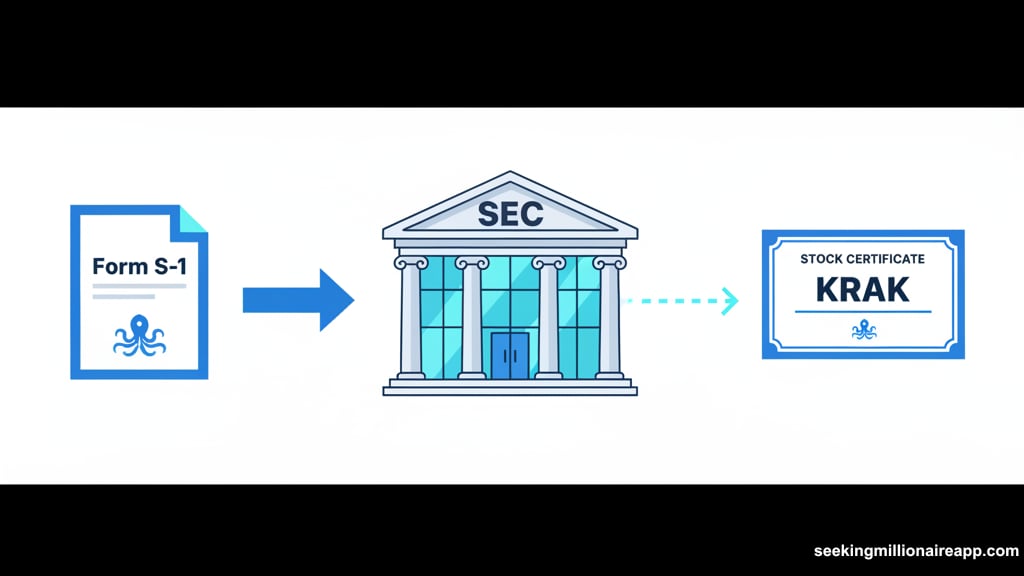

Kraken just filed confidentially with the SEC for an initial public offering. The move marks a major milestone for crypto exchanges and confirms earlier predictions about regulatory thawing under the Trump administration.

The San Francisco-based trading platform submitted a draft registration statement on Form S-1. While share numbers and pricing remain undisclosed, the IPO could proceed once the SEC completes its review. Market conditions will ultimately determine timing.

This development positions Kraken alongside other crypto firms exploring traditional finance routes. Plus, it validates Ark Invest’s prediction that regulatory shifts would open IPO pathways for major players like Circle and Kraken.

Ark Invest Called It Months Ago

Back in late 2024, Cathie Wood’s Ark Invest predicted exactly this scenario. The firm stated that Trump’s pro-crypto stance would unlock IPO opportunities for late-stage digital asset companies.

“Among the possibilities are the re-opening of the initial public offering (IPO) window for late-stage digital asset companies like Circle and Kraken,” the investment firm wrote.

That prediction materialized faster than expected. Circle already completed its public listing earlier this year. Now Kraken follows suit, demonstrating that crypto exchanges can successfully transition to publicly traded status in the US.

The regulatory environment clearly shifted. SEC reforms eased constraints that previously blocked crypto firms from traditional capital markets. So companies that once faced regulatory uncertainty now see viable paths to public listing.

From Private Fundraising to Public Markets

Kraken’s path to this point involved significant private capital raises. In July, the exchange planned to raise $500 million at a $15 billion valuation. That fundraising succeeded by September.

The company didn’t stop there. Kraken expanded beyond pure crypto trading into traditional finance. It launched the xStocks platform and acquired NinjaTrader, broadening its service offerings.

Hours before the SEC filing announcement, Kraken CEO Arjun Sethi revealed the exchange had raised $800 million. That capital infusion strengthens the company’s position heading into public markets.

Moreover, the timing seems strategic. Crypto markets have gained legitimacy through spot Bitcoin ETF approvals and increasing institutional adoption. Public investors now show more appetite for crypto-related investments than in previous years.

What ‘KRAK’ Stock Could Mean

Once Kraken officially goes public, its stock ticker could be ‘KRAK.’ That would make it the second major US crypto exchange trading publicly, joining Coinbase’s COIN stock.

The parallel is significant. Coinbase’s public listing in April 2021 marked a watershed moment for crypto legitimacy. However, that IPO occurred during peak market euphoria, and the stock subsequently struggled through the 2022 bear market.

Kraken’s listing enters different market conditions. Regulatory clarity has improved. Institutional adoption expanded. Plus, the Trump administration signals friendlier policies toward digital assets.

Still, public market investors will scrutinize Kraken’s financials, user growth, and competitive position. The exchange faces stiff competition from Coinbase, Binance.US, and emerging platforms. Trading volumes fluctuate with market conditions, creating revenue volatility.

Regulatory Backdrop Shifted Dramatically

The SEC’s willingness to process Kraken’s registration marks a notable change. Under previous leadership, the agency took aggressive enforcement actions against crypto firms. Many companies faced lawsuits, Wells notices, and regulatory uncertainty.

That environment made public listings nearly impossible. Investment banks hesitated to underwrite crypto IPOs. Investors feared regulatory crackdowns. So crypto firms remained private or listed on foreign exchanges.

Now the calculus changed. The Trump administration appointed crypto-friendly regulators to key positions. SEC enforcement priorities shifted away from blanket crackdowns toward clearer rulemaking. Consequently, crypto firms see viable paths to US public markets.

This benefits both companies and investors. Firms gain access to deeper capital pools and enhanced credibility. Public market investors get regulated exposure to crypto infrastructure without directly buying volatile digital assets.

Broader Implications for Crypto Industry

Kraken’s IPO filing represents more than one company going public. It signals crypto’s integration into mainstream finance. Traditional investors who avoid direct crypto exposure can now buy regulated exchange stocks.

Plus, public listings force transparency. Kraken will face quarterly earnings reports, audited financials, and shareholder scrutiny. That transparency builds trust with regulators and mainstream investors.

Other crypto firms will watch closely. Successful public listings by Circle and Kraken could encourage similar moves by Gemini, Blockchain.com, or other major platforms. The IPO window appears open for well-capitalized crypto companies with strong compliance programs.

However, public markets demand consistent performance. Kraken must demonstrate sustainable revenue growth, expanding user bases, and effective risk management. Market volatility in crypto creates challenges for publicly traded companies dependent on trading volumes.

Questions Remain About Timing and Pricing

Kraken hasn’t disclosed share pricing or the number of shares it plans to offer. Those details emerge during the SEC review process and roadshow presentations to institutional investors.

Market conditions will heavily influence final terms. If crypto markets rally, Kraken could command premium valuation. Conversely, market downturns might force conservative pricing or delayed timing.

The confidential filing allows flexibility. Kraken can adjust terms based on market feedback without public scrutiny. Once the SEC completes its review, the company will decide whether conditions support moving forward.

Investors should watch for the public S-1 filing. That document will reveal Kraken’s financial performance, risk factors, competitive landscape analysis, and growth strategy. The data will determine whether KRAK stock represents compelling value or excessive hype.

Kraken’s Journey Reflects Crypto’s Evolution

This IPO attempt caps Kraken’s 14-year journey from scrappy startup to major financial institution. The exchange survived multiple crypto winters, regulatory pressures, and fierce competition. Now it seeks validation from public markets.

The contrast with crypto’s early days is stark. A decade ago, exchanges operated in legal gray zones with minimal oversight. Today, they file registration statements with the SEC and submit to rigorous compliance requirements.

That evolution benefits the industry. Legitimate businesses thrive when rules are clear and enforcement is predictable. Public listings accelerate this maturation process. They bring scrutiny, transparency, and accountability that strengthen crypto’s long-term prospects.

Kraken’s success or failure in public markets will influence how other crypto firms approach growth strategies. The stakes extend beyond one company to the entire sector’s relationship with traditional finance.

Choose your path carefully. If Kraken executes well, its IPO could mark crypto’s full arrival in mainstream finance. If problems emerge, it might reinforce skeptics who view crypto infrastructure as too risky for public investment.