The Federal Reserve just pumped $29.4 billion into US banks through overnight repos. Meanwhile, China’s central bank flooded its system with record cash. Both moves happened within 24 hours.

This isn’t normal. In fact, the Fed’s injection marked the biggest single-day liquidity boost since the dot-com crash. So something’s breaking beneath the surface. And Bitcoin traders are paying very close attention.

Why the Fed Panicked on Friday

Overnight repo operations don’t usually make headlines. But Friday’s $29.4 billion injection broke records going back two decades.

Here’s what happened. Treasury markets showed serious stress. Yields spiked. Short-term credit markets seized up. So the Fed stepped in fast to prevent a funding crisis.

These repos let banks swap securities for immediate cash. That keeps the plumbing working when markets get tight. But the size of this move suggests real problems in the Treasury market.

Moreover, this liquidity injection expands the money supply. More dollars chasing the same assets typically lifts prices. That includes risk assets like Bitcoin.

Yet Fed Chair Jerome Powell recently signaled caution on rate cuts. His hawkish tone clashed with market expectations. Meanwhile, Fed Governor Christopher Waller called for a December rate cut. The mixed messages created uncertainty about where policy actually heads next.

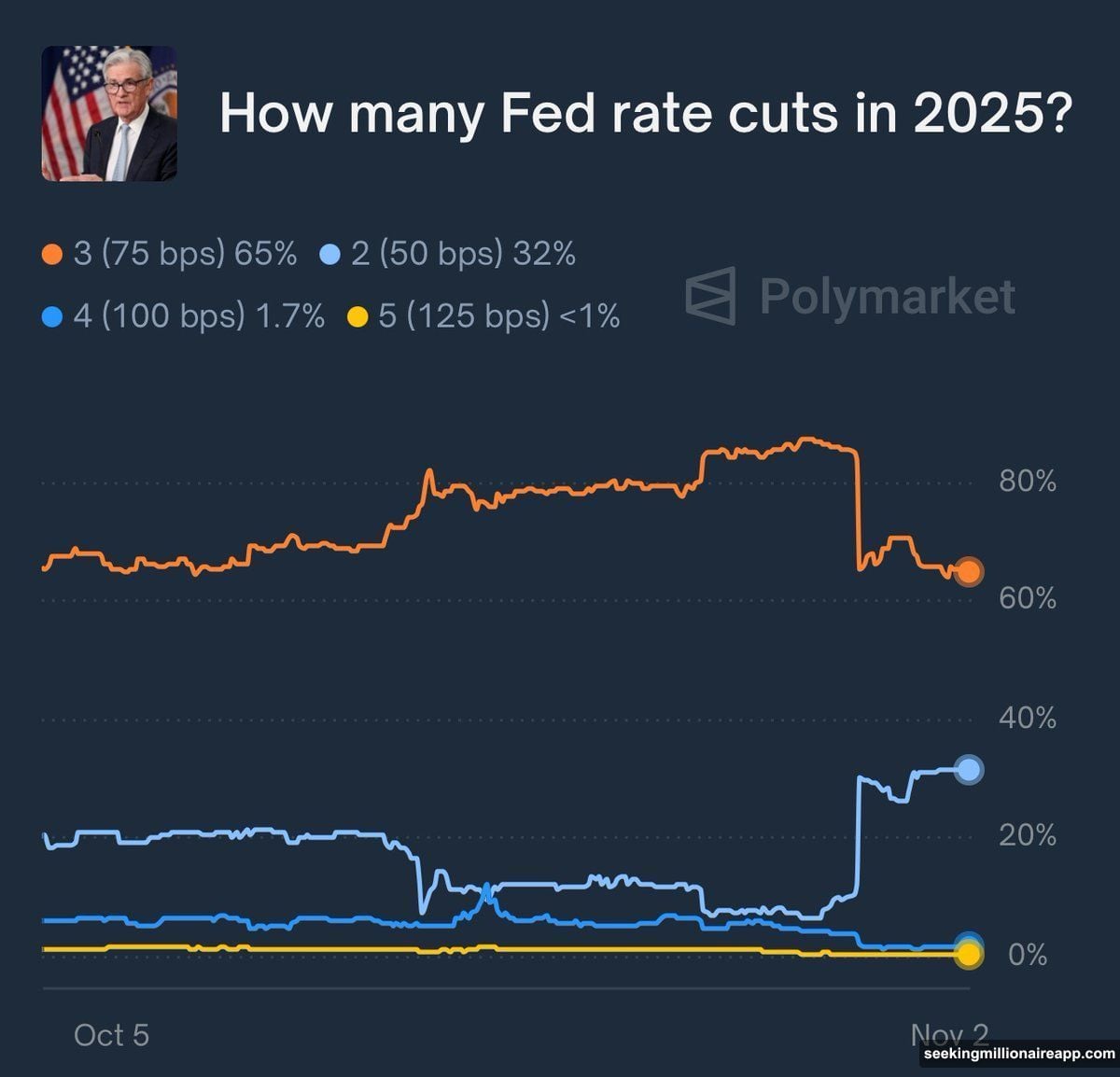

Market Odds Shift Fast on Rate Cuts

Polymarket data tells the story. Odds for a third rate cut in 2025 dropped from 90% to 65% in just days.

That’s a massive shift. Traders priced in easier policy. Now they’re hedging bets that the Fed might pause instead.

Here’s the risk. If the Fed doesn’t cut in December, markets could tank. Investors already positioned for cheaper money. Any reversal forces them to reprice every asset quickly.

Plus, Treasury stress isn’t going away. Bond yields remain elevated. The Fed’s repo operation bought time but didn’t fix the underlying problem. So more interventions might follow.

China Joins the Liquidity Party

The People’s Bank of China deployed its own record cash infusion the same week. This wasn’t coincidence.

China faces deflationary pressure. The property sector remains weak. Consumer spending hasn’t recovered. So Beijing needs lending to stay active and credit markets to stay loose.

The PBOC’s move mirrors responses from past crises. By flooding banks with cash, it aims to lower borrowing costs and stimulate growth. That also expands global money supply significantly.

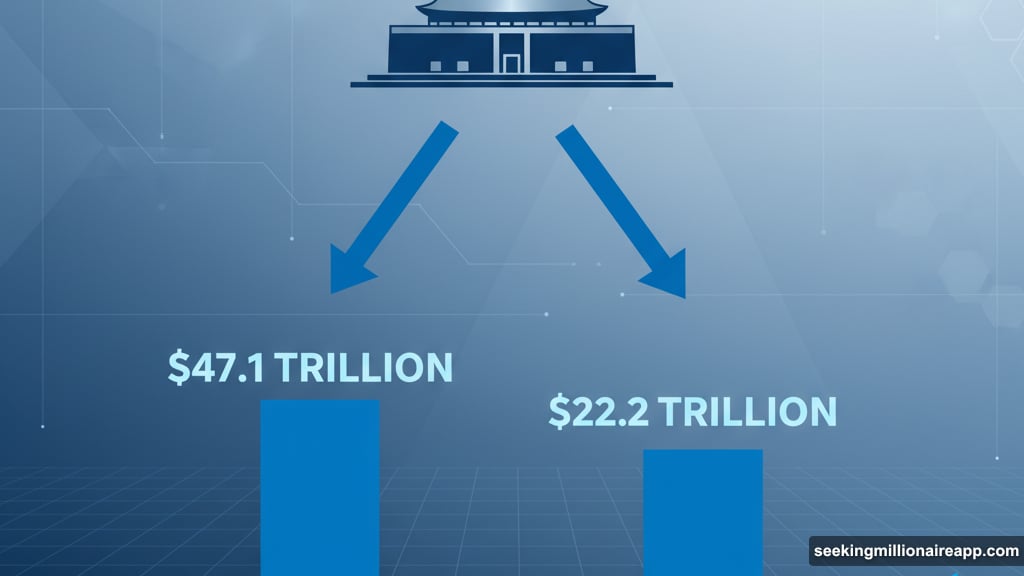

In fact, China’s M2 money supply now exceeds the US by over $25 trillion. That’s a staggering gap. China’s M2 sits around $47.1 trillion while US M2 measures roughly $22.2 trillion.

This matters for Bitcoin. Historically, Chinese liquidity shows stronger correlation with crypto prices than US monetary policy. When both central banks ease simultaneously, Bitcoin tends to rally hard.

The 2020 Playbook Might Repeat

Remember the 2020-2021 bull run? That happened right after massive Fed and PBOC stimulus following COVID-19.

Central banks printed aggressively. Investors searched for inflation hedges. Bitcoin soared from $10K to $69K in less than 18 months.

Now we’re seeing similar coordination. Both the Fed and PBOC are injecting liquidity to stabilize their systems. That creates conditions favorable to risk assets.

However, there’s a catch. The Fed still talks about fighting inflation. China wants growth without adding more debt. These goals conflict with unlimited money printing.

So the question becomes how long central banks maintain support. If they pull back quickly, any Bitcoin rally fizzles fast.

Bitcoin Stays Quiet While Traders Position

Bitcoin price action remains muted. The pioneer crypto traded in a tight range through October and early November.

Open interest on Bitcoin futures dropped from above 100,000 contracts to near 90,000 recently. That signals caution among derivatives traders. Many are waiting for clearer signals before making big bets.

Yet the macro setup looks increasingly positive. Lower US inflation combined with expanding money supply typically favors Bitcoin. Institutional investors increasingly view it as digital gold that protects against currency debasement.

The challenge is timing. If the Fed eases too slowly, global liquidity tightens and risk assets suffer. If China’s stimulus fails to revive its economy, sentiment weakens everywhere.

What Breaks First Decides Everything

Two scenarios now dominate trader conversations.

Scenario One: Central banks maintain liquidity support through 2026. The Fed cuts rates in December. China keeps pumping cash into banks. Global money supply expands steadily. Bitcoin rallies toward new highs as investors hedge inflation and seek alternatives to weakening fiat currencies.

Scenario Two: The Fed prioritizes inflation control over financial stability. It scales back repos and delays rate cuts. China’s stimulus fails to boost growth. Liquidity tightens globally. Bitcoin consolidates or corrects as risk appetite vanishes.

The next few weeks reveal which path unfolds. Treasury markets hold the key. If stress continues, the Fed must choose between fighting inflation and preventing a credit crisis. That choice determines whether Bitcoin enters another bull market or just treads water.

Right now, both central banks blinked. They chose liquidity over tightening. But the real test comes when they face sustained inflation again. Will they stay committed to easy money, or will they reverse course and crash risk assets?

Bitcoin traders are watching every repo operation, every PBOC statement, and every shift in Treasury yields. Because this time, the macro environment isn’t just background noise. It’s the entire story.

The liquidity race is on. And Bitcoin’s next move starts exactly here.