The crypto market just jumped $81 billion in 24 hours. That’s not a typo.

Total market capitalization now sits at $3.42 trillion, hovering right below the $3.43 trillion resistance level. Meanwhile, Bitcoin holds steady above $100,000, and some altcoins are absolutely exploding. Filecoin shot up 71% overnight, leaving traders scrambling to understand what’s happening.

Let’s break down the forces behind this sudden surge and what it means for your portfolio.

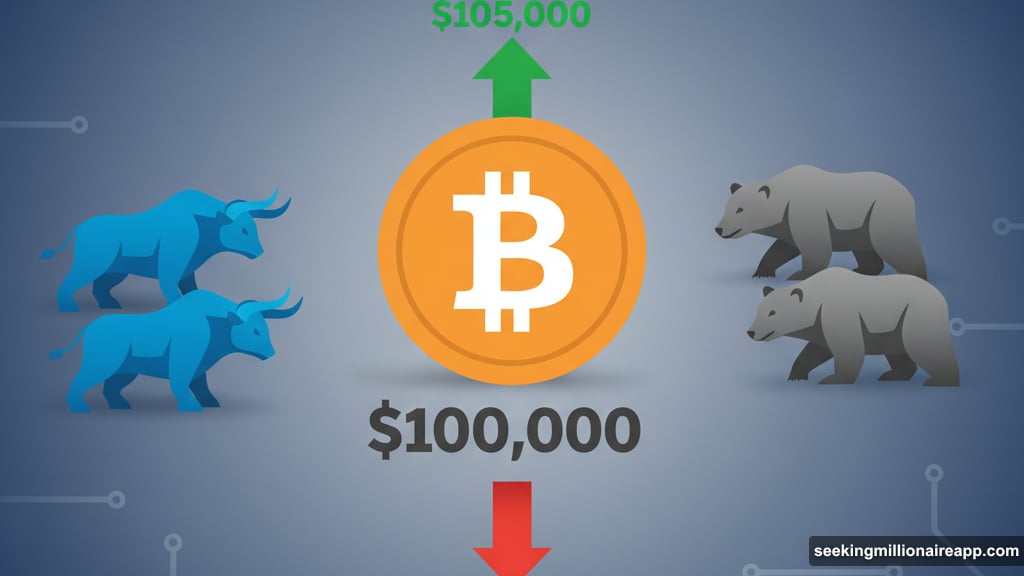

Bitcoin Refuses to Break Below $100K

Bitcoin’s trading at $102,574 right now. More importantly, it’s maintaining support above $101,477. That psychological $100,000 level keeps acting as a floor, which is exactly what bulls want to see.

The real question is whether BTC can push past $105,000. If buying pressure continues and sellers stay quiet, that’s the next logical target. Breaking through would signal genuine strength, not just a dead cat bounce.

But here’s the thing. If momentum fades or profit-taking kicks in, Bitcoin could slip back toward $100,000. A drop below that mark would kill the bullish narrative and send traders running for the exits. So we’re at a critical juncture right now.

The Broader Market Shows Cautious Optimism

That $81 billion increase in total market cap isn’t random. Investors are cautiously optimistic, testing whether this rally has legs or if it’s just another fake-out.

The $3.43 trillion resistance is the line in the sand. If the market breaks through, we’re looking at a potential climb toward $3.49 trillion, maybe even $3.56 trillion. That would require sustained inflows and improving macro conditions. Plus, global risk appetite needs to stay healthy.

However, any sign of weakness could flip this scenario fast. A reversal would drag the market down to $3.31 trillion, trapping it in a sideways range. That would delay recovery and frustrate everyone hoping for a sustained bull run.

So the next few days matter. A lot.

Filecoin Steals the Spotlight

While Bitcoin grabs headlines, Filecoin quietly had the day of its life. FIL surged 71% to $3.249, positioning itself just below the $3.56 resistance.

The technical setup looks promising too. FIL is nearing a Golden Cross formation, which historically signals strong upward momentum. If that pattern confirms, we could see FIL break past $3.56 and target $4.20. That’s the optimistic scenario.

But let’s be real. After a 71% pump, profit-taking is inevitable. If investors decide to cash out, FIL could drop below $3.00. That would expose it to further losses, potentially sliding toward $2.63. A move like that would invalidate the bullish thesis entirely.

So Filecoin holders face a choice. Hold for further gains or secure profits while they’re on the table. Both strategies have merit, depending on your risk tolerance.

What’s Driving This Rally

Two major news items are fueling optimism right now.

First, Kazakhstan announced plans to launch a $1 billion crypto reserve fund by early 2026. The fund will use seized assets and crypto-mining revenues. It’s a major step in legitimizing digital assets at the national level.

Second, there’s renewed regulatory clarity in the US. A mistrial in the US v. Peraire-Bueno case shows the complexity of prosecuting crypto-related crimes. That’s actually bullish, because it suggests regulators are still figuring things out. Markets love uncertainty more than outright hostility.

Plus, macroeconomic conditions are improving slightly. Risk appetite is creeping back. Traders who fled to safety during recent volatility are testing the waters again.

The Resistance Levels That Matter

For Bitcoin, $105,000 is the next battleground. A clean break above that level would confirm strength and attract more buyers. Fail to break through, and we’re stuck in a range between $100,000 and $105,000.

For the total market, $3.43 trillion is the number to watch. Breaking above opens the door to $3.49 trillion and beyond. Falling below sends us back to $3.31 trillion, which would trap the market sideways for weeks.

These aren’t arbitrary numbers. They’re levels where supply meets demand. Where whales take profits or accumulate positions. Where retail traders make emotional decisions.

Understanding these levels helps you avoid panic selling or FOMO buying at the wrong time.

What Could Go Wrong

Markets never move in straight lines. Several factors could derail this rally fast.

First, profit-taking. After sudden gains, early buyers cash out. That selling pressure can overwhelm new buyers and reverse momentum quickly.

Second, macro risks. Any negative economic news, whether it’s inflation data or geopolitical tensions, could spook risk assets. Crypto remains highly correlated with traditional markets during stress periods.

Third, regulatory surprises. Despite improving clarity, one enforcement action or regulatory crackdown could send prices tumbling. The SEC and other agencies are still actively monitoring the space.

So while optimism is justified, complacency is dangerous. Position sizes matter. Risk management matters more.

The Golden Cross Setup

Let’s talk about Filecoin’s technical pattern, because it matters beyond just FIL.

A Golden Cross occurs when a short-term moving average crosses above a long-term moving average. It’s considered one of the most reliable bullish signals in technical analysis. When it forms, it often precedes extended rallies.

FIL is approaching that formation now. If confirmed, it could attract algorithmic buying and technical traders. That creates a self-fulfilling prophecy where the pattern itself drives the rally.

But here’s the catch. Golden Crosses work best in trending markets, not choppy ones. If the broader market reverses before FIL confirms the pattern, all bets are off. Context matters as much as the pattern itself.

Smart Strategies for This Environment

So what should you actually do with this information?

If you’re bullish, watch those resistance levels closely. A break above $3.43 trillion for total market cap or $105,000 for Bitcoin would be your entry signal. Just don’t chase pumps. Wait for confirmation.

If you’re holding Filecoin or other altcoins that pumped hard, consider taking some profits. A 71% gain in 24 hours is rare. Securing partial profits protects you if the rally reverses while keeping you exposed to further upside.

If you’re sitting in cash, patience pays off right now. These resistance levels will either break or hold. Both scenarios create opportunities. Breaking through means you join the rally with confirmation. Holding means you wait for a better entry after the pullback.

Nobody Knows What Happens Next

Anyone claiming certainty about crypto’s next move is selling you something.

Yes, the technicals look promising. Yes, the news is relatively positive. But crypto markets can reverse on a dime. Liquidations cascade. Sentiment shifts overnight. Black swan events happen.

The best approach is preparing for multiple scenarios. Have a plan if Bitcoin breaks $105,000. Have a different plan if it drops below $100,000. Know your entry points, exit points, and position sizes before emotions take over.

Markets reward the prepared, not the hopeful.

This rally could be the start of something bigger. Or it could be a bull trap before another leg down. The answer reveals itself at those resistance levels we discussed. Until then, watch the data, manage your risk, and don’t let FOMO dictate your decisions.