Tether’s market share crossed a critical threshold this month. For the first time since 2021, USDT dominance broke above 6% and shattered a four-year resistance line.

That’s not a random spike. It’s a clear signal that investors are running scared. Instead of buying discounted altcoins, they’re parking money in stablecoins and waiting for the storm to pass.

The question isn’t whether this matters. It’s how bad things might get before they improve.

What Tether Dominance Actually Tells Us

USDT.D measures Tether’s market cap as a percentage of total crypto market value. When that number climbs, it means money is flowing out of Bitcoin, Ethereum, and especially altcoins into the safety of USDT.

TradingView data shows USDT.D peaked at 6.1% on November 18 before settling at 5.9%. Earlier in the month, it sat below 5%. So this represents a sharp shift in just a few weeks.

Plus, historical data reveals a strong inverse relationship between USDT.D and total market cap. When Tether dominance rises, market valuations typically fall. That correlation has held remarkably consistent across multiple market cycles.

Now USDT.D has broken above a trendline that remained intact since 2022. That’s significant. Breaking multi-year resistance often signals the start of deeper corrections or extended bear markets.

The Trendline Break Everyone’s Watching

Technical analysts pay close attention to long-term trendlines. They represent zones where price action consistently bounces or reverses. Breaking such a line suggests the underlying market dynamics have fundamentally changed.

In this case, USDT.D spent nearly four years respecting a descending resistance line. Each time it approached that level, selling pressure on stablecoins increased as investors deployed capital back into the market. That kept dominance contained.

But November changed everything. USDT.D didn’t just test the line. It broke clean through and continues trading above it. That shift implies the previous balance between risk-on and risk-off positioning has collapsed.

Several analysts now project USDT.D could reach 8% by year-end. If that happens, it would mark the highest reading since the 2022 bear market bottom. Moreover, such a move would likely coincide with significant price declines across most crypto assets.

Stablecoin Supply Is Actually Shrinking

Here’s where things get more concerning. It’s not just about money rotating into USDT. The entire stablecoin market is contracting.

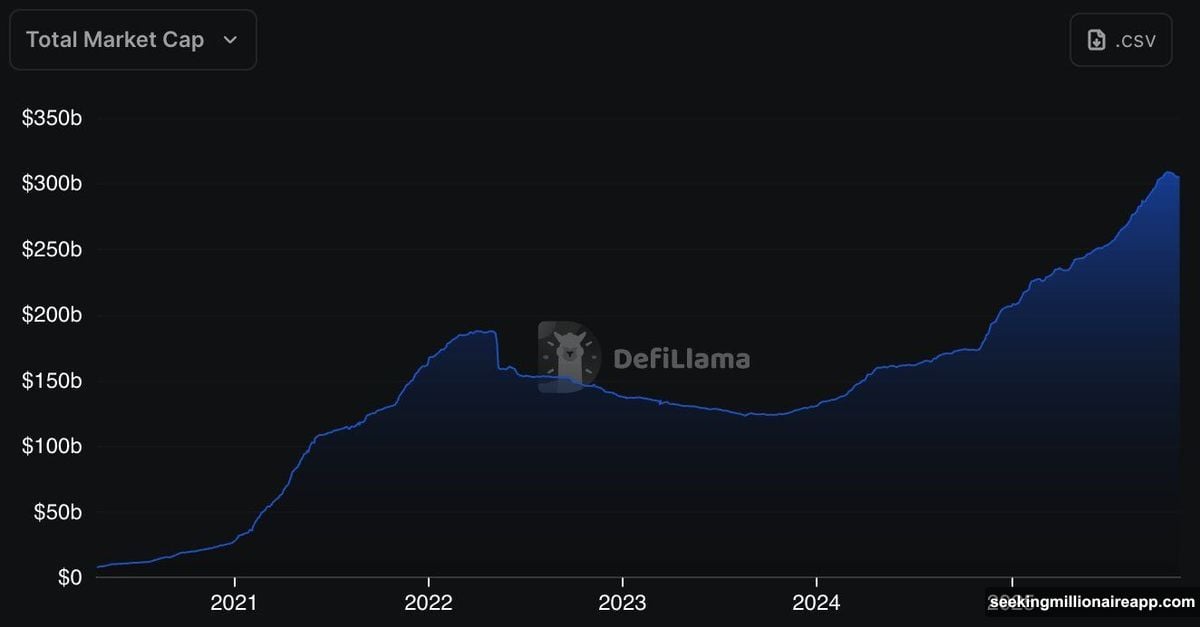

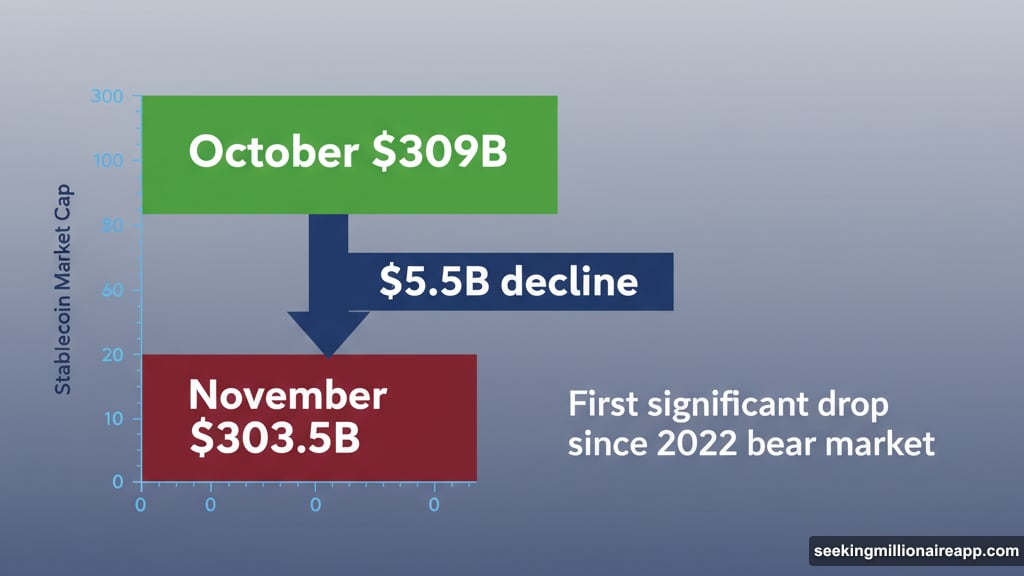

DefiLlama data shows total stablecoin market cap fell from $309 billion in late October to $303.5 billion in November. That’s a $5.5 billion decline in less than a month. Furthermore, this marks the first significant drop since the 2022 bear market.

The chart reveals four years of continuous growth suddenly flattening and turning downward. When stablecoin supply expands, it indicates fresh liquidity entering the crypto system. But when supply contracts, it signals that liquidity is exiting entirely.

So investors aren’t just selling altcoins into stablecoins. They’re actually pulling stablecoins off exchanges and out of the market. That’s a clear vote of no confidence.

Analyst Milk Road puts it bluntly: “When it flattens or reverses, it signals that the inflows powering the rally have cooled.” The market is operating with less fuel than it’s had in years. And that shortage often precedes significant price changes.

Exchange Holdings Paint a Different Picture

Despite the declining overall supply, one metric tells a more nuanced story. The amount of stablecoins held on exchanges has actually increased in November.

That seems contradictory at first. But it makes sense when you consider investor psychology. Some traders view the current downturn as a buying opportunity. Instead of withdrawing stablecoins completely, they’re moving funds to exchanges and waiting for better entry points.

This suggests the market hasn’t lost all hope. Fear dominates right now. However, some capital remains positioned to deploy if conditions improve heading into year-end.

Still, exchange holdings rising while total supply falls creates an interesting dynamic. It means the stablecoins leaving the market are coming from somewhere else—likely from DeFi protocols, cold storage, or retail investors exiting completely.

What History Says About Rising USDT Dominance

Past market cycles offer important context. Every time USDT.D has broken above major resistance levels, significant corrections followed.

In March 2020, USDT.D spiked above 5% as COVID-19 crashed markets. Bitcoin fell from $10,000 to $3,800 in days. The market took months to recover. Similarly, in May 2021, USDT.D surged as Bitcoin dropped from $64,000 to $30,000.

The pattern repeats consistently. Rising Tether dominance doesn’t guarantee crashes. But it reliably signals that risk appetite has evaporated and defensive positioning has taken over.

Right now, we’re seeing that same pattern develop. Fear is spreading. Capital is flowing to safety. And technical resistance levels that held for years are breaking down.

Nobody Wants to Catch a Falling Knife

Current market conditions explain why investors are choosing safety over opportunity. Bitcoin has consolidated after hitting new highs. Ethereum struggles to maintain support levels. And altcoins have bled heavily throughout November.

Under normal circumstances, such discounts would attract aggressive buying. Traders would deploy stablecoins to scoop up cheap assets. But that’s not happening. Instead, stablecoin dominance keeps climbing.

The reason is simple. When uncertainty prevails, catching falling knives feels foolish. Better to sit in USDT earning yield or simply protecting capital than to buy assets that might drop another 20-30%.

This mindset becomes self-reinforcing. As more investors rotate to stablecoins, selling pressure increases. Prices fall further. That validates the decision to stay defensive. And the cycle continues.

Three Scenarios for Where This Heads

The current setup could resolve in different ways. Understanding the possibilities helps frame risk appropriately.

Scenario one: Quick reversal. USDT.D peaks near current levels and begins declining as confidence returns. Bitcoin finds support and rallies heading into year-end. Altcoins recover sharply as risk appetite returns. This would mirror late 2023 dynamics.

Scenario two: Extended consolidation. USDT.D continues climbing toward 8% as predicted. Markets grind sideways through year-end with elevated volatility. Neither bulls nor bears gain clear control. This frustrates both sides but avoids catastrophic losses.

Scenario three: Full correction. USDT.D breaks above 8% and keeps rising. Major support levels fail across the market. Bitcoin tests $60,000 or lower. Altcoins give back most 2024 gains. This scenario resembles early 2022 conditions.

Each outcome has different implications for positioning. But all three share one common element: defensive positioning makes sense right now given the signals flashing warning signs.

What Smart Money Is Doing

Large holders and institutional investors have already adjusted positioning. On-chain data shows whale wallets increasing stablecoin allocations throughout November. They’re not panic selling. But they’re clearly reducing risk exposure.

Moreover, options markets reflect elevated hedging activity. Put options are expensive relative to calls. Implied volatility remains elevated. These indicators suggest sophisticated traders expect continued turbulence.

Some funds are maintaining smaller positions while keeping most capital liquid. Others have exited entirely until clearer trends emerge. Very few are aggressively buying the dip. That tells you everything about current sentiment.

The absence of strong hands stepping in to support prices amplifies downside risk. When everyone’s defensive simultaneously, markets lack the buying power needed to stabilize.

The Liquidity Problem Nobody Wants to Discuss

Shrinking stablecoin supply creates real structural issues beyond just sentiment. Crypto markets require constant liquidity inflows to sustain valuations. When that liquidity dries up, prices must adjust downward to find equilibrium.

Think about it practically. If total stablecoin supply falls 2% but the broader market tries to maintain the same valuation, something has to give. Either prices fall until reduced liquidity can support them, or new capital must enter to replace what left.

Right now, new capital isn’t arriving fast enough to offset what’s leaving. The November decline in stablecoin market cap proves that point. And without fresh inflows, the market is operating on borrowed time.

This explains why some analysts expect USDT.D could reach 8% or higher. The math simply requires it if stablecoin supply keeps shrinking while investors refuse to deploy capital into risk assets.

Not All Doom and Gloom

Despite the concerning signals, some analysts maintain cautious optimism. Milk Road argues the situation doesn’t necessarily indicate an impending crisis. Instead, the market is adjusting to operating with less fuel after years of continuous growth.

Such transitions often feel painful while happening. But they can also set the stage for healthier advances once excess froth clears. Markets that rally on decreasing liquidity tend to be unsustainable. Corrections that shake out weak hands and reset positioning can create stronger foundations.

Furthermore, the fact that exchange-held stablecoins are rising suggests some investors see opportunity in current prices. They’re not deploying capital yet. But they’re positioning to act if conditions improve.

If year-end brings positive catalysts—regulatory clarity, institutional inflows, or simply seasonal rally dynamics—that sidelined capital could quickly return to work. The current defensive positioning would unwind rapidly as FOMO kicks in.

The Year-End Wildcards

Several factors could change current dynamics heading into December. Regulatory developments in the US remain a key variable. Clearer rules around stablecoins and crypto trading could ease uncertainty and restore confidence.

Additionally, institutional flows through ETFs and other vehicles could provide the liquidity boost markets need. If those inflows materialize, they might offset shrinking stablecoin supply and stabilize valuations.

Tax-loss harvesting will also influence market structure. Many investors will realize losses before year-end for tax purposes. That typically creates selling pressure in late December. However, it also sets up potential rebounds in January as those same investors redeploy capital.

So while current conditions look challenging, they’re not necessarily predictive of what comes next. Markets can turn quickly when sentiment shifts or new information emerges.

What To Watch Next

Several indicators will signal whether this corrective phase is ending or just beginning. Monitor USDT.D closely. If it peaks and starts declining, that suggests risk appetite is returning. Conversely, if it continues climbing toward 8%, brace for further downside.

Watch stablecoin supply trends too. If total market cap stabilizes or begins growing again, it indicates liquidity is flowing back into the system. That would be an early positive signal before prices reflect the change.

Finally, pay attention to exchange stablecoin holdings. If those continue rising despite market weakness, it suggests investors are preparing to deploy capital. That dry powder could fuel sharp rebounds when conditions improve.

Right now, the market is sending clear defensive signals. USDT dominance breaking four-year resistance is significant. Shrinking stablecoin supply matters. And the absence of aggressive buying pressure tells an important story.

Whether this marks the start of an extended bear market or just a sharp correction remains unclear. But either way, caution makes sense until conditions improve. Protect capital first. Opportunities will come. They always do. Just not necessarily on your preferred timeline.