Bitcoin stalled near $100,000 all weekend. Meanwhile, two unexpected tokens exploded with double-digit gains that caught most traders off guard.

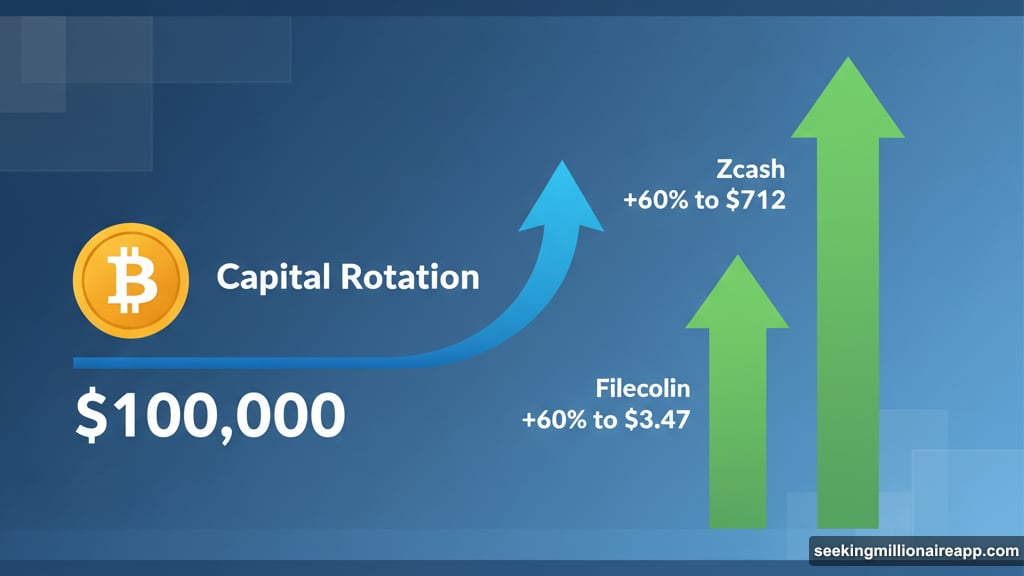

The shift wasn’t random. Traders rotated capital toward assets with clearer catalysts and actual momentum. Plus, Bitcoin’s narrow range trading pushed investors to hunt for opportunities elsewhere in the crypto market.

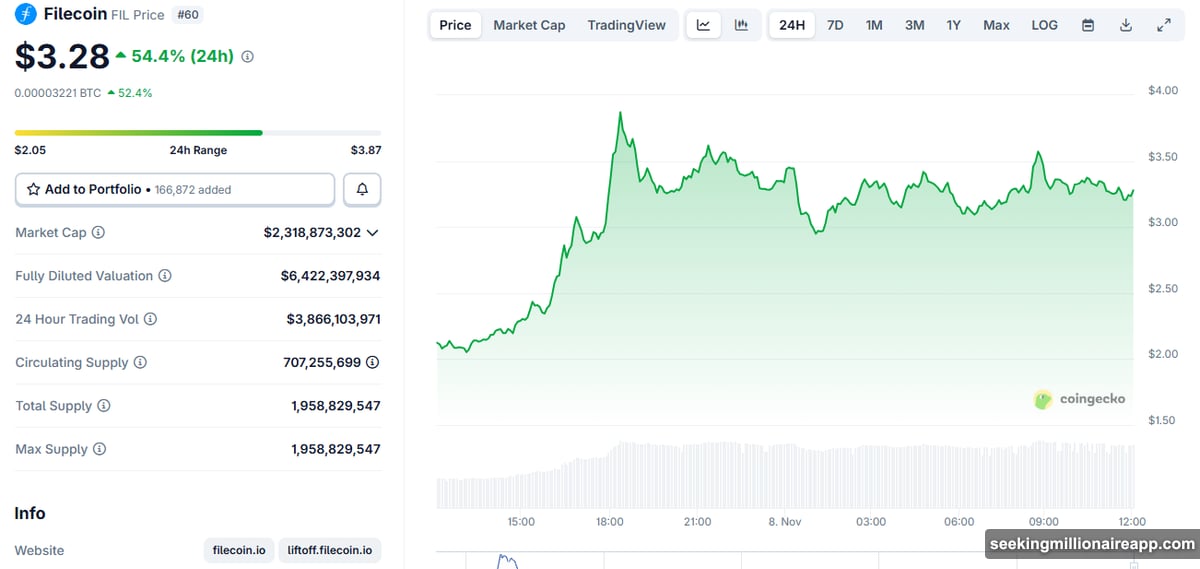

Filecoin Surges 60% in 24 Hours

Filecoin dominated the altcoin rally. The decentralized storage token jumped over 60% in a single day to reach approximately $3.47. That’s its highest price level since February 2025.

The move wasn’t isolated. Data from Santiment showed several mid-cap tokens outpacing Bitcoin. Filecoin led the pack alongside DASH, Internet Computer Protocol, and Zcash.

So why Filecoin specifically? The token sits at the center of the decentralized physical infrastructure (DePIN) narrative. That sector gained serious momentum after Amazon Web Services suffered a major outage in October.

The AWS crash disrupted Coinbase, Robinhood, and numerous other platforms for hours. It reminded everyone why centralized cloud infrastructure creates single points of failure. That event strengthened the case for hybrid, decentralized alternatives.

Moreover, Filecoin recently celebrated its fifth anniversary with rising developer activity. The network expanded beyond basic cold storage. Now it supports smart contract functionality through the Filecoin Virtual Machine (FVM).

According to Messari, FVM enables applications across DeFi, data management, and decentralized autonomous organizations. That technical evolution positioned Filecoin as a modular data layer for Web3 and AI workloads.

Traders responded by flooding into FIL tokens. The rally reflected both fundamental progress and perfect timing within a broader infrastructure narrative.

Privacy Tokens Stage Comeback Led by Zcash

Privacy-focused cryptocurrencies also attracted significant capital flows. Zcash led this category with a remarkable climb to $712 on November 7. That marked a multi-year high for the privacy token.

The price has since corrected to the mid-$500s. But Zcash remains significantly higher compared to earlier in 2025. The sustained rally began in early autumn and accelerated through recent weeks.

Arthur Hayes, co-founder of BitMEX, revealed that ZEC became the second-largest liquid holding in his family office portfolio behind Bitcoin. His public endorsement fueled additional interest from traders watching for institutional validation.

“Due to the rapid ascent in price, $ZEC is now the 2nd largest LIQUID holding in @MaelstromFund portfolio behind $BTC,” Hayes posted on social media.

Privacy tokens are benefiting from renewed demand for confidential settlement and trading mechanisms. Increasingly visible compliance requirements on mainstream payment rails pushed some traders toward alternatives.

Dash followed a similar trajectory. The token surged above $100 for the first time in years. Rising privacy-transaction volumes and renewed developer engagement supported the price action.

Both tokens captured capital from traders seeking clear narratives. Privacy technology offers a tangible use case that resonates during periods of regulatory scrutiny and surveillance concerns.

Why Bitcoin Got Left Behind This Weekend

Bitcoin’s consolidation near $100,000 created opportunity costs for active traders. The leading cryptocurrency remained locked in a narrow range with no clear directional bias.

That price action shifted capital toward altcoins with momentum and fundamental catalysts. Filecoin’s infrastructure narrative and Zcash’s privacy thesis provided concrete reasons to deploy capital.

Market analysts tracking sector-wide flows noted the rotation happened quickly. Traders positioned ahead of potential catalysts rather than reacting after price moves. That’s a notable shift in market behavior.

The speed of inflows suggests confidence in specific narratives. Decentralized infrastructure gained credibility from real-world failures of centralized systems. Privacy tokens benefited from growing concerns about financial surveillance and compliance overreach.

Whether this marks the beginning of a sustained altseason remains unclear. However, the focused nature of capital flows indicates selective rather than broad-based speculation.

Bitcoin’s dominance metric will provide key signals. If it continues declining while select altcoins surge, the rotation could intensify. But if Bitcoin breaks above $100,000 convincingly, capital might reverse course quickly.

Infrastructure and Privacy Lead Sector Rotation

The two strongest performing categories shared common themes. Both infrastructure tokens like Filecoin and privacy coins like Zcash solve real problems that resonate with current market conditions.

Filecoin addresses concerns about centralized cloud dependency. Its decentralized storage network offers redundancy and censorship resistance that traditional providers can’t match. Plus, integration with Web3 and AI workloads expands its potential use cases significantly.

Privacy tokens tackle financial surveillance and compliance complexity. Zcash’s shielded transactions provide confidentiality for users seeking alternatives to transparent blockchain settlement. That value proposition strengthens as regulatory requirements increase across traditional crypto platforms.

These narratives attracted capital because they connect technical features to market demands. Traders didn’t just chase price momentum. They positioned around technologies addressing specific pain points in crypto infrastructure and user privacy.

The rotation also reflects maturation in crypto markets. Instead of uniform bull runs lifting all assets, capital now flows toward projects with clear value propositions and working products.

Filecoin’s five years of development and expanding developer ecosystem demonstrate staying power. Zcash’s consistent privacy technology and institutional adoption by investors like Arthur Hayes validate its market position.

What This Rotation Means for Traders

Smart money moved before the crowd. That’s the key lesson from this weekend’s altcoin performance.

Waiting for Bitcoin confirmation would have meant missing substantial gains. Filecoin’s 60% surge and Zcash’s multi-year highs happened while Bitcoin traded sideways. Traders who diversified into altcoins with clear catalysts captured those moves.

The challenge now is identifying which narratives sustain momentum. Infrastructure tokens need continued adoption and real-world usage growth. Privacy coins require persistent demand for confidential transactions despite regulatory headwinds.

Both categories face competition. Filecoin competes with other decentralized storage networks. Zcash battles newer privacy technologies and regulatory uncertainty around privacy-preserving cryptocurrencies.

Yet current price action suggests these tokens have community support and technical credibility. The combination of fundamental progress and market timing created powerful rallies that might extend further.

For traders watching these markets, the message is clear. Altcoin opportunities exist even when Bitcoin consolidates. But success requires understanding the narratives driving specific tokens rather than blindly chasing price charts.

Capital rotation into Filecoin and Zcash wasn’t random speculation. It reflected calculated positioning around decentralized infrastructure and financial privacy. Those themes likely persist regardless of Bitcoin’s next move.

The weekend’s performance demonstrated that altcoin season doesn’t need Bitcoin’s blessing. Strong narratives and fundamental catalysts can drive independent rallies that attract substantial capital flows.

Whether this rotation continues depends on follow-through. Sustained developer activity, growing usage metrics, and continued institutional interest will determine if these rallies have staying power or fade as Bitcoin regains trader attention.