Digital asset funds are bleeding. Hard.

Last week alone, crypto investment products lost $1.17 billion. That’s the second consecutive week of massive outflows, and it’s sending a clear message about investor confidence right now.

But here’s what makes this interesting. While Bitcoin and Ethereum got crushed, two cryptocurrencies actually attracted money. Solana and XRP bucked the trend entirely, pulling in hundreds of millions while everything else tanked.

So what’s driving this split? The answer reveals which cryptocurrencies institutional investors actually believe in when markets get rough.

Federal Reserve Spooked US Investors

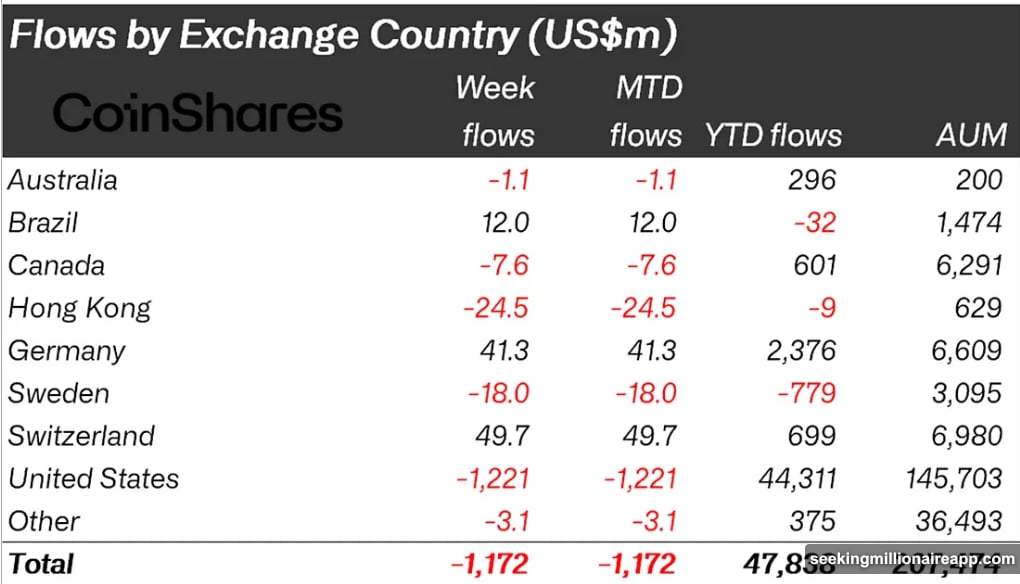

The United States led the exodus with $1.22 billion in withdrawals. That’s massive.

Why the panic? Federal Reserve Chair Jerome Powell recently signaled he won’t cut interest rates anytime soon. Plus, the threat of a government shutdown loomed over markets all week. Together, these factors created perfect conditions for risk-off sentiment.

Powell’s hawkish stance hit especially hard. Investors betting on monetary easing suddenly faced reality. No rate cuts means higher borrowing costs, which typically crushes speculative assets like crypto. So money flowed out fast.

Meanwhile, political gridlock in Washington added fuel to the fire. Congress couldn’t agree on budget measures to prevent a shutdown. That uncertainty made investors nervous about broader economic stability.

The combination proved toxic for crypto sentiment. When macroeconomic clouds gather this dark, institutional investors typically pull back from volatile assets first.

Europe Stayed Surprisingly Bullish

Not every region panicked. Germany and Switzerland actually posted inflows totaling $91 million.

Germany contributed $41.3 million while Switzerland added $49.7 million. These numbers suggest European investors see different opportunities than their US counterparts. Perhaps they’re less concerned about Fed policy since it doesn’t directly impact European markets.

This geographic split tells an important story. Risk appetite varies dramatically by region right now. US investors are running scared while Europeans are buying the dip. That divergence rarely lasts long, though.

Trading volumes remained robust at $43 billion for the week. Activity spiked midweek when Congress briefly seemed ready to avoid the shutdown. That hope proved short-lived, but it shows how quickly sentiment can shift based on political developments.

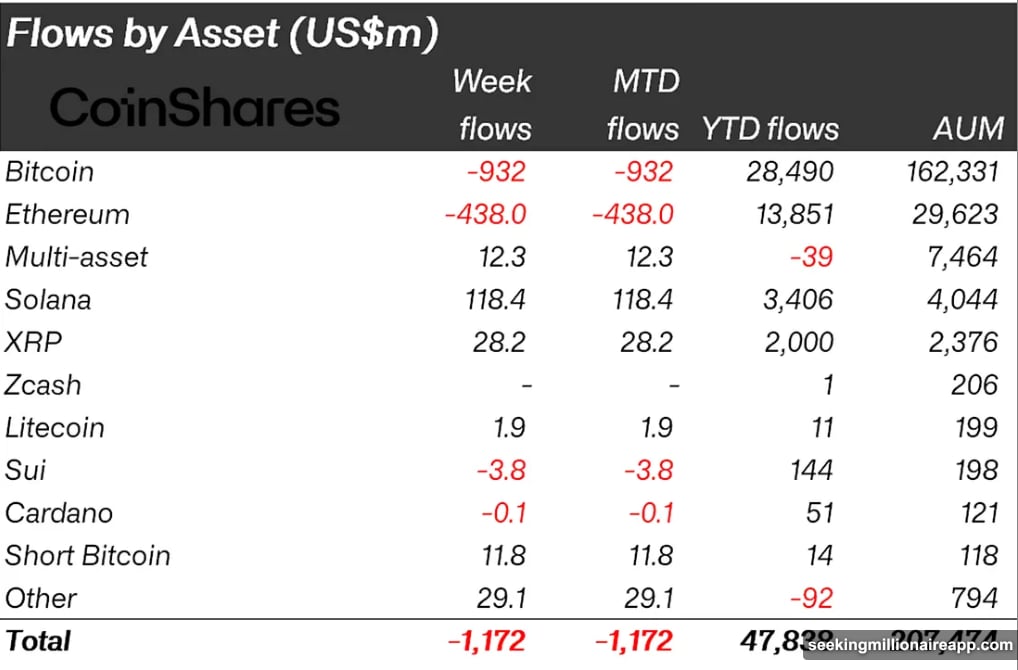

Bitcoin Took the Biggest Hit

Bitcoin products hemorrhaged $932 million last week. That’s brutal.

The leading cryptocurrency remains incredibly sensitive to US policy shifts. When Powell speaks hawkishly, Bitcoin holders listen and often sell. This latest exodus proves that relationship hasn’t changed despite Bitcoin’s institutional adoption.

Ethereum suffered too, losing $438 million in outflows. The previous week saw $57.6 million in inflows, which makes this reversal especially striking. Ethereum investors clearly can’t decide if they’re bullish or bearish right now.

Short Bitcoin positions attracted $11.8 million in new money. That’s the highest inflow for Bitcoin shorts since May 2025. Investors are actively betting against Bitcoin’s price, expecting further declines.

This surge in short positions reveals something important. A growing number of institutional players think Bitcoin’s recent rally is over. They’re positioning for downside, which could become self-fulfilling if enough money follows.

Solana Made Institutional History

While Bitcoin and Ethereum bled, Solana attracted $118 million in fresh capital. Even more impressive? That brings Solana’s nine-week total to $2.1 billion in inflows.

For the entire year 2025, Solana products have pulled in $3.3 billion. That’s extraordinary growth for a cryptocurrency that many once dismissed as a “beta” play on Ethereum.

The recent launch of US Solana ETFs accelerated this trend. Bitwise’s BSOL and Grayscale’s GSOL both saw strong demand. Together, they recorded four straight days of net inflows totaling $200 million.

The previous week, Solana saw $421 million in inflows—its second-highest on record. This consistent demand suggests institutions genuinely believe in Solana’s long-term value proposition, not just short-term speculation.

XRP also bucked the broader trend with positive inflows, though specific numbers weren’t disclosed. Other altcoins showing strength included HBAR with $26.8 million and Hyperliquid with $4.2 million.

What This Split Really Means

The divergence between Bitcoin/Ethereum and Solana/XRP reveals a fundamental shift in institutional thinking.

Bitcoin and Ethereum react heavily to macroeconomic conditions. When the Fed turns hawkish or political uncertainty rises, these assets get sold first. They’ve become correlated with traditional risk assets like tech stocks.

Solana and XRP, however, seem to be attracting a different type of investor. These buyers focus on specific use cases, technological advantages, and product launches rather than broad macro trends.

Solana’s performance advantage likely stems from its speed and lower transaction costs compared to Ethereum. As more institutions evaluate blockchain infrastructure, Solana’s technical merits become harder to ignore.

XRP’s resilience probably connects to ongoing regulatory clarity and its established role in cross-border payments. Despite Ripple’s past legal battles with the SEC, institutional buyers see value in XRP’s specific use case.

This creates an interesting dynamic. Bitcoin remains the macro proxy—rising and falling with broader market sentiment. But Solana and select altcoins are starting to trade on their own fundamentals.

Washington’s Gridlock Drives Everything

Federal policy remains the dominant force shaping crypto flows right now. Powell’s stance on interest rates will determine whether outflows continue or reverse.

If economic data worsens or regulations tighten further, expect more withdrawals from Bitcoin and Ethereum products. The correlation between macro uncertainty and crypto selling pressure shows no signs of breaking.

Conversely, any dovish pivot from the Fed or resolution to Washington’s budget stalemate could trigger rapid inflows. Crypto markets remain incredibly sensitive to these macro signals.

For now, though, caution rules. Institutional investors are pulling back from broad crypto exposure while selectively betting on specific projects with clear value propositions.

The question is whether this two-tier market persists or if everything eventually follows Bitcoin’s lead. History suggests Bitcoin’s direction usually matters most. But Solana’s record-breaking inflows hint that narrative might be changing.

Smart money is getting selective. They’re not abandoning crypto entirely—they’re just demanding better reasons to stay invested beyond “number go up.” That’s probably healthy for the market long-term, even if it hurts in the short run.