The crypto market just shed $92 billion in a brutal 24-hour selloff. Bitcoin fell below $100,000 for the first time since June. And the panic hasn’t stopped yet.

Total market cap now sits at $3.29 trillion, teetering dangerously close to critical support at $3.26 trillion. Plus, bearish momentum is building across every major chart. Investor confidence is evaporating fast.

So what’s driving this sudden collapse? Let’s dig into the technicals and see what happens next.

Bitcoin Breaks Down Below Six-Figure Support

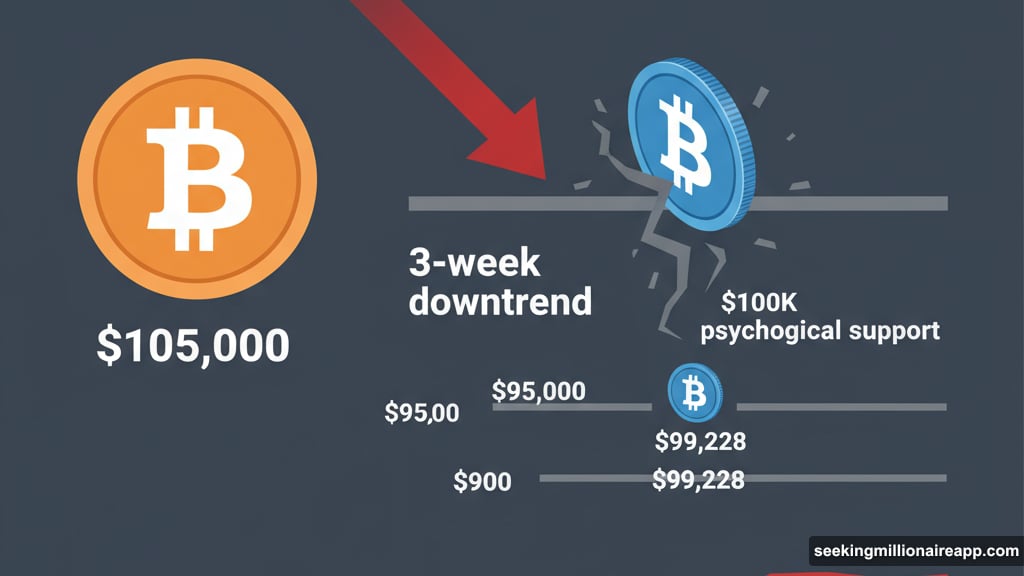

Bitcoin trades at $99,228 after smashing through the psychological $100K level. That’s a three-week downtrend with no signs of reversing.

The Relative Strength Index confirms growing bearish momentum. Buyers stepped away completely. And weaker demand continues to pressure short-term stability across all timeframes.

Here’s the scary part. If selling intensifies, BTC could slip under $95,000 within days. Then $90,000 becomes the next target. That kind of move would trigger widespread panic and force leveraged positions to liquidate across major exchanges.

But there’s a slim hope for bulls. If Bitcoin can defend current levels and reclaim $100,000, it might push toward $105,000. That scenario requires immediate buying pressure and improving sentiment. Right now, neither exists.

Market Cap Hovers Near Make-or-Break Support Zone

The total crypto market cap dropped from $3.38 trillion to $3.29 trillion in just one day. That’s roughly 3% vanished overnight.

Moreover, the $3.31 trillion support level just broke. Now all eyes focus on $3.26 trillion. Defending that zone becomes absolutely critical for preventing deeper losses across the entire crypto space.

Technical indicators paint a grim picture. If $3.26 trillion fails to hold, the next stop is $3.21 trillion. That would extend downside pressure and likely drag most altcoins lower regardless of individual fundamentals.

However, a bounce off $3.26 trillion could restore some confidence. A move back toward $3.31 trillion would open the path to $3.42 trillion. But that requires capital inflows and positive sentiment shifts that aren’t showing up yet.

Altcoins Show Mixed Signals Amid Broad Weakness

Interestingly, several altcoins held gains despite Bitcoin’s collapse. That’s unusual behavior during major market downturns.

Take MYX Finance as an example. It trades at $2.28 after an 11% daily drop. Still, it remains above the key $2.24 support level. The Parabolic SAR signals an emerging uptrend too.

So buyers continue defending certain altcoin positions even as Bitcoin bleeds. This creates a strange dynamic where some assets resist broader downside pressures. But it won’t last long if Bitcoin keeps falling.

If MYX holds $2.24, it could bounce toward $2.64. That would support ongoing consolidation and potentially attract more buyers. But a break below $2.24 opens the door to panic selling and deeper pullbacks.

What Triggered This Sudden Market Collapse?

No single catalyst explains the $92 billion wipeout. Instead, multiple factors converged at once.

First, investor outflows intensified across major assets. Capital simply left the crypto market for safer havens. Second, liquidity conditions deteriorated as trading volumes spiked during the selloff.

Third, leveraged positions started liquidating. When Bitcoin broke $100,000, stop losses triggered and forced more selling. That created a cascading effect that amplified downward momentum.

Meanwhile, external news added to the bearish sentiment. Though the articles mention Pavel Durov’s legal situation and Australian crypto scams, neither directly caused the market crash. But they certainly didn’t help investor confidence.

Three Scenarios That Could Play Out Next

The market faces three possible paths from here.

Scenario One: Full Breakdown. If $3.26 trillion support fails, we’re looking at $3.21 trillion next. Bitcoin could test $90,000. Most altcoins would follow Bitcoin lower. This scenario creates maximum pain for late buyers and forces widespread capitulation.

Scenario Two: Relief Bounce. Markets defend $3.26 trillion and stage a recovery. Bitcoin reclaims $100,000. Total market cap pushes back toward $3.42 trillion. This requires immediate buying pressure and improving sentiment across all sectors.

Scenario Three: Prolonged Chop. The market bounces between $3.26 trillion and $3.31 trillion for weeks. Bitcoin trades sideways near $99,000. Altcoins show mixed performance. This frustrates both bulls and bears while draining capital through constant volatility.

Right now, Scenario One looks most likely. The technicals favor continued downside. And sentiment remains deeply bearish across crypto Twitter and major trading desks.

Why Support Levels Matter More Than Ever

Technical support zones become critical during market crashes. They represent areas where buying interest historically stepped in.

The $3.26 trillion level for total market cap isn’t arbitrary. It’s where previous rallies found support multiple times. Similarly, Bitcoin’s $95,000 zone has historical significance from earlier consolidation periods.

If these levels break, the next support sits much lower. That’s why traders watch them obsessively. A clean break through support typically triggers accelerated selling as stop losses execute and panic spreads.

But support levels can also create powerful bounces. When prices reach oversold conditions at key support, bargain hunters often step in. That dynamic creates sharp reversals that catch short sellers off guard.

The Bigger Picture Nobody’s Discussing

This selloff reveals uncomfortable truths about crypto market structure. Despite claims of maturation and institutional adoption, the market still moves on sentiment and leverage more than fundamentals.

When fear dominates, prices collapse regardless of network fundamentals or adoption metrics. Bitcoin’s hash rate remains strong. Ethereum processes transactions normally. Yet prices fall because leveraged traders liquidate and retail investors panic.

Moreover, the concentration of holdings means relatively small sell pressure from whales can trigger outsized moves. That creates an inherently unstable market prone to violent swings in both directions.

So while this crash looks severe, it’s actually just business as usual in crypto. The volatility that enables massive gains also produces brutal drawdowns. Anyone surprised by this selloff hasn’t been paying attention.

The next few days determine whether this becomes a temporary shakeout or the start of a deeper correction. Watch those support levels closely. They’ll tell you everything you need to know about where we go from here.