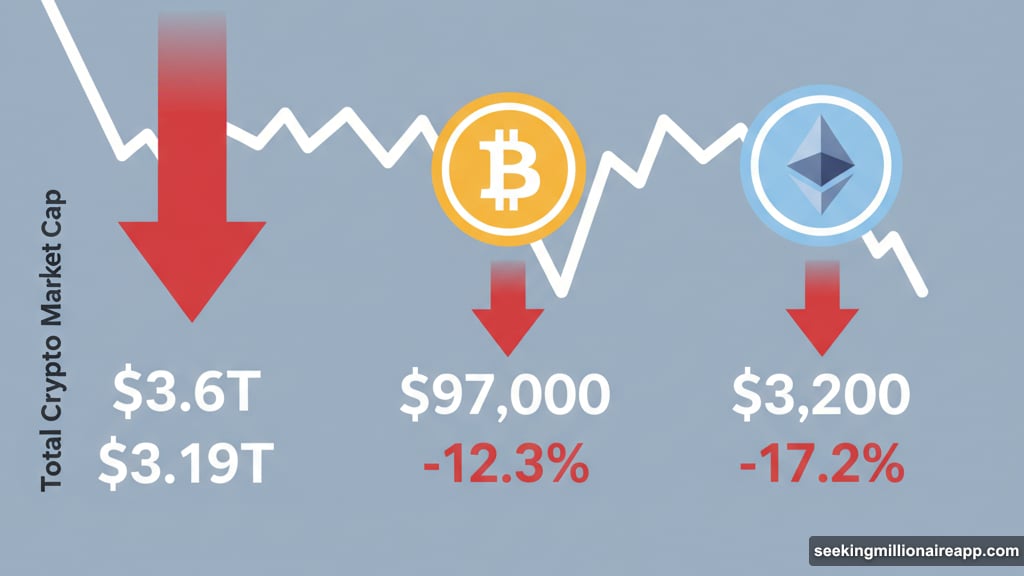

Crypto markets are bleeding. Bitcoin dropped under $97,000 this week. Ethereum fell 17% in November alone. Total market cap hit four-month lows.

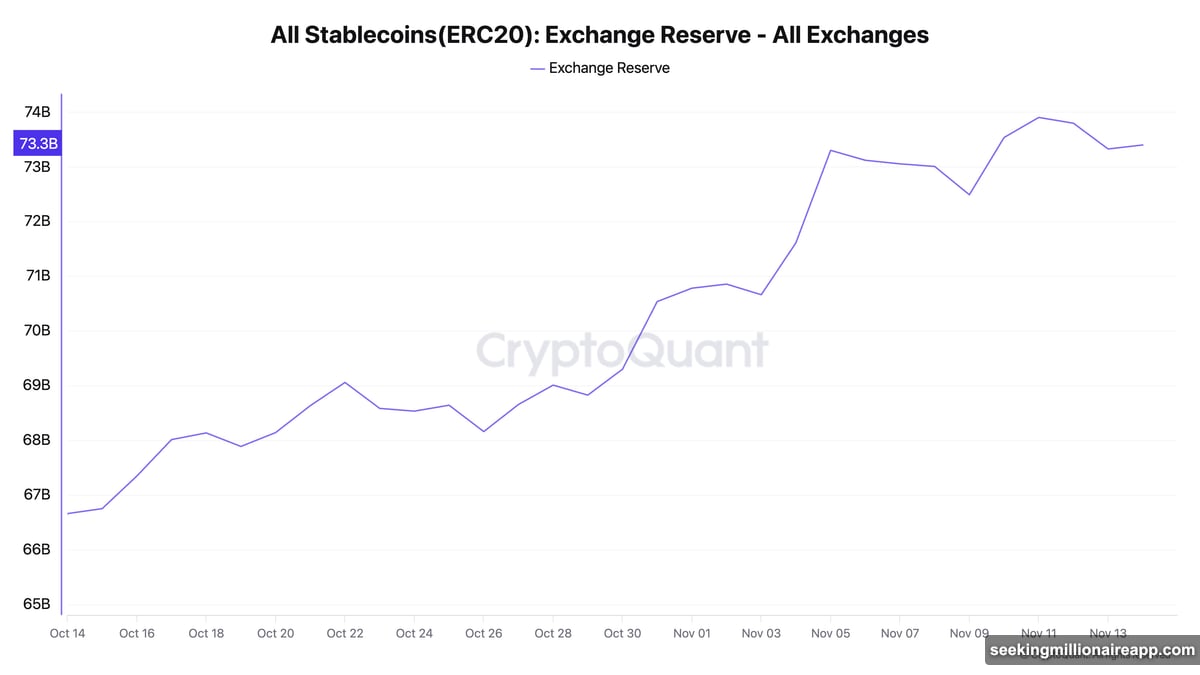

But one metric is surging: stablecoin reserves on exchanges just jumped $2.6 billion this month. That’s not panic selling. It’s strategic positioning. And it might signal the next big move is closer than most traders think.

Markets Crater to Summer Levels

November crushed the optimistic Q4 predictions. Total crypto market cap fell from $3.6 trillion to $3.19 trillion in just two weeks. That’s a 12.3% drop to levels last seen in early July.

Bitcoin broke below the psychologically crucial $100,000 mark multiple times throughout the month. On November 14, it briefly dipped under $97,000 for the first time since May 8. At press time, BTC traded around $97,426.

Ethereum suffered even more. The second-largest cryptocurrency shed 17.2% of its value this month. It was hovering near $3,200 during Asian trading hours, extending a brutal downtrend that started in late October.

So traders are clearly moving to safer ground. But they’re not leaving crypto entirely. Instead, they’re parking capital in stablecoins and keeping it on exchanges. That detail matters more than most people realize.

$2.6 Billion in Fresh Stablecoin Reserves

CryptoQuant data shows stablecoin exchange reserves increased by approximately $2.63 billion since November began. That’s a massive influx of sideline capital building up during a sharp market correction.

Plus, this isn’t just defensive rotation. The pattern of stablecoin withdrawals tells a more interesting story.

CryptoQuant analyst Maartunn pointed out that when Bitcoin approached $125,000 earlier, stablecoin withdrawals spiked above 72,000. Traders were pulling funds off exchanges, either to secure profits or exit positions entirely.

Now? Withdrawal activity is slowing down significantly. That means holders are intentionally keeping stablecoins on exchanges rather than moving them to cold storage or off-platform wallets.

This behavior suggests conviction, not capitulation. Investors aren’t running from crypto. They’re waiting for the right entry point.

Dry Powder Builds Before Major Moves

Large stablecoin reserves sitting on exchanges are widely considered a bullish precursor. This “dry powder” creates significant potential for rapid buying once market sentiment shifts.

Analyst Milk Road described the current setup as “one of the clearest signals that fresh capital is gearing up to deploy.” They noted that the last time inflows spiked at similar levels, it marked the beginning of a major risk-on move across the entire market.

But timing matters. Just because capital is available doesn’t mean it will flow immediately.

Swissblock added important context. Despite the liquidity buildup, investors aren’t rushing back into Bitcoin yet. They’re watching two key scenarios.

First, a capitulation move that pushes BTC down toward $95,000 could create an attractive entry point for buyers hunting a bottom. Second, Bitcoin stabilizing and reclaiming the $100,000 level would signal strength and reduce perceived risk.

Either trigger could unleash the sidelined capital currently sitting in stablecoins. Until then, most traders seem content to wait.

Bitcoin Tries to Hold Critical Support

Bitcoin is currently testing the $97,000 to $98,500 support zone. This range has acted as a battleground throughout November, with bulls and bears fighting for control.

Technical analysts are watching closely. A clean break below $97,000 with sustained selling pressure could accelerate the decline toward $95,000. But holding this level and building a base here might set up a bounce back toward $100,000.

Meanwhile, Ethereum’s chart looks even more precarious. Down 17.2% this month, ETH is struggling to maintain $3,200. If Bitcoin weakens further, altcoins like Ethereum typically suffer amplified losses.

Yet the stablecoin data suggests many traders are prepared for either scenario. Capital is positioned to buy dips or chase strength, depending on which way the market breaks.

What Happens When Sentiment Flips

Markets don’t stay oversold forever. And when confidence returns, the $2.6 billion in fresh stablecoin reserves could quickly become rocket fuel.

Here’s how it typically plays out. Bitcoin finds a floor, either through capitulation or gradual accumulation. Buyers start testing resistance levels. Once a key psychological level breaks with volume, FOMO kicks in.

That’s when sidelined capital floods back into the market. Stablecoins convert to BTC and ETH. Altcoins follow Bitcoin’s lead. Suddenly, the same traders who were defensive at $97,000 are aggressively buying at $105,000.

This pattern has repeated multiple times in crypto’s history. The current setup looks similar to previous accumulation phases before major rallies.

However, there’s no guarantee this time follows the same script. Macro conditions, regulatory developments, and broader market sentiment all influence when and how capital deploys.

Not Panic, Just Patience

The combination of falling prices and rising stablecoin reserves paints a clear picture. Investors aren’t abandoning crypto. They’re repositioning strategically.

Think of it like athletes stretching before a race. The lack of movement isn’t weakness. It’s preparation.

Most experienced traders understand that the best entries happen during fear, not euphoria. Right now, fear is abundant. Bitcoin broke key support levels. Ethereum extended losses. Market sentiment is cautious at best.

But the money hasn’t left. It’s just waiting on the sidelines, watching for the right signal to re-enter.

Whether that signal comes from a capitulation drop to $95,000 or a confident reclaim of $100,000 remains to be seen. Either way, the stage is set for significant volatility once the market picks a direction.

The next few weeks will be critical. Bitcoin needs to hold current support or risk further declines. Stablecoin holders need clear technical confirmation before deploying capital. And the broader market needs to regain confidence after a brutal November.

But if history is any guide, periods of maximum pain often precede the biggest opportunities. The question isn’t whether capital will flow back into crypto. It’s when and at what price.

Smart money is already positioned. Now it’s just a matter of waiting for the market to make its move.