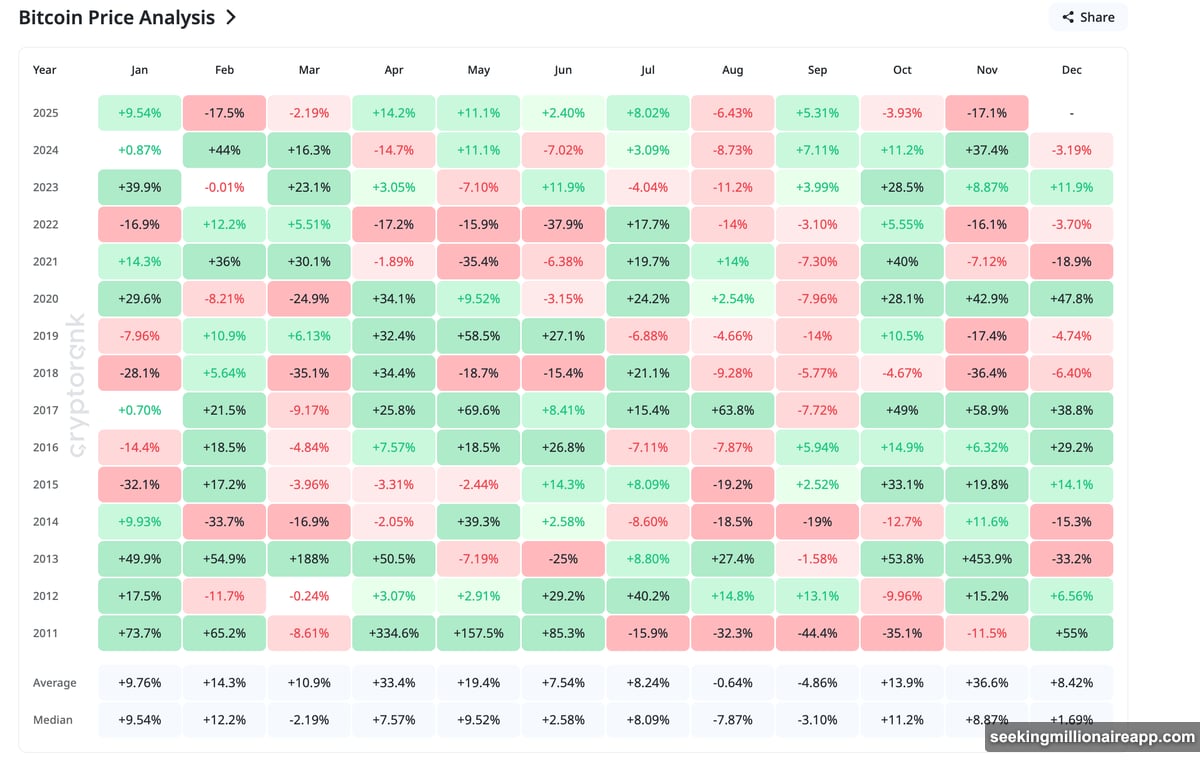

Bitcoin ended November down 17%. That broke its usual rally pattern and left traders asking whether December brings recovery or more pain.

The recent bounce from $80K looked promising at first. But early December data shows caution everywhere. ETF flows stayed weak. Long-term holders kept selling. Whales continued moving coins to exchanges.

December’s history doesn’t help much either. The average return sits at 8.42%, but the median return drops to just 1.69%. Plus, three of the last four Decembers finished negative.

Let’s break down what actually matters for Bitcoin’s price direction this month.

November’s Drop Changed the Game

November typically drives strong Bitcoin rallies. Not this year. Instead, BTC dropped more than 17% from its recent highs.

That shift matters because it broke a reliable seasonal pattern. More importantly, it came with sustained selling pressure from the biggest holders in the market.

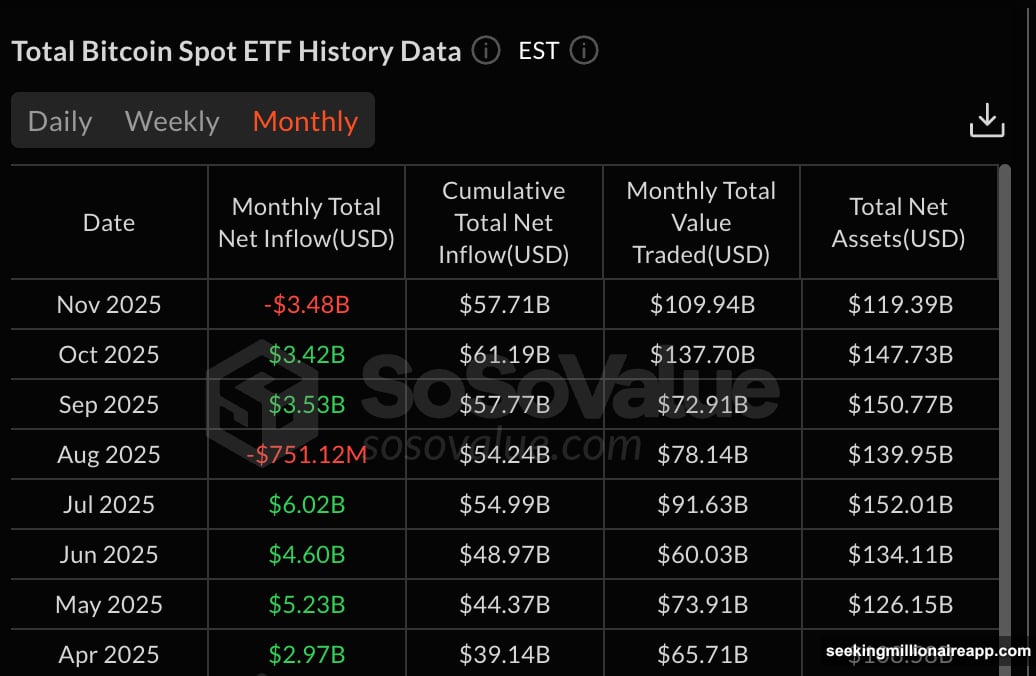

US spot ETFs recorded $3.48 billion in net outflows during November. That marked the worst monthly flow since these products launched. The last clear multi-month inflow streak happened between April and July.

Since then, institutional money stayed defensive. November confirmed that institutions aren’t rushing back yet.

MEXC Chief Analyst Shawn Young told BeInCrypto that sustained ETF demand needs to return before any meaningful rally begins:

“When Bitcoin spot ETFs begin to see multiple days of inflows of $200–$300 million, it may indicate that institutional allocators are rotating back into BTC.”

So far, that hasn’t happened. December started with more muted flows. Without institutional conviction, Bitcoin’s path higher gets much steeper.

Whales Keep Sending Coins to Exchanges

Bitcoin’s on-chain data tells a clear story. Big holders are still selling, not accumulating.

The Exchange Whale Ratio measures how much of total exchange inflows come from the top 10 largest wallets. That metric climbed from 0.32 earlier in November to 0.68 on November 27.

Even after easing to 0.53, it remains in a zone that historically signals distribution. Whales typically stop sending coins to exchanges before durable bottoms form. That hasn’t happened yet.

Meanwhile, long-term holders continued reducing their positions throughout November. The Hodler Net Position Change stayed deep in negative territory for more than six months straight.

The last strong Bitcoin rally in late September only started after this metric turned positive. It hasn’t flipped green again since then.

Hunter Rogers, Co-Founder of TeraHash, explained why this matters:

“When long-term holders quietly move back into accumulation, it means supply pressure is fading.”

Supply pressure hasn’t faded yet. Both whales and long-term investors continue distributing coins. That keeps a ceiling on any December rally attempt.

December’s Price Structure Shows Two Key Levels

Bitcoin’s chart structure now sits at a critical decision point. The price recently slipped below the lower band of a bear flag pattern that built across several weeks.

That breakdown suggests potential downside toward $66,800. However, the market may not reach that level immediately if liquidity holds steady.

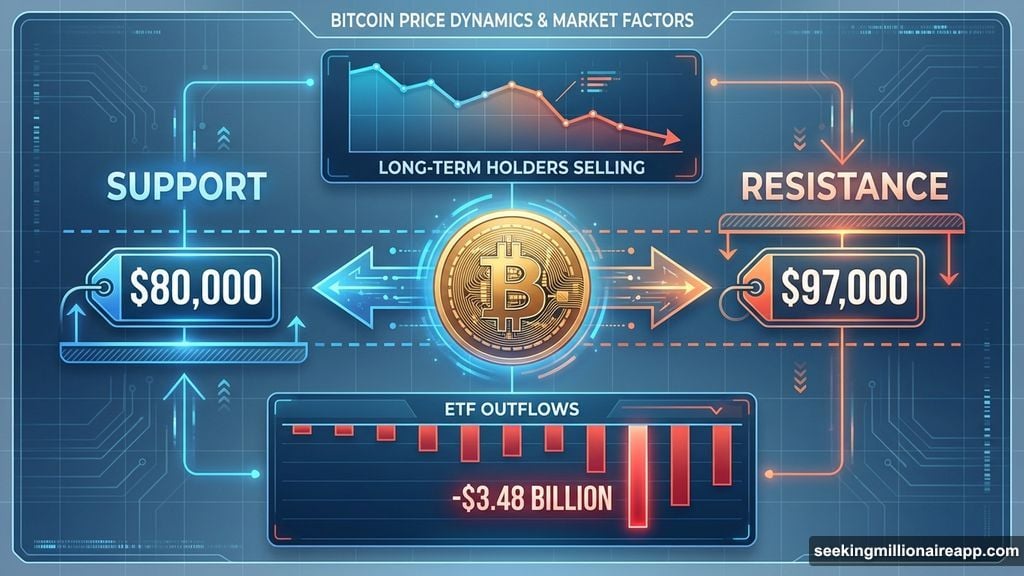

For December, two price zones matter most:

$80,400 Support Zone

This level acted as a rebound area earlier in November. But it remains fragile. A clean close below $80,400 opens room for new lows and aligns with what analysts call a “liquidity sweep” before any stronger recovery attempt.

$97,100 Resistance Zone

The chart structure only flips bullish if Bitcoin reclaims this midpoint level. A daily close above $97,100 would erase the bear flag breakdown and start a move toward $101,600 resistance.

However, that reclaim only matters if trading volume increases alongside price. Without volume confirmation, any breakout attempt stays suspect.

Shawn Young believes Bitcoin might attempt a sharp downside move first:

“Bitcoin’s market setup suggests a wick-style liquidity sweep rather than a prolonged breakdown.”

That means a quick drop below $80K to clear out leveraged positions, followed by a potential recovery. But that scenario still requires institutional flows and on-chain metrics to improve.

What Actually Triggers a December Rally

Bitcoin won’t rally just because December arrives. The market needs specific conditions to shift:

First, ETF flows must turn positive for several consecutive days. Small inflows won’t cut it. The market needs sustained institutional demand above $200 million daily to signal real conviction.

Second, whales need to stop sending coins to exchanges. The Exchange Whale Ratio must drop below 0.40 and stay there. That would signal large holders moved from distribution to accumulation.

Third, long-term holders must stop selling. The Hodler Net Position Change needs to flip positive. Until that happens, supply pressure continues weighing on price.

Hunter Rogers doesn’t expect major volatility this month:

“I don’t expect a highly-volatile December — neither a major jump nor a major drop. A quieter month with a slow upward movement looks more realistic.”

That matches what the data shows. December may stay range-bound between $80K support and $97K resistance unless one of these key triggers activates.

The Setup Favors Caution Over Optimism

Bitcoin’s December price action starts with caution baked in. The seasonal pattern offers little help. ETF flows remain weak. Whales continue distributing. Long-term holders keep selling.

The chart confirms what the data already shows. Bitcoin sits between two critical walls. Below $80,400, deeper retests become likely. Above $97,100, a trend reversal becomes possible.

For now, the downside risk looks more pronounced than upside potential. That doesn’t mean Bitcoin can’t rally in December. But it does mean the conditions for a sustainable rally haven’t appeared yet.

Smart traders watch three things: ETF flows turning positive for multiple days, the Exchange Whale Ratio dropping below 0.40, and long-term holder distribution finally ending.

Until those conditions align, Bitcoin’s December likely stays defensive. The market needs proof, not hope.