November kicked off with a clear signal. Crypto whales moved aggressively into three specific tokens, betting on gains before most retail traders even noticed.

The buys weren’t small either. We’re talking millions of dollars shifted into privacy coins, DEX platforms, and SocialFi projects. Plus, the timing matters. These accumulation patterns started just as October closed, suggesting whales positioned early for whatever they expect in November.

Let’s break down exactly where the smart money went and why these bets matter.

Railgun Whales Went All In on Privacy

Privacy tokens don’t usually top whale buying lists. But Railgun (RAIL) just became the exception.

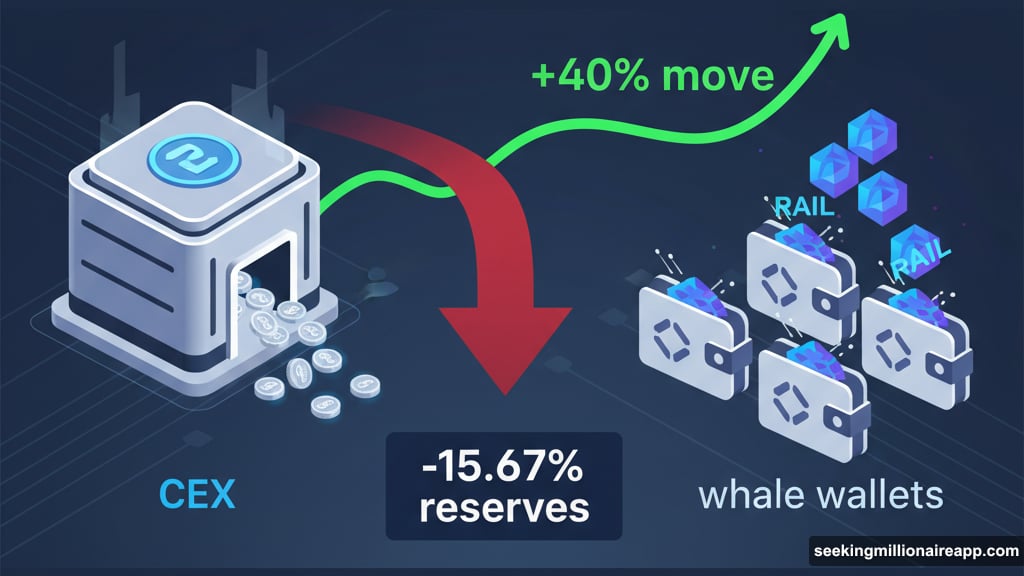

In the past 24 hours alone, whale holdings jumped 30%. That translates to roughly 56,000 RAIL tokens added, worth about $220,000. Meanwhile, the RAIL price surged over 40% during the same window.

Here’s what makes this interesting. Smart money wallets — addresses consistently tied to profitable trades — increased their RAIL balances by 8.17%. At the same time, exchange reserves dropped 15.67%. So tokens are leaving exchanges, not arriving for sale.

That’s textbook accumulation behavior. Whales and experienced traders don’t buy this aggressively unless they see something coming.

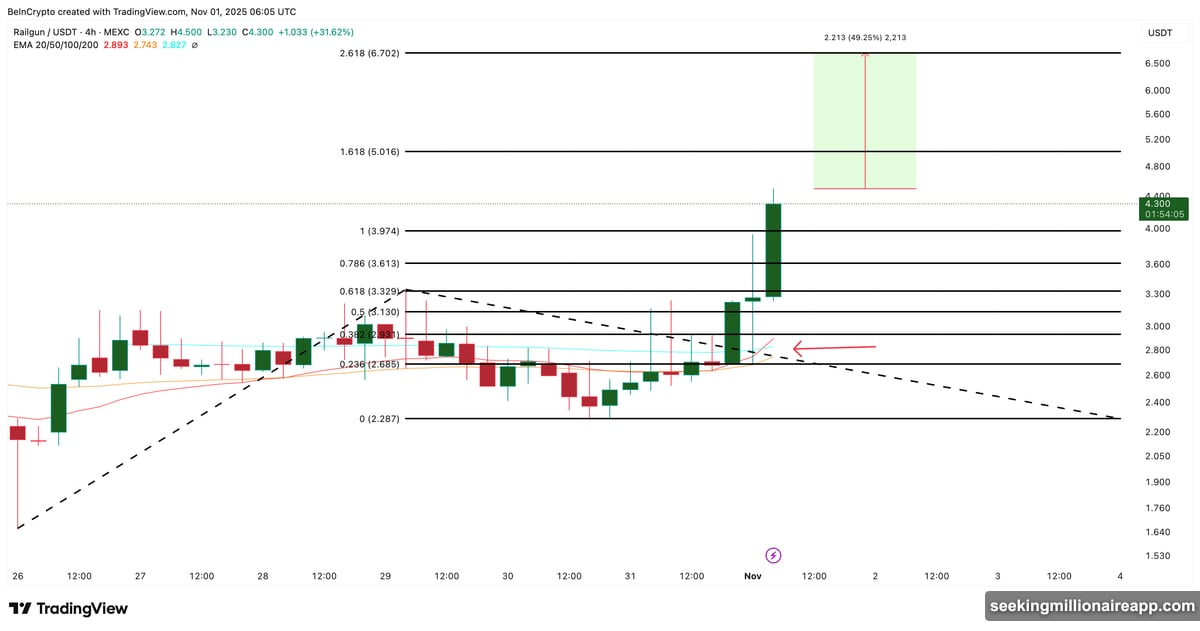

The Technical Setup Supports More Upside

Railgun’s chart structure backs up the whale thesis. On the 4-hour timeframe, the 20-period exponential moving average already crossed above the 50 EMA. That confirms short-term bullish momentum.

Now the 50 EMA is approaching the 100 EMA. If that “golden crossover” completes, RAIL could target $5.01 as the first psychological resistance. A stronger push might reach $6.79.

However, support levels sit at $3.97 and $3.32. Those zones typically act as rebound bases after sharp rallies. A sustained drop below $2.28 would invalidate this entire setup and likely pause whale buying.

For now, though, whales seem convinced Railgun offers one of November’s strongest risk-reward opportunities in the privacy sector.

Aster Whales Bet Big on BNB Chain DEX

The second token drawing whale attention is Aster (ASTER). It’s a next-generation decentralized exchange built on BNB Chain, offering both spot and perpetual trading.

After a quiet October, Aster whales suddenly woke up. Over the past 24 hours, whale holdings increased 11.98%, lifting their total stash to 21.77 million ASTER. That means whales added nearly 2.33 million tokens, worth around $2.3 million.

Even the top 100 addresses — the mega whales — saw steady increases. So accumulation is happening across both large and mid-sized wallets.

ASTER is up 7% in the past day, though it remains down about 10% for the week. That suggests whales might be positioning early for a rebound before the broader market catches on.

Aster’s Pennant Pattern Could Trigger Breakout

The price action shows why whales are moving now. ASTER is trading inside a pennant-like pattern, a technical setup that often precedes strong directional moves.

A 4-hour close above $1.06 would signal a breakout. If that happens, prices could target $1.09 or even $1.22 if momentum builds. However, a drop below $0.94 or $0.92 would invalidate the pattern and open room for a decline to $0.85.

The lower pennant trendline only has two touch points, making it a weaker support. Still, whales seem to be betting on the upside as ASTER trades closer to its breakout zone.

With growing accumulation and a tightening technical setup, Aster could deliver if the breakout confirms. That’s likely what whales are banking on.

Pump.fun Whales Accumulated All Week

While Railgun and Aster saw 24-hour buying sprees, Pump.fun (PUMP) whales have been accumulating quietly for a full week.

Pump.fun is a SocialFi project on Solana that lets users easily create and launch meme coins. It’s generated significant buzz among small-cap traders looking for quick rotations.

Over the past seven days, whale balances rose 11.84%, lifting their total stash to 17.13 billion PUMP. That means whales added around 1.81 billion tokens, worth close to $8.1 million.

The increase aligns with steady drops in exchange balances. Most purchases are being moved off-exchange, a classic sign of conviction buying rather than speculative flipping.

PUMP is up 10% in the past week and nearly 5% over the past 24 hours. So whales have been buying into strength, not trying to catch a falling knife.

Flag Pattern Points to Bigger Move

On the 12-hour chart, PUMP is forming a flag-and-pole pattern. This technical structure usually signals a pause before another breakout in the same direction.

The token has tested both the upper and lower flag trendlines multiple times, typical for a volatile new asset consolidating after a rally.

A break above $0.0049 would confirm a bullish breakout. Short-term targets sit at $0.0053 and $0.0061. Based on the pole’s height, a full breakout could push PUMP toward $0.0078, marking a 60% potential move.

If momentum stays strong, even the previous all-time high of $0.0088 could come into play. A move beyond $0.0095 would mark a new record entirely.

For now, whales appear to be front-running the breakout. They’re steadily adding exposure while the market awaits confirmation. The bullish trend would lose effect if a 12-hour candle closes under $0.0041.

Why These Three Tokens Matter

These aren’t random picks. Whales moved into three distinct sectors — privacy, decentralized exchanges, and SocialFi — all with clear technical setups and growing on-chain accumulation.

Railgun offers privacy with Ethereum integration. Aster provides multi-chain DEX functionality on BNB Chain. Pump.fun taps into the meme coin creation trend on Solana.

Each token serves a different niche. But they share one thing: whale conviction right as November starts.

That doesn’t guarantee gains. Markets can turn quickly, and whale bets sometimes fail. But when multiple whale cohorts move this decisively into specific tokens within 24-48 hours, it’s worth paying attention.

These three could define early November momentum if their technical setups confirm. Or they could fade if broader market conditions deteriorate. Either way, whales just showed their hand.