Corporate crypto treasuries just got crushed. Bitcoin’s 16% monthly drop erased equity buffers that seemed solid weeks ago.

Now companies holding massive crypto positions face a brutal reality. Their portfolios sit deep underwater. Plus, shareholders are getting nervous as unrealized losses pile up faster than anyone expected.

Strategy’s Buying Spree Grinds to a Halt

Strategy owns more than 675,000 BTC. That makes it the largest corporate Bitcoin holder on Earth. But something changed recently.

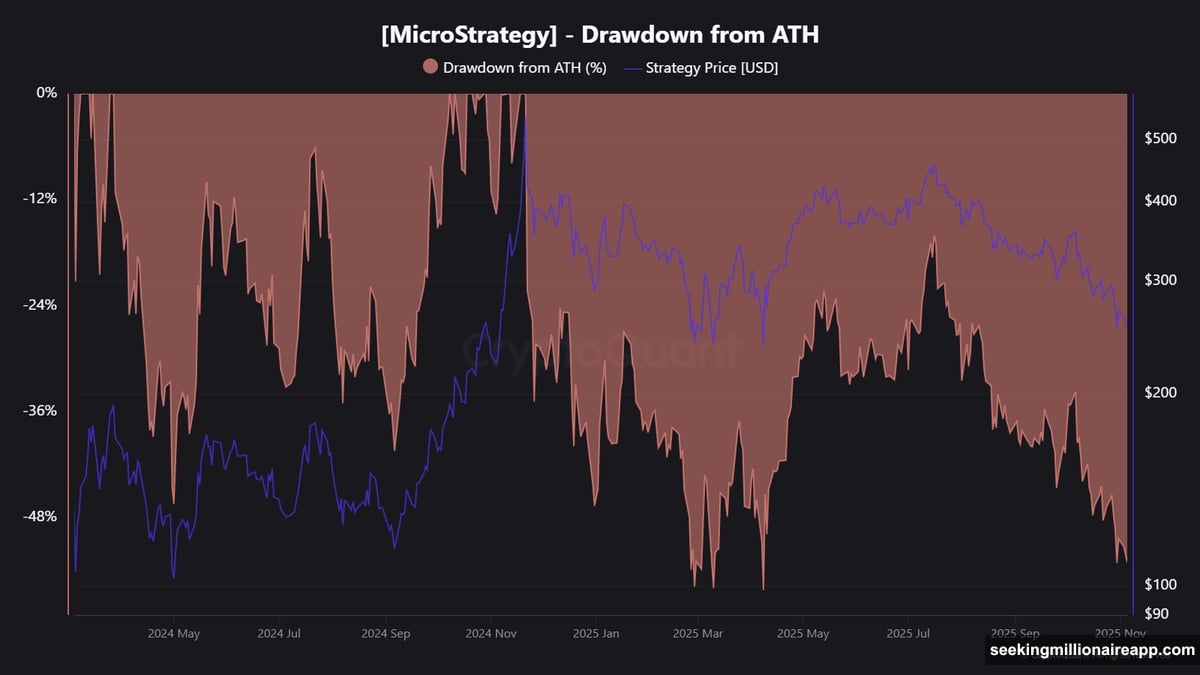

The company slowed purchases dramatically. It went from buying thousands of coins monthly to just a few hundred. Why? Bitcoin slipped under $100,000 and Strategy’s stock crashed hard.

MSTR shares dropped 53% from their peak to roughly $242. So the company can’t keep buying aggressively while its own equity gets hammered. That’s a painful reversal for a firm that built its entire strategy around accumulating Bitcoin at any price.

The slowdown signals more than caution. It reveals how quickly conviction crumbles when portfolios bleed and investors demand answers.

Metaplanet Drowns in $120 Million Loss

Tokyo-listed Metaplanet thought it found a winning strategy. The company loaded up on 30,823 BTC at an average price of $106,000 per coin.

Then Bitcoin crashed. Now Metaplanet sits on more than $120 million in unrealized losses. That’s real money evaporating from the balance sheet.

Worse still, the stock collapsed 80% from its high. Market net asset value got crushed. So management launched a share buyback program trying to restore confidence.

But buybacks don’t fix underwater crypto positions. They just redistribute capital while the core problem persists. Shareholders want to know when losses stop mounting.

XRP Treasury Faces $79 Million Deficit

Evernorth became the largest corporate XRP holder in mid-October. The timing couldn’t have been worse.

The company accumulated 388.7 million XRP tokens right before the market tanked. Now it’s sitting on roughly $79 million in unrealized losses.

XRP’s price action destroyed what looked like a smart diversification move. Instead, Evernorth joined the growing list of treasuries absorbing massive markdowns.

Moreover, altcoin volatility amplified the damage. XRP’s swings are more violent than Bitcoin’s. So treasury managers who thought diversification reduced risk discovered it just changed which tokens drain capital fastest.

Ethereum Position Bleeds $2.1 Billion

BitMine holds more than 3.4 million ETH. That makes it the largest Ethereum treasury anywhere. But being the biggest also means absorbing the worst losses.

Ethereum dropped over 22% this month. So BitMine’s unrealized deficit swelled to approximately $2.1 billion. That’s not a typo. Billions with a B.

The scale of these losses exposes a harsh truth. Companies that built positions during bull markets face the fastest capital erosion when sentiment flips. And sentiment flipped violently.

ETH’s decline hit harder than Bitcoin’s because altcoins amplify both gains and losses. BitMine discovered the amplification works both ways. Fast gains during rallies turn into brutal losses during crashes.

Structural Risks Nobody Wanted to Discuss

Here’s what crypto treasury advocates avoided mentioning during the bull run. Digital asset accumulation carries risks that not every firm can absorb.

Building massive positions during strength feels brilliant. Watching those positions crater during downturns feels devastating. Yet that cycle is predictable and unavoidable.

Companies convinced themselves they could ride out volatility. Some believed they were buying generational opportunities. Others thought institutional adoption guaranteed upside.

Both assumptions proved optimistic. Now treasuries face a sharper test of resilience. They must maintain long-term conviction while absorbing near-term financial pain that tests shareholder patience.

Balance Sheets Get Defensive Fast

Treasury managers are scrambling to adopt defensive strategies. Slower buying. Tighter risk controls. More conservative balance sheet management.

The shift reflects cold reality. Falling token prices don’t just hurt paper profits. They compress equity cushions, weaken valuations, and force uncomfortable conversations with boards and investors.

Strategy’s slowdown set the tone. If the largest Bitcoin treasury pulled back, smaller players had to follow. Nobody wants to be the last firm buying aggressively while portfolios bleed.

Meanwhile, buyback programs and equity maneuvers try to reassure markets. But these tactics don’t fix the core problem. Underwater crypto positions stay underwater until prices recover.

Conviction Meets Financial Strain

Corporate treasuries preached long-term conviction during the bull market. Now they’re discovering what conviction costs when markets turn.

Holding through volatility sounds brave. Watching billions evaporate tests whether that conviction is real or just marketing. Plus, shareholders demand results, not philosophy.

Some firms will survive this downturn and look smart when prices recover. Others will fold, sell at losses, and become cautionary tales. The difference comes down to capital reserves and risk tolerance.

But here’s the uncomfortable truth. Most treasury strategies assumed prices would keep rising. Few prepared adequately for extended downturns. That lack of preparation is showing up in balance sheets across the sector.

What Comes Next for Crypto Treasuries

This downturn isn’t over. Bitcoin hovers near critical support levels. Ethereum looks worse. Altcoins are getting massacred.

So treasury losses will likely deepen before they improve. Companies need to prepare for more pain, not less. That means conservative buying, careful equity management, and honest communication with stakeholders.

The firms that survive will be those with deep capital reserves and realistic expectations. They’ll accumulate during weakness and wait patiently for recovery. That patience will separate winners from liquidations.

Meanwhile, the crypto treasury model itself faces scrutiny. Does it make sense for public companies to bet balance sheets on volatile assets? Should shareholders tolerate this risk? These questions don’t have easy answers.

But one thing is certain. The easy money phase ended. What’s left is the hard part. Surviving downturns, managing losses, and maintaining conviction when portfolios bleed millions weekly.

Treasury managers signed up for volatility. Now they’re getting it. The next year will reveal who truly believed and who just chased hype.