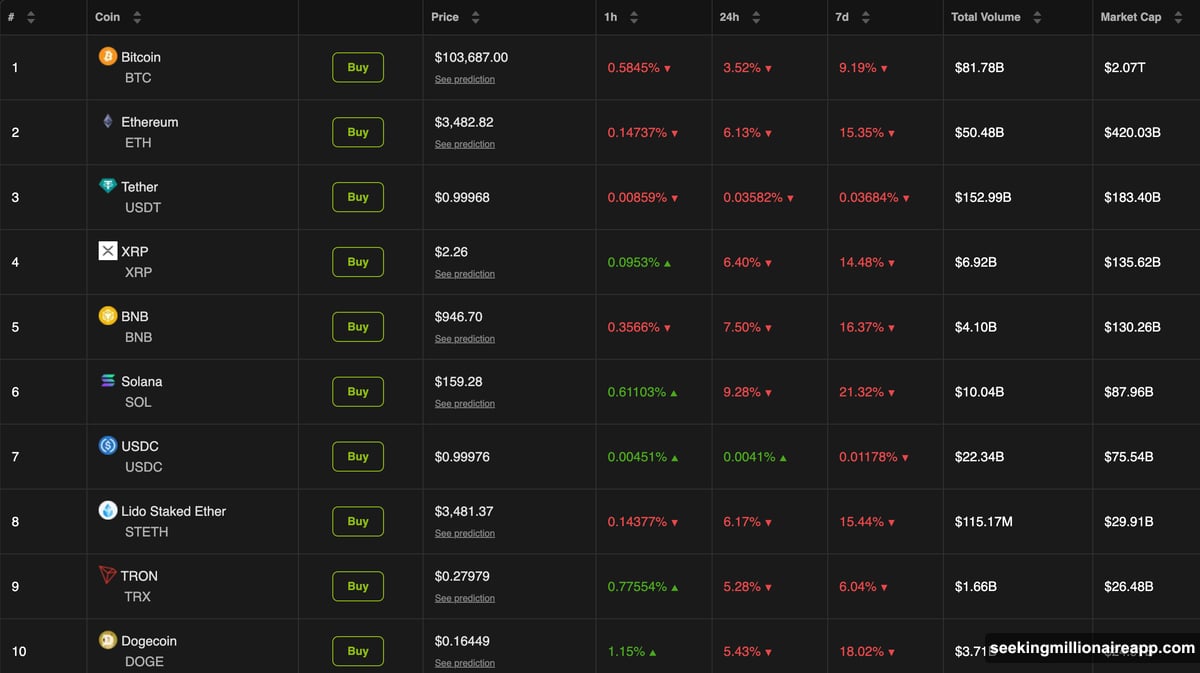

The crypto market just wiped out $1.3 billion in 24 hours. Bitcoin crashed to $103,687. Ethereum dropped to $3,482. Solana got absolutely crushed with a 9% nosedive.

But here’s the twist. While hundreds of thousands of traders watched their positions evaporate, one mysterious whale walked away with over $36 million in profit. The secret? Betting against the market when everyone else was betting up.

The Bloodbath by the Numbers

Markets don’t just decline anymore. They liquidate people.

Over the past day, 336,622 traders got liquidated. That’s not a typo. More than 300,000 positions closed automatically because traders couldn’t cover their losses. The damage totaled $1.37 billion in wiped positions.

Long positions took the brunt of it. Traders betting on price increases lost $1.22 billion. Meanwhile, shorts only lost $150 million. The message couldn’t be clearer—most people positioned themselves for gains that never materialized.

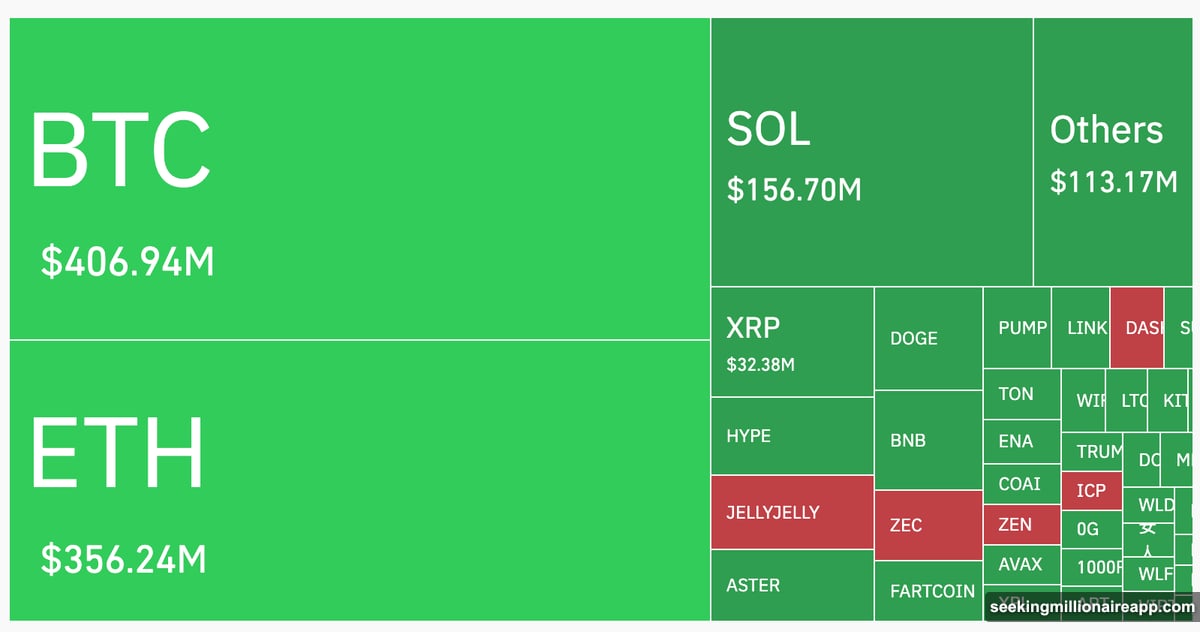

Bitcoin led the carnage with $406.94 million in liquidations. Ethereum followed close behind at $356.34 million. Even smaller assets like Solana, XRP, and Dogecoin saw massive position closures. HTX exchange recorded the single biggest liquidation: a Bitcoin-USDT position worth $47.87 million closed instantly.

One Trader Saw It Coming

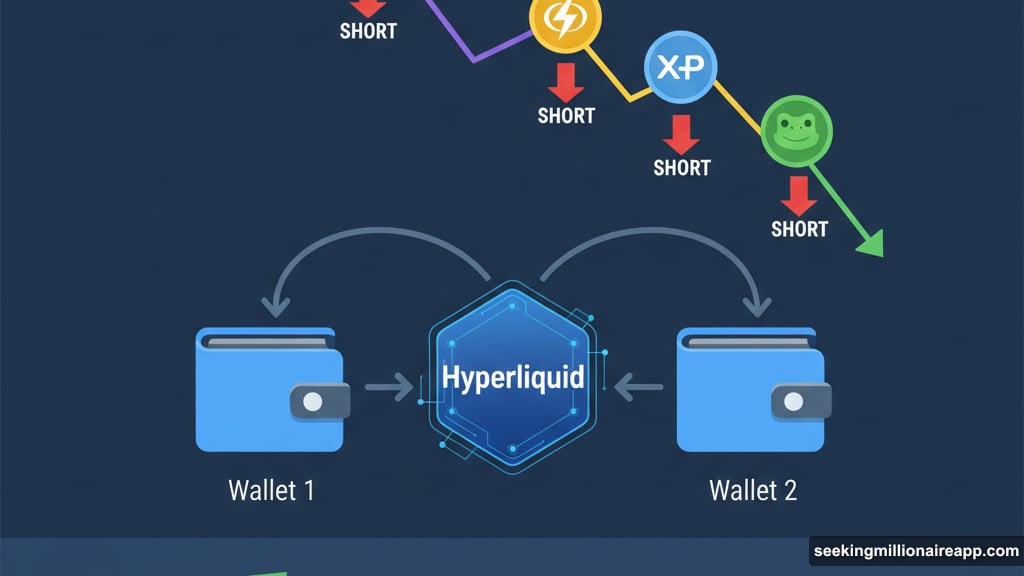

While retail traders bled money, one whale played the opposite side. Known as the “Anti-CZ Whale,” this trader has been shorting cryptocurrencies on Hyperliquid, a decentralized derivatives platform.

The strategy paid off spectacularly. By betting against ASTER, DOGE, ETH, XRP, and PEPE across two wallets, the whale accumulated over $36 million in unrealized profits as prices crashed. Plus, data from HyperDash shows a perfect 100% win rate across both wallets.

This isn’t beginner’s luck either. During October’s market downturn, the same trader reportedly earned more than $18.5 million from short positions. Their total profit on Hyperliquid now approaches $100 million. That’s not trading—that’s systematic market reading.

Why Most Traders Got Destroyed

Leverage amplifies everything. When markets move in your favor, gains multiply fast. But when they turn against you, losses happen even faster.

Most traders entered long positions expecting Bitcoin to climb past $110,000 or Ethereum to push toward $4,000. Instead, prices reversed sharply. The 4% market cap decline doesn’t sound dramatic until you factor in leverage. Many traders use 10x, 20x, or even higher leverage ratios.

Here’s how that math works. With 10x leverage, a 4% price drop becomes a 40% loss on your position. At 20x leverage, that same 4% move wipes out 80% of your capital. Once losses exceed your margin, exchanges automatically close your position to prevent negative balances. That’s liquidation.

The whale avoided this trap by betting against the market. Short positions profit when prices fall. So while long traders lost money on declining prices, the whale gained. Moreover, shorting on a platform like Hyperliquid offers different risk profiles than traditional exchanges.

Solana Led the Losses

Not all assets fell equally. Solana crashed hardest among major cryptocurrencies, dropping 9.28% in 24 hours. That’s nearly double the market average.

Why did SOL get hit so hard? Several factors likely contributed. First, Solana experienced rapid gains during recent rallies. Assets that rise fastest often fall hardest during corrections. Second, leverage was particularly high on Solana positions. Traders piled into SOL expecting momentum to continue.

Bitcoin fell 3.52% to $103,687. Ethereum dropped 6.13% to $3,482. Both saw significant liquidations, but Solana’s steeper decline caught traders off guard. The altcoin’s volatility makes it attractive for leverage trading, but that same volatility turns deadly during reversals.

The Pattern Keeps Repeating

This isn’t crypto’s first liquidation event. It won’t be the last.

“Months of boredom, 3 days of euphoria, biggest liquidation event in history, sideways misery, depression and more pain. Crypto is basically an abusive relationship we keep going back to,” analyst Quinten Francois noted.

He’s not wrong. The crypto market follows predictable patterns. Long periods of sideways movement lull traders into complacency. Then sudden rallies trigger FOMO (fear of missing out). Traders pile into leveraged long positions chasing gains. Finally, markets reverse sharply, liquidating everyone who arrived late.

The “Anti-CZ Whale” profits by betting against these patterns. While retail traders chase momentum, the whale positions against it. That contrarian approach requires discipline and capital, but the results speak for themselves.

November Starts Rough After Red October

October earned the nickname “red October” in crypto circles. Tariff concerns, macro uncertainty, and profit-taking combined to drag markets lower throughout the month. Many traders hoped November would bring relief.

Instead, November opened with another sharp decline. The total crypto market cap fell 4% in just 24 hours. That suggests underlying weakness hasn’t resolved. Plus, the lack of recovery momentum indicates sellers remain in control.

Bitcoin’s failure to hold above $105,000 triggered technical selling. Ethereum’s drop below $3,500 accelerated liquidations. Without strong support levels, prices can fall further before finding buyers willing to step in.

What Retail Can Learn From Whales

The contrast between whale profits and retail losses reveals important lessons. Successful trading requires more than picking direction. Risk management, position sizing, and timing all matter.

The “Anti-CZ Whale” didn’t just short randomly. The trader built positions across multiple assets, spreading risk. Moreover, the whale clearly understands market structure and timing. Shorting too early means paying funding rates while prices rise. Shorting at the right moment captures the full downward move.

Retail traders often lack this precision. They enter positions based on excitement rather than analysis. They use maximum leverage to maximize potential gains, ignoring maximum potential losses. And they hold losing positions hoping for reversals instead of cutting losses early.

Hyperliquid’s Role in the Trade

The whale executed these trades on Hyperliquid, a decentralized derivatives platform. Unlike centralized exchanges, Hyperliquid offers different trading mechanics and risk profiles.

Decentralized platforms provide transparency. Anyone can verify the whale’s positions and performance on-chain. That transparency builds credibility in ways centralized exchange claims can’t match. However, decentralized platforms also carry smart contract risks and liquidity constraints.

The whale’s $100 million profit on Hyperliquid demonstrates the platform’s capabilities. But it also shows the risks other traders took. For every dollar the whale gained, someone else lost a dollar. That’s how derivatives markets work—they’re zero-sum games before fees.

The Volatility Warning

Crypto’s appeal lies partly in its volatility. Prices can double or triple in months. That attracts traders seeking life-changing gains. But the same volatility destroys capital just as quickly.

This recent liquidation event proves crypto hasn’t matured past extreme swings. Traditional markets rarely see $1.3 billion liquidated in a single day. Even during stock market crashes, circuit breakers halt trading to prevent cascading liquidations.

Crypto markets operate 24/7 with no circuit breakers. When selling begins, it can accelerate without pause. Algorithms trigger stop losses, which trigger more stop losses, creating liquidation cascades. Only when prices fall far enough do buyers return.

What Comes Next

Whether markets stabilize or fall further remains unclear. Bitcoin still trades above $100,000, showing relative strength despite recent losses. Ethereum holds above $3,400, though barely. Solana’s recovery will indicate whether altcoins can regain momentum.

Technical indicators suggest more downside risk exists. Bitcoin’s failure to hold $105,000 removed a key support level. The next major support sits around $98,000. If that breaks, $90,000 becomes the target. Ethereum faces similar technical weakness below $3,400.

The “Anti-CZ Whale” likely monitors these levels closely. If support breaks, more shorting opportunities appear. If prices stabilize and reverse, the whale might close positions and wait for the next setup. That patience separates professional traders from desperate gamblers.

Crypto markets punish overconfidence ruthlessly. This latest liquidation event proved that again. While one whale profited enormously, hundreds of thousands of traders lost everything. The difference wasn’t luck—it was preparation, discipline, and betting against the crowd when everyone else followed the herd.