Solana’s price keeps falling. Down to $157, the altcoin extended its month-long slide as Bitcoin drags it lower.

But here’s the problem nobody’s talking about. SOL can’t move independently anymore. Its price mirrors Bitcoin’s every move with scary precision. So when BTC struggles, Solana bleeds.

Plus, a key metric just flashed warning signs. Yet that same signal might actually set up the next rally. Let’s break down what’s really happening.

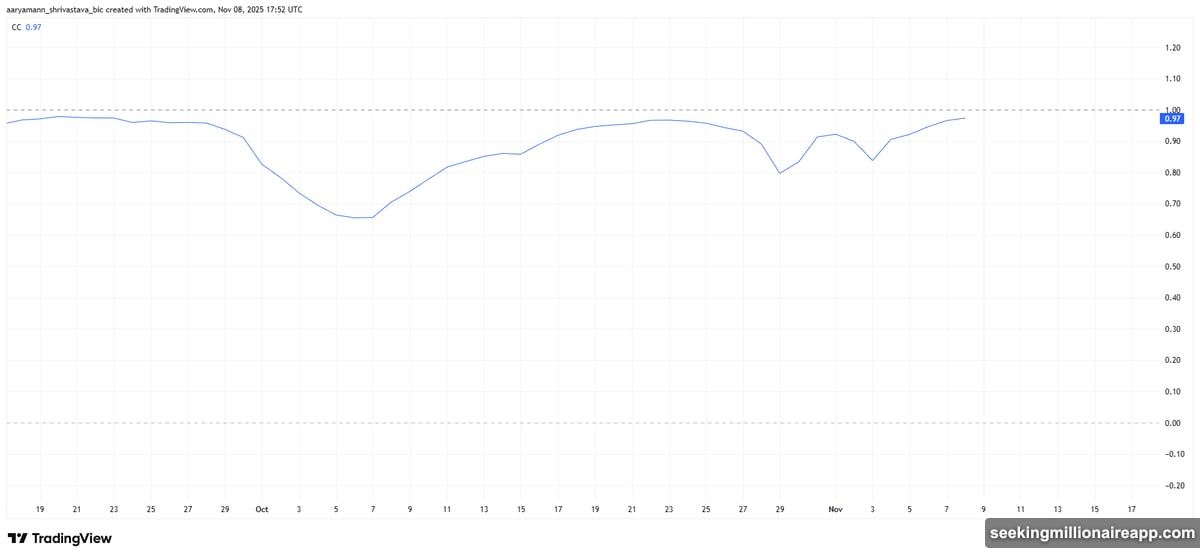

Bitcoin Controls Solana’s Destiny Now

The correlation between Solana and Bitcoin hit 0.97. That’s almost perfect lockstep. For context, a correlation of 1.0 means two assets move identically.

What does 0.97 mean in practice? Every time Bitcoin dips, Solana follows. When BTC stalls near resistance, SOL stalls too. There’s virtually no independent price action anymore.

This matters more than you think. Bitcoin currently hovers around the $100,000 level without breaking higher. Meanwhile, Solana sits trapped in the crossfire. No Bitcoin momentum means no Solana recovery.

Moreover, this dependency limits SOL’s upside potential. Even positive developments in the Solana ecosystem can’t overcome Bitcoin’s gravitational pull. So investors watching for a Solana breakout need to watch Bitcoin first.

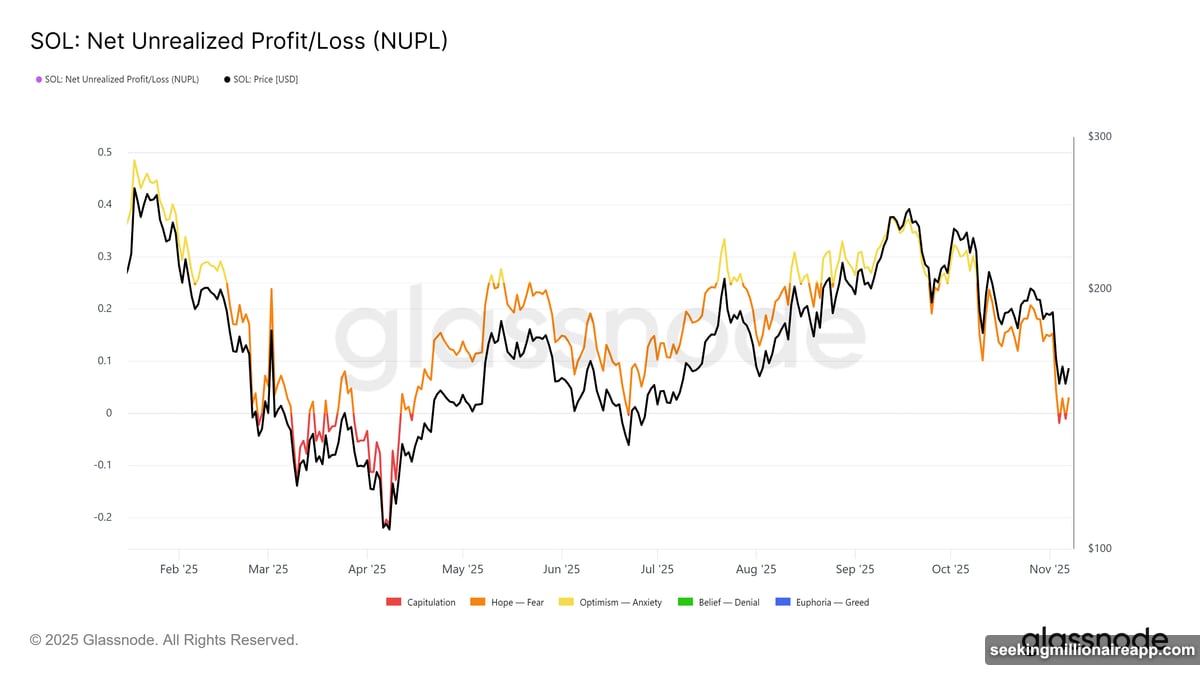

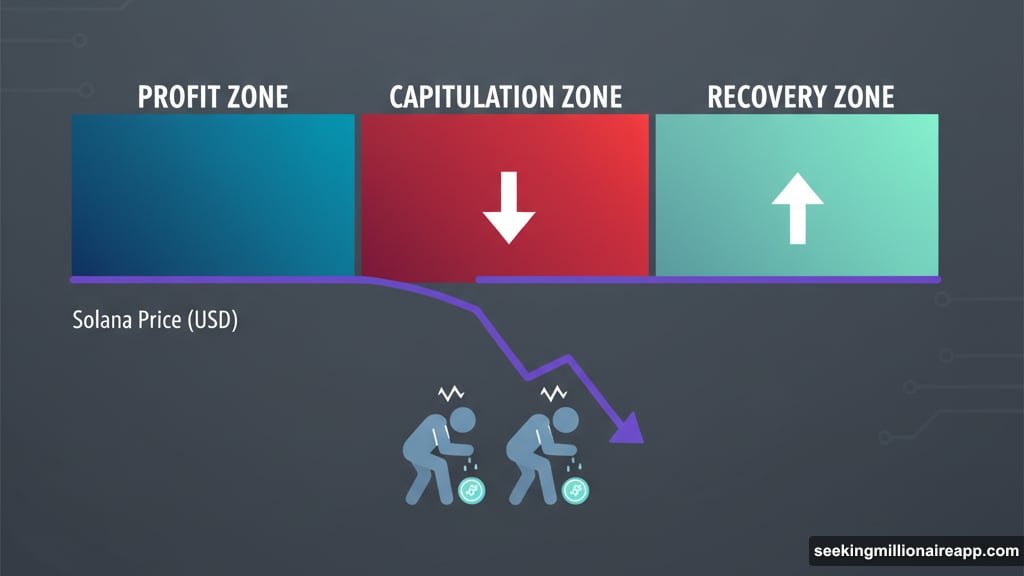

Capitulation Zone Signals Investor Exhaustion

Solana’s Net Unrealized Profit and Loss (NUPL) metric just entered the capitulation zone. This indicator measures the difference between unrealized profit and loss across all holders.

What does capitulation mean? Investors are holding at a loss but refusing to sell. They’ve essentially given up on short-term recovery. Historically, this marks critical turning points.

Here’s the twist. Capitulation phases often precede rebounds. When enough holders refuse to sell at a loss, selling pressure dries up. That creates conditions for accumulation and eventual recovery.

But there’s a catch. If Bitcoin continues weakening, Solana’s NUPL could sink deeper into capitulation territory. The correlation to BTC makes this scenario likely unless Bitcoin stabilizes soon.

Still, past Solana capitulations led to significant rallies once sentiment shifted. So this metric cuts both ways. It confirms current weakness but hints at future opportunity.

Price Action Shows Clear Support Zones

Solana trades at $157 after extending its downtrend for over a month. The technical picture reveals two likely scenarios depending on Bitcoin’s next move.

First, the bearish case. If Bitcoin fails to hold current levels, Solana could slide to $150 or even $146. Those levels represent significant support zones where buying interest might return.

However, a drop to $146 would deepen losses considerably. Some analysts warn that breaking below this level could push SOL toward $140. That would invalidate any near-term bullish thesis and extend the downtrend further.

Now for the optimistic scenario. If buying pressure returns and Bitcoin stabilizes, Solana could recover toward $163. That would confirm the downtrend’s end and open the door to $175.

But here’s the reality check. Solana’s recovery depends entirely on Bitcoin’s performance. Independent rallies seem impossible with a 0.97 correlation. So watching BTC’s price action matters more than watching SOL itself.

The Dependency Problem Nobody Addresses

This correlation reveals a deeper issue with altcoin markets. When major tokens move in perfect sync with Bitcoin, they lose their investment thesis.

Why hold Solana specifically if it just mirrors Bitcoin? The answer used to be Solana’s unique technology and ecosystem growth. Fast transaction speeds, low fees, and thriving DeFi applications made SOL attractive independently.

Yet price action tells a different story. Market sentiment toward Bitcoin overwhelms everything else. Solana’s technological advantages don’t matter when BTC dominates price direction.

This creates a frustrating situation for Solana believers. Positive developments in the ecosystem get ignored. Network upgrades barely register. Instead, Bitcoin’s ability to break resistance levels determines SOL’s fate.

What Happens Next Depends On BTC

Solana holders face a waiting game. The token can’t rally independently. So the path forward hinges entirely on Bitcoin’s next moves.

If Bitcoin breaks above resistance and resumes its uptrend, Solana will follow. The 0.97 correlation guarantees it. A BTC rally toward new highs would likely lift SOL back above $175 and possibly higher.

But if Bitcoin continues struggling, Solana’s downtrend extends. The capitulation zone in NUPL suggests many holders have already accepted losses. Further weakness could trigger more selling once patience runs out.

For traders, this means watching Bitcoin’s charts matters more than Solana’s fundamentals right now. Technical levels in BTC will dictate SOL’s price action in the near term.

For long-term investors, the capitulation phase might represent opportunity. Historically, these periods mark accumulation zones before eventual recovery. But timing that recovery requires Bitcoin cooperation.

The frustrating truth? Solana’s price independence won’t return until the correlation weakens. Until then, SOL remains a leveraged bet on Bitcoin’s direction. Nothing more, nothing less.