October wasn’t kind to altcoin holders. Prices crashed hard as derivatives markets experienced massive deleveraging. But now several analysts see something different happening.

The market might be stabilizing. In fact, key indicators suggest altcoins could mount a comeback in November. Let’s examine what’s actually changing and whether these signals hold water.

Fear Still Grips the Market

The numbers paint a stark picture. The Fear and Greed Index hit 29 at October’s end. That’s three straight weeks of fear since the October 11 liquidation event.

Fear keeps investors on the sidelines. Nobody wants to catch a falling knife. But interestingly, most altcoins stopped making new lows. Prices started moving sideways instead of down.

This matters more than you’d think. Sideways action often precedes reversals. Markets don’t turn on a dime. They pause first.

Altcoins Enter Stabilization Zone

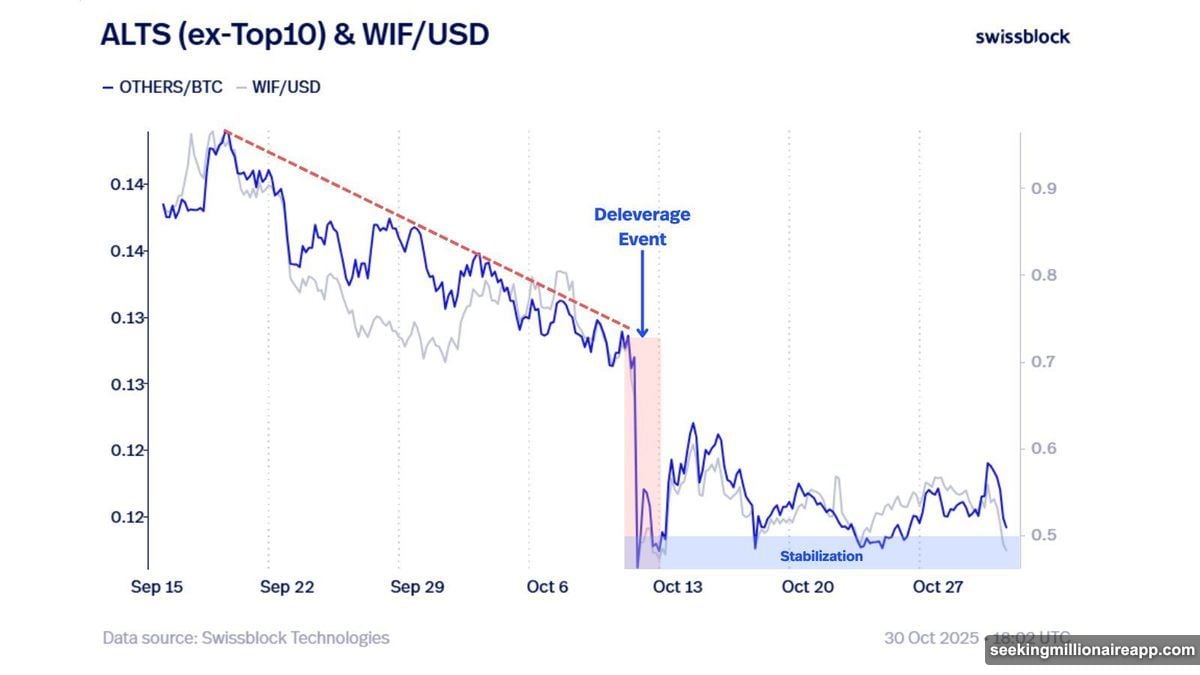

Altcoin Vector, known for institutional-level analysis through Swissblock, spotted something important. The OTHERS/BTC chart dropped from above 0.14 in September to below 0.12 in October.

That chart tracks all altcoins except the top 10 versus Bitcoin. It’s basically a health check for the broader altcoin market.

Now here’s the shift. OTHERS/BTC moved into what analysts call a “Stabilization” phase. Prices bounce around in a defined range rather than plunging lower.

“If the stabilization zone holds as support, we could see short-term alt rallies,” Altcoin Vector noted. They’re careful not to call it a full altcoin season yet. Instead, they expect “relief moves that help release downside pressure.”

Plus, dogwifhat (WIF) serves as a prime example. Its price action mirrors the broader trend perfectly. The meme coin stabilized after weeks of selling pressure.

Historical Patterns Suggest Bigger Moves Ahead

Michaël van de Poppe takes a more bullish stance. The founder of MN Fund called OTHERS/BTC “one of the most valuable charts in today’s market.”

His reasoning? Altcoins now trade at valuations similar to previous market bottoms. Think Q4 2016 and Q1 2020.

Both periods preceded massive rallies. In 2017, Ethereum and other altcoins exploded hundreds of times over. In 2020-2021, a full bull run unfolded after pandemic uncertainty cleared.

History doesn’t repeat exactly. But it often rhymes. So these parallels deserve attention.

RSI Hits Unprecedented Oversold Levels

Analyst Javon Marks highlighted another critical signal. The RSI indicator of “Others Dominance” reached its deepest oversold level ever recorded on monthly timeframes.

Others Dominance measures how much of the total crypto market non-top-10 altcoins control. When it’s oversold this severely, it typically signals exhausted selling pressure.

“When a market is oversold, it can mean that prices have fallen ‘too far,’ that seller pressure is exhausted, and that a bounce higher or a reversal could be nearing,” Marks explained.

Meanwhile, analyst Ted shared similar optimism. He predicts a “beautiful bull market” ahead based on these technical signals.

Historically, altcoin seasons often kick off around November. The timing aligns with several leading analysts’ predictions for a potential recovery starting next month.

Why This Time Feels Different

But not everyone’s convinced. The Altcoin Season Index remains below 50. That’s the threshold where altcoins need to outperform Bitcoin consistently.

Plus, fear persists despite favorable macro conditions. The Federal Reserve already started cutting interest rates. In past cycles, that triggered immediate risk-on behavior.

This environment differs from previous bull runs. Investors seem more cautious. Burned by 2022’s brutal bear market, they’re not rushing back in.

Still, the technical setup looks promising. Multiple indicators point toward potential upside. The question isn’t whether altcoins can bounce. It’s whether that bounce turns into sustained momentum.

Stabilization Doesn’t Guarantee Recovery

Here’s the reality check. Stabilization zones can break either direction. They’re pause points, not guarantees.

If Bitcoin rallies hard, it might drain liquidity from altcoins. Conversely, if Bitcoin consolidates, money could rotate into cheaper alts seeking bigger gains.

The derivatives market holds another key. October’s deleveraging cleared out excessive leverage. That’s healthy long-term. But it doesn’t guarantee immediate recovery.

Moreover, many retail investors left crypto entirely. Volume remains light compared to 2021 peaks. Without fresh capital inflows, rallies struggle to sustain.

What November Might Actually Bring

Short-term relief rallies seem likely. Technical oversold conditions typically resolve upward eventually. But expecting a 2017-style altcoin explosion might be premature.

More realistic? A gradual grind higher. Altcoins could recover some October losses without entering euphoric territory. That would match the cautious tone from experienced analysts like Altcoin Vector.

Watch Bitcoin’s behavior closely. If it breaks through resistance and maintains momentum, altcoins usually follow with a lag. If Bitcoin stalls or drops, altcoins will struggle regardless of their technical setups.

Also monitor exchange supply metrics. When altcoins leave exchanges, it suggests holders expect higher prices. When supply on exchanges increases, it signals distribution and potential selling pressure.

The altcoin market looks better than it did three weeks ago. Stabilization beats capitulation. But true bull markets require more than just oversold bounces. They need sustained demand, improving fundamentals, and renewed investor confidence.

November could mark the start of something bigger. Or it might just provide temporary relief before another leg down. The indicators lean slightly bullish. But in crypto, nothing’s certain until it happens.