The crypto faithful treated Bitcoin halvings like clockwork for over a decade. Cut the mining reward in half, wait 12-18 months, then watch prices explode. Simple, right?

Not anymore. This cycle broke the pattern. Plus, the data suggests something deeper changed in how crypto markets actually work.

Stablecoins Are Bleeding Out

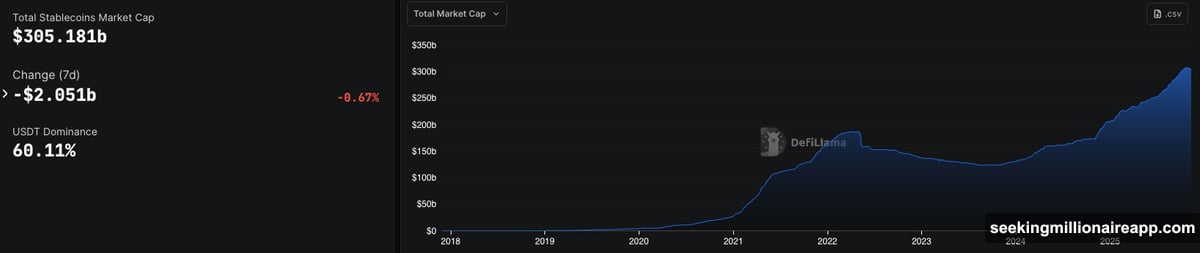

Global stablecoin supply just dropped for the first time in two years. DefiLlama shows the total market cap fell from $309 billion to $305 billion in November 2025.

That’s a big deal. Stablecoins represent the “dry powder” sitting on exchanges, ready to buy crypto. When that supply shrinks, it means money is leaving the system.

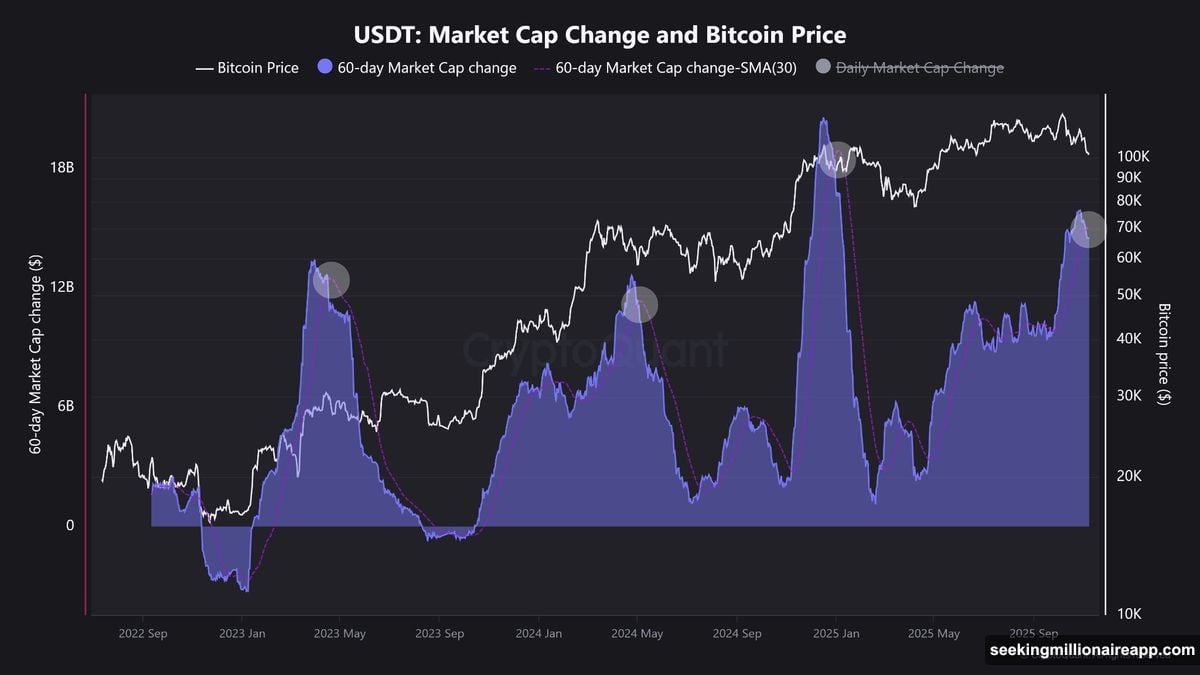

CryptoQuant data confirms the trend. USDT supply started slipping, which historically signals trouble ahead for Bitcoin prices. Meanwhile, USDT circulation has flatlined around $183 billion for three weeks straight. No new issuance. No fresh capital flooding in.

Remember mid-2025? Stablecoin issuers were minting billions monthly. That aggressive expansion fueled the rally. Now? Crickets.

ETF Momentum Hit a Wall

Even the institutional darling of 2024—spot Bitcoin ETFs—is showing fatigue. Wintermute reports that ETF inflows and Digital Asset Trusts both slowed dramatically.

This matters because ETFs represented Wall Street’s embrace of crypto. Strong inflows meant serious money entering the market. But that flow turned into a trickle.

Some traders now argue crypto is “self-funding” rather than attracting genuine new capital. Translation: existing holders are just trading among themselves. No fresh blood means no fuel for sustained rallies.

So three major liquidity sources—stablecoins, ETFs, and institutional trusts—all point to the same conclusion. The easy money phase just ended.

The Halving Narrative Crumbled Under Scrutiny

For years, crypto analysts preached the Halving Gospel. Every four years, Bitcoin’s mining reward gets cut in half. Supply shock triggers demand surge. Prices moon. Rinse and repeat.

But 2025 didn’t follow that script. Many analysts now believe the traditional Liquidity Bitcoin Halving model is dead. Instead, they argue global liquidity from the Federal Reserve and ETF flows drive price action, potentially extending this cycle into 2026.

Sounds plausible. Except the data doesn’t support it.

Adez Research dug into Bitcoin’s historical performance since 2013. They compared price movements against the Fed’s balance sheet changes—periods of quantitative easing and tightening. Result? No consistent correlation.

Bitcoin rallied during both liquidity expansion and contraction. It also crashed during both conditions. The supposed connection between Fed policy and Bitcoin prices is empirically weak.

Large Market Makers May Be Playing You

Adez Research suspects something shadier is happening. They believe large market makers are deliberately pushing the “liquidity extension” narrative while quietly distributing their holdings.

“When institutional players coordinate narratives while the data shows otherwise, that’s your signal,” Adez warned on social media.

Their cycle analysis suggests the current rally already peaked. Historical patterns point to a 50-70% correction being more likely than another 50-100% surge from here.

Why? All the major catalysts already fired. Spot ETF approvals happened. Bitcoin hit new all-time highs before the halving—historically unusual. The playbook got flipped.

Unless massive new liquidity appears out of nowhere, this rally may be entering its final distribution phase. That’s when smart money exits while retail investors buy the “dip” that keeps dipping.

What Actually Drives Markets Now

If halvings lost their magic and Fed liquidity doesn’t correlate either, what’s left?

Real macroeconomic fundamentals. Lower interest rates. Expanded global liquidity. Institutional capital returning to risk assets because the risk-free rate dropped enough to make speculative bets attractive again.

Those shifts take time. They require economic conditions to deteriorate enough that central banks reverse course on tight monetary policy. Not exactly a quick catalyst.

Plus, those drivers apply to all risk assets—not just crypto. Bitcoin would rise alongside stocks, gold, and other speculative investments. Nothing special about crypto in that scenario.

That’s a far cry from the old halving narrative, where Bitcoin had its own independent four-year cycle regardless of broader markets.

The Market Sits in Limbo

Right now, crypto exists in a weird calm period. ETF inflows slowed. Stablecoin supply contracted. The halving narrative faded. Yet prices haven’t completely collapsed either.

This might be healthy reaccumulation. Markets need breathing room between major rallies. The frothy speculation got wrung out. Weak hands sold. Now the market searches for a new equilibrium.

Short term? Tightening liquidity will probably pressure Bitcoin and altcoins lower. The math is simple. Less money entering the system means less fuel for price appreciation.

Long term? This reset could lay groundwork for a more sustainable bull market. One built on actual liquidity inflows and fundamental value rather than meme-driven “halving pumps” that always end in crashes.

My Take: The Old Playbook Died

I’ve watched crypto long enough to see multiple cycles play out. Each one felt different at the time but followed similar patterns. Until now.

This cycle genuinely broke the mold. The halving happened and markets shrugged. ETFs arrived and produced a modest bump, not a revolution. Stablecoin growth stalled despite zero regulatory crackdown.

Something structural changed. Maybe crypto got too big for simple supply-shock narratives to move markets. Maybe institutional involvement complicated the dynamics. Maybe everyone front-ran the halving pump, making it a self-defeating prophecy.

Whatever the cause, the old four-year cycle is dead. Crypto now trades more like a leveraged tech stock than a unique asset with its own magical rhythms.

That’s not necessarily bad. It just means you can’t rely on historical patterns to predict the next move. The market matured. Act accordingly.