The crypto market just dropped 20% in November. Most traders panicked and sold. But the biggest wallets? They’re buying.

Whale activity reveals where smart money positions before trends reverse. While retail investors watch prices fall, institutional-sized wallets have quietly accumulated three specific tokens over the past 30 days. These aren’t meme coins or hype plays. They’re established projects with real fundamentals and technical setups that suggest accumulation, not distribution.

Let’s break down what whales are buying and why these patterns matter.

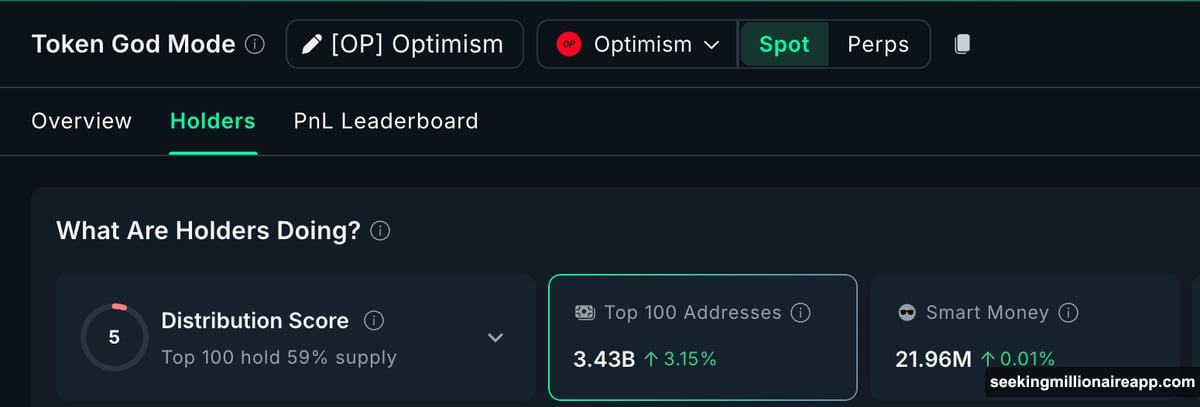

Optimism Whales Add $54 Million Despite 13% Drop

Optimism (OP) fell 13.3% this month. Yet the top 100 addresses increased their holdings by 3.15% over the past 30 days.

That’s roughly $54 million in fresh capital flowing into OP while everyone else was selling. These mega-whales clearly see value that the broader market is missing.

Why Optimism? It’s one of the largest Layer-2 scaling solutions for Ethereum. Plus, the project has proven staying power and consistent development activity. So while market sentiment turns bearish, whales are positioning for a longer-term thesis.

The chart backs up their conviction. On the two-day timeframe, OP’s price made a lower low between April and November. But the RSI made a higher low during the same period. That’s a bullish RSI divergence—a classic signal that downward momentum is fading.

These divergences often appear right before major trend reversals. And whales seem to be betting on exactly that.

For the reversal to confirm, OP needs to break above $0.47. That level has rejected every rally since mid-October. A clean break there opens the door to $0.61, with $0.85 in play if momentum builds.

On the downside, $0.38 acts as critical support. Losing that level puts $0.31 back in focus. And a breakdown below $0.31 would invalidate the entire bullish setup, potentially sending OP toward $0.23.

Aster Whales Increase Holdings by 140% in 30 Days

Now this one’s aggressive. Whale accumulation in Aster (ASTER) exploded by 140% over the past month.

Their total holdings now sit at 67.03 million ASTER, worth approximately $75.7 million at current prices. That means nearly $44 million in fresh buying happened during this market drawdown.

Smart money wallets moved even faster. Their holdings jumped 678% in the same timeframe. When both whales and smart money pile into the same token simultaneously, something’s brewing.

The chart shows why they’re buying now. ASTER just broke out of a falling channel on the 12-hour timeframe. That signals the bearish trend is losing steam. Plus, there’s a textbook bullish RSI divergence forming between October 17 and November 14.

During that period, ASTER’s price made a lower low while the RSI made a higher low. Momentum is shifting before price catches up—exactly what whales look for when positioning early.

Short-term action already reflects this shift. ASTER is up nearly 9% in the past 24 hours. But this looks more like the start of a reversal than a simple dead-cat bounce.

The next major resistance sits at $1.29. That level blocked the rally on November 2. So a clean break above it would confirm stronger upside potential, with $1.59 as the next target.

Support sits at $1.11 first. Losing that level opens the path to $1.00. And if that fails, the deeper support at $0.81 comes into play. But given the aggressive whale accumulation, those lower levels may never get tested.

Maple Finance Accumulation Across All Major Holder Groups

Maple Finance (SYRUP) shows the most coordinated accumulation pattern of the three.

The top 100 mega-whale addresses increased their holdings by 3.47% over 30 days, bringing their total stash to 1.11 billion SYRUP. At current prices, that’s worth approximately $499.5 million.

But here’s what makes this interesting. Smart money wallets added 1.86%, and regular whales increased holdings by 4.57%. When every major holder category moves in the same direction, it’s not random. That’s conviction.

Maple Finance operates in DeFi lending with a focus on institutional credit. It’s not flashy. But it’s fundamentally sound, which explains why multiple wallet types are positioning here.

The chart reveals why timing matters now. SYRUP is forming an inverse head and shoulders pattern—a classic reversal setup. The neckline sits near $0.53. A breakout above that level would validate the pattern, with a target extending toward $0.65 or higher.

There’s also an On-Balance Volume (OBV) signal to watch. OBV tracks buying and selling pressure. Right now, buying is showing up on OBV, but the indicator still sits below a falling trendline that started around October 14.

For a stronger reversal confirmation, whales likely want to see two things happen together: a break above the neckline at $0.53 and OBV breaking its trendline simultaneously. When price and volume break together, rallies tend to hold better and last longer.

The setup shows conviction right now, not confirmation yet. But if buyers fail and the price slips, the invalidation level sits at $0.38. A drop below that would weaken the entire pattern and could push SYRUP toward $0.28.

What Whale Accumulation Actually Means

Whale buying doesn’t guarantee prices will rise immediately. But it reveals where the biggest capital allocators see value before the broader market catches on.

These wallets have resources to analyze fundamentals, monitor on-chain data, and position early. So when multiple whale cohorts accumulate the same tokens during market weakness, it’s worth paying attention.

All three tokens—Optimism, Aster, and Maple Finance—share common traits. They’re established projects with real use cases. They’re not riding hype cycles. And they’re all showing technical setups that suggest downside exhaustion rather than continuation.

The crypto market might be entering a bear phase. Or this could just be a deep correction before the next leg up. Either way, whales are betting these three tokens will outperform when sentiment eventually shifts.

Watch the key levels. If these breakouts confirm, the smart money will already be positioned. If they fail, whales will likely have exit plans ready. But right now, the message is clear: accumulation, not distribution.