The crypto market just lost $106 billion in 24 hours. Bitcoin fell to $103,000, dragging altcoins down with it.

This wasn’t a flash crash. It’s part of a broader pullback that’s testing investor nerves across the space. Plus, the market’s now back to levels we saw during earlier consolidation periods, raising questions about what comes next.

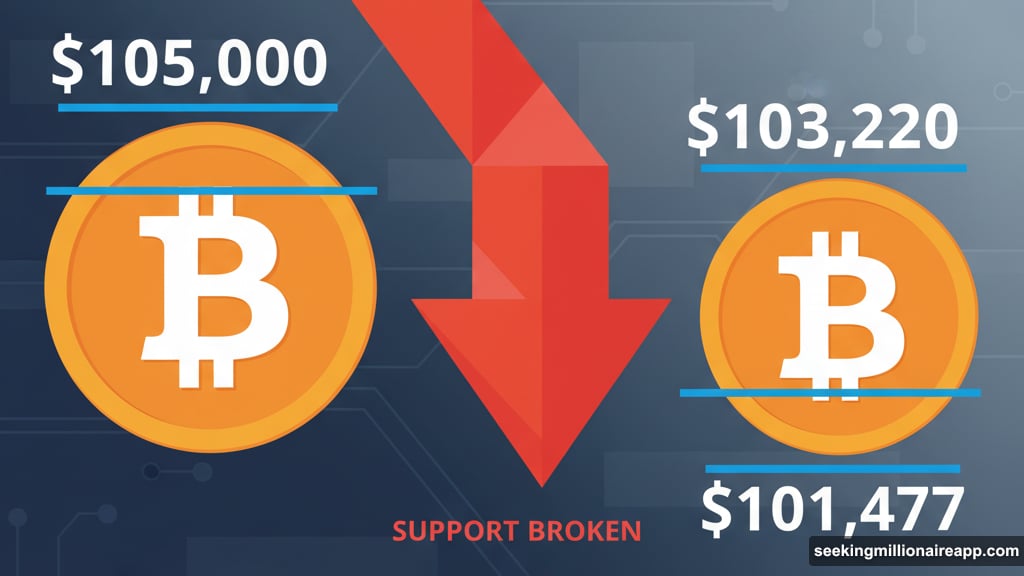

Bitcoin Can’t Hold $105K Support

Bitcoin dropped to $103,220 after failing to defend the $105,000 level. That price point acted as resistance before, and now it’s proving tough to reclaim as support.

The breakdown matters because it signals weakening momentum. Traders who bought expecting $105,000 to hold are now underwater. Meanwhile, the next major support sits at $101,477—a level that previously served as a consolidation base during earlier trading sessions.

If Bitcoin slides to $101,477, we could see another round of stop-losses trigger. That would amplify selling pressure and potentially push prices even lower in the near term.

However, a recovery above $105,000 changes everything. Breaking back above that threshold would invalidate the current bearish setup. In fact, it could spark a move toward $108,000 if buying pressure returns and sentiment improves.

Total Crypto Market Cap Retreats to $3.42 Trillion

The entire crypto market fell from $3.56 trillion to $3.42 trillion in one day. That’s a significant drop that reflects broader weakness in risk assets.

What happened? The market tried to breach $3.56 trillion resistance but failed. Now it’s back in a familiar range around $3.42 trillion—a zone where prices consolidated before the recent rally attempt.

This level matters because it’s been both support and resistance in recent weeks. If bearish momentum continues, the market could test $3.31 trillion next. That would mark a deeper correction and potentially shake out more leveraged positions.

Yet the picture isn’t entirely bleak. Improving macroeconomic conditions could reverse the slide. If investor sentiment shifts and capital flows back into crypto, the market cap might reclaim $3.49 trillion quickly. From there, another attempt at the $3.56 trillion resistance becomes possible.

Altcoins Follow Bitcoin Lower

Bitcoin’s weakness pulled down the broader altcoin market. Internet Computer (ICP) dropped 10.8% to $6.10, one of the sharper declines in the top 100.

ICP is holding above $5.94 support for now. But if selling pressure increases, the altcoin could slide to $4.67 in coming days. That would represent a significant correction from recent highs and confirm extended downside pressure.

Other altcoins showed similar patterns. When Bitcoin falls, altcoins typically amplify the move in both directions. So recovery depends heavily on whether BTC can stabilize and reverse course.

For ICP specifically, a bounce from $5.94 would be the first positive signal. A move back above $7.61 would invalidate the bearish setup entirely and suggest buyers are stepping back in.

What’s Driving the Weakness

Several factors converged to trigger this pullback. Weakening investor sentiment in traditional financial markets spilled over into crypto. Plus, recent news about regulatory actions and exchange freezes added uncertainty.

Argentina’s investigation into the LIBRA token project and its ties to President Javier Milei created headlines. Separately, China accused the US of seizing 127,000 Bitcoin worth $13 billion from a 2020 mining pool hack—a claim the Justice Department denied.

These stories create noise that makes investors nervous. When uncertainty rises, risk assets typically suffer. Crypto, being one of the more volatile asset classes, tends to see exaggerated moves during these periods.

Moreover, technical factors play a role. Bitcoin’s failure to hold $105,000 triggered algorithmic selling and stop-loss orders. That created a cascade effect, pushing prices lower and amplifying the initial decline.

What Comes Next

The key question: Will $101,477 hold for Bitcoin?

If yes, we might see another consolidation phase before the next directional move. Consolidation isn’t exciting, but it allows the market to reset and prepare for the next leg up or down.

If no, Bitcoin could test lower support levels around $98,000 or even $95,000. That would mark a more significant correction and likely trigger another wave of fear across the market.

For altcoins, the outlook depends entirely on Bitcoin’s path. If BTC stabilizes and recovers, altcoins will likely follow with outsized gains. But if Bitcoin continues falling, altcoins will amplify the downside.

Traders should watch $105,000 closely. Reclaiming that level as support would be the first sign that buyers are regaining control. Until then, caution makes sense, especially for leveraged positions or new entries at current prices.

The market isn’t broken. It’s correcting. The question is whether this correction is over or just beginning.

Post Title: Crypto Market Down $106B: Why Bitcoin Fell Below $105K

Meta Description: The crypto market just lost $106 billion in 24 hours. Bitcoin fell to $103,000, dragging altcoins down with it. This wasn’t a flash crash. It’s part of a broader pullback that’s