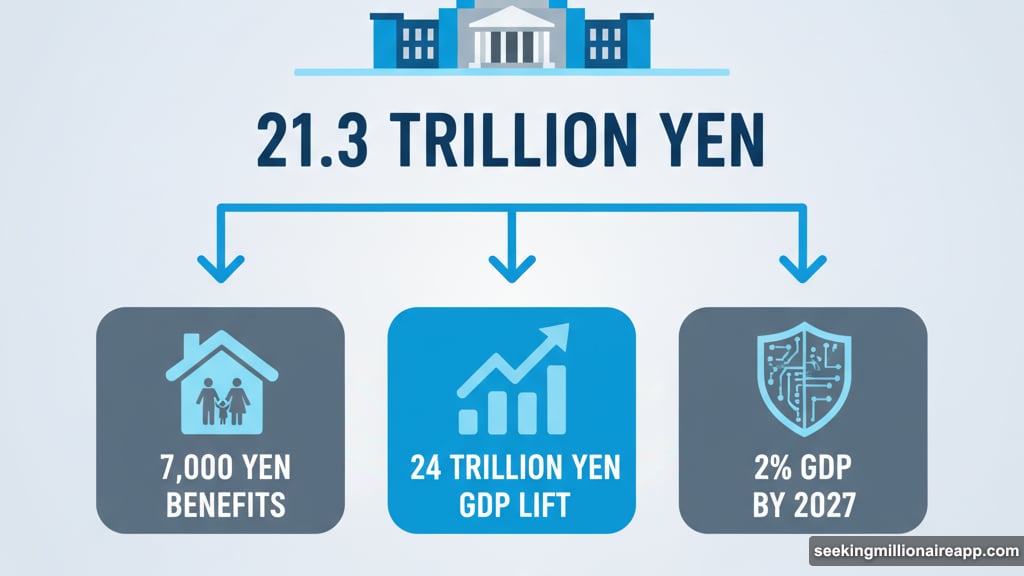

Japan just dropped its biggest economic bomb since COVID-19. On November 21, the cabinet approved a massive 21.3 trillion yen stimulus package worth $135.5 billion.

But here’s the kicker. The yen immediately tanked to its weakest level against the dollar since January. Plus, 40-year bond yields hit a historic 3.697%. So investors are now asking: will this fuel Bitcoin’s next surge, or trigger a global market meltdown?

Why Japan Needs This Massive Injection

The timing isn’t random. Japan’s economy contracted 1.8% annualized in Q3 2025—the first decline in 18 months.

Moreover, inflation has stayed above the Bank of Japan’s 2% target for 43 straight months. October inflation hit 3%. That’s painful for consumers already squeezed by rising costs.

The stimulus aims to tackle three goals. First, ease rising prices through local government grants and energy subsidies. Households should see around 7,000 yen in benefits over three months. Second, drive robust economic growth with a projected 24 trillion yen GDP lift. Third, boost defense spending to reach 2% of GDP by 2027.

Yet some economists remain skeptical. The supplementary budget will pass by year-end with allied support. But the ruling coalition holds just 231 of 465 Lower House seats. So political fragility adds another layer of uncertainty.

Currency Crisis Brewing

The yen’s sharp drop after the announcement raised alarm bells. Despite prior government intervention attempts, capital keeps flowing out.

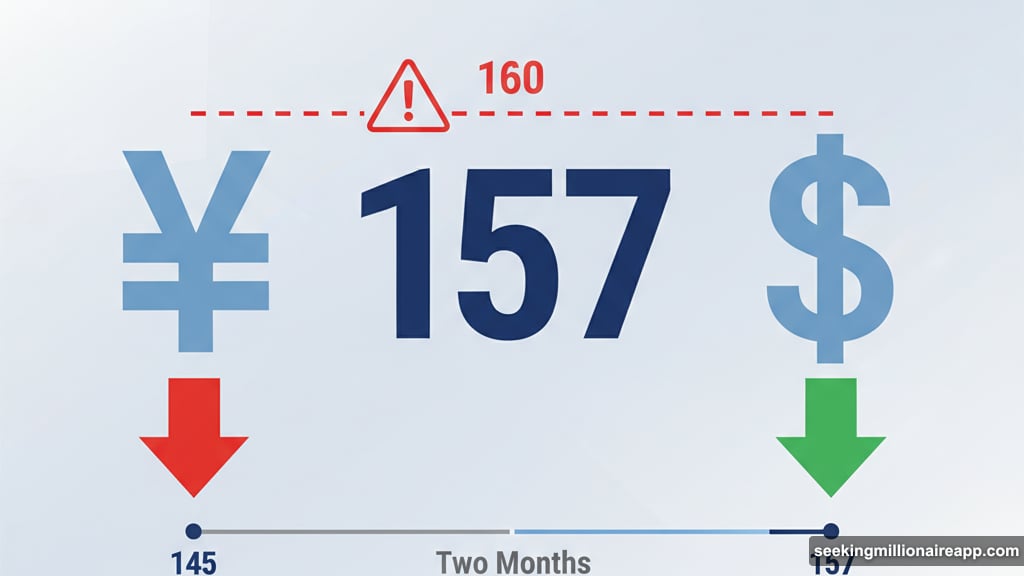

In fact, traders are now watching the 160 yen-per-dollar level closely. Government officials hinted they might intervene before hitting that threshold. Currently, the yen has weakened from 145 to 157 over two months. That’s just 2% away from potential intervention territory.

Meanwhile, October exports rose only 3.6% year-over-year. This modest gain hasn’t offset broader currency concerns. Plus, the price of five-year credit default swaps on Japanese government bonds jumped to 21.73 basis points on November 20—the highest in six months.

That signals growing investor worry about default risk.

Bond Market Sending Warning Signals

Here’s where things get really interesting. The 40-year bond yield surged to a historic 3.774% on Thursday.

Normally, massive fiscal stimulus would lower long-term rates by flooding markets with liquidity. Instead, yields are climbing. This suggests investors fear future inflation and doubt Japan’s fiscal health.

Every 100-basis-point jump in yields raises annual government financing costs by roughly 2.8 trillion yen. That fuels concerns about unsustainable debt servicing down the road.

The bigger danger? The $20 trillion yen carry trade. Investors have borrowed yen cheaply for years to invest in higher-yielding assets overseas. But higher yields and yen appreciation could trigger rapid unwinding.

Historical data shows a 0.55 correlation between yen carry trade unwinding and S&P 500 declines. So if this trade collapses, markets worldwide could tumble.

Bitcoin Faces Mixed Signals

This creates a complicated picture for Bitcoin and crypto markets. On one hand, massive liquidity injections typically boost demand for alternative assets.

A weaker yen usually drives Japanese investors toward alternatives like Bitcoin. The currency has lost significant value, making dollar-denominated assets more attractive. Plus, the Bank of Japan keeps its key rate at just 0.5%, even as inflation runs hot.

Some analysts call this setup one of the strongest macro tailwinds for Bitcoin heading into 2026. Combined with potential Federal Reserve easing, US Treasury cash draws, and weekly liquidity injections from China, conditions look favorable for risk assets.

However, there’s a major risk. If bond yields keep climbing, they could force unwinding of the massive yen carry trade.

That would trigger global deleveraging. Institutions holding Bitcoin would face pressure to sell and cover positions. Crypto markets trade 24/7, making them especially vulnerable to sharp deleveraging events.

Remember, crypto often mirrors broader market moves during stress periods. The question becomes: will the liquidity boost outweigh the deleveraging risk?

What Happens Next

Japan’s gamble comes with high stakes. The government expects total economic impact near $265 billion from this package.

But skeptics point out that relying on fiscal stimulus beyond emergencies creates long-term problems. Debt keeps piling up while structural issues remain unresolved.

For Bitcoin specifically, the next few months will reveal which force wins. Will currency weakness and liquidity drive Japanese investors into crypto? Or will bond market turmoil spark a global sell-off that drags everything down?

The answer probably depends on whether Japan’s bond yields stabilize or continue surging. If yields keep climbing past 4%, expect serious deleveraging pressure across global markets.

Bitcoin holders should watch the yen-dollar exchange rate and Japanese bond yields closely. These indicators will signal whether Japan’s stimulus becomes a crypto catalyst or a market crash trigger.

Right now, we’re seeing both bullish and bearish forces at work. The outcome isn’t clear yet. But the stakes couldn’t be higher for risk assets entering 2026.