The IRS just greenlit staking for crypto ETFs. Headlines celebrated. But buried in the guidance sit three operational quirks that could reshape how institutions deploy billions.

Most coverage focused on the headline win. Yes, trusts can now stake and earn yields. But the fine print reveals unexpected flexibility in some areas and strict limits in others. Plus, key ambiguities remain that could trip up fund managers.

Let’s break down what the guidance actually says versus what people think it says.

Single-Asset Trusts Get All the Benefits

Here’s the catch nobody’s talking about. This relief only works for single-asset trusts.

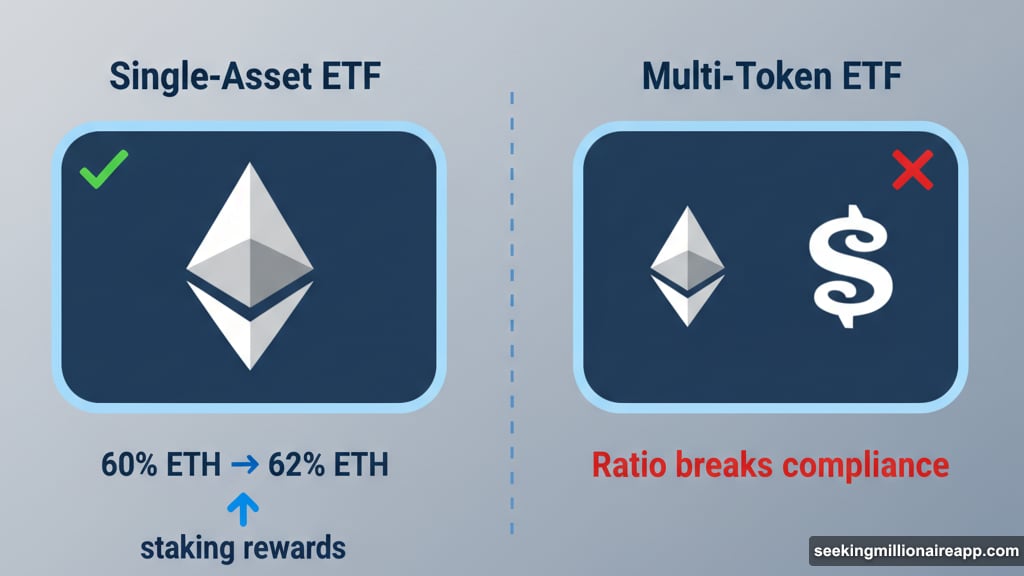

Got an ETF holding just Ethereum? You’re golden. But mixed-asset trusts that hold multiple tokens in different ratios? Excluded from the party.

Why the restriction? Staking rewards would mess up the asset proportions. Say you hold 60% ETH and 40% SOL. Then ETH staking rewards roll in. Now your ratio shifted to 62% ETH and 38% SOL. That breaks the grantor trust compliance rules.

So institutions face a choice. Stick with single-asset products to enable staking. Or build multi-token funds that can’t stake at all.

This limitation will likely push the market toward more single-token ETF products. Mixed-asset crypto index funds just got less attractive from a yield perspective.

Liquidity Flexibility Surprises Everyone

Now for the unexpected good news. The IRS granted more operational wiggle room than usual.

Trusts can now adjust their liquidity reserves dynamically. They can also use financing arrangements to handle redemptions. That’s unusual flexibility within the normally rigid grantor trust framework.

Why does this matter? It means institutions won’t need to unstake assets constantly to meet redemption demands. Instead, they can maintain staking positions longer while managing cash flow through other mechanisms.

Analyst Greg Xethalis called this approach beneficial for trust beneficiaries. Translation: funds can maximize staking yields without sacrificing liquidity. That could mean higher returns for investors in staking-enabled ETFs.

However, this flexibility comes with operational complexity. Fund managers need sophisticated treasury management. They must balance staking lockup periods against potential redemption waves. Get it wrong and you’re scrambling to meet withdrawals.

Slashing Liability Remains Murky

Here’s where things get messy. The guidance requires staking providers to indemnify against slashing. But it never clarifies who actually bears the liability.

Is it the staking provider? The custodian? The ETF sponsor? Nobody knows for sure.

This ambiguity creates operational headaches. Imagine a validator gets slashed and tokens disappear. Who compensates the trust? What happens if the provider disputes the claim? How fast must they make investors whole?

The guidance stays silent on these details. So institutions must negotiate these terms privately with their staking providers. That introduces inconsistency across products.

Moreover, the provider must remain independent from the trust and sponsor. But not necessarily from the custodian. This creates a weird dependency structure where custodians might bundle staking services without technically violating independence requirements.

Smart investors will dig into each ETF’s specific arrangements. Not all staking setups carry equal risk profiles. Some providers offer stronger indemnification terms than others.

Private Trusts Left Behind

Another overlooked detail: this relief excludes private trusts and those not listed on a National Securities Exchange.

Translation? Small private funds can’t benefit. The relief targets public, exchange-listed products only. Plus, the underlying networks must be permissionless. No private blockchain staking allowed.

This conservative approach makes sense from the IRS perspective. Permissionless networks offer public verification. Anyone can audit validator performance and slashing events. Private networks lack that transparency.

But it limits the scope significantly. Wealth management firms that run private crypto trusts for high-net-worth clients? They’re out of luck. Family office structures? Same deal.

The guidance clearly favors institutional, public-market products over private wealth structures. That might push more capital toward exchange-traded vehicles as the only tax-efficient way to earn staking yields.

What This Means for Your Portfolio

These nuances will shape how institutions deploy capital into staking. Here’s what matters most for regular investors.

First, expect more single-asset ETF launches. Fund sponsors will prioritize simple, single-token products that qualify for staking relief. Multi-token index funds might struggle to compete on yield.

Second, pay attention to liquidity management. ETFs with sophisticated treasury operations can maintain higher staking ratios without sacrificing redemption capabilities. That translates to better returns.

Third, scrutinize slashing protections. Each fund negotiates different indemnification terms with staking providers. Some offer rock-solid guarantees. Others include escape clauses. Read the fine print.

Fourth, recognize that private wealth structures can’t access these benefits. If you’re investing through a private trust, you won’t get staking yields in a tax-compliant way. Exchange-listed products hold the advantage.

The Real Strategy Here

The IRS crafted this guidance carefully. They opened the door to staking but kept guardrails tight. Single-asset focus prevents gaming through ratio manipulation. Public listing requirements ensure transparency. Independence rules prevent conflicts of interest.

But the operational flexibility around liquidity surprised everyone. That’s the IRS acknowledging that rigid redemption rules would kill staking viability. They bent the typical grantor trust framework specifically for this use case.

Still, the slashing ambiguity bugs me. Institutions hate uncertainty. Until the IRS clarifies liability allocation, some conservative funds might avoid staking entirely. That uncertainty could slow adoption more than expected.

Meanwhile, aggressive funds will race ahead. They’ll negotiate strong indemnification deals with top-tier staking providers. Then they’ll market higher yields to attract assets. Competitive pressure will eventually force conservative funds to follow.

Early Movers Win Big

Understanding these details matters now because the products haven’t launched yet. Early entrants who structure their operations around these nuances will capture market share.

Investors who recognize the single-asset advantage can position themselves in upcoming launches. Those who understand liquidity flexibility can evaluate which sponsors built superior operational infrastructure. And those who scrutinize slashing protections can avoid funds with weak risk management.

The guidance sounds like a win. ETF analyst Eric Balchunas called it exactly that. But the devil lives in operational details that most headlines ignored. Knowing these three overlooked elements gives you an edge as staking-enabled ETFs hit the market.