So when the AI bubble eventually bursts, crypto will likely experience the worst damage. Leveraged positions will unwind catastrophically. And we’ll see another $19 billion liquidation event—or worse.

The Speculation Treadmill

Markets now run on headline-driven momentum rather than fundamentals. Trump’s tariff announcements proved that sentiment alone could create massive price moves. Tech giants learned that lesson and applied it to their own partnerships.

The result? A financial system where only a few players can reliably move markets. Their announcements trigger predictable buying and selling. Prices inflate and deflate on news rather than value. And speculation becomes self-reinforcing.

But this can’t continue forever. Eventually, underlying performance has to match inflated expectations. When it doesn’t—and it won’t—the correction will be brutal. Investors who bought the hype will exit fast. And the entire closed-loop system will unwind.

Smart money already sees this coming. They’re positioning for volatility rather than growth. They know the game is temporary. The only question is when the music stops and who’s left holding worthless assets when it does.