Crypto investors just shifted targets. After Privacy Coins ran their course, smart money moved to something unexpected: decentralized storage tokens.

The data tells a clear story. Three storage projects show heavy accumulation in early November. Plus, exchange balances are dropping fast. That usually means one thing—investors are betting big on these tokens.

Let’s break down what’s happening and which coins are catching attention.

Privacy Coins Already Had Their Run

Remember the Privacy Coin rally last month? Tokens like Monero and Zcash pumped hard. Now that wave is fading.

So where’s the capital rotating next? Storage tokens emerged as the clear answer in early November.

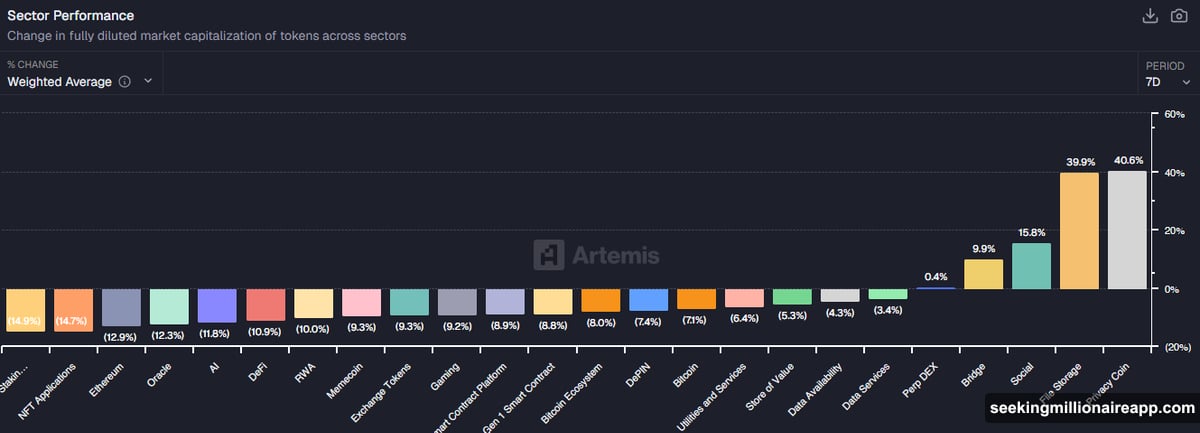

According to Artemis data, Storage Coins delivered nearly 40% average returns in the first week of November. That performance almost matches the Privacy Coin surge. Moreover, investor iWantCoinNews noted that File Storage tokens are now outpacing Bitcoin itself.

These aren’t new projects either. Most storage tokens launched years ago but never recovered their previous cycle highs. That creates opportunity. Many holders remain underwater from buying at peak prices. But fresh accumulation patterns suggest new money is betting on a comeback.

Filecoin Leads the Pack

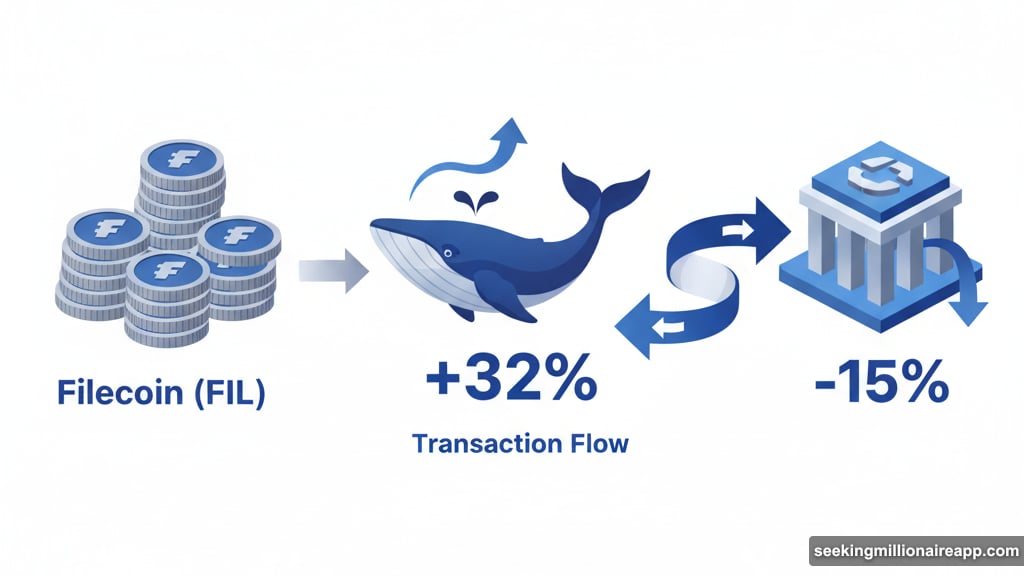

Filecoin (FIL) dominates the storage category right now. Trading volume recently exceeded $1.4 billion, which is massive for this sector.

The whale data looks even better. Top FIL wallets accumulated 32% more tokens over the past month. Meanwhile, available balances on exchanges dropped 15%. That combination signals serious accumulation by big players.

Grayscale jumped in too. The investment firm has been steadily increasing FIL holdings throughout November. When institutional players accumulate, retail often follows.

Price predictions are getting aggressive. Analyst CryptoBoss expects FIL to surpass $2.50 soon, with a potential run to $5. Bold call? Sure. But the accumulation data backs it up.

Here’s what makes FIL interesting. The project generates actual revenue from customers who pay to store data. It’s not just speculation. That real-world utility could support higher valuations if adoption continues growing.

BitTorrent Holder Count Exploded

BitTorrent (BTT) brings something different to this list. The project uses blockchain technology with the BitTorrent protocol—one of the oldest peer-to-peer file-sharing systems in existence.

The holder data is wild. In October, BTT had around 91,000 holders. By November? That number jumped to 341,000. That’s nearly 4x growth in one month.

Exchange balances paint the same picture. Since June, available BTT on exchanges fell more than 6%. At the same time, the top 100 wallets increased holdings by 5.8%. Clearly, big players are accumulating while retail is just discovering the token.

BTT crashed 50% over the past year. So it’s down bad from previous highs. But that’s exactly when smart money tends to accumulate. If storage tokens continue attracting capital rotation, BTT could have significant recovery room.

The risk here is obvious. All those new holders might exit quickly if prices spike. But the accumulation pattern suggests conviction, not speculation.

Storj Shows Record Holder Growth

Storj rounds out the list as another established storage project. NVIDIA even highlighted Storj in a report late last year, which gives it credibility.

The holder count tells an impressive story. Despite Storj’s prolonged downtrend, holders climbed to a record high above 103,000 in November. People keep buying even as price declined. That’s accumulation, not panic.

Then the price woke up. Storj pumped more than 20% in 24 hours recently. That’s the kind of move that catches attention and brings in new buyers.

Investor The BitWhale sees a clear rotation pattern: “First ICP, then FIL, then AR, now Storj.” According to this thesis, Storj looks like the top play among low-cap storage tokens for maximum return potential.

The narrative makes sense. Capital tends to flow from large caps to mid caps to small caps during rotation phases. If storage coins are entering that rotation, Storj could be positioned for outsized gains compared to larger projects like Filecoin.

The Big Question: How Long Does This Last?

Storage coins are pumping. Whales are accumulating. Exchange balances are dropping. All positive signals.

But here’s the risk nobody wants to discuss. Most of these tokens have massive holder bases stuck at high prices from the 2021 cycle. Those people are desperate to break even. So when prices recover, they’ll likely dump immediately.

That creates resistance. Every major rally could face heavy selling pressure from underwater holders trying to escape. It’s not a deal-breaker, but it’s real.

The other question is timing. Capital rotations in crypto move fast. Privacy Coins rallied hard, then cooled off within weeks. Storage coins might follow the same pattern—sharp gains followed by consolidation or decline.

So if you’re considering exposure to storage tokens, watch the data closely. Monitor exchange balances and whale accumulation patterns. When those indicators reverse, the trend probably ends.

For now, though, the accumulation looks real. Filecoin, BitTorrent, and Storj are all showing strong buy signals from investors who study the data. Whether that translates to sustained price appreciation depends on how long this rotation phase lasts.

Choose carefully. Storage coins offer real utility and revenue generation. But they also carry baggage from previous cycles. The opportunity exists, but so does the risk.