Money started flowing back into crypto investment funds yesterday. After nearly $3 billion fled in less than a week, investors finally returned.

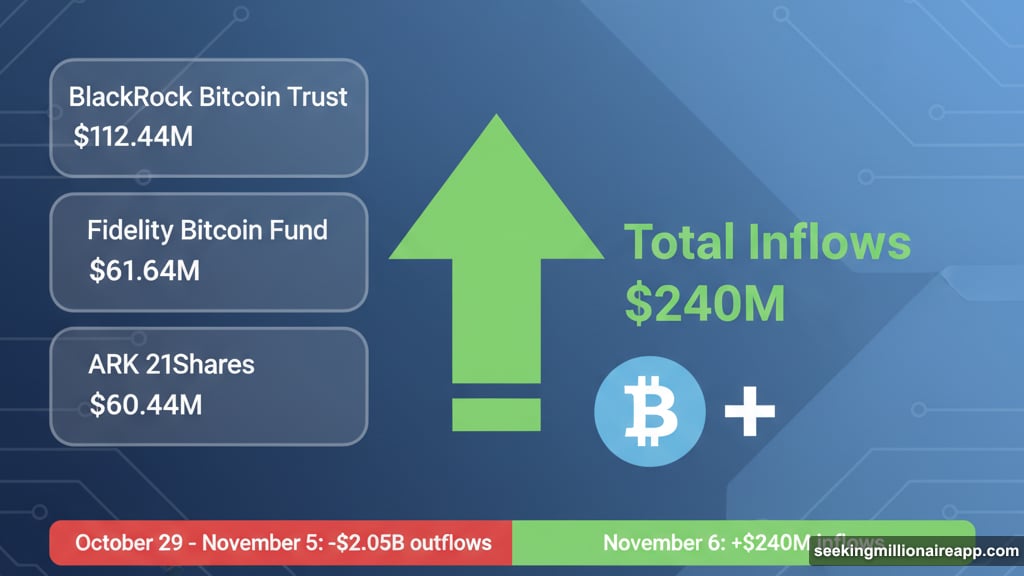

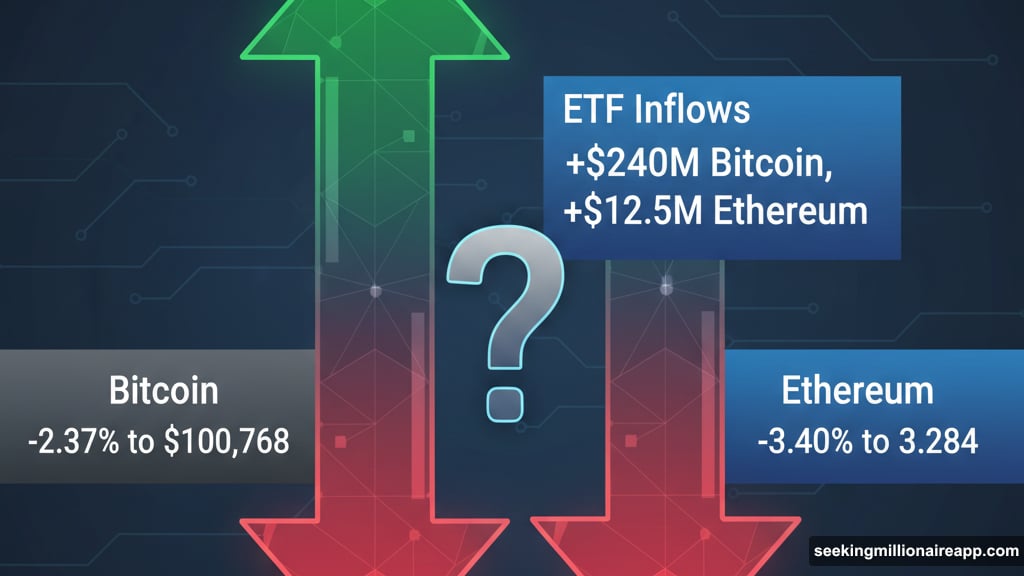

Bitcoin ETFs grabbed $240 million in fresh capital. Ethereum funds collected $12.5 million. That ended the longest consecutive outflow streak either product has seen this month.

But here’s the twist. Despite the influx of new money, both cryptocurrencies kept falling anyway.

BlackRock Leads the Comeback

Not all ETF providers benefited equally from the return of investor confidence. BlackRock dominated the recovery on both fronts.

The firm’s iShares Bitcoin Trust pulled in $112.44 million alone. That represented nearly half of all Bitcoin ETF inflows for the day. Meanwhile, their Ethereum Trust added $8 million, leading all competing Ethereum products.

Fidelity came in second for both categories. Their Bitcoin fund attracted $61.64 million while the Ethereum fund collected $4.95 million. ARK 21Shares rounded out the top three Bitcoin performers with $60.44 million in new investments.

Remarkably, not a single Bitcoin ETF reported outflows that day. Every product either gained money or stayed flat. That’s the first time that’s happened since late October.

The Six-Day Bloodbath

The previous week told a different story entirely. Between October 29 and November 5, investors yanked roughly $2.9 billion from spot crypto ETFs combined.

Bitcoin products bore the brunt of the exodus. Approximately $2.05 billion left Bitcoin ETFs during that stretch. Ethereum wasn’t spared either, losing $837.66 million over the same period.

Several factors drove the selling pressure. Broader market weakness played a role. Plus, technical indicators suggested both cryptocurrencies might fall further. So investors rushed for the exits rather than wait for potential losses to mount.

That makes Thursday’s reversal particularly notable. After six straight days of withdrawals, any inflow signals a potential shift in sentiment. Whether it lasts remains unclear.

Prices Tell a Different Story

Here’s where things get interesting. The ETF inflows didn’t help cryptocurrency prices at all.

Bitcoin dropped 2.37% on the same day money flowed back into ETFs. Over the past week, it’s down nearly 9%. At press time, Bitcoin traded around $100,768. That’s well below recent highs and concerning for bulls hoping for a recovery.

Ethereum performed even worse. The second-largest cryptocurrency fell 3.40% yesterday despite ETF inflows. Over the past week, ETH declined roughly 15%. It now trades around $3,284, hovering dangerously close to key support levels.

This disconnect between ETF flows and price action raises questions. Normally, significant inflows should support prices or at least slow declines. Yet both cryptocurrencies kept falling regardless of investor interest in the funds.

Critical Technical Levels Ahead

Analysts are watching specific price points closely. For Bitcoin, the 50-week Exponential Moving Average emerged as the line in the sand.

Trader Ted Pillows emphasized its importance. A weekly close above this level with strong buying volume would signal Bitcoin has bottomed. However, a close below it suggests more pain ahead. In fact, Pillows warned that falling below the EMA-50 means “the dump is just the beginning.”

Ethereum faces its own critical threshold. The $3,100 to $3,200 range represents crucial support. Pillows noted that if Ethereum loses this zone again, the altcoin could correct to new monthly lows. That would likely trigger another wave of selling across the broader crypto market.

Both scenarios put pressure on ETF providers. If prices continue declining despite inflows, investor confidence could evaporate quickly. That would likely restart the outflow cycle and compound selling pressure.

Why the Disconnect Matters

The gap between ETF performance and cryptocurrency prices reveals something important about current market dynamics.

ETF inflows suggest institutional interest hasn’t completely died. Professional investors and wealth managers continue allocating capital to crypto products. That’s generally a positive signal for long-term adoption and legitimacy.

Yet spot prices keep falling anyway. This indicates that selling pressure from other sources outweighs ETF buying. Perhaps retail investors are capitulating. Maybe crypto-native holders are taking profits. Or algorithmic trading might be amplifying downward momentum.

Whatever the cause, the disconnect won’t last forever. Eventually, either ETF inflows will support prices, or continued price declines will scare investors away from ETFs. One side will win this tug-of-war.

What Comes Next

The coming weeks will determine whether Thursday’s reversal marked a genuine turning point or just a brief pause in a longer decline.

Several factors could influence the outcome. Macroeconomic data releases might shift risk appetite either way. Regulatory developments could boost or suppress institutional interest. Plus, technical breaks above or below key levels would likely accelerate price movements in either direction.

For ETF investors specifically, the decision gets harder by the day. Buying during weakness sounds smart in theory. But catching a falling knife rarely works out well. Those who entered yesterday hoping for an immediate rebound got burned as prices continued sliding.

Meanwhile, those who stayed on the sidelines watched nearly $3 billion leave the market before inflows resumed. Timing these swings perfectly is nearly impossible. That’s precisely what makes crypto investing so challenging and why even professional products struggle during volatile periods.

The November performance so far suggests investors remain nervous about near-term prospects. Whether BlackRock’s leadership in attracting capital signals confidence or simply reflects their market dominance remains to be seen.