The crypto market just woke up. After weeks of bleeding, prices jumped 4% in 24 hours. But the real story isn’t the rebound itself—it’s what the whales are doing with their millions.

Big-money traders moved over $110 million in Bitcoin to exchanges this weekend. Meanwhile, fresh wallets pulled $2.9 million in Chainlink off those same platforms. So are whales buying or selling? Turns out, both. And their mixed signals reveal competing bets on where crypto heads next.

Let’s break down what happened and what it means for the market.

Bitcoin Whales Moved $110 Million to Exchanges

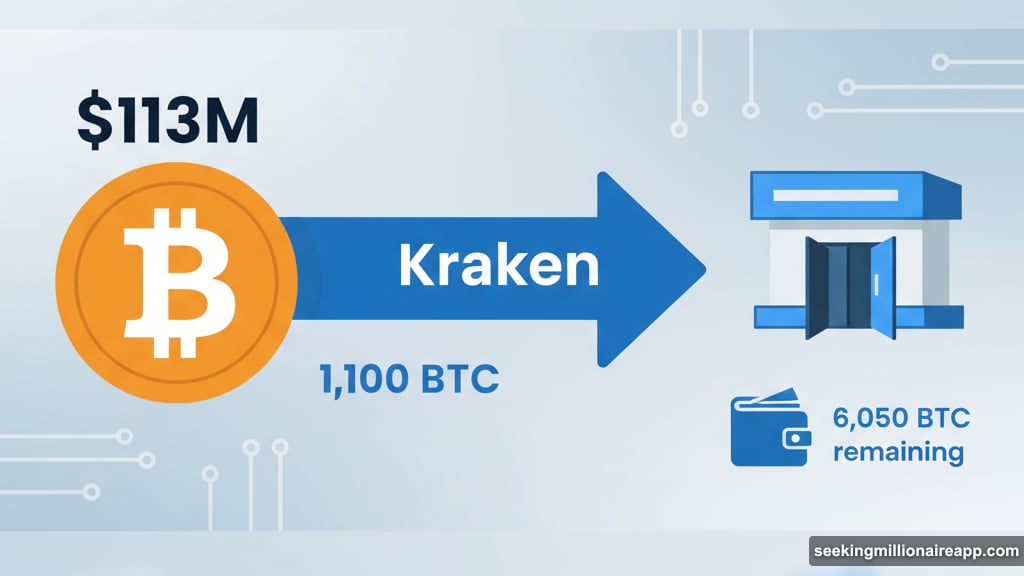

Early Bitcoin investor Owen Gunden made waves this weekend. He transferred 1,100 BTC—worth roughly $113 million—to Kraken across two separate transactions.

First, he sent 500 BTC on Saturday. Then another 600 BTC followed Sunday. Both moves suggest he’s preparing to sell, not hold.

But here’s the thing. Gunden still controls 6,050 BTC, currently valued at $619 million. So this weekend’s transfers represent just 15% of his total holdings.

That’s significant but not catastrophic. He’s taking profits, not dumping everything. Still, when a whale moves nine figures to an exchange, the market notices.

Fresh Wallets Accumulated $2.9 Million in Chainlink

While Bitcoin whales prepared to exit, Chainlink saw fresh buying. Two newly created wallets withdrew 187,500 LINK from Binance over three days.

The purchases averaged $15.50 per token. That’s roughly $2.9 million in total. Plus, these wallets had no previous transaction history—classic whale behavior when they want to accumulate quietly.

Why Chainlink? Hard to say definitively. But LINK has strong fundamentals and real-world partnerships. Smart money often moves into projects with actual utility during market rebounds.

The contrast is stark. Bitcoin whales sent millions to exchanges. Chainlink whales pulled millions off exchanges. So different assets are attracting different strategies right now.

Leveraged Traders Got Crushed on Bitcoin Shorts

Derivatives markets told a brutal story this weekend. Several high-profile traders bet against Bitcoin using extreme leverage. Most lost badly.

One trader deposited $7 million USDC into Hyperliquid three days ago to short BTC. Repeated stop-losses wiped out his position. He ended with just $560,000—a loss of $6.44 million.

Another trader known as “0x7B7b” fared even worse. He lost $6.19 million in under four days. His $7 million bankroll shrank to $672,000 as his Bitcoin shorts got stopped out 300 times at $31.75 million.

Here’s the lesson. Shorting Bitcoin during a rebound with high leverage is financial suicide. The volatility chops accounts to pieces before traders can react.

Some Whales Made Millions on Ethereum Longs

Not everyone lost money this weekend. A trader known as the “Anti-CZ Whale” switched from shorting to longing Ethereum at exactly the right time.

That single position now shows over $15 million in unrealized profit. Meanwhile, another investor called “Brother Machi” increased his ETH long position to 25 times its original size.

Both traders demonstrate sustained bullish conviction on Ethereum. They’re not just catching a bounce—they’re betting on a longer-term reversal.

Plus, their timing was impeccable. They entered longs before the 4% weekend surge, maximizing gains while short sellers got liquidated.

Zcash Whales Closed $1.25 Million in Profits

Zcash attracted serious whale attention in derivatives markets. A mysterious trader known as “0x6EF9” used limit orders to build a ZEC long position, then closed it for $1.25 million in profit.

But that’s not the end. A new wallet labeled “0x089f” appeared immediately after. It deposited 3.54 million USDC into Hyperliquid and placed a limit long order at $508.50 for ZEC.

This suggests coordinated whale activity. One trader exits profitably, another enters with similar conviction. They’re passing the baton while maintaining bullish exposure to Zcash.

Zcash isn’t typically a top-tier whale target. So this level of attention indicates something’s brewing with privacy coins.

One Ethereum Trader Exited at a Loss

Not all whale moves succeeded. An Ethereum trader who bought 6,028 ETH during the October 11 crash finally capitulated this weekend.

He originally bought at $3,638 per coin. This weekend, he sold all 6,028 ETH for 22.26 million USDC at an average price of $3,587. That’s a $320,000 loss.

The timing stings. He held through weeks of volatility, then sold just as the market rebounded 4%. Plus, if he’d held just one more day, he might have broken even or profited.

But whale psychology is complex. Maybe he saw technical resistance. Or maybe he just wanted out after weeks of stress. Either way, his exit added selling pressure right as others were buying.

What This Whale Activity Really Means

The mixed signals reveal competing narratives. Bitcoin whales are taking profits after strong gains. Chainlink whales are accumulating during the dip. Ethereum longs are printing money. And leveraged shorts are getting destroyed.

So what’s the consensus? There isn’t one. Different whales are making different bets based on different timeframes and risk tolerances.

But one pattern emerges clearly. Whales who bet on the rebound—with Ethereum longs, Zcash longs, or spot Chainlink buys—made money. Those who fought the rebound with leveraged Bitcoin shorts got crushed.

The market punished pessimism this weekend. Whether that trend continues depends on what happens next with Bitcoin’s price action and broader macro conditions.

Leveraged Trading Remains a Risky Game

This weekend proved again why extreme leverage destroys accounts. Traders using 40x or higher leverage got liquidated repeatedly, even when they were directionally correct at times.

The problem? Crypto volatility creates wild price swings that trigger stop-losses before positions can recover. So even if Bitcoin eventually goes lower, leveraged shorts might not survive long enough to profit.

Plus, whales with deep pockets can manipulate prices specifically to trigger these liquidations. They hunt stop-loss clusters, force liquidations, then reverse the market.

Smart money uses leverage sparingly. Reckless traders use maximum leverage and get wrecked. This weekend showed that difference clearly.

The Real Winners Used Spot Markets

While leveraged traders faced liquidation cascades, spot market whales executed cleaner strategies. The Chainlink accumulation wallets withdrew tokens at $15.50 and will profit if LINK rises. No liquidation risk. No forced exits.

Similarly, Owen Gunden’s Bitcoin transfers to Kraken let him sell at his chosen price. No leverage. No forced liquidations. Just straightforward profit-taking.

Spot trading requires more capital. But it avoids the catastrophic risks that destroyed leveraged positions this weekend. For whales managing millions, that stability matters more than potential leverage gains.

So the lesson? If you’re not prepared to lose everything, don’t use extreme leverage. Spot markets offer enough opportunity without the existential risk.

What Comes Next for Crypto Markets

This 4% weekend rebound doesn’t guarantee a sustained rally. Macro conditions remain uncertain. Bitcoin whales are taking profits. And technical resistance levels still loom overhead.

But the whale activity shows conviction in certain assets. Ethereum longs are holding strong. Chainlink accumulation continues. Zcash attracted fresh capital.

So while Bitcoin faces profit-taking pressure, altcoins might lead the next leg higher. That’s happened before during crypto rebounds—Bitcoin consolidates while altcoins surge.

Watch the whales closely. Their next moves will signal whether this weekend’s rebound was a dead cat bounce or the start of something bigger.