Nvidia just posted record earnings. But the smartest money on Wall Street is running for the exit.

The company reported $57 billion in revenue and nearly $32 billion in profit. Those numbers look incredible on paper. Yet Michael Burry bought put options betting the stock crashes to $140. Peter Thiel reportedly sold his entire position. And the stock has swung wildly despite blockbuster results.

Something doesn’t add up. Let’s dig into what these legendary investors spotted that most people missed.

The Money That Never Arrives

Nvidia has a growing problem with cash that doesn’t exist yet. Customers owe the company $33.4 billion in unpaid bills. That’s almost double what they owed last year.

Worse, customers now take 53 days to pay on average. Last year they paid in 46 days. Meanwhile, Nvidia claims demand is through the roof. But the company is sitting on $19.8 billion worth of unsold chips.

Both can’t be true at the same time. Either customers aren’t actually buying as fast as Nvidia suggests, or they’re buying without real cash backing those purchases.

Shanaka Perera, a financial analyst tracking the situation, put it bluntly: “The cash flow tells the real story.”

Profit That Doesn’t Show Up in the Bank

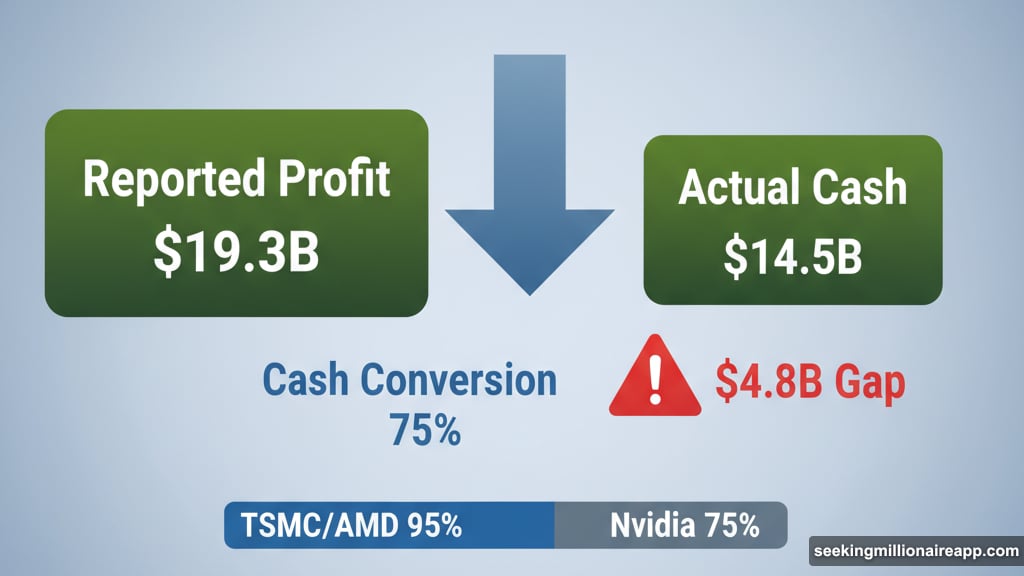

Here’s where things get stranger. Nvidia reported $19.3 billion in profit last quarter. But only $14.5 billion showed up as actual cash in the bank.

That means $4.8 billion of reported “profit” hasn’t materialized as real money yet. For context, other chipmakers like TSMC and AMD convert over 95% of their profits into cash. Nvidia manages just 75%.

That gap matters enormously. Cash is what pays bills, funds operations, and proves revenue is real. Paper profits without cash backing them raise red flags about whether growth is sustainable or just accounting tricks.

“That’s distress level,” Perera noted. Plus, healthy chip companies don’t show these kinds of gaps between profit and cash generation.

The Circular Money Machine

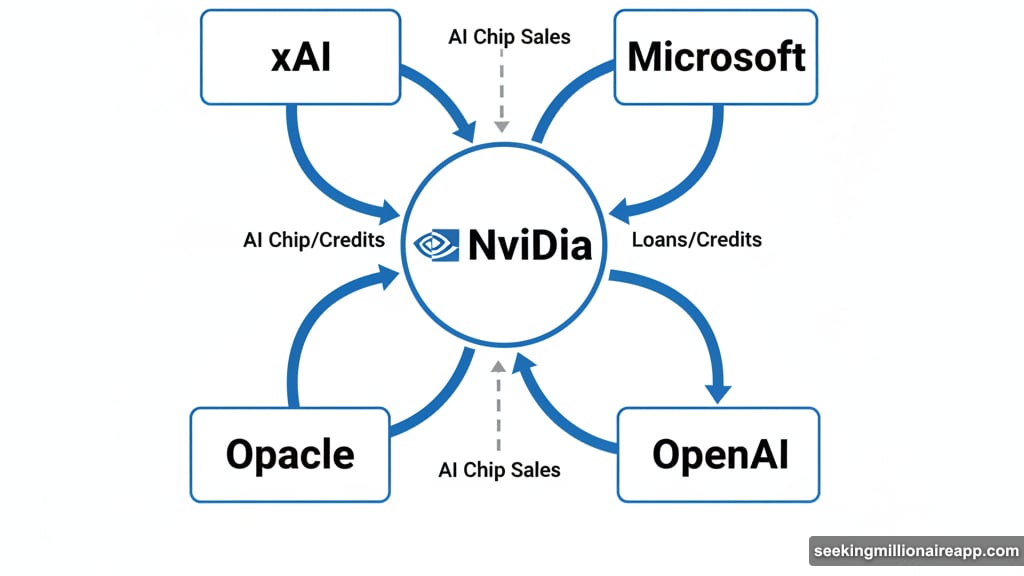

The revenue picture gets even murkier when you trace where the money actually comes from. Nvidia sells AI chips to companies like xAI, Microsoft, OpenAI, and Oracle. Nothing unusual there.

But many of these sales get funded by loans or credits from the same companies in the network. The same dollars get counted multiple times as they circle between firms. So reported revenue might not reflect actual end-user demand.

Michael Burry called this out directly. He described it as “suspicious revenue recognition” and warned that “true end demand is ridiculously small.” In fact, he said the future would view these arrangements as pictures of fraud rather than legitimate business flywheels.

His point cuts deep. If AI companies are essentially funding each other’s purchases with recycled credit, the entire growth story could unravel fast when that credit dries up.

Buybacks That Don’t Help Shareholders

Nvidia has spent $112.5 billion on stock buybacks since 2018. That should reduce the number of shares and increase value for remaining shareholders. Instead, the company kept issuing new shares at the same time.

The result? Existing shareholders got diluted even as billions went toward buybacks. Burry questioned whether this was actually helping investors or just creating the illusion of returning capital.

He also raised concerns about Nvidia’s older GPUs. These chips use far more electricity than newer models. Just because they’re still running doesn’t mean they’re profitable for customers dealing with massive power bills.

“Just because something is being used doesn’t mean it’s profitable,” Burry stated. That matters because Nvidia counts all those older chips in its installed base numbers.

Smart Money Exits Fast

Peter Thiel reportedly sold all 537,742 of his Nvidia shares. SoftBank dumped $5.8 billion worth on November 11. And Burry took out put options betting the stock crashes to $140 by March 2026.

These aren’t casual retail investors panicking. These are some of the sharpest minds in finance with access to information most people never see. When they bail simultaneously, it signals trouble ahead.

One striking observation making rounds on social media: Nvidia alone now represents 15% of US GDP. That concentration is historically dangerous. Markets don’t sustain that kind of weight in a single company for long.

Crypto Gets Caught in the Crossfire

The AI bubble risk is bleeding into crypto markets too. Bitcoin dropped nearly 30% since October. Part of that decline traces back to AI startups holding $26.8 billion in Bitcoin as collateral for loans.

If Nvidia’s stock crashes further, those startups face margin calls. They’d be forced to sell Bitcoin to cover losses. That selling pressure could trigger a broader crypto market collapse.

So the health of Nvidia’s stock isn’t just an AI or tech issue anymore. It’s becoming a systemic risk that touches multiple asset classes. And according to a recent Bank of America survey, 45% of fund managers now view AI as a major market bubble risk.

Global regulators, including the IMF and Bank of England, have started echoing those concerns publicly. That’s significant because regulators typically lag behind market problems rather than lead the conversation.

The Counterargument Worth Considering

Not everyone believes disaster is imminent. Nvidia still has $23.8 billion in actual cash flow. Companies like Microsoft and Meta continue placing massive orders. And some inter-company financing deals are standard practice in the tech industry.

Supporters argue the company is simply operating at unprecedented scale. Rapid growth creates temporary cash flow gaps and billing delays. Plus, the AI revolution is real, even if speculation around it gets excessive.

That view has merit. Nvidia dominates AI chip manufacturing with no close competitor. Demand for AI computing power keeps accelerating. And the company has executed brilliantly for years.

But even if you buy that optimistic view, the gap between reported profits and actual cash remains troubling. So does the reliance on circular financing and customers taking longer to pay.

Critical Dates Coming Fast

The next few months will reveal whether bears like Burry are right. Nvidia reports fourth-quarter results in February 2026. If cash flow problems persist or worsen, expect market panic.

March could bring credit rating downgrades if agencies decide the cash gaps signal financial stress. And April might see financial restatements if accounting issues come to light.

Jensen Huang, Nvidia’s CEO, reportedly told staff “the whole world would’ve fallen apart” if the company delivered a bad quarter. That’s not confidence. That’s pressure that suggests the entire AI boom rests on Nvidia continuing to post perfect results.

Markets hate that kind of fragility. When one company carries the weight of an entire sector, any stumble becomes catastrophic. And right now, Nvidia’s stumbling already started with that 18-hour stock swing after earnings.

The Test Case for AI’s Future

Nvidia’s story is no longer just about one chip company. It’s become the test case for whether the AI boom is sustainable or speculative excess.

If Burry and Thiel are wrong, Nvidia will close its cash flow gaps, demand will prove real, and AI will keep driving massive economic value. The stock will recover and probably hit new highs.

But if they’re right, we’re watching the early stages of a major market correction. The AI bubble pops. Companies overextended on AI infrastructure face losses. And the collateral damage spreads to crypto and other risk assets.

Either way, betting against Michael Burry has historically been expensive. He called the housing crash when everyone else was bullish. He exited Netflix before it collapsed. And now he’s betting billions that Nvidia is overvalued.

The cash flow numbers suggest he might be onto something. Again.