A mistrial in a $25 million crypto theft case left jurors emotionally devastated. Some lost multiple nights of sleep trying to decide if aggressive trading counted as fraud.

Two brothers in their 20s walked away from criminal charges this week. Not because they proved innocence. But because the jury couldn’t agree on whether their actions crossed the line from clever trading into actual crime.

The case exposed something bigger. Prosecuting crypto crimes in traditional courtrooms might be fundamentally broken.

The Brothers Who Allegedly Robbed Trading Bots

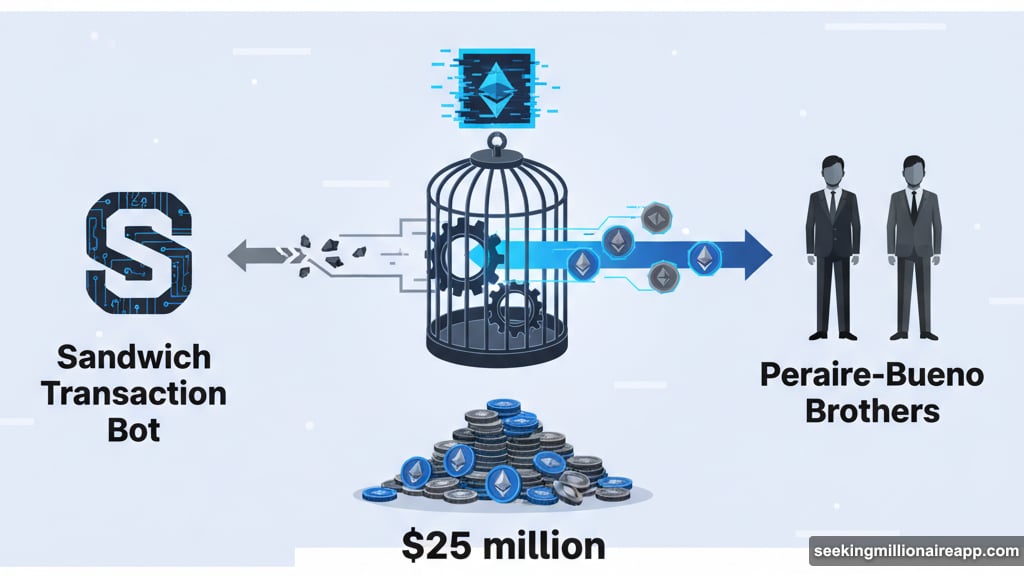

Anton Peraire-Bueno and James Pepaire-Bueno got arrested in May 2024. The Justice Department claimed they “attacked the Ethereum blockchain and stole $25 million.”

That sounds dramatic. What actually happened was more technical.

The brothers allegedly targeted trading bots performing “sandwich transactions.” These bots exploit other traders by manipulating prices mid-transaction. They’re legal but widely hated in crypto circles.

So the brothers set a trap. They lured these parasitic bots into situations that made them malfunction. The glitching bots released valuable tokens in exchange for worthless ones. Then the brothers allegedly tried laundering their $25 million haul.

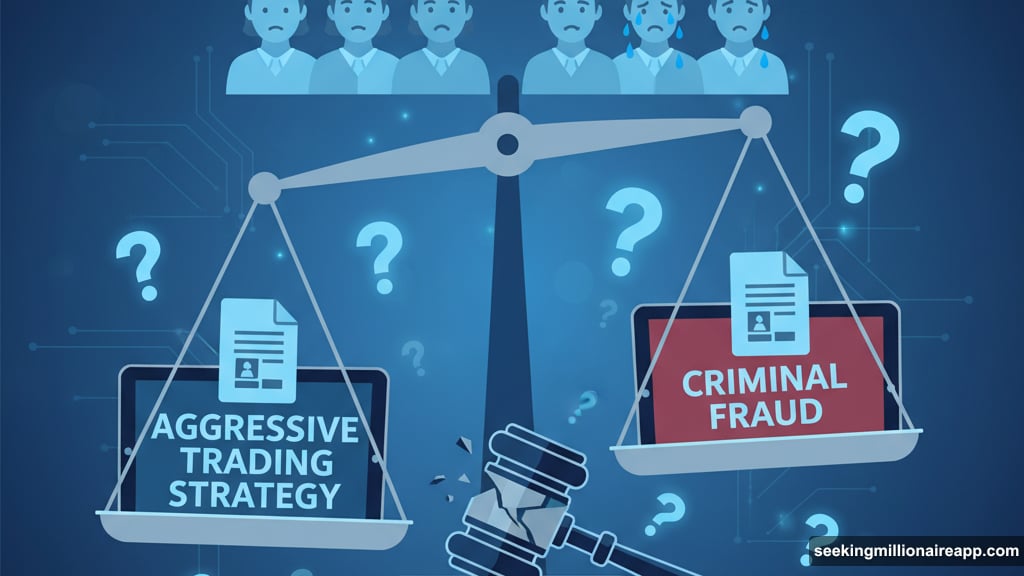

Was this theft? Or just outsmarting aggressive traders at their own game?

When Smart Trading Becomes Criminal

The prosecution argued this was fraud. Clear and simple.

But the defense called it a “trading strategy.” The brothers spotted an exploit in bot behavior and capitalized on it. Nothing in crypto’s rulebook explicitly forbade their actions.

Plus, their targets were performing sandwich transactions. These are legal arbitrage plays that prey on unsuspecting traders. Many in crypto view sandwich trading as parasitic profiteering.

So the brothers essentially mugged the digital muggers. That’s not quite Robin Hood territory. But it’s also not obviously criminal in crypto’s Wild West environment.

The jury needed to decide where aggressive trading ended and fraud began. Turns out that question was impossible to answer.

A Jury Chosen for Intelligence Still Couldn’t Decide

Manhattan prosecutors assembled a sophisticated jury for this case. Half held master’s degrees. Almost all were middle-aged or older.

Business Insider noted the careful selection. Prosecutors wanted jurors who could parse complex technical distinctions. They needed people who understood blockchain mechanics and trading strategies.

The trial lasted three weeks. Evidence wasn’t disputed. Everyone agreed on what happened. The only question was whether those actions constituted crimes.

Then the jury started falling apart.

Deliberations Became an Emotional Crisis

Friday brought desperate messages from the jury room. Multiple jurors had lost “multiple nights” of sleep wrestling with the decision.

Later that day, another note arrived. Deliberating created an “emotional burden” the jury couldn’t handle. Half the jurors had “spontaneously broken down in tears” during discussions.

U.S. District Judge Jessica Clarke declared a mistrial. The jury simply couldn’t reach agreement.

Think about that. Twelve intelligent people spent weeks studying this case. They agreed on facts. But they still couldn’t decide if a crime occurred.

Half of them cried trying to figure it out.

Why Crypto Cases Break Traditional Justice

This mistrial exposes fundamental problems with prosecuting crypto crimes.

Traditional fraud laws assume clear victims and obvious theft. But crypto blurs every line. When bots rob bots in an unregulated market, who’s the victim? Only one human ever came forward claiming losses.

The brothers exploited legal trading practices. They used sophisticated code to beat other sophisticated code. In traditional finance, this might be fraud. In crypto, it looks like Tuesday.

Moreover, the jury’s education level didn’t help. More degrees meant more nuance awareness. That made consensus harder, not easier.

So prosecutors now face a tough choice. Retry the case and hope for a different jury? Or accept that some crypto crimes might be unprosecutable?

Prosecutors Must Try Again

A deadlocked jury doesn’t free the Peraire-Bueno brothers. Prosecutors can retry the case. They probably will.

But they’re fighting uphill now. They already went to trial and ended in stalemate. That doesn’t inspire confidence.

Plus, the emotional toll on the first jury sends a message. Nobody wants to be on a crypto jury. The technical complexity combined with moral ambiguity creates impossible decisions.

Future juries will know what happened to this one. Half cried. Multiple lost sleep. All struggled with questions that have no clear answers.

That’s not a selling point for justice system participation.

The Real Problem Nobody Wants to Address

Crypto operates in a legal gray zone by design. That’s the whole point. Decentralized finance deliberately avoids traditional regulations and oversight.

So when someone gets robbed in this space, traditional courts struggle. They’re applying old laws to new realities. Square pegs, round holes.

The brothers allegedly stole $25 million. But from whom? Bots performing parasitic trades? Other anonymous traders? The distinction matters legally.

Yet crypto enthusiasts resist regulation. They want Wild West freedom combined with courthouse protection. That’s contradictory.

You can’t build systems designed to evade oversight, then cry for help when someone exploits them. The Peraire-Bueno case proves traditional justice can’t handle crypto’s deliberate ambiguity.

So either crypto needs real regulation. Or it needs to accept that clever exploitation isn’t technically crime.

This jury couldn’t decide. The next one probably won’t either.