Bitcoin can’t seem to break free. After weeks of failed attempts, BTC remains trapped below $108,000 while traders churn positions at an alarming rate.

The latest on-chain data reveals why this recovery keeps stalling. Short-term holders now dominate the market, flipping positions faster than Bitcoin can build momentum. Plus, historical resistance zones are lining up to block any breakout attempt.

Let’s dig into what’s actually happening beneath the surface.

Speculators Are Running the Show

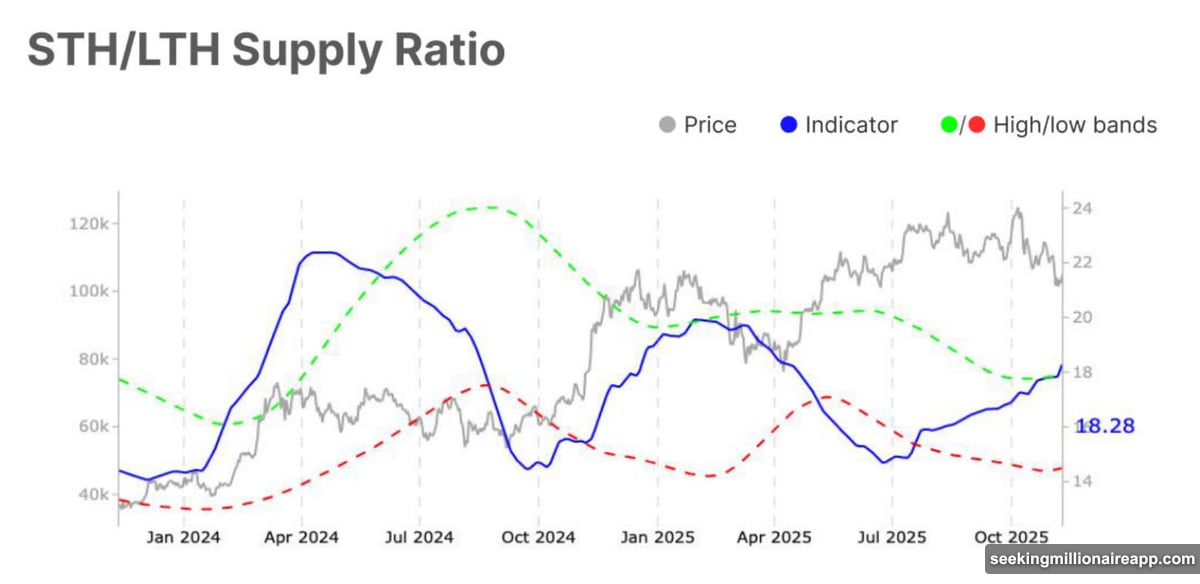

The Short-Term Holder to Long-Term Holder (STH/LTH) Supply Ratio just hit 18.3%. That’s above the typical upper threshold of 17.9%.

What does this mean? Traders are buying and selling rapidly instead of holding with conviction. This creates a market dominated by speculation rather than long-term accumulation.

In fact, this elevated ratio shows that Bitcoin’s current price action reflects short-term trading pressure more than fundamental strength. When speculators control most of the supply, volatility spikes and directional moves become harder to sustain.

Moreover, quick position flips create constant selling pressure near resistance levels. Each failed breakout attempt shakes out weak hands, forcing Bitcoin back into consolidation. That’s exactly what’s happened multiple times near $105,000 over the past two weeks.

The $108K Wall Nobody Can Break

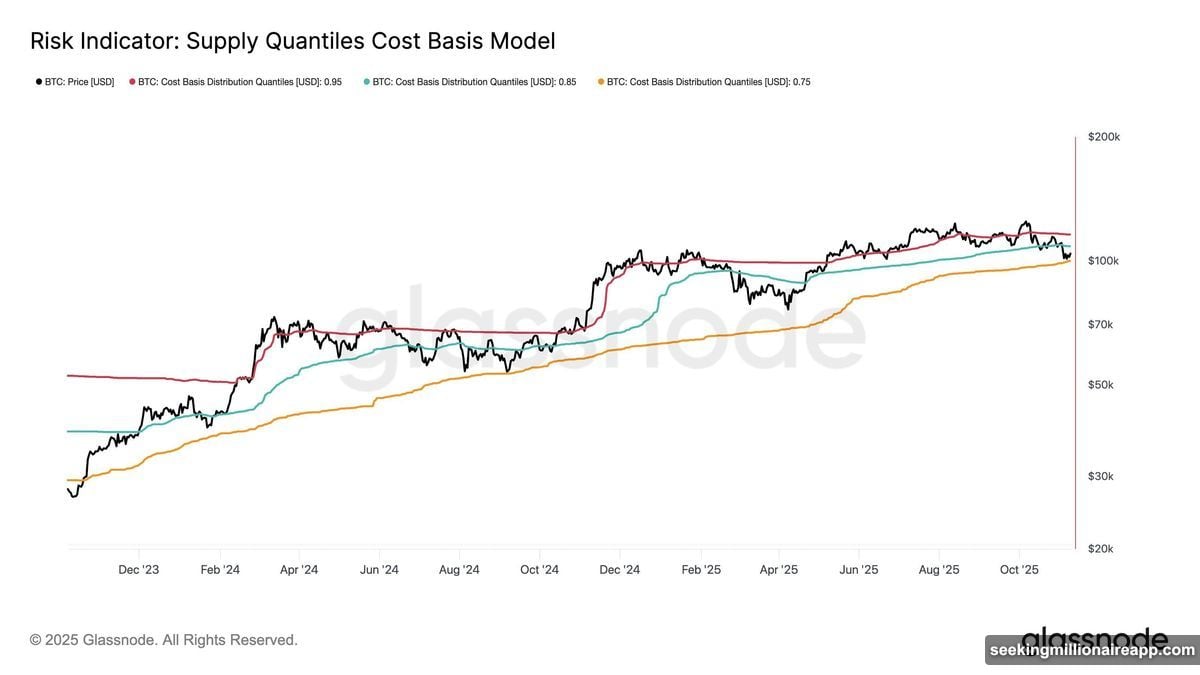

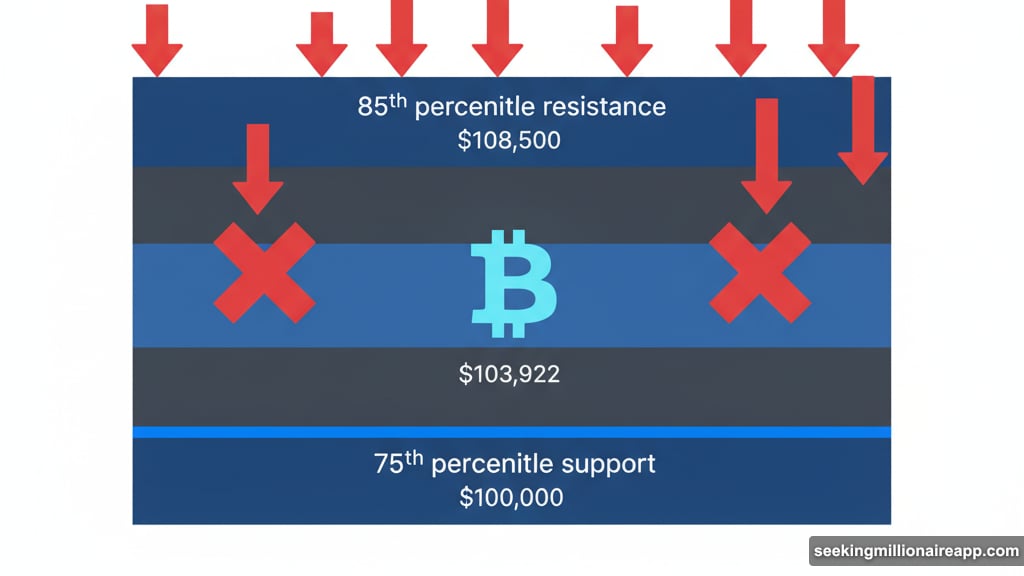

Bitcoin’s recovery keeps hitting the same ceiling. The 85th percentile cost basis sits around $108,500 according to Glassnode’s Supply Quantiles model.

This level represents the price at which 85% of Bitcoin’s circulating supply last moved. Historically, these zones act as strong resistance during recovery phases. So Bitcoin faces selling pressure from holders who bought near current prices and want to exit breakeven.

Currently, BTC trades around $103,922 after bouncing from the 75th percentile near $100,000. That zone provided temporary support as traders who accumulated lower defended their positions.

However, the space between $106,200 and $108,500 has become a battleground. Bulls can’t push through, while bears haven’t forced a breakdown. This deadlock keeps Bitcoin trapped in an uncomfortable middle ground.

Two Weeks of Rejection

Bitcoin’s price chart tells a frustrating story. The same downtrend that started in late October continues to cap every rally attempt.

BTC has tested the $105,000 resistance twice in the past two and a half weeks. Both times, sellers emerged quickly to push prices back down. That pattern confirms bearish sentiment still controls short-term price action.

Right now, Bitcoin holds above $101,477 support. This level marks a critical floor that’s contained recent weakness. But holding support doesn’t equal strength when you can’t break resistance.

The current range between $101,477 and $105,000 has become Bitcoin’s prison. Volatility remains high as the price whipsaws within this zone, but neither bulls nor bears can establish clear control.

What Happens Next

Two scenarios stand out. First, if bulls finally push Bitcoin above $105,000 with conviction, the path opens toward $108,000. Breaking that level would mark Bitcoin’s first significant recovery since October ended.

That outcome would require short-term holders to shift from flipping to holding. Without reduced market churn, rallies will continue to stall as traders take quick profits.

Second, failure to break $105,000 likely means extended consolidation. Bitcoin could chop between $101,477 and $105,000 for weeks until something forces a decisive move. Given current on-chain conditions, this seems like the higher probability outcome.

The STH/LTH ratio needs to drop before sustainable rallies can develop. Until long-term holders start accumulating aggressively, Bitcoin lacks the foundation for a breakout that sticks.

The Real Problem

Bitcoin’s current struggle isn’t about one resistance level. The deeper issue is market structure. When speculators dominate and long-term conviction disappears, every rally becomes a selling opportunity instead of the start of a trend.

That’s why Bitcoin keeps hitting the same ceiling around $108,000. It’s not just a technical barrier. It represents the price at which too many holders want out, and not enough buyers want in.

Until that changes, expect more of what we’ve seen. Choppy price action, failed breakouts, and frustrating consolidation that goes nowhere fast.

The only question is which breaks first: resistance or support.