Ethereum just lost a critical support level. Worse, the biggest holders aren’t stepping in to catch the fall.

For the first time in four months, ETH dropped under $3,000. Now trading at $2,784, the asset faces mounting pressure from both technical breakdown and weakening whale conviction. What happens next depends largely on whether major holders regain confidence or start cutting losses.

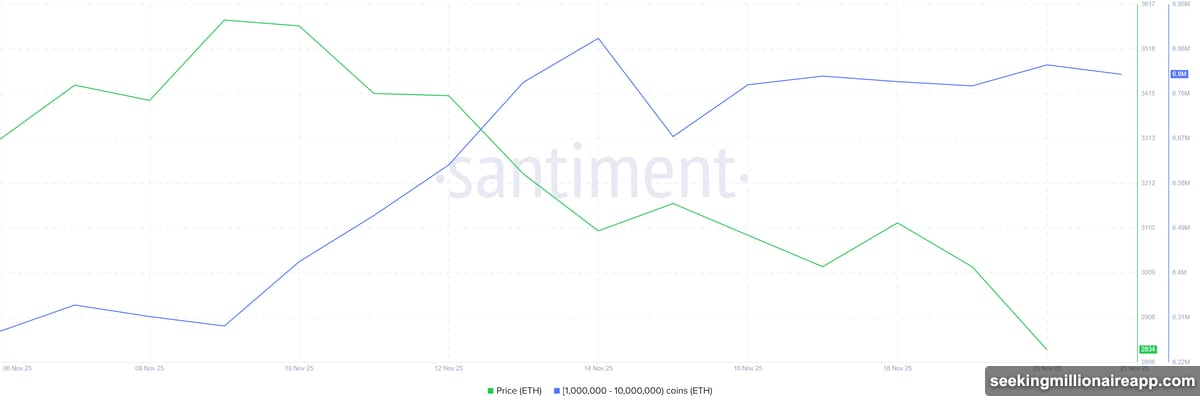

Whale Accumulation Stalls at Worst Possible Time

Big money is backing away. Addresses holding between 1 million and 10 million ETH were buying aggressively earlier this month. That accumulation trend has now completely stopped.

This matters because whale behavior often signals market direction. When large holders buy during dips, they provide price support and signal confidence in recovery. Their absence now leaves Ethereum vulnerable to further declines.

The timing couldn’t be worse. Ethereum needs buying pressure to stabilize after breaking key support levels. Instead, the largest participants are sitting on the sidelines, watching prices fall without intervention.

Plus, this hesitation suggests whales don’t expect an immediate rebound. These sophisticated investors typically have better market intelligence than retail traders. Their caution should concern anyone hoping for a quick recovery.

Long-Term Holders Face Shrinking Profits

The pain extends beyond whales. Ethereum’s MVRV Long/Short Difference metric just hit a four-month low, revealing that long-term holders are losing profitability relative to short-term traders.

This indicator tracks whether investors who held ETH for extended periods remain in profit. Declining values mean their unrealized gains are evaporating. When long-term holders see profits shrink, they often sell to preserve what’s left.

That creates a dangerous feedback loop. If long-term investors start dumping tokens, selling pressure increases. More selling pushes prices lower. Lower prices trigger more selling as additional holders panic.

Moreover, long-term holders typically represent the most committed part of Ethereum’s investor base. When even they lose confidence, market sentiment deteriorates rapidly. Their potential capitulation would remove a key support pillar for ETH.

Critical Support Levels Now in Play

Ethereum lost $3,000 yesterday and hasn’t recovered since. The asset now trades at $2,784, having fallen 7.4% in 24 hours. That breaks the $2,814 support level that held for weeks.

Technical analysis points to $2,681 as the next downside target. If ETH drops through that floor, the path opens toward $2,606 or lower. Each broken support level makes the next decline easier.

However, recovery remains possible if sentiment shifts. A bounce back above $3,000 would signal returning strength and invalidate the bearish outlook. From there, ETH could target $3,131, restoring some market confidence.

But that scenario requires renewed buying interest. Without whale accumulation or long-term holder confidence, reaching $3,000 again looks difficult. The momentum clearly favors bears right now.

Network Fundamentals Can’t Save Price Action

Here’s what frustrates Ethereum bulls: the network itself continues functioning well. Transaction volumes remain healthy. Layer 2 solutions keep growing. Development activity stays strong.

Yet none of that matters when market psychology turns negative. Investors aren’t selling because Ethereum stopped working. They’re selling because prices keep falling and major holders won’t defend support levels.

This disconnect between fundamentals and price action happens regularly in crypto markets. Strong technology doesn’t guarantee strong prices, especially during broader market weakness. Sentiment drives short-term moves more than development progress.

So Ethereum faces a test of investor conviction. Can the asset stabilize without whale support? Will long-term holders maintain their positions as profits evaporate? These questions will determine whether ETH finds a bottom near current levels or continues falling toward $2,600.

The next few days are critical. Watch whether major holders resume buying or remain sidelined. Monitor whether long-term holders start capitulating. Those signals will tell you where Ethereum heads next better than any chart pattern.

Right now, the setup favors more downside. Unless whales return with serious buying pressure, ETH looks likely to test lower support levels. That’s not a prediction—it’s just what the data shows about current market structure and participant behavior.