Bitcoin became Wall Street’s darling in 2025. Meanwhile, privacy coins quietly staged a comeback nobody saw coming.

Zcash surged over 500% while major cryptocurrencies bled value. The rally wasn’t random. Instead, it reflects a growing divide in crypto philosophy between institutional adoption and financial privacy. That tension now defines the market’s next chapter.

Privacy Coins Went From Dead to Dominant

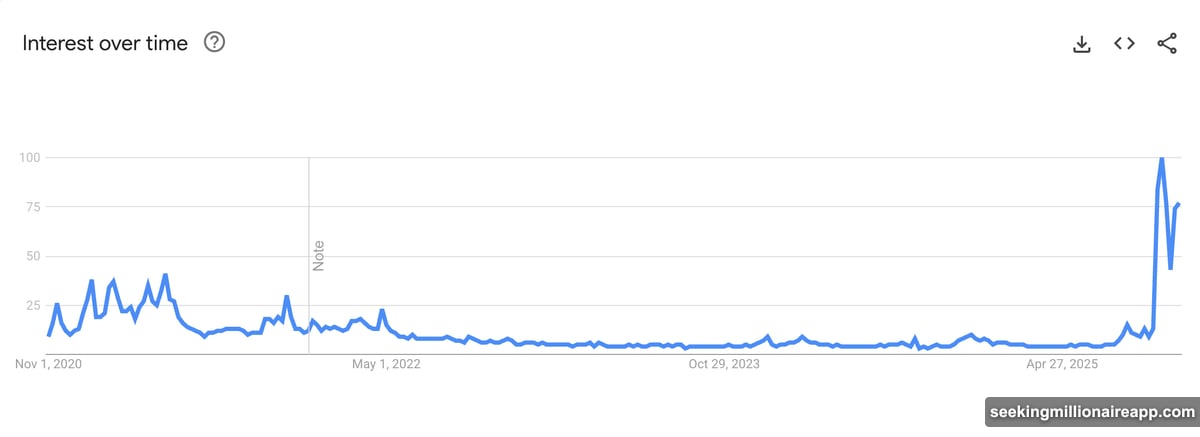

Zcash essentially disappeared from public consciousness for years. Google Trends data showed minimal search interest from 2020 through early 2024. Then everything changed.

In October, Grayscale launched its Zcash Trust. The coin immediately jumped to 3-year highs. But here’s the surprising part. The rally continued even as Bitcoin and other major assets crashed amid tariff fears.

By November, ZEC overtook Monero to become the largest privacy coin by market capitalization. That’s a complete reversal from its near-irrelevance just months earlier. Plus, search interest hit 100 on Google Trends, matching its highest levels ever.

So what triggered this dramatic shift? The answer lies in what happened to Bitcoin itself.

Bitcoin Sold Its Soul to Wall Street

Bitcoin ETF approvals changed everything. BlackRock, Fidelity, and other traditional finance giants now dominate Bitcoin markets. Record institutional inflows pushed prices higher. Yet that success came with a cost.

Galaxy Digital’s research highlighted growing frustration in the crypto community. Critics argue Bitcoin abandoned its cypherpunk roots. The cryptocurrency that promised financial sovereignty now gets held primarily by centralized custodians and ETF issuers.

“Many Bitcoin critics lament the ‘institutionalization’ of Bitcoin, calling it ‘dominated by ETFs’ and centralized custodians,” Galaxy Digital analyst Will Owens wrote. Bitcoin’s transparency always existed. But institutional intermediaries fundamentally changed who controls the asset.

That philosophical divide created an opening for privacy-focused alternatives.

Zcash Became “Encrypted Bitcoin”

Zcash advocates frame their coin differently than Monero or other privacy options. They position it as what Bitcoin should have been. A return to cypherpunk principles that prioritize financial anonymity alongside decentralization.

The comparison resonates now because on-chain surveillance exploded. Analytics firms like Chainalysis track every Bitcoin transaction. Social media investigators routinely expose wallet activities. Privacy went from a niche concern to a mainstream anxiety.

Galaxy Digital noted that Zcash’s technical fundamentals barely changed since launch. But perception evolved dramatically. Privacy technology shifted from experimental to essential in investor minds. Moreover, a16z’s 2025 State of Crypto report documented sharp increases in Google searches for privacy-related topics.

This cultural shift matters more than technical specifications. Investors increasingly value financial anonymity as governments and corporations expand surveillance capabilities. Zcash benefited from perfect timing.

The Rally Exposed Institutional Bitcoin’s Weakness

Bitcoin’s institutional adoption brought legitimacy. It also exposed vulnerabilities that privacy advocates predicted years ago.

Centralized custodians create single points of failure. ETF structures require identity verification and reporting. Regulatory compliance eliminates the anonymity that initially attracted many to cryptocurrency. These trade-offs became impossible to ignore in 2025.

Meanwhile, Zcash demonstrated that demand for permissionless, private money remains strong. The 500% price surge wasn’t just speculation. It reflected genuine concerns about financial privacy in an increasingly transparent blockchain ecosystem.

Galaxy Digital’s report captured this sentiment. “This rally is driven by both constant vocal support from some of crypto’s top voices and also a reminder of how important privacy is for permissionless money,” analysts wrote.

Privacy Demand Will Shape Crypto’s Future

Whether Zcash sustains these gains remains uncertain. Privacy coins face regulatory scrutiny and exchange delistings. Technical challenges around scalability and adoption persist.

But the philosophical question won’t disappear. Crypto must decide if it prioritizes institutional acceptance or cypherpunk ideals. Bitcoin chose Wall Street. That decision opened space for alternatives that prioritize privacy above regulatory compliance.

Investors now have clear options. Transparent, institutionalized Bitcoin for mainstream adoption. Privacy-focused alternatives like Zcash for financial anonymity. The market will determine which philosophy wins long-term.

For now, Zcash’s dramatic reversal proves one thing. Reports of privacy coins’ death were greatly exaggerated. The demand never vanished. It just waited for the right moment to resurface.