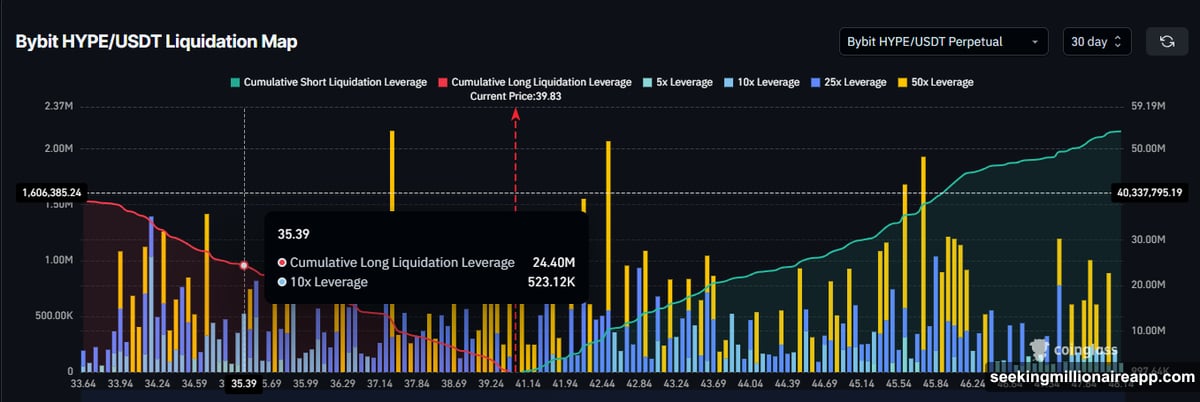

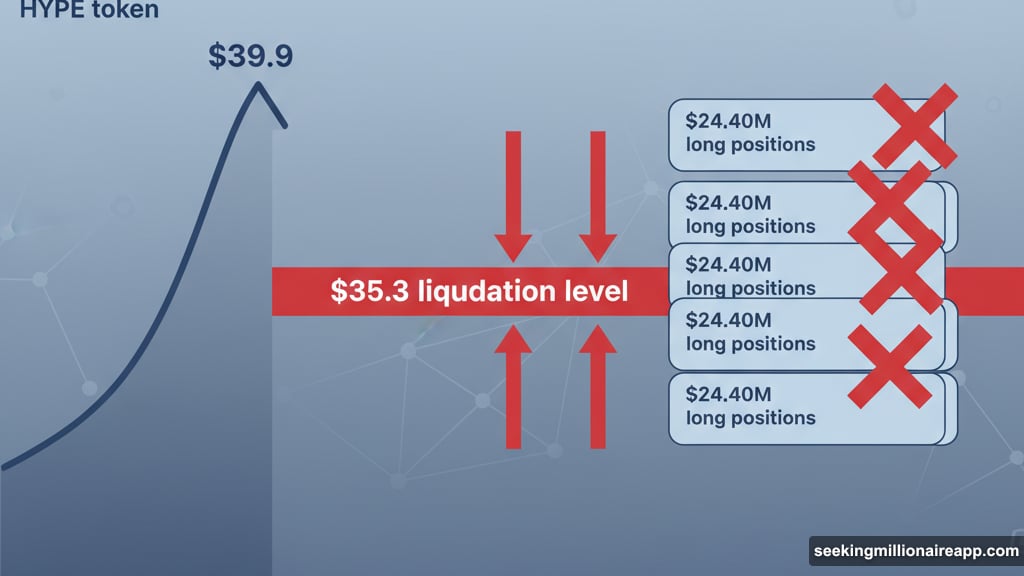

Hyperliquid’s native token just hit dangerous territory. Long traders hold positions worth $24 million that could evaporate if HYPE drops to $35.3.

That’s not speculation. The liquidation maps show exactly what’s at stake. Plus, this critical support level already broke twice in the past month. A third test rarely ends well.

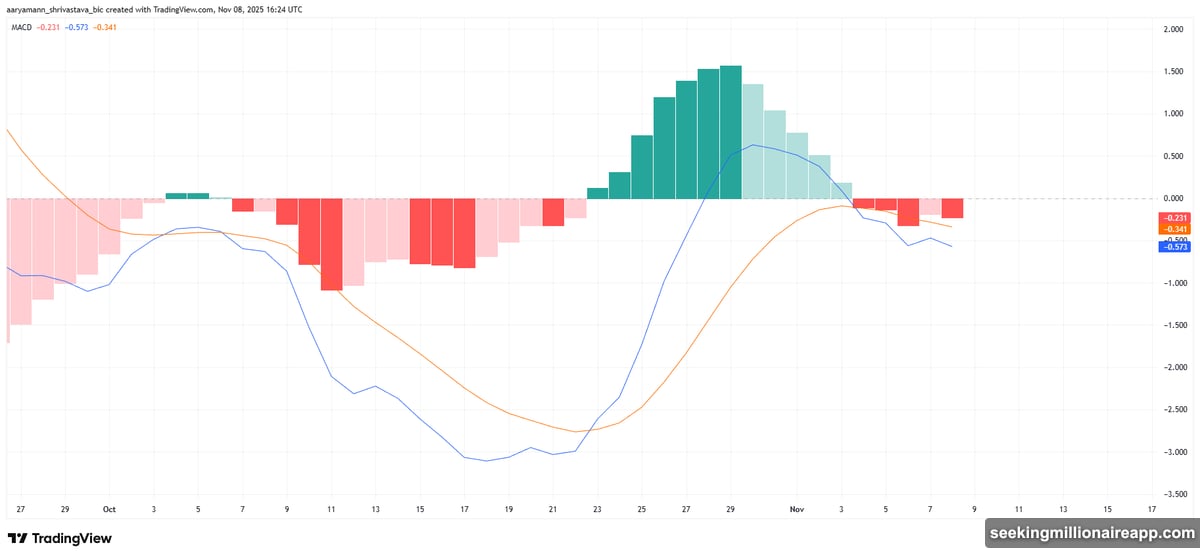

Currently trading at $39.9, HYPE sits in a precarious spot. Technical indicators flash warning signs. Momentum is fading. And the bearish crossover on the MACD suggests things could get worse before they improve.

Why $35.3 Matters So Much

This support level carries enormous weight. If HYPE drops there, $24.40 million in long positions face forced liquidation.

That’s not just a number. It represents real traders holding leveraged positions. When liquidations cascade, they trigger automatic selling. That selling pushes prices lower. Lower prices trigger more liquidations. The cycle feeds itself.

Moreover, this level already failed twice this month. First test held. Second test barely survived. Markets rarely give third chances.

Think about trader psychology here. Each failed test erodes confidence. Long traders start questioning their positions. New buyers hesitate to enter. The support that once felt solid becomes fragile.

Technical Indicators Paint Bearish Picture

The MACD just completed a bearish crossover. For those unfamiliar, that’s when the signal line crosses below the MACD line. It signals weakening momentum and potential downside ahead.

Right now, the bearish trend isn’t severe. But it’s building. And technical analysis suggests it could intensify if broader crypto sentiment deteriorates.

Here’s what concerns me. HYPE trades in a tight range between $42.4 and $38.4. That narrow consolidation often precedes significant moves. The question is which direction.

Based on current indicators, odds favor downside. The MACD crossover suggests sellers are gaining control. Volume patterns show weakening buyer interest. And the liquidation risk creates a self-fulfilling prophecy dynamic.

The Cascading Liquidation Risk

Let’s walk through what happens if HYPE breaks $38.4 support.

First, stop losses trigger. Traders protecting positions exit automatically. That selling pushes price toward $35.3.

Then, margin calls begin. Leveraged long positions underwater face liquidation. Exchanges automatically close these positions, adding more selling pressure.

Finally, panic sets in. Retail traders watching positions deteriorate hit the sell button. The cascade accelerates.

This isn’t theoretical. We’ve seen this pattern play out repeatedly in crypto markets. Liquidation clusters create volatility magnets. Price gravitates toward them because the forced selling creates downward momentum.

The $24 million figure represents significant forced selling. That volume can move markets, especially for tokens with lower liquidity than major cryptocurrencies.

Narrow Trading Range Increases Volatility Risk

HYPE currently consolidates between $42.4 and $38.4. That’s a tight 10% range.

Narrow ranges like this compress volatility. Think of it like a spring. The tighter it coils, the more explosive the eventual move.

For long traders, this creates uncomfortable uncertainty. Break above $42.4, and HYPE could run toward $47.1. Break below $38.4, and liquidations cascade toward $35.3.

The risk-reward currently favors neither side clearly. But the technical setup and liquidation data tilt probabilities downward.

What Bitcoin’s Moves Mean for HYPE

Altcoins don’t trade in isolation. Bitcoin’s price action drives overall crypto sentiment.

If Bitcoin strengthens, it could lift HYPE and reduce liquidation risk. Improved market confidence would attract buyers, potentially pushing HYPE above $42.2 resistance.

However, if Bitcoin weakens or consolidates, HYPE faces additional pressure. Altcoins typically amplify Bitcoin’s moves—both up and down.

Recent Bitcoin price action hasn’t provided much support. Without a clear bullish catalyst from major cryptocurrencies, HYPE struggles to break its current range.

The Bullish Case Still Exists

Despite bearish indicators, HYPE could reverse if conditions improve.

Breaking above $42.2 would invalidate the bearish setup. That move could trigger short covering and attract momentum buyers. Target in that scenario: $47.1.

What would drive such a reversal? Improved crypto market sentiment, positive news about Hyperliquid, or technical capitulation that clears out weak hands.

The MACD, while bearish, hasn’t reached extreme levels. A shift in momentum could reverse the indicator relatively quickly if buyers return.

Also, consider contrarian positioning. If too many traders bet on downside, the market sometimes moves opposite to trap the crowd. Liquidation data shows heavy long positioning, but that doesn’t guarantee downside—just creates potential for it.

Key Levels to Watch

Three price levels matter right now:

$38.4: Immediate support. Break below here confirms bearish momentum and targets $35.3.

$35.3: Critical support where $24 million in liquidations wait. Breaking this level triggers the cascade.

$42.2: Resistance that needs to flip to support. Breaking above invalidates bearish thesis and targets $47.1.

Watch volume carefully at these levels. High volume breakdowns confirm bearish moves. High volume breakouts confirm bullish reversals. Low volume moves often fake out and reverse.

What Long Traders Should Consider

If you’re holding HYPE long positions, several factors deserve attention.

First, evaluate your risk tolerance. The liquidation threat is real. If your position would liquidate near $35.3, consider reducing leverage or adding margin.

Second, monitor Bitcoin and overall crypto market conditions. HYPE’s fate partially depends on broader trends. Deteriorating sentiment across crypto increases downside risk.

Third, watch for confirmation. Don’t exit prematurely based solely on one indicator. But don’t ignore warning signs either. The MACD crossover plus liquidation data creates meaningful risk.

Finally, consider position sizing. If you’re overexposed, the volatility ahead could create uncomfortable drawdowns even if your thesis ultimately proves correct.

The Broader Altcoin Context

HYPE isn’t alone in facing pressure. Many altcoins struggle after recent rallies.

The market is consolidating. Traders are taking profits. Leverage is elevated across multiple tokens. This environment creates choppy conditions where technical levels matter more than usual.

For altcoins like HYPE, this means increased vulnerability. Without strong catalysts, momentum fades. And when momentum fades, leveraged positions become liabilities.

The saving grace? Markets don’t move in straight lines. Even bearish setups experience counter-trend bounces. The question is whether those bounces offer exit opportunities or sustainable reversals.

What Happens Next

Short-term outlook remains uncertain. HYPE trades at $39.9, stuck between support and resistance.

Bearish indicators suggest downside risk. The MACD crossover and liquidation data point toward potential weakness. Break below $38.4 could trigger the cascade toward $35.3.

But markets surprise. Positive catalysts could emerge. Bitcoin could rally. Sentiment could shift. HYPE could break above $42.2 and invalidate the bearish case.

For long traders, vigilance is essential. Monitor key levels. Watch Bitcoin’s moves. Consider your risk exposure. The next significant move could happen quickly, and being prepared matters more than predicting direction perfectly.

The $24 million liquidation risk isn’t guaranteed to trigger. But it’s real. And ignoring real risks rarely ends well in volatile crypto markets.