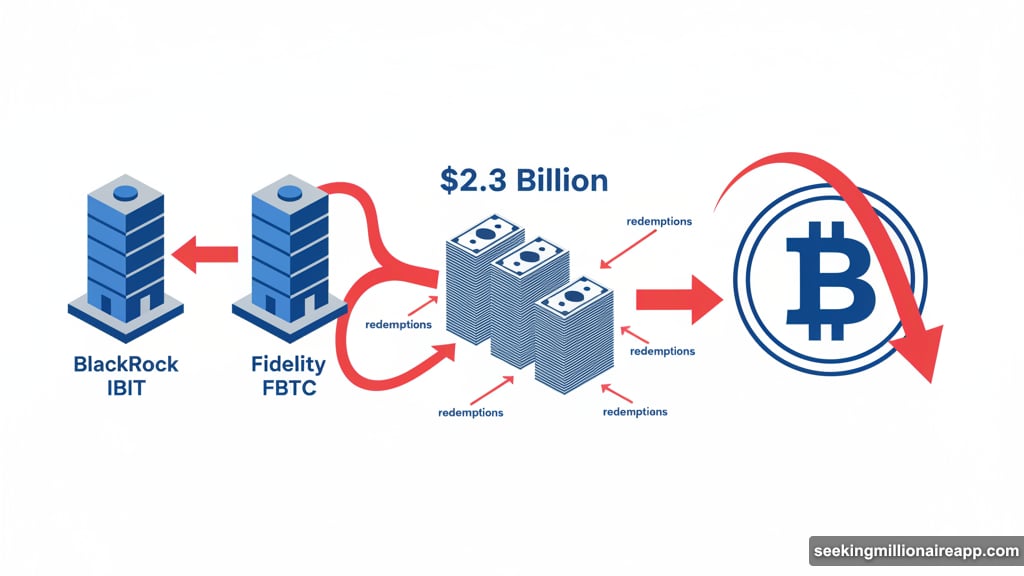

Spot Bitcoin ETFs are hemorrhaging money. In fact, withdrawals just hit their highest level since May, with roughly $2.3 billion flowing out the door.

This isn’t a minor blip. The selling pressure is concentrated in the biggest funds—BlackRock’s IBIT and Fidelity’s FBTC—and it signals something important. Institutional investors are backing away from crypto exposure as market conditions shift.

Let’s break down what’s driving this exodus and what it means for Bitcoin’s next move.

$2 Billion Gone in Just One Week

The numbers tell a stark story. According to SoSo Value data, Bitcoin ETFs shed nearly $2 billion in the past seven days alone. That’s one of the sharpest weekly declines since these products launched.

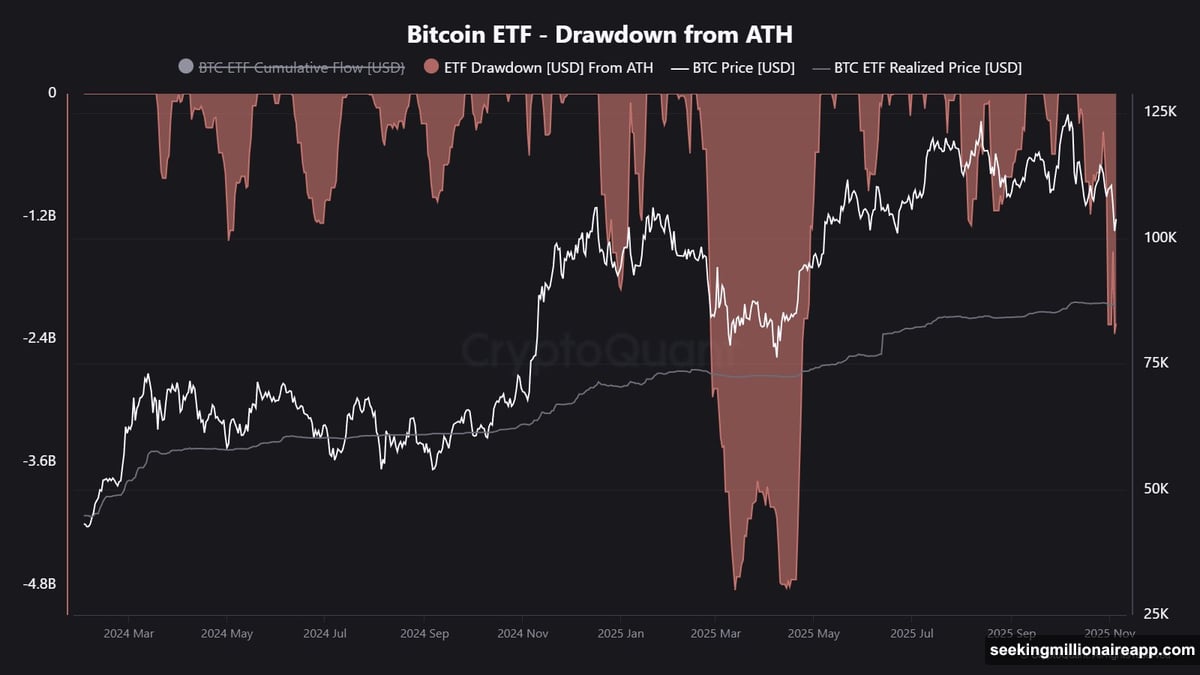

CryptoQuant data confirms the broader trend. Total redemptions have climbed to approximately $2.3 billion from recent peaks. Plus, this reverses an entire month of steady inflows that had been building investor confidence.

So what changed? The selling isn’t isolated to a single fund rebalancing its portfolio. Instead, the pressure is widespread across major vehicles. That suggests institutions are collectively reducing their Bitcoin exposure rather than making tactical adjustments.

May saw even heavier withdrawals—more than $4.8 billion fled during that volatility spike. But the current pace still marks a six-month high. Moreover, the pattern mirrors earlier periods when professional allocators rotated away from high-risk assets.

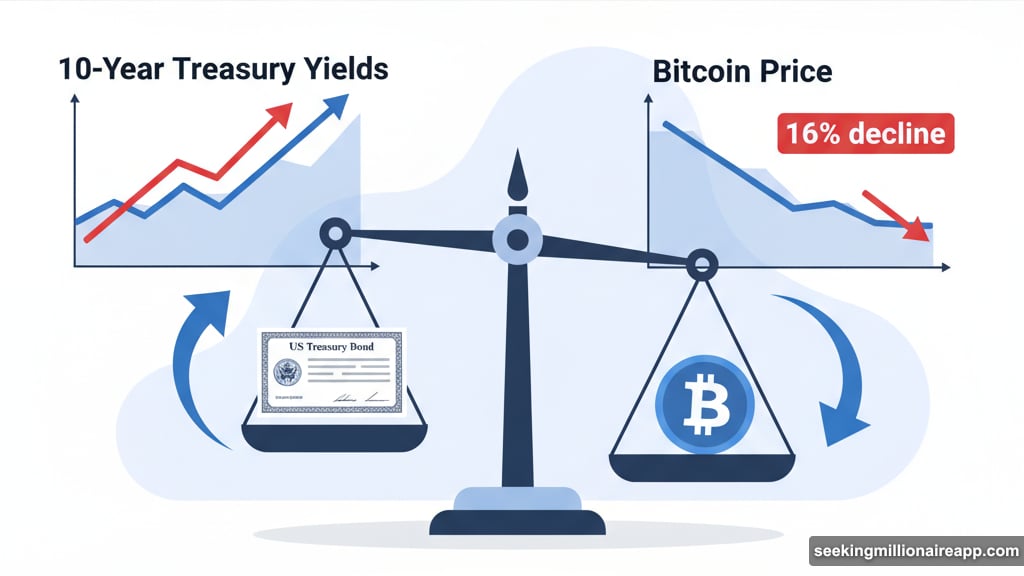

Treasury Yields Are Crushing Crypto Demand

Here’s the real culprit behind the outflows. US Treasury yields are surging, particularly the 10-year note. That shift fundamentally changes the risk-reward calculus for institutional portfolios.

Rising yields make fixed-income instruments more attractive. Why hold volatile Bitcoin when you can lock in predictable returns from government bonds? Professional money managers face this decision constantly.

Historically, Bitcoin weakens during these yield spikes. The asset typically behaves as a high-beta play—amplifying broader market moves. So when yields climb, investors rotate toward assets with clearer income profiles and lower volatility.

This isn’t new behavior. However, the scale matters now because ETFs control a larger share of market-moving liquidity. When these vehicles see redemptions, issuers must unwind their underlying Bitcoin holdings. That adds real selling pressure during periods of already muted demand.

Think of it as a feedback loop. Rising yields pull investors away. Their redemptions force ETF issuers to sell Bitcoin. Those sales push prices lower. Lower prices trigger more defensive positioning. The cycle continues until something breaks it.

Bitcoin Price Confirms the Shift

Bitcoin’s chart reinforces what the flow data shows. The asset has dropped approximately 16% since early October. As of now, it trades around $101,804.

Most of that decline happened after October 10. A massive liquidation cascade wiped roughly $20 billion in market value that day. Leveraged traders got crushed. Plus, the event forced a widespread reset in positioning across perpetual futures and options markets.

That liquidation event changed the game. Traders who survived became more cautious. Institutional investors took note. ETF redemptions accelerated shortly after.

However, the current selling doesn’t look like full capitulation yet. Portfolio managers appear to be rotating into duration-sensitive instruments rather than abandoning digital assets completely. Indeed, the flows match earlier macro-driven pullbacks when allocators trimmed risk in response to policy uncertainty.

Still, the link between ETF flows and price has never been stronger. Heavy redemptions create immediate downward pressure. Conversely, strong inflows tend to stabilize markets by absorbing spot supply. So these vehicles have become real-time gauges of institutional conviction—and powerful drivers of short-term price action.

BlackRock and Fidelity Lead the Exit

The concentration of outflows matters. BlackRock’s IBIT and Fidelity’s FBTC are seeing the heaviest redemptions. These are the two largest spot Bitcoin ETFs by assets.

When the biggest players pull back, it amplifies market impact. Smaller funds might adjust positions without moving prices much. But when BlackRock and Fidelity sell, the market feels it immediately.

This concentrated selling also suggests something about investor sentiment. These funds attract sophisticated institutional capital. Their clients include pension funds, endowments, and professional allocators. So when they withdraw, it reflects careful risk assessment rather than panic selling.

Moreover, these institutions typically have longer time horizons than retail traders. Their retreat signals a fundamental reassessment of risk-reward rather than short-term trading. That makes the current outflows more significant than comparable retail-driven selloffs.

What Comes Next for Bitcoin ETFs

The immediate outlook depends on two factors: Treasury yields and Bitcoin’s ability to hold key support levels.

If yields continue rising, expect more outflows. Professional allocators won’t reverse course until the risk-free rate becomes less attractive. That could take weeks or months depending on Federal Reserve policy and inflation data.

However, if Bitcoin stabilizes around current levels, some investors might view it as a buying opportunity. May’s $4.8 billion outflow eventually reversed. Markets stabilized. Inflows returned. So the current situation isn’t necessarily permanent.

Plus, not all investors are abandoning crypto entirely. Many are simply reducing exposure to match changing market conditions. That’s different from full capitulation. Indeed, some analysts note that these rotations have been routine throughout 2024 as investors adjust to volatile macro conditions.

The structural role of ETFs has changed the game though. These vehicles now control significant Bitcoin liquidity. Their flows directly influence spot prices in ways that didn’t exist before 2024. So tracking redemption patterns has become essential for understanding short-term price direction.

Defensive Positioning or Full Retreat?

Here’s what matters most. Are institutions temporarily defensive or permanently exiting?

The evidence suggests the former. Portfolio managers are responding to higher yields and tighter risk conditions. But they’re not dumping crypto assets indiscriminately. Instead, they’re reducing exposure to match their risk models and client mandates.

That’s a crucial distinction. Temporary rotations eventually reverse when conditions improve. Full retreats take much longer to recover from. So far, this looks more like the first scenario.

Still, the pain is real. Nearly $2.3 billion in redemptions creates genuine selling pressure. Bitcoin’s 16% decline since October reflects that pressure. Moreover, if yields keep rising or if Bitcoin breaks key support levels, the outflows could accelerate.

The next few weeks will clarify the situation. Watch Treasury yields. Monitor ETF flow data. Track Bitcoin’s ability to hold above critical price zones. Those three factors will determine whether this is a temporary pause or the start of something worse.

For now, institutions are playing defense. The question is how long they’ll stay in that posture.