The crypto market woke up this weekend. Bitcoin pushed past $102,000. Total market cap climbed by $81 billion in 24 hours. And one altcoin absolutely exploded.

So what sparked this sudden rally? Three key factors converged at once. Plus, specific technical signals suggest this momentum might stick around longer than usual.

Let’s break down what’s really driving prices higher and which tokens are leading the charge.

Bitcoin Holds Above $100,000 Again

Bitcoin trades at $102,574 right now. More importantly, it’s holding firmly above the critical $101,477 support level.

That’s significant. Bitcoin tested this zone multiple times over the past week. Each time, buyers stepped in to defend the level. This shows genuine demand at these prices.

The $100,000 psychological barrier matters too. Many traders thought Bitcoin would crash through this level and spiral lower. Instead, the cryptocurrency stabilized and started climbing.

Now Bitcoin faces its next challenge at $105,000. If buying pressure continues and sellers don’t flood the market, Bitcoin could break through this resistance. That would signal renewed confidence across the entire crypto space.

However, momentum can shift fast. If Bitcoin drops below $100,000, the bullish thesis breaks down. Traders watching this level closely will likely cut positions quickly if support fails.

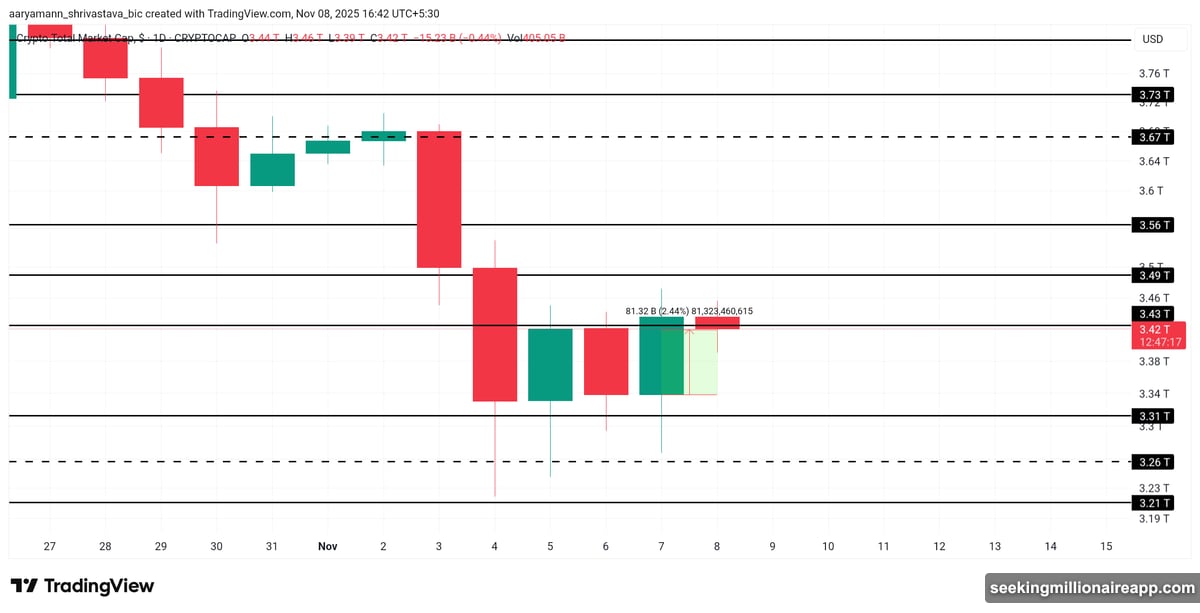

Total Market Cap Tests Key Resistance

The total crypto market capitalization reached $3.42 trillion. That puts it right against the $3.43 trillion resistance level that’s been hard to crack.

This resistance matters because markets tested it three times since March without breaking through. Each time, sellers overwhelmed buyers at this level. So breaking above it would represent a real shift in market sentiment.

What happens next depends on whether buying pressure can overcome this barrier. If it does, the path opens toward $3.49 trillion and potentially $3.56 trillion. Those levels represent the next major resistance zones.

But markets don’t move in straight lines. If global risk appetite weakens or large holders start selling, the total market cap could drop to $3.31 trillion instead. That would trap the market in a sideways range and delay any sustained recovery.

For now, cautious optimism is building. Investors are watching closely to see if this momentum continues or fades.

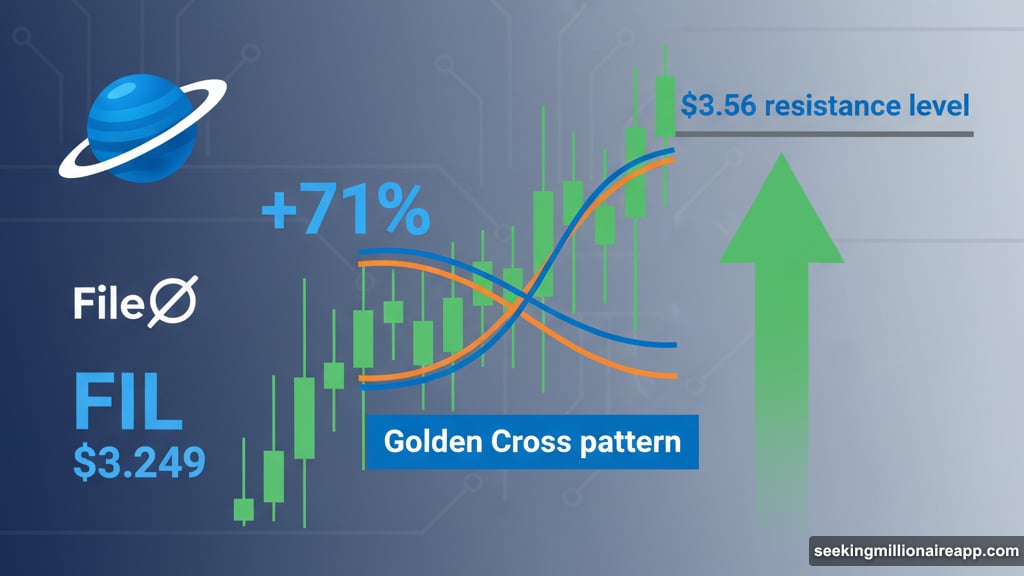

Filecoin Explodes 71% in One Day

While Bitcoin moved steadily higher, Filecoin (FIL) absolutely soared. The token jumped 71% in just 24 hours, reaching $3.249.

That’s not a typo. Filecoin nearly doubled in a single day.

What caused this surge? Technical indicators point to an emerging Golden Cross pattern on FIL’s chart. This happens when a short-term moving average crosses above a long-term moving average. Traders view this as a strong bullish signal.

Moreover, Filecoin trades just below the $3.56 resistance level. If buying continues and FIL breaks through this barrier, the next target sits at $4.20. That would represent another 29% gain from current prices.

But after such a massive rally, profit-taking becomes a real risk. Investors who bought FIL weeks ago are sitting on huge gains. If they start selling to lock in profits, FIL could drop quickly.

A fall below $3.00 would signal trouble. That would invalidate the current bullish setup and could push FIL down to $2.63 or lower. So while the momentum looks strong right now, this remains a high-risk, high-reward situation.

What’s Actually Driving This Rally

Three specific catalysts are powering this weekend’s gains.

First, institutional sentiment improved after recent economic data showed inflation cooling faster than expected. Lower inflation increases the odds of interest rate cuts, which historically benefits risk assets like crypto.

Second, on-chain metrics show Bitcoin accumulation accelerating. Large holders have been buying steadily for the past two weeks. This creates a supply squeeze that supports higher prices.

Third, technical momentum is building across multiple timeframes. Weekly charts for both Bitcoin and major altcoins show bullish patterns forming. When technical and fundamental factors align like this, rallies tend to persist longer.

Still, crypto markets remain volatile. Weekend trading volumes are typically lower, which means large orders can move prices more dramatically in either direction. So while the setup looks promising, nothing is guaranteed.

The Real Risk Nobody’s Mentioning

Here’s what concerns me about this rally. It’s happening on relatively modest volume compared to previous bull runs.

Yes, prices are rising. But trading volume hasn’t surged proportionally. That suggests fewer participants are actually driving this move higher. In other words, this rally might be narrower than it appears.

Narrow rallies can reverse quickly when selling pressure arrives. If a few large holders decide to take profits, there might not be enough buying interest to absorb those sales. That creates the potential for sharp corrections.

Plus, macro uncertainty still looms. Global economic conditions remain fragile. Geopolitical tensions continue simmering. Central banks are still navigating complex policy decisions. Any of these factors could trigger sudden risk-off sentiment that would hammer crypto prices.

So while today’s gains feel good, maintaining perspective matters. Crypto has rallied before only to give back those gains just as quickly. The key question is whether this momentum can sustain itself or if we’re seeing another false start.

For now, Bitcoin’s ability to hold $100,000 provides some confidence. But until we see volume increase and more participants join this rally, treating this move with caution makes sense.