Bitcoin didn’t crash because traders lost faith. It dropped because Washington froze $850 billion in cash.

The longest US government shutdown in history has been choking dollar liquidity since October 2025. That means less money circulating through banks, fewer dollars available for risk assets, and tighter conditions across crypto markets. Bitcoin fell roughly 5% during this period. But the mechanism that drained liquidity works both ways.

When Congress finally ends the standoff, hundreds of billions in government spending will flood back into the financial system. Plus, that cash has to go somewhere. History suggests a significant portion flows into crypto.

The Treasury Cash Freeze Drained Markets

The government shutdown started October 1, 2025. Six weeks later, Congress still hasn’t passed a budget. Both parties refuse to compromise on healthcare subsidies and spending levels.

Meanwhile, the Treasury General Account swelled past $850 billion. Every dollar sitting in that government reserve is a dollar not circulating in the economy. That represents an 8% drop in available liquidity since July’s debt ceiling increase.

Bitcoin tracked that decline almost perfectly. The correlation between Bitcoin and dollar liquidity currently sits at 0.85, one of the strongest relationships among all asset classes.

This isn’t coincidence. Crypto analyst Arthur Hayes calls the phenomenon “stealth QE in reverse.” When the Treasury hoards cash, liquidity tightens. Risk assets fall. Bitcoin corrects. But the process reverses just as mechanically when government spending resumes.

More Than a Million Workers Unpaid

The economic damage extends beyond market dynamics. Over a million federal employees aren’t receiving paychecks. Low-income food assistance programs stopped payments. Air travel faced disruptions due to air-traffic controller shortages.

The Congressional Budget Office estimates economic losses between $7 billion and $14 billion. Moreover, Q4 GDP growth likely dropped by up to two percentage points. Consumer sentiment hit near-record lows.

These real-world impacts create political pressure for resolution. That pressure builds daily as the shutdown drags on. When Congress finally breaks the deadlock, pent-up spending will hit markets fast.

The Liquidity Mechanism Works Both Ways

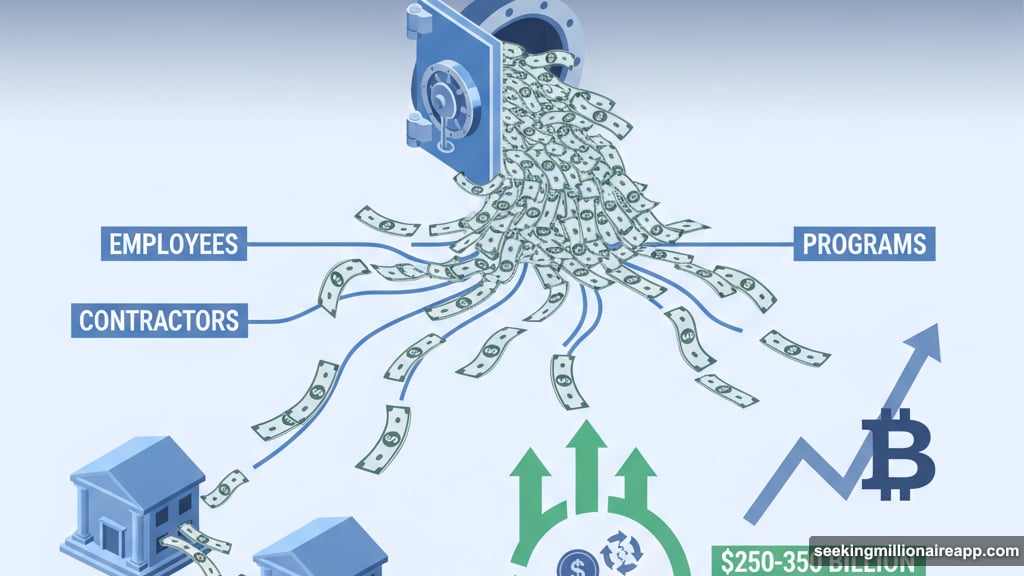

Here’s what happens when the government reopens. Treasury starts spending that $850 billion reserve. Checks go to employees, contractors, and program beneficiaries. That cash flows through banks into money markets and eventually stablecoin systems.

Analysts estimate $250-350 billion will re-enter circulation in the first few weeks. This liquidity injection effectively reverses the drain that pulled Bitcoin lower.

Historical patterns support this outlook. In March 2020, global liquidity injections launched the COVID bull run. During the March 2023 banking crisis, Fed balance sheet expansion pushed Bitcoin from $20,000 to $30,000 in weeks.

So the same liquidity sensitivity that hurt crypto during the shutdown becomes an advantage when spending resumes. The question isn’t whether crypto recovers but how quickly.

Bitcoin Whales Already Positioning

On-chain data shows large holders accumulating during the dip. Bitcoin’s RSI sits around 46, far below euphoric levels that signal market tops. The price closed above $100,000 for six straight months before the recent correction.

Technical analysts call this phase a “window of pain” driven by temporary fiscal tightening. But the fundamentals remain intact. Rate-cut expectations for early 2026 are growing as the shutdown weakens short-term growth.

Plus, global liquidity from China and Japan continues rising, partially offsetting US tightening. Speculative leverage that inflated crypto in late 2024 has been flushed out. That creates healthier market conditions for the next move up.

Many traders expect Bitcoin to recover toward $110,000-$115,000 in Q1 2026, assuming the shutdown ends soon and no new shocks emerge.

The Fed’s Hidden Support System

Beyond direct Treasury spending, the Federal Reserve operates mechanisms that amplify liquidity effects. The Standing Repo Facility allows banks to quickly convert securities into cash during stress periods.

When government spending resumes, this facility ensures smooth distribution of liquidity throughout the financial system. Banks get cash. Money market funds expand. Stablecoin supplies grow. Each step brings dollars closer to crypto exchanges.

This infrastructure didn’t exist in previous cycles. It makes the current liquidity transmission faster and more efficient than historical precedents. That suggests the crypto rebound could materialize quicker than past recoveries.

Political Pressure Builds Toward Resolution

Both parties face mounting criticism as the shutdown drags on. Federal workers protesting unpaid status. Airlines warning of safety issues from understaffing. State programs running out of funding.

History shows shutdowns end when political pain exceeds partisan stubbornness. At six weeks, this shutdown already broke the previous record. Every additional day increases pressure for compromise.

Smart money anticipates resolution within weeks, not months. That timeline aligns with the Q1 2026 recovery outlook most analysts predict. The longer the shutdown lasts, the stronger the liquidity surge when it finally ends.

What This Means for Crypto Traders

The current correction represents technical pullback driven by frozen liquidity, not fundamental weakness. Bitcoin’s correlation to dollar availability remains the dominant factor.

When Washington reopens for business, expect rapid recovery across crypto markets. However, the exact timing depends on Congressional negotiations nobody can predict.

For now, accumulation by whales suggests institutional money views this as opportunity rather than crisis. The liquidity framework supports that view. Crypto fell because dollars stopped moving. It will rise when they start flowing again.

Position accordingly. The shutdown created the dip. The reopening should create the rally. That’s not speculation about adoption or technology. It’s just liquidity mechanics playing out as designed.