The crypto market just wiped out another $1 billion in trader positions. In 24 hours flat.

This isn’t shocking news anymore. That’s the problem. Billion-dollar liquidation events used to signal major market catastrophes. Now they happen weekly. Over the past seven days alone, traders lost over $5 billion to forced liquidations.

Something fundamental shifted in how crypto markets function. The question isn’t if another massive liquidation wave hits. It’s when.

190,000 Traders Got Crushed in One Day

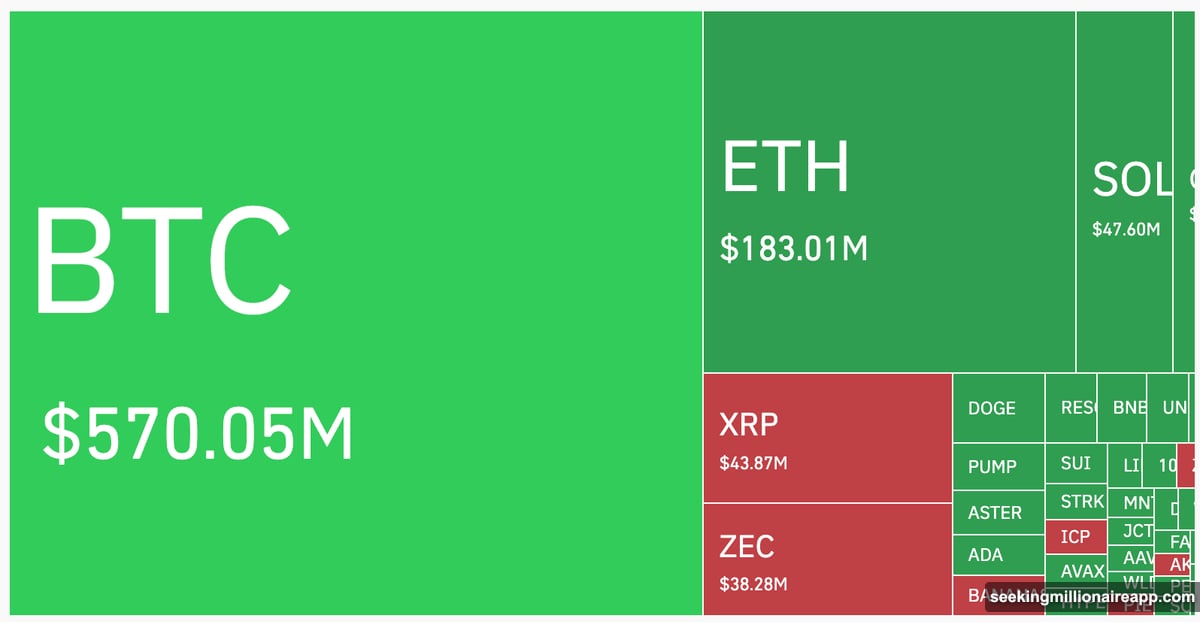

Coinglass data reveals the brutal math. Over $1.03 billion in positions liquidated across 190,000+ traders in the past 24 hours.

Long positions took the hardest hit. Traders betting on price increases lost $726.5 million. Short positions accounted for $308.2 million in losses. That’s a 70-30 split favoring liquidated longs.

The biggest single liquidation? A $96.51 million BTC-USD position on Hyperliquid. One trade. Nearly $100 million gone instantly.

Meanwhile, Bitcoin dropped below $90,000 before recovering to $91,000. Ethereum briefly lost the $3,000 support level. At press time, ETH traded at $3,050, down 4.4% for the day. Every major altcoin bled red – XRP, BNB, and Solana all posted 3-4% daily losses.

Seven Days, $5 Billion Evaporated

Step back for perspective. The past week saw cumulative liquidations exceed $5 billion. That’s not a typo.

Plus, the broader crypto market lost $1.2 trillion in value over 42 days. That represents 28% of the entire sector’s market cap. Current valuations sit 24% below October 10 levels, when a flash crash triggered $19 billion in liquidations.

Traders expected November to bring recovery. Instead, the bleeding accelerated. The Kobeissi Letter noted something strange about this decline: “There haven’t been many material bearish developments on the fundamental side of crypto.”

In fact, President Trump recently called making America “number one in crypto” his top priority. Positive headlines. Supportive political environment. Yet prices keep falling and liquidations keep mounting.

Excessive Leverage Broke the Market

Here’s what changed. The market structure itself fractured during October’s mega-liquidation event.

Crypto trader Crypto Rover captured the sentiment: “Feels like the BIG liquidation event really broke something in the market. Price action hasn’t been the same since then.”

Two factors collided to create this mess. First, institutional money started flowing out from mid-to-late October. That drained liquidity from the system. Second, retail traders kept piling into 20x-100x leveraged positions despite thinning markets.

The math gets ugly fast with extreme leverage. A 2% price move can wipe out your entire position at 50x leverage. When prices drop, margin calls trigger forced selling. That pushes prices lower. More margin calls hit. More liquidations follow. Liquidity vanishes.

This feedback loop explains why $500 million liquidation days became standard. It’s why billion-dollar wipeouts now cluster together instead of appearing as rare stress events.

Why This Keeps Happening

The Kobeissi Letter identified the core problem: “Excessive levels of leverage have resulted in a seemingly hypersensitive market.”

Think about the dynamics. Spot market liquidity dried up. But traders still gamble with massive leverage ratios. Even minor price swings trigger cascading liquidations across the board.

Moreover, institutional participants remain cautious. Without their capital stabilizing markets, retail leverage amplifies every move. A 3% dip turns into a 5% crash as liquidations accelerate.

So far, nothing suggests this pattern will change. Leverage ratios stay elevated. Spot liquidity remains weak. The market continues to demonstrate extreme sensitivity to small price movements.

What Comes Next

Expect more billion-dollar liquidation days. The structural issues haven’t resolved.

Until leverage resets significantly or institutional participation returns, traders face outsized risk. A 5% daily move used to be notable. Now it’s Tuesday.

Plus, the traditional support mechanisms aren’t functioning. Low liquidity means fewer buyers step in during drops. High leverage means more forced sellers appear at exactly the wrong moment.

This creates a precarious situation. The market can’t stabilize when every minor dip triggers massive liquidations. But traders keep adding leverage despite repeated warnings written in billions of dollars of losses.

—

The crypto market entered a new phase. One where $1 billion liquidation events happen routinely instead of rarely. Where 190,000 traders can lose everything in 24 hours. Where the market demonstrates fragility rather than resilience.

This isn’t temporary volatility. The market structure changed. So either trading strategies need to adapt, or these devastating liquidation cycles will continue erasing trader capital at an alarming rate.

Choose your leverage carefully. The market isn’t forgiving mistakes anymore.