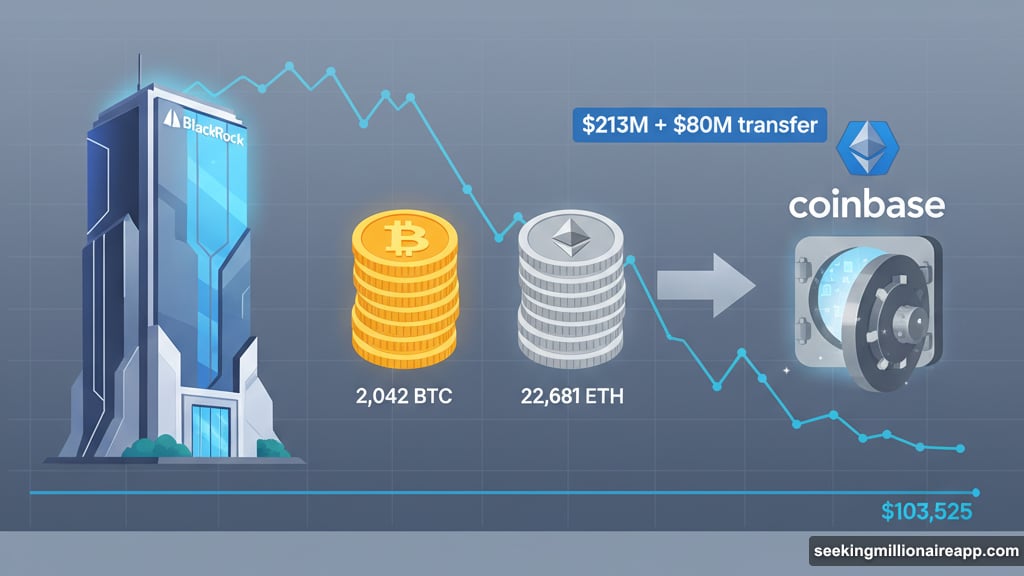

BlackRock moved massive crypto holdings to Coinbase right as Bitcoin’s price looked shaky. The timing couldn’t be worse for crypto bulls hoping to defend the crucial $100,000 level.

On Tuesday morning, the world’s largest asset manager transferred 2,042 BTC (worth $213 million) and 22,681 ETH (valued at $80 million) to Coinbase during US trading hours. Bitcoin was already sliding, hovering around $103,525—its lowest point since June.

So what does this mean? When institutional giants move crypto to exchanges, it usually signals one of two things: strategic rebalancing or profit-taking. Neither is particularly bullish in the short term.

Why This Move Has Traders Worried

The crypto community noticed immediately. Large institutional transfers rarely happen in a vacuum, and traders watch these movements closely for early warning signs.

“Last time they did this, the market dipped soon after,” Kyle Doops posted on X. “Now with Bitcoin sitting near $104K… is sub-$100K next?”

Plus, this isn’t just about one big transfer. Bitcoin and Ethereum spot ETFs have seen persistent outflows for four straight trading days. That’s a lot of selling pressure building up at once.

Analyst Daan Crypto Trades pointed out that old-school whales have been dumping coins for weeks. Now institutional money is following suit through ETF redemptions. The combination creates a dangerous cocktail of selling momentum.

However, there’s a silver lining. ETF flows often lag actual market sentiment. Sometimes massive outflows happen near market bottoms, not tops. So the fact that Bitcoin hasn’t collapsed yet despite all this selling could mean buyers are defending key support levels.

The $100,000 Line in the Sand

Bitcoin’s current price action revolves around one critical number: $100,000. This psychological level has repeatedly attracted institutional demand during previous dips.

Traders describe the support here as “thin.” Below $100,000, things could fall apart quickly. The next major support doesn’t appear until much lower, possibly in the $90,000 range.

Moreover, the broader market context isn’t helping. ETF expert Eric Balchunas connected Bitcoin’s weakness to wider risk-market fatigue. The S&P 500 has climbed 83% since late 2022. A pullback makes sense at this point, even a healthy one.

“Bitcoin sniffed out this pullback—like the way an animal can tell a rogue wave is coming—and that’s why it’s been meh,” Balchunas explained on X.

He views the current phase as a natural “back step” in ETF market development. His analogy? ETF growth follows a “two steps forward, one step back” pattern. Right now, we’re in the back step phase.

What Comes Next

Nobody knows if BlackRock’s transfer signals broader institutional rotation or just routine portfolio management. But the timing raises questions that won’t get answered until we see price action over the next few days.

If buyers defend $100,000 aggressively, this could mark a local bottom. The heavy selling combined with price stability might indicate accumulation by different players. That would set up Bitcoin for a potential rebound once the selling pressure eases.

But if $100,000 breaks cleanly, watch out. The next support zone sits far below current levels. A break could trigger cascading liquidations and momentum selling that pushes prices down to the $90,000 range or lower.

The macro environment isn’t helping either. Rising economic uncertainty makes investors nervous about risk assets. Crypto remains extremely sensitive to broader market sentiment shifts. When stock investors get cautious, crypto usually sells off harder.

Reading the Tea Leaves

Here’s the uncomfortable truth about institutional crypto movements: they’re both leading indicators and lagging indicators at the same time.

BlackRock’s transfer to Coinbase happened during a price slide. That’s reactive behavior, not predictive. Yet it also adds selling pressure that could accelerate the decline. So past and future blur together in crypto markets.

Meanwhile, retail traders are left guessing about institutional intentions. Did BlackRock need liquidity for redemptions? Are they rotating into different assets? Or did they simply decide Bitcoin got too expensive above $100,000?

We won’t know until someone from BlackRock clarifies their strategy, which probably won’t happen. Institutional players rarely telegraph their moves publicly. So the market has to figure it out through price action alone.

This creates a feedback loop. Uncertainty breeds more uncertainty. Traders see a big transfer, assume the worst, and start selling. That selling validates the original bearish interpretation, even if BlackRock’s actual intentions were benign.

The coming days will determine whether Bitcoin’s current price represents a solid floor or just a temporary pause before another leg down. If buyers show up with conviction around $100,000, confidence could return quickly. Crypto markets move fast in both directions.

But if buyers stay on the sidelines, waiting for “cheaper prices,” that hesitation becomes self-fulfilling. Prices go lower precisely because everyone expects them to. Then the cycle repeats at each new support level.

Bitcoin remains trapped in this psychological no-man’s land. Bulls point to resilient support despite heavy selling. Bears point to institutional outflows and deteriorating momentum. Both sides have valid arguments. Neither has definitive proof they’re right.

So we wait. And watch whether $100,000 holds or breaks. Everything else is just noise until the market makes its decision. The only certainty? Volatility isn’t going anywhere.