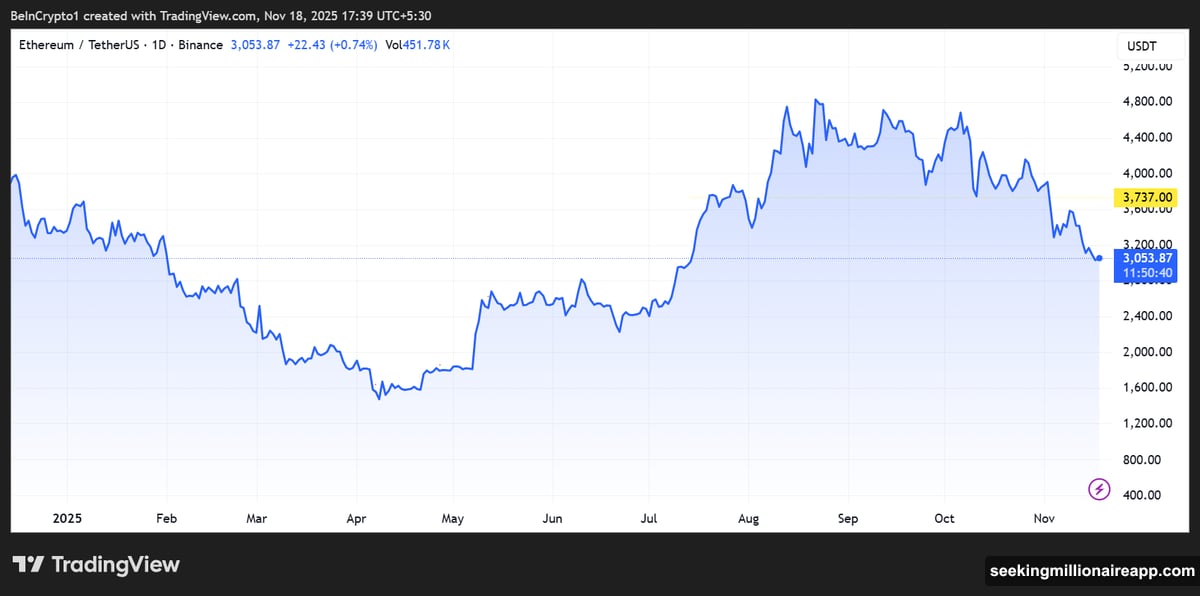

Ethereum just endured one of its sharpest selloffs this year. Most traders blame the Federal Reserve. Tom Lee says they’re wrong.

The real culprit? Crypto’s own internal plumbing may have sprung a massive leak. According to the Fundstrat veteran, market-makers vanished after October’s liquidation bloodbath. That created a liquidity crunch far more damaging than anything the Fed could throw at markets.

So while everyone watches interest rates, a quiet crisis is playing out inside crypto infrastructure itself. Let’s break down what actually happened and why it matters for Ethereum’s future.

The Biggest Liquidation Event in Crypto History

October 10 changed everything. That day unleashed the largest liquidation cascade crypto has ever seen.

Lee described the scale as unprecedented. Positions worth billions got wiped out in hours. But the immediate price drop was only part of the damage.

The real problem emerged afterward. Some market-makers who normally provide liquidity simply disappeared. They got caught in the liquidation wave and couldn’t recover fast enough to resume normal operations.

Think of market-makers as crypto’s shock absorbers. They smooth out price movements by constantly buying and selling. When they vanish, even small trades cause wild swings.

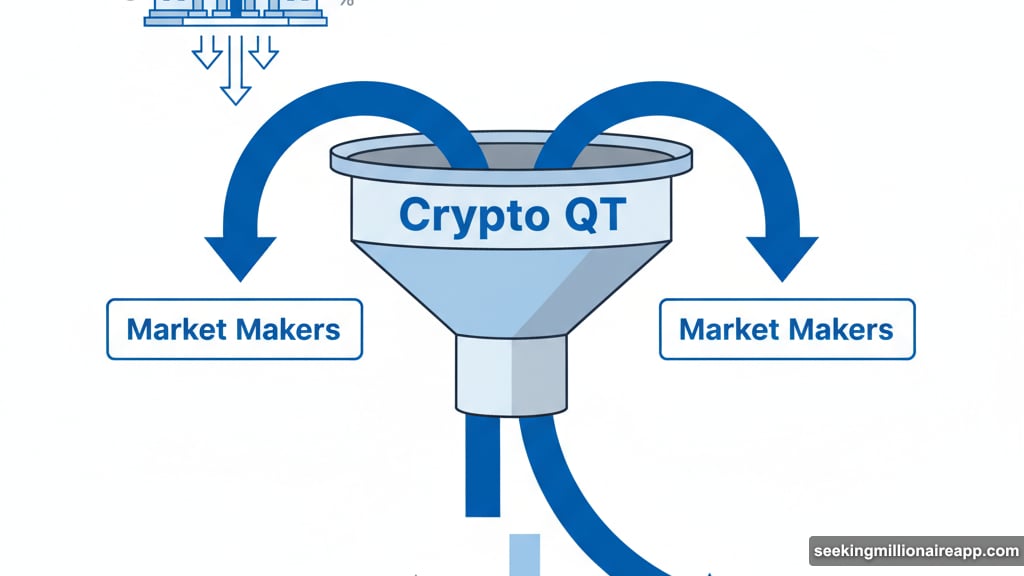

Crypto’s Version of Quantitative Tightening

Lee coined a new term for what happened next: “Crypto QT.”

Traditional quantitative tightening happens when central banks pull money out of financial systems. Crypto QT works similarly, except liquidity drains because market-makers retreat instead.

“It’s almost like Crypto QT,” Lee explained in his latest interview. “It does have the signs that maybe a market maker or two actually is unable to provide market liquidity.”

Here’s why that matters more than Fed policy. When the Fed raises rates, crypto feels pressure but maintains functioning markets. When internal liquidity providers vanish, the entire trading infrastructure gets stressed.

Plus, this type of crisis takes weeks to resolve. New market-makers need time to step in. Existing players must rebuild their positions. Meanwhile, price discovery breaks down and volatility spikes.

For Ethereum specifically, the impact has been brutal. ETH dropped harder than most major tokens because it relies heavily on active market-making to handle its complex DeFi ecosystem.

Fed Fears Keep Traders Nervous

The macro picture hasn’t helped either. Crypto investors remain hypersensitive to interest rate signals.

“If you end up with a hawkish Fed, it gets crypto investors very nervous,” Lee noted. That fear compounds the liquidity problem.

Recent data suggests December rate cut odds have collapsed. The market initially priced in multiple cuts through year-end. Now traders doubt the Fed will move at all.

However, Lee argues the Fed narrative distracts from the bigger issue. Yes, hawkish policy hurts risk assets. But Ethereum’s pain stems primarily from the structural liquidity gap, not monetary policy.

The distinction matters for timing recovery. Fed policy evolves slowly over months. Internal crypto liquidity can snap back in weeks once market-makers stabilize.

Ethereum’s Supercycle Thesis Remains Intact

Despite near-term stress, Lee sees Ethereum entering a massive growth phase. He points to four expanding categories that depend on Ethereum’s infrastructure.

Stablecoins continue surging. Circle’s USDC and Tether’s USDT process billions in daily volume. Most of that activity happens on Ethereum or its Layer 2 networks.

Real-world asset tokenization is accelerating. Major financial institutions now explore tokenizing equities, bonds, and real estate. Ethereum’s smart contract platform dominates this space.

Prediction markets exploded after Polymarket’s success during the 2024 election cycle. These platforms need programmable money and transparent settlement. Ethereum provides both.

Digital identity infrastructure is emerging as a critical use case. Decentralized identity systems require blockchain rails. Ethereum’s established ecosystem positions it to capture this growth.

“These are all rising,” Lee emphasized. “That’s why we consider it a Supercycle.”

BitMine, where Lee serves as chair, continues accumulating Ethereum despite the price decline. Their conviction stems from tracking on-chain activity rather than just price charts.

Bitwise CIO Calls Current Prices a Gift

Matt Hougan, Bitwise’s chief investment officer, echoed Lee’s optimism. He described today’s entry point as “almost a gift” for long-term investors.

Hougan’s thesis focuses on inevitable adoption curves. “Regardless of what happens on the economy in the next year, stablecoins will grow tremendously,” he said.

His projections sound aggressive but rest on concrete trends. Stablecoin market cap already exceeds $180 billion. That could easily double in 12-18 months as more users need dollar-denominated crypto.

Tokenization could expand 10x in the next few years. Banks and asset managers are actively building platforms. Each new tokenized asset increases demand for Ethereum’s infrastructure.

Prediction markets represent a billion-dollar opportunity that barely exists today. As regulation clarifies, these platforms could process massive volume.

Digital identity needs solutions now. Governments and corporations want decentralized systems. Ethereum’s lead in this race positions it to capture significant value.

For investors thinking beyond quarterly charts, these fundamentals outweigh short-term liquidity concerns.

Bitcoin’s Next Move Will Set the Tone

One critical question looms over the entire crypto market: Has Bitcoin already peaked this cycle?

Lee said the answer determines how to interpret coming months. “If Bitcoin makes a new high this year, then it really obviates the fact that there is a four-year cycle.”

Traditional cycle theory suggests Bitcoin peaks roughly every four years after halving events. However, that pattern could break as markets mature and institutional adoption accelerates.

Lee expects broader market strength into year-end. That momentum should push Bitcoin past recent highs. Such a breakout would confirm the cycle continues and likely lift Ethereum along with it.

December rate cut odds dropped sharply this week. Yet equity markets held up reasonably well. That resilience suggests risk appetite remains intact despite hawkish Fed signals.

For crypto, a Bitcoin rally would reset sentiment immediately. Traders would stop obsessing over liquidity concerns and refocus on growth narratives.

The next few weeks matter. A strong close to 2025 validates the Supercycle thesis and positions Ethereum for significant gains into next year.

The Industry Needs Time to Find Its Footing

Lee acknowledged recovery won’t happen overnight. “It does take a few weeks for the industry to sort of find its footing,” he said.

Market-makers need capital to rebuild positions. Risk managers must assess exposure and adjust strategies. New liquidity providers evaluate whether to enter the space.

This process creates choppy trading conditions. Prices whipsaw on modest volume. Support levels that normally hold can break unexpectedly. Resistance that should cap rallies sometimes gets blown through.

For active traders, this environment is treacherous. For long-term holders focused on fundamentals, it’s noise.

The key question isn’t whether Ethereum recovers from this liquidity crunch. The question is whether the underlying adoption trends justify current valuations and beyond.

Lee clearly thinks they do. BitMine’s continued accumulation backs up that view with capital allocation. Hougan’s aggressive projections suggest Bitwise sees similar opportunities.

Liquidity Will Return, Question Is When

Crypto markets have survived worse shocks. The 2022 bear market wiped out Luna, FTX, and countless other major players. Yet market structure eventually stabilized and new participants emerged.

This liquidity crisis feels different because it’s more technical than psychological. Traders aren’t panic selling based on fear. Market-makers simply can’t provide normal service after getting liquidated.

That distinction matters for recovery timing. Fear-driven selloffs can reverse quickly when sentiment shifts. Structural problems take longer to fix but resolve more permanently.

Once new market-makers establish positions, liquidity should improve dramatically. Trading will smooth out. Price discovery will function normally again. That sets the stage for the next leg up.

Lee’s timeline of “a few weeks” suggests early recovery signs could emerge before year-end. Bitcoin hitting new highs would accelerate that process by attracting fresh capital.

The setup for 2026 looks compelling if these pieces fall into place. Ethereum would enter the new year with restored liquidity, growing fundamentals, and renewed investor confidence.

Whether that translates to immediate gains or takes months to play out remains uncertain. But the direction seems clear.